Open Banking in the Philippines and the Opportunities in the Data

How data sharing can improve credit risk decisioning

Open Banking in the Philippines - the path ahead

The launch of the Open Finance Framework by Bangko Sentral ng Pilipinas (BSP) in 2021 was a big step forward in driving financial inclusion for millions of Filipinos across the market who still do not have access to credit. Open Banking in the Philippines promises to give customers the control to share their data and allow third-party providers to access their data. It provides banks with information to access the credit risks of underbanked customers who would have previously been denied financing due to their lack of credit history.

The complexities of architecting open banking mean that only a few countries in Asia have made meaningful progress. India and Australia, for instance, have adopted a government-regulated approach. In contrast, other countries, including the Philippines and Hong Kong, have taken a less regulated approach, with regulators setting the ground rules but the industry and financial institutions are defining the APIs and implementing the framework.

Like Hong Kong, the Philippines has an open API framework. BSP has proposed implementing open banking in a tiered approach across five phases: product information, credit application, account information, payment/transfer integration, and non-banking products. While Philippine banks have been quick to implement phase one and two, the actual open banking element of providing transaction data or opening their payment systems have been more of a challenge to implement. The final tiers of the open banking framework will take some time to roll out, but once implemented, are set to improve credit access for the underbanked Filipinos. In this respect, Philippine access to open banking is ahead of the curve compared to most countries in Asia.

Open banking makes financial products more personalized and accessible to all

Over the past five years, there has been a massive transformation across all markets in the way consumers manage their money. Influenced by both a shift in consumer demand and fintech disruption, consumers increasingly rely on digital or mobile technology to receive and transmit funds to make purchases.

With on-demand access to this wealth of digital data, banks and financial institutions are able to make better and quicker decisions and interact with customers on a personal and highly individualized level, based on real-time data about the consumer’s habits and actions.

With open banking, financial services companies can gain access to customers’ data both within and outside of the bank’s records. This facilitates a more complete view of the customer and enables banks to make more informed decisions around credit risk, cross-sell and upsell opportunities, collections and more. By using advanced analytics technology, banks are in a better position to increase penetration into untapped or underbanked segments, as well as offer more relevant and time-appropriate solutions to existing customers.

How to leverage open banking for credit risk decisions

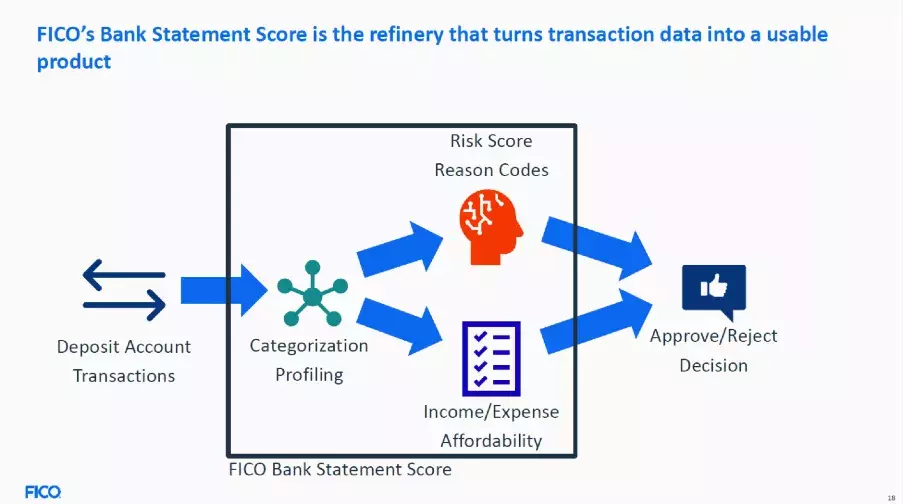

While the implications of access to larger pools of consumer data are exciting to realize for the financial services sector, such data is only as useful as it is understood. The challenge for financial institutions in the Philippines is to turn transaction data into a usable product.

The consumer data that banks analyze must be available, relevant, and accurate. But more importantly, it should provide valuable insights into the customer’s credit risks.

We can look at monthly balances or summarized data of a customer’s withdrawals in terms of ATM transactions and transfers in a month, for example, but this doesn’t paint the full picture of the customers’ spending history. Instead, if we can go a step further to analyze when these transactions happen within the month, we can understand the customer’s spending patterns to assess credit risk.

FICO’s Bank Statement Score

FICO’s Bank Statement Score breaks down transactional data into over 100 categories according to the banking industry terms used in the country. The module generates thousands of features for each transaction data type derived across categories such as time discretization, merchant category codes, transaction type, and geocoding location classification, which can then be used to build customer profiles.

The customer’s cash flow can also be analyzed based on a disposable income calculation from data on the customer’s income, outgoings, and financial commitments. The analysis results can be used to make decisions on lending for existing customers and for accepting or declining a new customer account based on their application risk score.

However, financial data alone won’t build the full picture. FICO’s Bank Statement Score incorporates a machine learning model that characterizes transactions tuned to every country, to classify every transaction and build a comprehensive client profile. Aggregating this information, we can assess potential risks and apply a risk score. Data derived is also not restricted to the bank’s data, but pulls from all real-time data available from open banking.

With such a wealth of real-time accurate data on the customer’s spending habits and risk profile, banks are in a better position to offer solutions they would not have been able to do before, thereby increasing access to credit to Philippine customers who may need it the most.

Email us at InfoAsia@fico.com to request a 1:1 consultation so we can help you accelerate your open banking initiatives.

How FICO Can Help You Advance Your Use of Banking and Transaction Scores

- Read a whitepaper on how transaction scoring based on authorizations data raises predictive power.

- Read our blog post on How Transactional Analytics for SME Lending Drive Greater Value

- Read our blog post on How Transaction Analytics Transform Lending Speed and Results

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.