Preparing Your Collections Operation for the Current Crisis

Use this webinar series for guidance on how to manage collections and recovery through the COVID-19 pandemic

Organizations’ ability to help customers manage their debts is about to be tested like never before!

We are facing both a massive economic disruption that is imperiling consumers’ ability to make payments and an unprecedented public health crisis that is inhibiting companies’ ability to staff the contact centers as their customers are calling in for help en masse.

This confluence of challenges has prompted an urgent question for any organization that deals with receivables management – how do we build more resiliency into our collections and recovery operations?

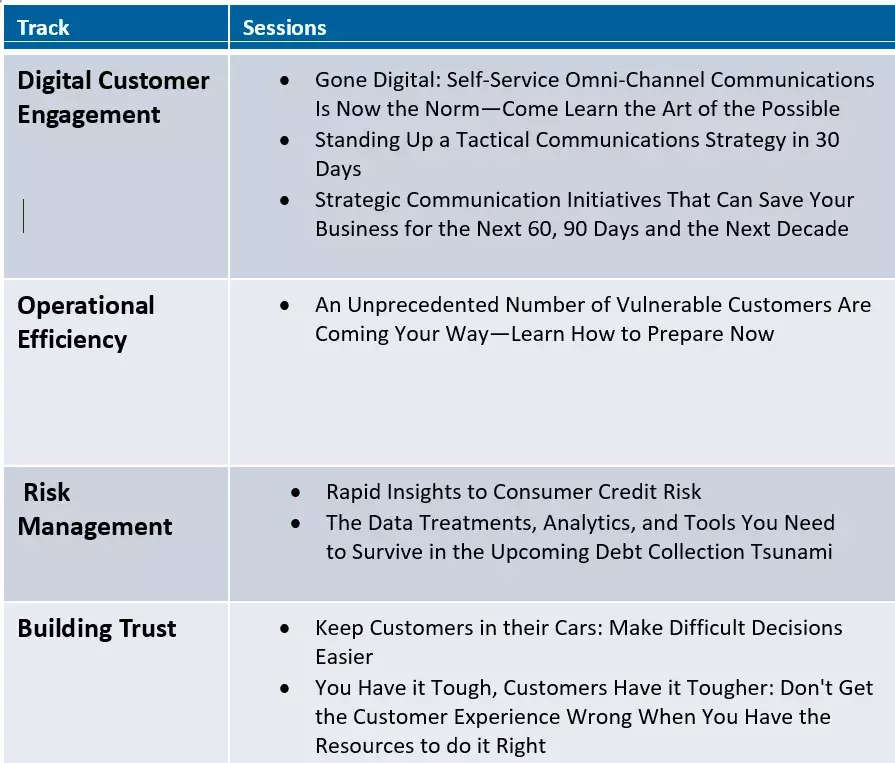

FICO is here to help you answer this question. On April 20, we will launch a month-long virtual event entitled “Building Resiliency: Adapting to the Challenges of Today”. With a series of webinars held across the globe, FICO subject matter experts will share learnings, best practices and strategies on topics that fall within six tracks: Adaptability, Digital Customer Engagement, Risk Management, Operational Efficiency, Building Trust and Protecting Customers.

Below are a few of the sessions, across these tracks, focused on the critical challenges facing collections and recovery professionals right now.

Registration is complementary and open now. We hope to see you there!

For more information on collections in the current crisis, read these recent posts by the FICO team:

Payment Holidays: New Tool for Managing the Surge

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.