Precise, Multi-Lever Promotional Pricing for Deposits: How to Actually Make it Happen

Here we are. My third and final post in the series on promotional deposit offers. If you’ve followed along this far, you may be saying, “Sure, that all sounds great, but it’s ideal…

Here we are. My third and final post in the series on promotional deposit offers. If you’ve followed along this far, you may be saying, “Sure, that all sounds great, but it’s idealistic and pie in the sky. It can’t actually be implemented, delivered, and measured.” Realists (and skeptics) of the world unite. In this post, we’ll get detailed, real, and dive into the practitioners overarching question: “HOW?” How can anyone deliver on the vision and reap the benefits shared in our previous posts?

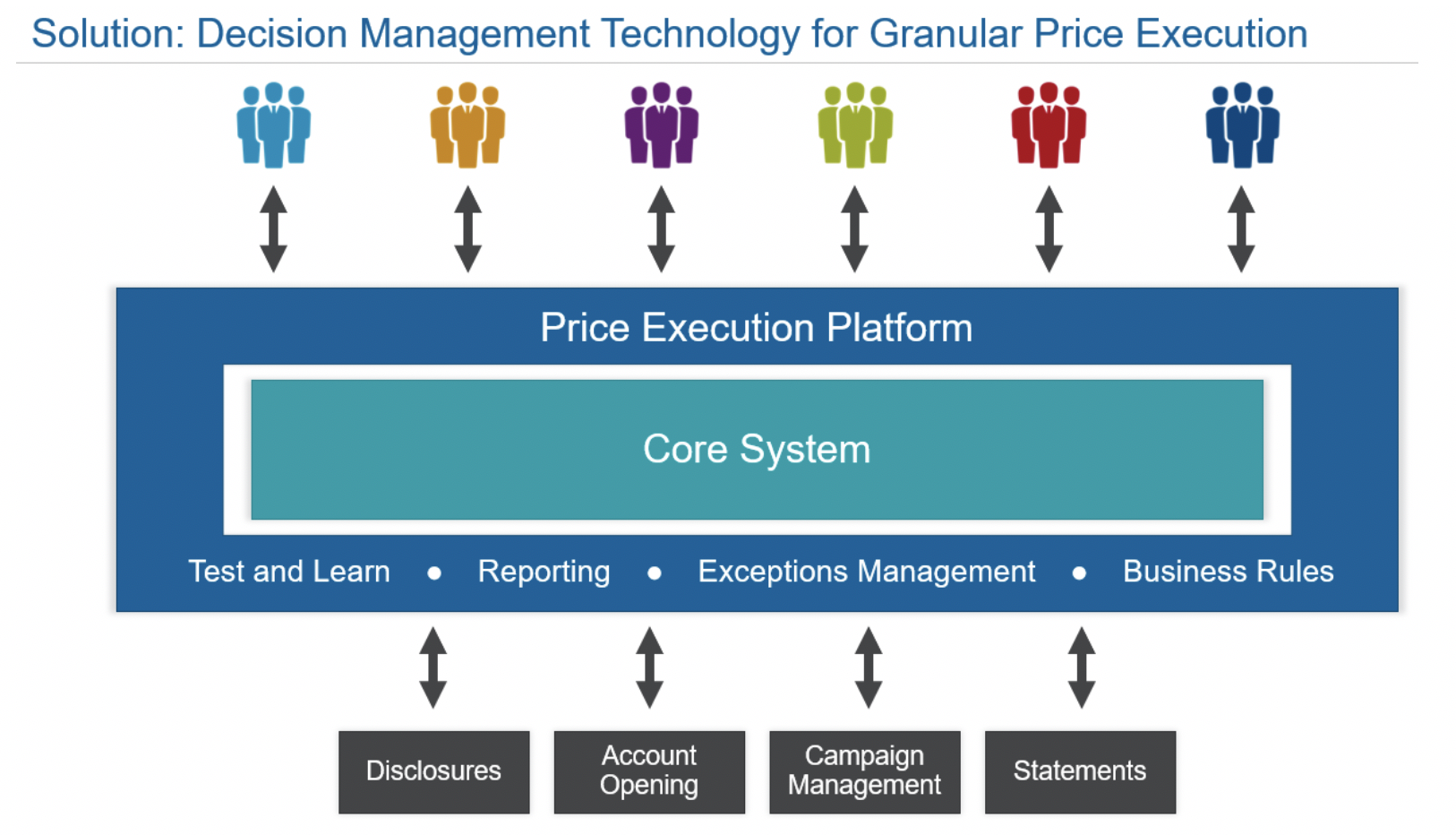

Here’s the reality: deposit accounts reside within a “core system” that provides account features, such as balance, interest accrual, and account properties. These systems (even in modern systems) only manage accounts and cannot serve as a flexible pricing engine. So, how can banks use multiple levers to build sophisticated, intelligent pricing strategies with entrenched (and often inflexible) core systems? The answer—a price execution platform.

How does it work? A price execution platform provides a “layer” or “wrapper” around the core system to deliver on any pricing construct the business team considers. The price execution platform is responsible for the offer attributes, eligibility criteria, and delivers a variety of outputs, including price, rate, or promotional benefits (like bonus interest). When multiple decisions are needed to determine an account’s interest rate, the platform performs the required decisioning, and then sends the resulting account rate or rate table to the core system for interest accrual.

The pricing process typically goes something like this:

- Customer, account, and transaction data is orchestrated and feeds into the platform from one (or more) core systems.

- The aggregated data is passed to the price execution platform.

- The platform evaluates the data to determine any required segmentation assignments, and then proceeds to eligibility logic.

- The process concludes with a decision result, such as the price, rate, or reward for the customer.

- Within this process, data enrichment is often applied. For example, if a minimum balance requirement was not met, the platform provides the dollar amount required, which can improve customer communication and business insights.

Banks can also combine prescriptive analytics in the form of optimization to improve operational effectiveness. Mathematical optimization can determine the best price for a customer or segment.

Consider a customer who is part of a 12-month promotional offer. Through optimization, the best customer retention offer can be identified, enabling the price execution platform to operationalize these analytically driven insights. When a bank deploys a price execution platform, they can respond quickly to market needs, develop attractive offers, and provide distinctive attributes to existing deposit products. Banks can fulfill offers without inefficient manual workarounds.

But, how does a bank know a specific offer will be effective? The answer is simple. When in doubt, test it! Testing offers is a proven method to validate offer effectiveness. Champion-challenger testing can validate offers and should be part of any price execution solution. Those proven offers and strategies can be used to inform future strategy design, creating a feedback loop of executing strategies, testing strategies, optimizing for further refinement, and designing more precise and intelligent strategies.

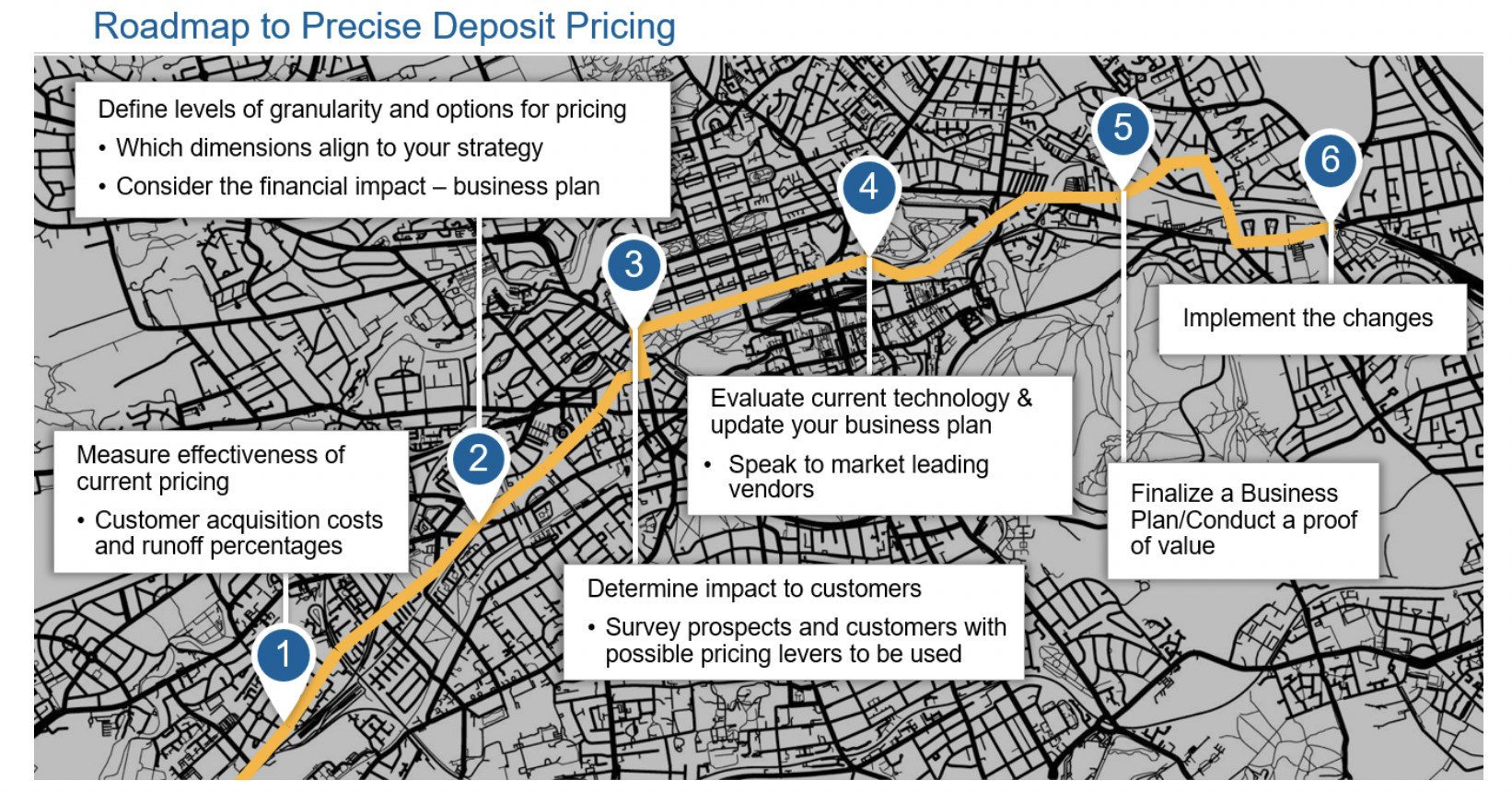

So, what are the next steps to bring a price execution solution into your organization? Here are some tips to consider:

- It’s important to look for trusted technology partners who provide proven analytic capabilities and deep domain experience.

- To overcome “status quo” mindsets, we’ve helped market-leading Deposit Teams build compelling business cases, and often the value extracted from effective offers provides an impressive ROI for decisionmakers.

- Often, it’s also possible to blend more than one business unit into the solution as a platform approach vs. a limited point solution. This enterprise approach provides measurable benefits that more than one line of business can leverage, magnifying the overall business value of the solution.

- Lastly, here’s a handy roadmap that charts the typical journey to implement precise deposit pricing. Part art, part science, and completely critical for banks who want to lead in the war for deposits.

To learn more, check out FICO’s Precision Price Execution Solution for Deposits.

Previous blogs:

Promotional Pricing for Deposits—One Size Does NOT Fit All

“The Art of the Possible” in Promotional Pricing for Deposits: A Precise, Multi-Lever Approach

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.