Open Banking: Are You Ready to Become a Banking Ecosystem?

Now is the time to move from a traditional financial company to a modern Open Banking ecosystem

Within the past 20 years, we’ve witnessed a quantum leap in the evolution of business models - from being product-based to platform-based. With the rise of Open Banking, this trend is now hitting financial services. Are you ready to become a banking ecosystem?

Retail typifies the move to platform, most notably by global online giant Amazon, which started out selling books, to becoming a platform championing other ecommerce outlets, while diversifying into movies, music, its own technology, fresh groceries and healthcare!

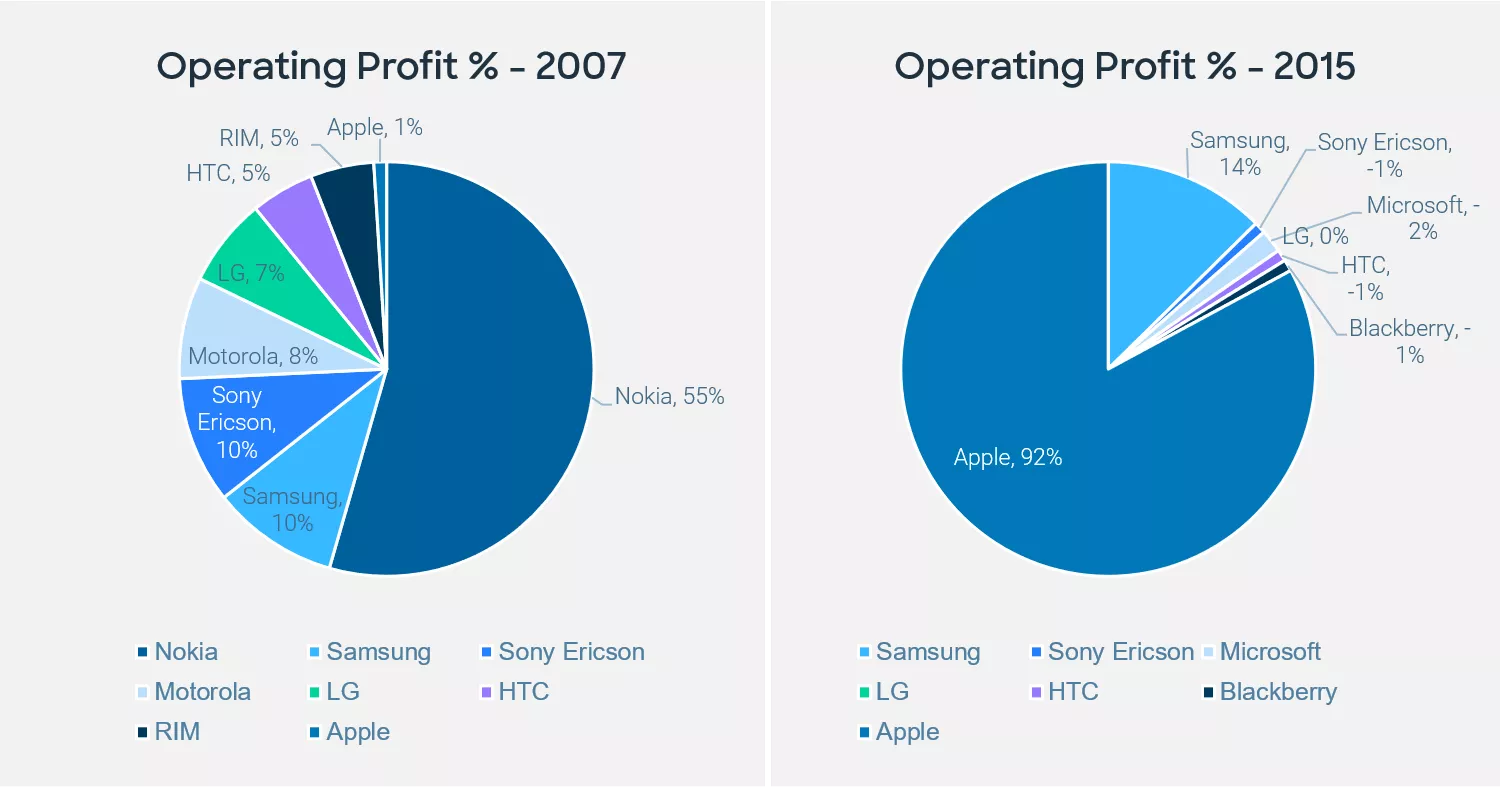

Then there was the mobile market. Up until 2007, seven companies shared 99% of global mobile phone profits: Nokia, Samsung, Sony Ericsson, Motorola, LG, RIM and HTC. But 2007 was a tipping point, when Apple launched the iPhone - essentially a smart, user-friendly platform offering a self-contained ecosystem of mobile applications. By 2015, 92% of global profits were being pocketed by Apple. The other seven shared just 8%. Clearly platforms grow profits.

In financial services, the switch to digital financial marketplaces is being driven by the proliferation of fintechs and customer-centric legislation that’s enabled Open Banking. While banks are in a race to understand the emerging revenue streams existing customers offer, fintechs are using Open Banking to reach new, younger and digitally savvy demographics.

The 2020s will be the age of Open Banking. The winners will be providers offering a platform showcasing a mix of in-demand products and services that go far beyond customers’ traditional financial needs.

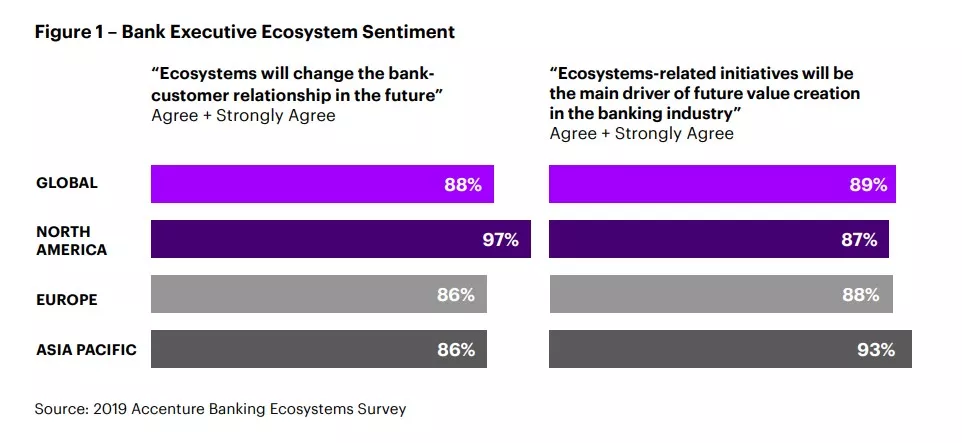

In a 2019 Accenture poll, the vast majority (88%) of executives from 120 global banks said emerging ecosystems would change the bank-customer relationship forever.

Are You Ready?

Building a successful ecosystem is no mean feat. Having determined the key customer segments to focus on, identified how to get the maximum value from your platform, and designed a multi-year strategy and operating model, there’s also the tricky question of analysing the technological capabilities your ecosystem needs.

- Data ingestion – Data feeding your ecosystem will come from numerous sources and multiple formats. Can you access all internal data regardless of its location or format? Differing customer activities happening right now need to be captured to trigger and inform real-time decisions. Are you able to accurately capture real-time, streamed data?

- Use of external data – Several third-party data providers and partners can be plugged into your ecosystem. Are you able to access, gather and transform valuable external data to help drive appropriate real-time customer decisions?

- Characteristic library – Success hinges on creating predictive characteristics from the ecosystem’s available data and turning them into usable insight to offer the right customer decisions at the right time. How quickly are you able to do this today?

- Microservices – As business users in your ecosystem gather and enrich data to develop analytical models, models will need to be refined and operationalised to deliver appropriate customer decisions - across credit, risk, fraud and other decisions. For example, is application fraud or suspicious behaviour being flagged up accurately?

- Data orchestration – At any given moment, numerous complex decisions between business users and partners will be underway and will need to be understood. Are you able to accurately visualise and understand the complex decision-making processes?

- Data governance and reporting – Naturally, there will be high volumes of data transactions constantly underway within the ecosystem. Complex automated decisions are being made in fractions of a second, constantly challenging your ability to leverage and track streamed data. Do you have a robust tracking repository for reporting data across ecosystem users?

- Business authoring – Ecosystems within other sectors often have authoring environments shared with fellow commercial partners. They’re kept open to any ecosystem member so that they can add new capabilities and activities to the ecosystem. Are your non-technical users able to create decision services? Are you able to test and verify new business authoring rules before deploying into production?

- Simulating business outcomes – Before accepting a new partner or adding a new component, understanding its potential impact on the ecosystem users is vital. Can you create differing scenarios and apply ‘what-if’ analysis to understand the impact?

- Customer lifecycle services on a single platform – Assuming your ecosystem is built to mainly focus on the financial needs of your customers, it’s likely to be a marketplace for banking services, insurance, car rental, home ownership, travel money and more. But an equally accurate understanding and 360-degree view of customer data, including demographics, payment behaviour, spending, location, activity, or favoured device, are all vital in providing timely, personalised and precise customer decisions. Offers can underpin the marketing of a new product/service, new financing, expansion of a new credit line, delinquency management, or fraud prevention, right across the customer lifecycle. But can you consistently provide the right collaborative and efficient approach across separate teams? Are they siloed, or can they get access to the same level of data to continually offer the best customer decision?

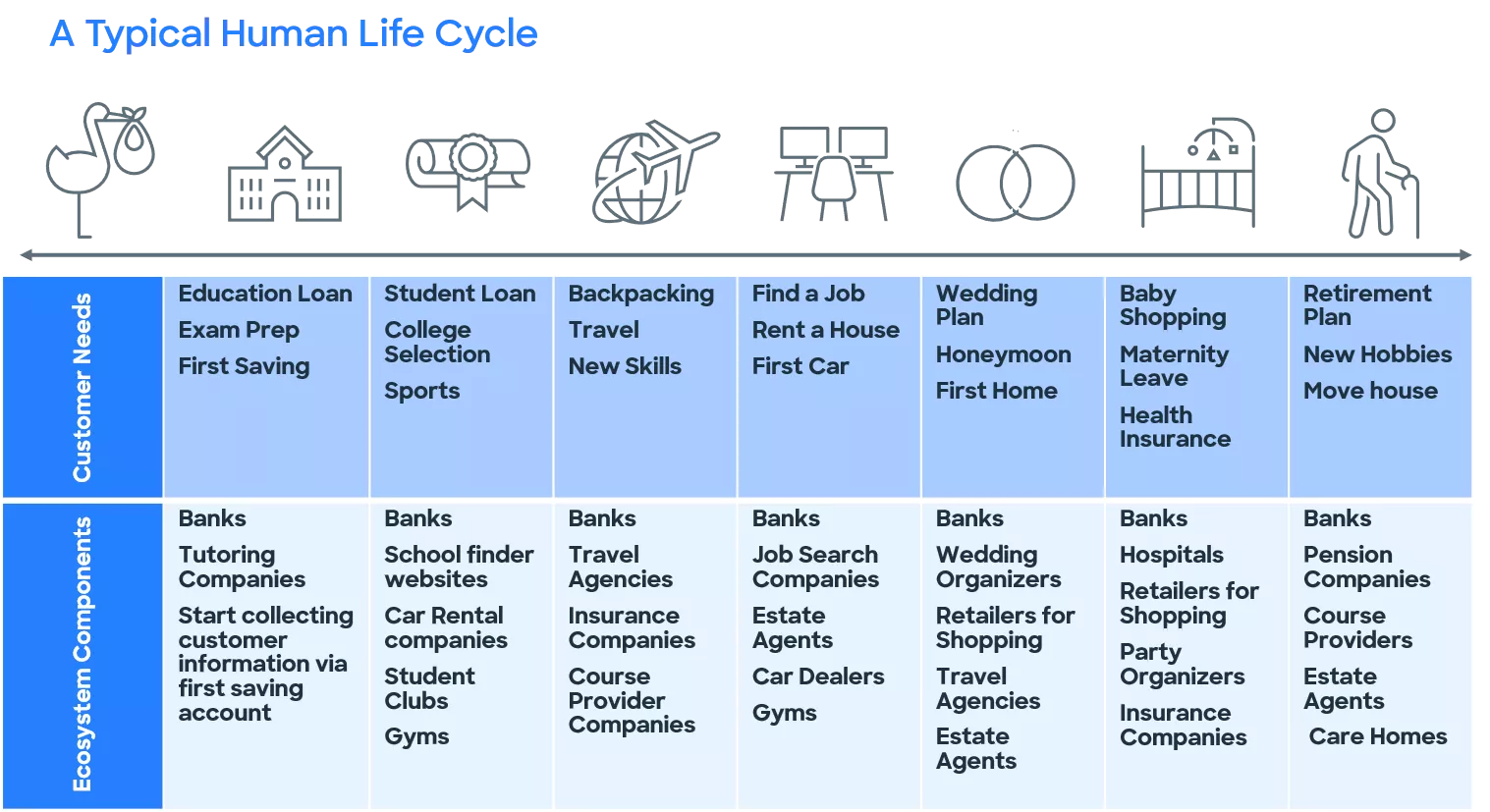

Using these capabilities and partnering, financial institutions can add an endless series of services and products into their ecosystem in order to further engage with their customers and drive more value. One idea can be to start covering the basic needs of a typical human life cycle:

For further inspiration for what you may require designing your own ecosystem, I recommend exploring some early trials from different markets:

- BBVA’s Valora

- Development Bank of Singapore’s Car Marketplace

- USAA’s Residential Real Estate Services

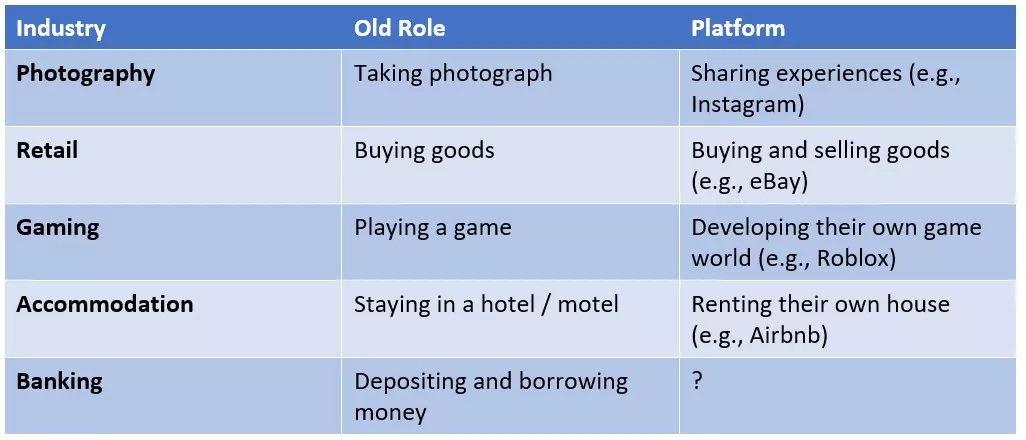

Finally, and most importantly, don’t forget to put yourself in shoes of your ecosystem’s end-users — your customers. Their role also evolved in other industries as the industry evolved to be platform-based:

FICO can provide you the technology platform you need to transform your company into a modern age financial ecosystem.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.