FICO Xpress Optimization Surpasses AlphaEvolve’s Achievements

FICO’s global optimization solver outperforms Gemini AI-powered AlphaEvolve coding agent by improving solutions for complex, constrained math problems

Recently, Google DeepMind made waves with a report and blog post about AlphaEvolve, a new LLM-based, Gemini-powered tool that writes its own algorithms to crack notoriously difficult math problems. AlphaEvolve writes Python code that finds valid solutions for mathematical problems, and in several cases, those solutions are better than the previously known best ones. In other words, AlphaEvolve set records for certain longstanding mathematical problems. Examples from their report are improved matrix multiplication and new solutions for circle packing problems.

AlphaEvolve used an evolutionary approach to discover new algorithms, and the FICO Optimization team wondered what would happen if we gave the same problems to FICO® Xpress Solver, which is part of the FICO® Xpress Optimization suite. We teamed up with our MODAL research campus partners at Zuse Institute Berlin (ZIB) to test our approach. The results weren’t just comparable — they were better. In multiple benchmark problems from the AlphaEvolve report, FICO® Xpress Solver produced new best solutions, surpassing the recent records set by DeepMind.

The Technology: Global Optimization

The key observation is that most of the problems in the report can be formulated as global optimization problems. These involve minimizing or maximizing a (nonlinear) objective function subject to a set of (nonlinear) constraints, e.g., maximizing the area covered by a set of non-overlapping circles. In global optimization, the goal isn’t just to find a solution, but to prove that it is the best possible solution (or to provide a bound on how close a solution is to the optimum). The algorithms developed by the Google team with the support of AlphaEvolve take a slightly different approach; they are heuristics, focused on finding good solutions rather than providing a bound.

The Versatility of Global Optimization

Most of the problems in the AlphaEvolve report are either unconstrained or only lightly constrained, for example, by simple variable bounds. This makes them particularly well-suited for automatically trained heuristic search methods, where the algorithm can explore the solution space freely without needing to manage complex constraint interactions or running into local infeasibilities. The true challenge in these problems lies in the highly nonlinear, often nonconvex objective functions which can produce many local optima. Global optimization, however, is far more versatile. It is designed to not only handle such nonlinearities, but also to deal effectively with highly constrained problems, including problems with integrality requirements, where only a few feasible solutions exist, and those may lie in narrow or disconnected regions of the search space.

Since global optimization is a core feature of FICO® Xpress Solver, we were excited to see how well FICO® Xpress Global (a global optimization engine, which is part of FICO® Xpress Solver) performed on some of the 13 showcase problems of the AlphaEvolve report. The beauty of mathematical optimization is that formulating a model can often be done with a few lines of code. The search algorithms in FICO® Xpress Solver can then tackle a wide range of instances of the model.

FICO® Xpress Optimization Results

Circle packing (problems 12 and 13)

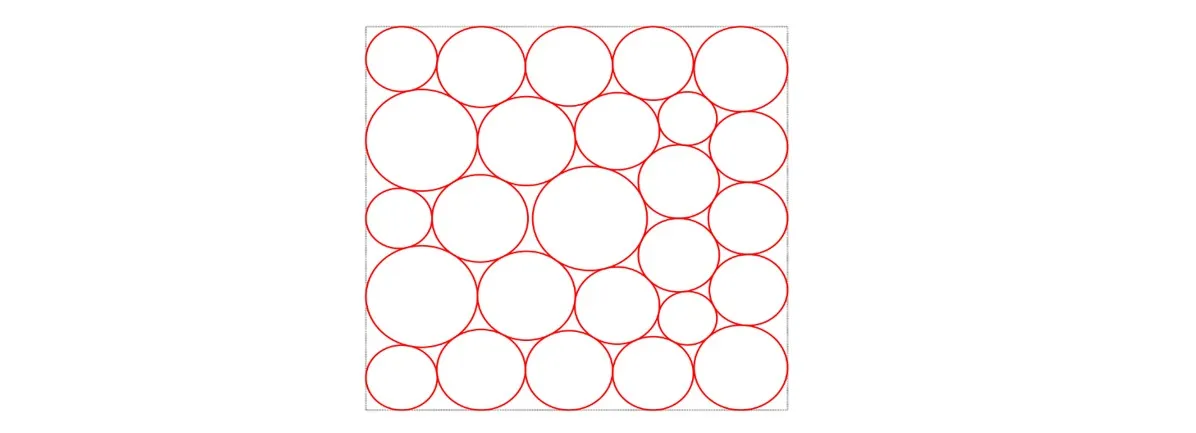

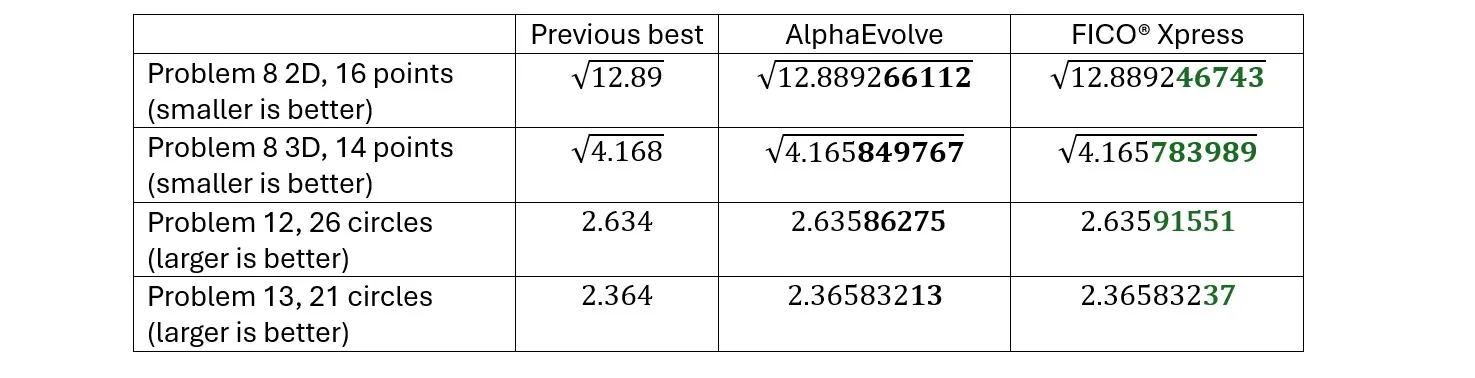

One of the problems we examined is a version of circle packing: the task is to place circles of arbitrary sizes into a unit square to maximize the sum of their radii (or, equivalently, their total perimeter). AlphaEvolve produced a search algorithm that found a solution with the sum of the radii of 2.63586275 for the case with 26 circles, improving the previously best-known solution of 2.634. FICO® Xpress Solver found an even better solution of 2.63591551. All that was needed was to formulate the problem (or, in other words, the model) in its most natural form and leave the rest to the sophisticated search algorithms inside FICO® Xpress Solver.

Figure 1. A new solution to the circle packing problem in a unit square for N=26, with sum of radii 2.63591551+.

Problem 13 in DeepMind’s list is closely related to problem 12. Instead of packing the circles into a unit square, they need to be placed inside a rectangle with a total perimeter of 4. Because the shape isn’t fixed, there's more flexibility to adjust the configuration. To formulate problem 13, only five lines of code needed to be changed from the model for problem 12, and we could crack the next challenge, slightly improving on the AlphaEvolve solution of 2.36583213 with the Xpress solution of 2.36583237. We verified the correctness of these and all other solutions using the solution checking script provided on DeepMind’s Google Colab notebook.

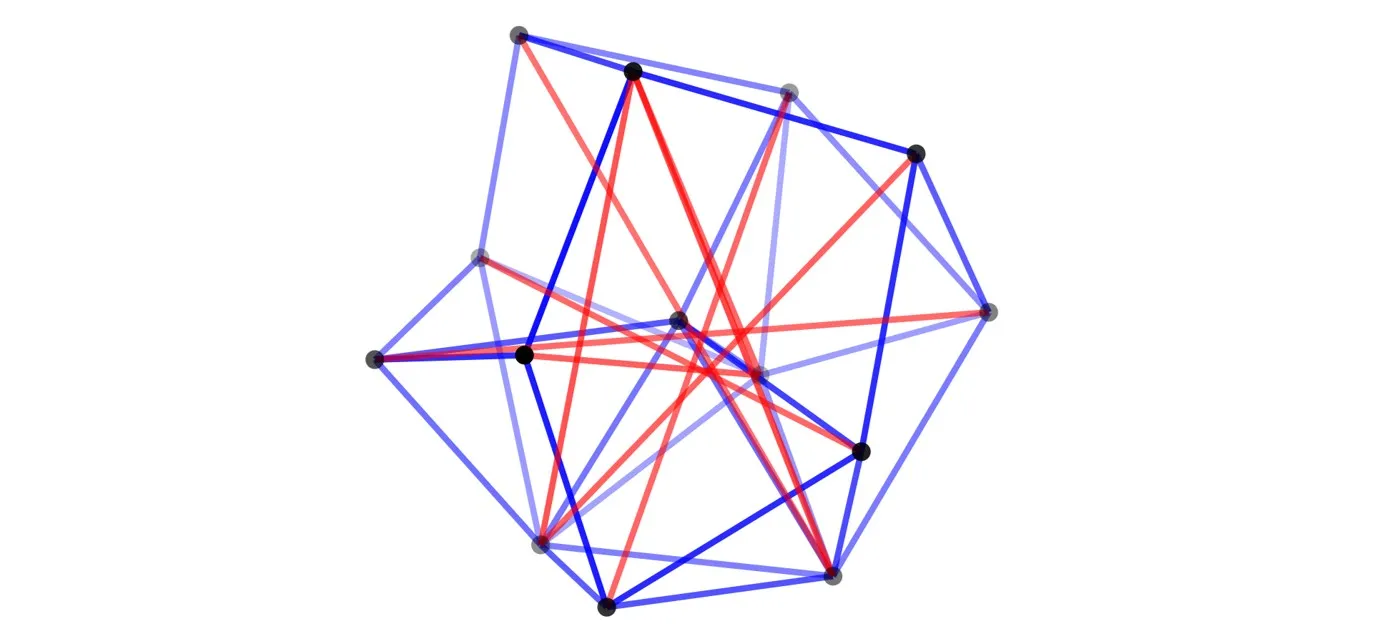

Minimum distance ratio (problem 8)

Problem 8 in the AlphaEvolve paper is to arrange a given number of points to minimize the ratio of the largest and smallest pairwise distances. In other words, place the points in such a way so that the largest distance between any two points is as similar as possible to the smallest distance between any two points. The question can be posed in any dimension; we are focusing on the 2D and 3D cases. Since scaling the resulting shape up or down does not change the ratio of distances inside a unit square/cube. For the 2D problem, AlphaEvolve discovered a search algorithm that found a solution with a ratio of √12.889266112 for the case with 16 points, improving the previously best-known solution of √12.89. FICO® Xpress Global again found a better solution of √12.889246743. For the 3D variant and 14 points, the pattern repeated. AlphaEvolve improved the previously best-known solution of √4.168 by finding a solution of √4.165849767. FICO® Xpress Global improved that to √4.165783989, again confirmed by the solution verification tool.

Figure 2. The new solution to the 14-point 3D distance ratio problem.

Summary of results

Our results are summarized in Table 1. We encourage you to explore our Python notebooks and run the models yourself. You can run the circle packing problem and minimum distance ratio problem in just a few minutes. Play around with the controls to see if you can find even better solutions —and if you do, drop us a note!

Table 1: Summary of solutions found by AlphaEvolve and FICO® Xpress. Problem 8 is a minimization problem (smaller is better). Problems 12 and 13 are maximization problems (larger is better).

Conclusion

For those working in mathematical optimization, the focus is on the model, not the algorithm. That’s a fundamental difference from many in-house approaches, where designing, tuning, and maintaining an algorithm (by hand or AI-assisted) is half the battle. With FICO® Xpress Optimization, users describe what they want to solve — the objective and constraints — in a natural, compact formulation. The solver then takes care of the how, automatically selecting and orchestrating sophisticated algorithmic techniques under the hood. This separation of modeling and solving empowers business users to focus on their domain of expertise while relying on decades of optimization research to do the heavy computational lifting.

Generative AI methodologies are producing innovations in many areas, and some show promise for advancing the state-of-the art in some mathematical problems. While FICO explores this new and exciting technology, the rigorous mathematical optimization algorithms of FICO® Xpress Solver are getting faster and better with every release. Note, AI (distinct from GenAI) and FICO® Xpress Solver often work hand in hand (see more on integrating AI into the Solver here and here). Meanwhile, we are excited about novel ideas attempting to push the boundaries of mathematics.

Responsible AI at FICO

FICO® was founded on the promise of using data to remove human prejudice and discrimination in lending decisions. FICO® invented a fair, transparent, and ethical approach to credit scoring that is based on math instead of subjective human judgement or bias. Our company has been operationalizing explainable and responsible AI for more than 20 years in the areas of credit risk and fraud detection and has patented new algorithms for explainable AI, ethical AI, and model governance standards and guidelines.

How FICO can help with Optimization

FICO® Xpress Optimization enables businesses to solve their toughest, most complex problems across all industries with mathematically proven algorithms. FICO® Xpress Solver offers a wide range of innovative optimization algorithms that are fast, scalable, and robust. FICO® Xpress Optimization leverages decades of FICO® innovation in Optimization combined with real-word expertise to deliver business value to hundreds of customers worldwide.

For every application, from logistics to credit risk to supply chain resilience, FICO Xpress Optimization supports a wide range of advanced analytics use cases. Users can build models using intuitive coding interfaces (Python, Mosel, Java, .NET, C++), adapt them to different industries, and execute high-performance optimization routines that are purpose-built to improve accuracy, scalability, and decision quality. This makes it ideal not only for data scientists and operations researchers, but also for business users working in increasingly AI-driven environments.

- Explore FICO® Platform’s combined AI, machine learning, and optimization stack, from model design to deployment and it’s Enterprise Optimization capability.

- See how to generate scalable solutions for real-world applications — visit the optimization in practice blog.

Acknowledgments

Special thanks to our FICO® colleagues: Imre Pólik, who initiated this project, Bruno Vieira and Susanne Heipcke for contributing the Python notebooks and visualizations, and to Gioni Mexi and Liding Xu at ZIB/MODAL for their contributions to solving problems 8 and 13.

The list of new best solutions found by FICO® Xpress Solver, together with verification script output, can be found here.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.