The Perfect Credit Score: Understanding the 850 FICO Score

What do credit score high achievers have in common and what can we learn from the credit behavioral characteristics in these populations?

At FICO we get a lot of questions about credit scoring and what it what it takes to achieve an excellent credit score. Some of the more frequent credit score related questions people ask are around the subject of a perfect FICO® Score:

- What is the perfect FICO Score?

- How can I get a perfect FICO Score?

- Does anyone have a perfect FICO Score?

- What’s the typical credit profile of someone who has a perfect FICO Score?

FICO® Scores are a sequence of three-digit numbers ranging from 300-850* and are based on the information provided by credit bureaus such as Equifax, TransUnion and Experian. Each lender determines the credit score cutoff they require to approve a request for credit and to help them set the terms (interest rate, credit limit, etc.) of the available credit being extended. Typically, most lenders do not require an individual to have the highest credit score to secure the best loan features. Instead, they set a high-end credit score cutoff (typically in the upper 700’s) where those applicants scoring above that credit score cutoff qualify as a very good credit score and get these most favorable terms.

In other words, don’t sweat it if you “only” have an 800 credit score as most lenders are likely to treat you the same if you score in the 800-850 range because your risk of not paying as agreed is very low in these highest FICO Score ranges.

The percent of the population with the highest credit score of 850 is relatively small but has been increasing. As of April 2023, about 1.7% of the U.S. scorable population had a perfect 850 FICO® Score. That compares to 1.5% in April 2018 and 0.8% in April 2013. This slight uptick is not surprising as we have been seeing the average FICO Score on the national population increasing as time since the “great recession” ages.

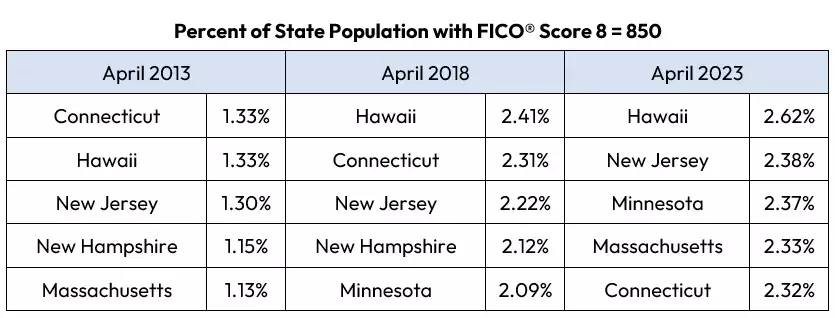

The top five states with the highest percentage of their respective populations with a perfect credit score of 850 has remained fairly consistent over the past ten years and that percentage has increased with each state over the time period as well.

These states also tend to demonstrate other “high achiever” behaviors in areas such as having a healthier lifestyle and higher education levels which likely correlate with sound credit history management behaviours. According to America’s Health Rankings by United Health Foundation, Hawaii, Connecticut, New Hampshire and Minnesota are in the top 10 states in terms of overall health rankings. Connecticut, New Jersey, New Hampshire and Minnesota are in the top 10 states for the percent of residents who have a bachelor’s degree.

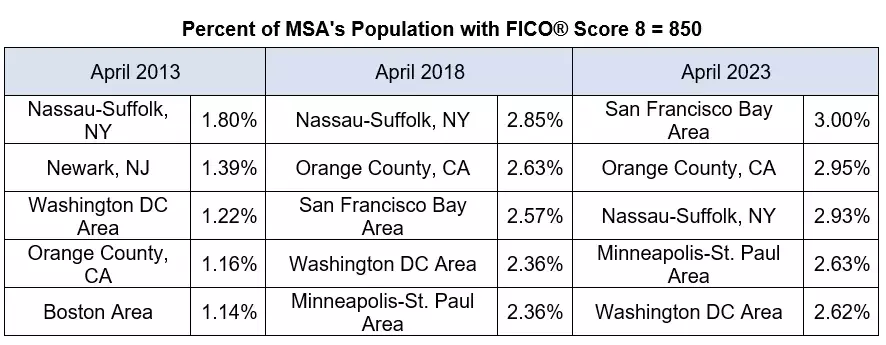

We also looked into the top MSAs (Metropolitan Statistical Area) to understand which cities have the highest percentage of their respective populations with the highest credit score of 850. As shown in the table below, large metropolitan areas encompassing Boston, New York, San Francisco, southern California, and Washington DC consistently surface for having the “bragging rights” for the largest percent of residents with a perfect 850 credit score. The data also shows that the percentage of the MSA’s population with the highest credit score of 850 has increased over the time period as well.

If you happen to have a “high achiever” personality and are focused on improving your good credit score to the "perfect" having an 850 FICO® Score, here are some credit behavioral characteristics we observed on the population with an 850 FICO® Score in April 2019:

- Payment history accounts for 35% of a FICO® Score and, not surprisingly, we see that those with an 850 basically have no reported history of missed payments, collections or derogatory information.

- Many people assume that to get an 850 you should have no credit debt. In fact, and perhaps somewhat surprisingly to some, we see that the 850 profile has and uses credit with an average credit balance of ~$13,000 reported (mortgage balances excluded). Their average revolving credit utilization tends to be relatively low compared to their available credit at 4.1%

- Most have a very established credit history with the average age of their oldest account being 30 years old.

- They are not all immune to seeking and opening new credit. About 10% had one or more inquiries in the past year and about 1/4th had opened one or more new credit accounts in the past year.

While it’s true that having a high FICO® Score can increase your access to more affordable credit, an all-consuming focus on trying to have a “perfect” 850 FICO® Score won’t really change how lenders look at you as compared to other high scoring applicants. Instead of focusing on having a perfect credit score, you can work toward attaining a high FICO® Score by paying your bills on time and improving your payment history, keeping credit card balances low, and only applying for credit as needed.

* Auto and Bankcard industry FICO® Score versions have a slightly wider credit score range of 250-900.

How FICO Can Help You Understand the FICO Score:

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.