NCAP Public Record Removals Have Little Impact to FICO Scores

The National Consumer Assistance Plan (NCAP) is a comprehensive series of initiatives intended to evaluate the accuracy of credit reports, the process of dealing with credit inform…

The National Consumer Assistance Plan (NCAP) is a comprehensive series of initiatives intended to evaluate the accuracy of credit reports, the process of dealing with credit information, and consumer transparency. As a result of NCAP, in July 2017, the three credit reporting agencies (CRAs) are scheduled to make required changes to the criteria used to accept the reporting of a tax lien and/or civil judgment.

It is anticipated that civil judgments and some tax liens will be removed from consumer reporting agency (CRA) data when this goes into effect, including previously reported tax liens and/or civil judgments that do not meet the new NCAP-related reporting requirements. All credit scores that utilize CRA data will be impacted, including but not limited to FICO® Scores.

FICO recently conducted research on the most widely used FICO® Score versions at all three CRAs to assess the impact of the NCAP-driven removal of public records on the FICO® Score, and results were similar in each instance.

(Note that, as opposed to analyzing a worst-case scenario, where all judgments and tax liens were removed from the credit file, this analysis is based on each CRA’s detailed assessment and representation of the judgments and tax liens that would be removed after the NCAP-related public record standards are implemented by the CRAs in July 2017.)

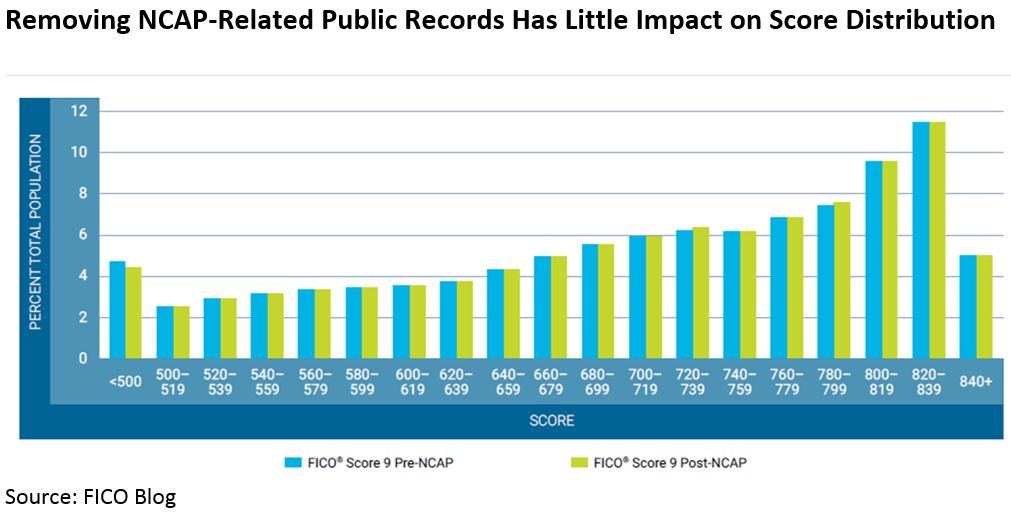

Our results showed that NCAP-related public record removals have no material impact on the aggregate population to the FICO® Score’s predictive performance, odds-to-score relationship, or score distribution.

For example, the figure below compares the FICO® Score 9 distribution on the total US population before vs. after NCAP-related public record removal; the two distributions are nearly identical.

Based on FICO’s analysis, only 6-7% of scorable credit files are impacted, and these files are very likely to have additional derogatory information on their credit file. Therefore, impacted files tend to score relatively low, even after these public records are removed, and more than 75% of FICO® Score increases are less than 20 points.

Since we determined that few consumers were impacted, and the vast majority of those impacted consumers had other derogatory information and FICO® Scores that remained low, the ability of FICO® Scores to rank-order risk on the total population prior to these public records being excluded is almost identical to what lenders would experience with these public records excluded.

Our analysis also showed that volumes above or below score cut-offs remained virtually unchanged on the aggregate, and there was no material impact to the bad rate at a given FICO® Score. While lenders are encouraged to conduct analyses quantifying the impact of NCAP-related public record removals on their own portfolios, they may find that they do not need to make notable changes to their strategies.

For more information, read our executive brief on the impact of NCAP to FICO® Scores.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.