New Trends in Payments Fraud in Asia Post-Pandemic

Why consumers are moving to banks with the best fraud and scam prevention

The Growth of Real-time Payments and Fraud in Asia

The payments landscape in Asia is rapidly evolving, thanks to the emergence of new payment methods. The trend towards mobile payments has bolstered the use of mobile devices for financial transactions and spurred innovation across industries, while real-time payments have delivered incredible efficiency and convenience by providing a digital equivalent of physical cash that allows people to pay for things instantaneously.

In Asia, these technologies are being adopted by a rapidly growing middle class with increasing disposable income and a rising demand for financial services. The adoption has of course been turbo-charged by the pandemic. In India for example, our research showed that 95 percent of consumers do all or most of their banking online and have been keen adopters of real-time payments, with 78 percent uptake this year, a level significantly higher than customers in leading economies such as the U.S. (26%) and Germany (20%).

The appeal of these banking innovations has also made it a honeypot for fraud. Scammers are attracted to the increase in money flows and finding new inexperienced consumers to con online. One such cybercrime called Authorized Push Payment (APP) fraud, is a scam where fraudsters trick a target into sending them money. This makes this scheme particularly difficult to detect and prevent.

What’s concerning is that not all customers may be aware of the risks involved in banking services like real-time payments. As money is transferred near instantly to a peer or to a merchant, victims don’t have a window of time where they can try to reverse a payment once they realize they have been deceived. Fraudsters also swiftly launder it through multiple accounts, making it difficult to trace.

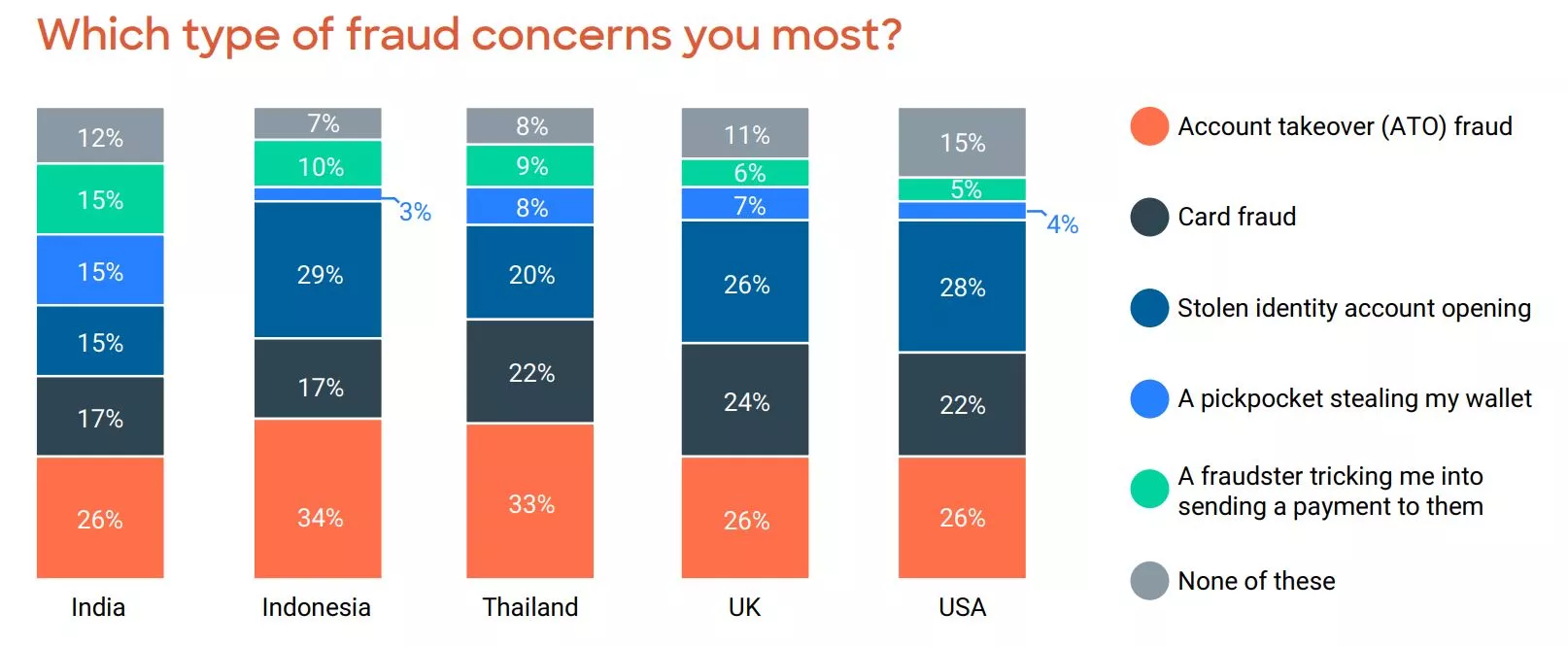

Indians Most Concerned About APP Fraud

FICO’s research revealed that Indian consumers were the most awake to the threat of Authorized Push Payment fraud. Fifteen percent of Indians said it was the type of fraud that concerned them the most. This was much higher than the U.S. (5%), the UK (6%), Indonesia (10%) and Thailand (9%).

What we are seeing is that APP fraud is becoming a bigger problem in India and across Asia as we see a boom in the use of real-time payments. Real-time payment systems such as India’s Unified Payments Interface (UPI) have been a prime target for fraud as transaction volume on the platform grows at a breakneck pace. One of the issues is that the platform is often used for transacting small dollar amounts, where hardly any authentication or verification checks are used, making users more vulnerable to fraud.

Protecting real-time payments requires analytics that look for changes in customer behavior such as using accounts or devices outside of their usual habits, as well as standard anomalies such as time-of-day or frequency of a transfer. FICO has found that the use of targeted profiling of customer behavior to spot scams has yielded some impressive results with 50 percent more scam transactions detected.

Fraud and Scam Protection the Top Consideration When Selecting a New Financial Account

Asian consumers are looking for banks that will protect them from scams like APP fraud. FICO’s latest survey has revealed that good fraud protection is now the top consideration when consumers are looking to open a new financial account. In the Philippines, 2 in 5 consumers see it as the top priority, with a further 1 in 4 saying it is the second most important consideration. The story is similar in Malaysia, with 1 in 3 ranking security first and a further 1 in 4 ranking it second.

This is a significant opportunity for banks that are leading the field in fraud and scam protection. It means that almost 23 million Filipinos and 7 million Malaysians are filtering financial providers to find those with the strongest security. This shows that good fraud protection can be a bank’s biggest competitive advantage rather than just an overhead.

Balancing Strong Fraud Protection with Convenience

Asian consumers are also becoming more aware of the efforts banks are making to protect them against crimes such as identity theft, account takeover and card fraud. 61 percent of Filipinos said that identity checks have increased when making online purchases and 56 percent have experienced more identity checks when they log into accounts.

It is important however to balance these checks to make sure they don’t provide too much friction to the banking process. The survey found for example that many Malaysians won’t open an account if the identity checks are too difficult or time-consuming. 37 percent gave up opening a savings account, 29 percent on a credit card and 27 percent on a personal loan.

Further to this, 26 percent of Malaysians said troublesome checks meant they reduced their use or stopped using their bank account and 27 percent their credit card.

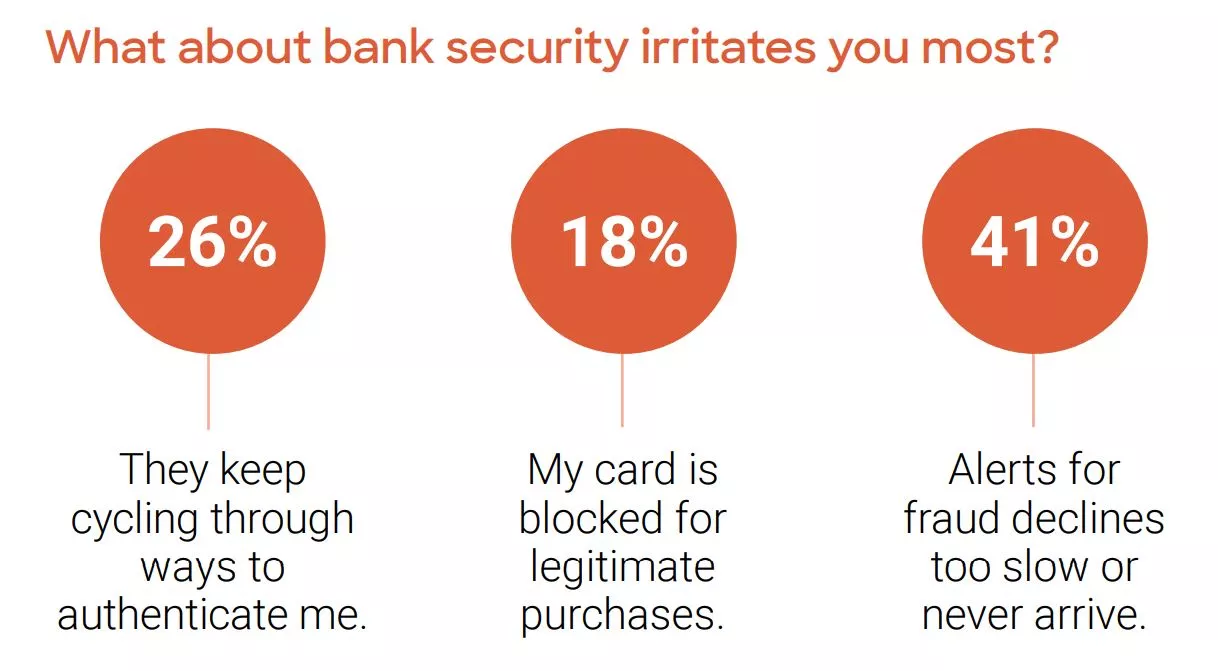

When it comes to convenience, 41 percent of customers in India are most irritated by declined transaction alerts for fraud that are late or never arrive. A further quarter (26%) of customers dislike banks changing the methods used to authenticate customers.

The uptick in adoption of digital payment modes not only expands the fraud attack surface but makes for a more complex set of customer experience concerns. These pit the need for superior fraud management against the desire for easier customer communication, authentication, and verification preferences.

As new scams and frauds emerge, banks are increasingly challenged with balancing customer experience needs against managing fraud risks and controls such as securing payment verification. Implementing effective account security technologies that reduce friction is therefore a priority.

Read more about our research findings for Asia here:

Fraud survey findings news release for The Philippines

See How FICO Can Help You Improve Your Fraud Prevention to Make it a Sales Asset

- Read our blog on FICO’s Scam Detection Score and how its use of targeted profiling of customer behavior has resulted in 50 percent more scam transactions detected.

- Read an article from Malaysia’s Star newspaper on why fraud protection is crucial to consumers

- Read our blog on How Can Banks Stop Authorised Push Payment Fraud?

- Take a listen to our ‘Around the World in Scams’ podcast looking at some of the challenges faced in Asia

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.