Real-Time Payments Survey Reveals Growth in Usage - and Scams

Real-time payments are a growing global phenomenon, but the shifting payments landscape is also giving fraudsters new attack vectors

Real-time payments have become popular worldwide, with volumes growing by double digits quarter over quarter for four straight years. According to FICO’s latest survey of consumers from 14 countries around the globe, 90% of all consumers have sent a real-time payment, and at least 95% of consumers have used real-time payments in India, Indonesia, the Philippines, and Brazil.

Real-time Payments Growing in Use, Popularity

Consumers’ use of real-time payments (RTP) has grown more frequent. Globally, 38% of consumers are using real-time payments more than 5 times per month, most often to pay another person or a business. In Brazil, however, 62% of consumers use real-time payments more than 5 times per month and 38% transact this way more than 10 times per month.

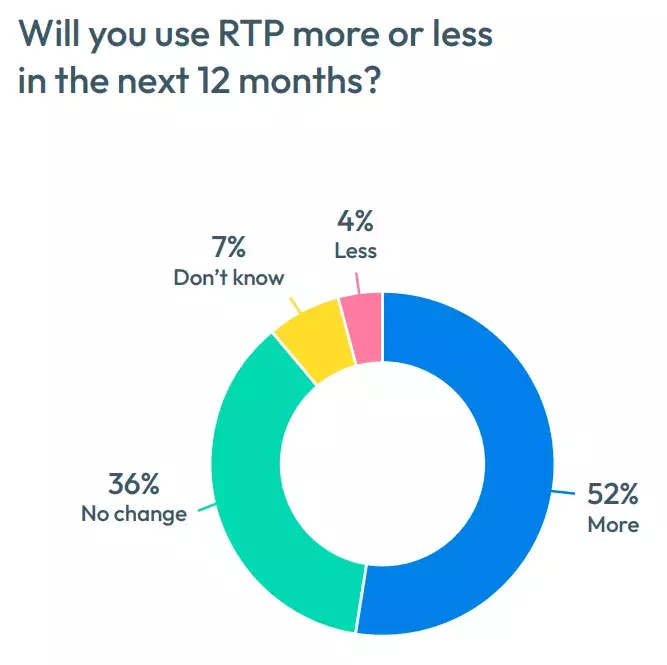

Throughout the countries we surveyed, RTP usage shows no signs of slowing. Almost 9 out of 10 consumers (88%) expect either to increase their use in the coming year or to continue at their current rate. In India, where 61% of consumers already use RTP more than 5 times per month, 82% say they will increase their RTP use this year. Similarly, in Turkey, 45% of consumers already use RTP more than 5 times per month and 63% plan to use RTP more in the coming year.

When asked what they like best about RTP, 87% of consumers admit it is the sheer speed with which they can transfer funds. 76% say they like how easy RTP is to use, and another 53% favor RTP’s accessibility. Had we surveyed the scammers who take advantage of real-time payment users, they might have provided similar answers!

More Business Adoption Coming

Businesses are expected to use RTP more too, with 32% of those surveyed saying they’ve used RTP to pay from a business to a person. S&P Global Market Intelligence reports that in the second quarter of 2022 alone, real-time payroll payments more than doubled compared to the prior quarter and accounted for nearly 15% of total RTP volume.

It stands to reason that as more payees adopt this simple and inexpensive form of payment, more businesses will also gravitate to it as a less expensive and faster way to compensate employees and contract workers. One significant consideration for businesses turning to RTP is the potential for fraud in various forms, from fake invoices to mules requesting refunds for goods that were initially stolen. As we see in any new payments channel, fraudsters are often first in line for exploiting weaknesses, so businesses that use RTP will need to keep a sharp eye out for scams.

Growth in RTP = Growth in Scams

With the global growth of RTP comes the corresponding global growth of authorized push payment fraud (APP fraud), also widely known as scams. In 2022, UK Finance reported that nearly 41% of fraud losses were due to APP fraud, where individuals are conned into sending funds via RTP to criminals. The U.S. environment is not faring any better; according to the US Federal Trade Commission (FTC), US consumers lost at least $8.8 billion in scams in 2022, a 30% increase over 2021. Most common were impostor scams, where consumers or businesses are conned into sending money to criminals that falsely impersonate a legitimate person or business.

“As real-time-payments continue to grow, scammers are using increasingly sophisticated technology to target more victims than ever before. Banks and consumers must work together to combat fraud in real time,” said my colleague Adam Davies, vice president of fraud and identity solutions at FICO. “Consumers’ safety must be the first priority for banks by leveraging outside technology to stop scammers before they start.”

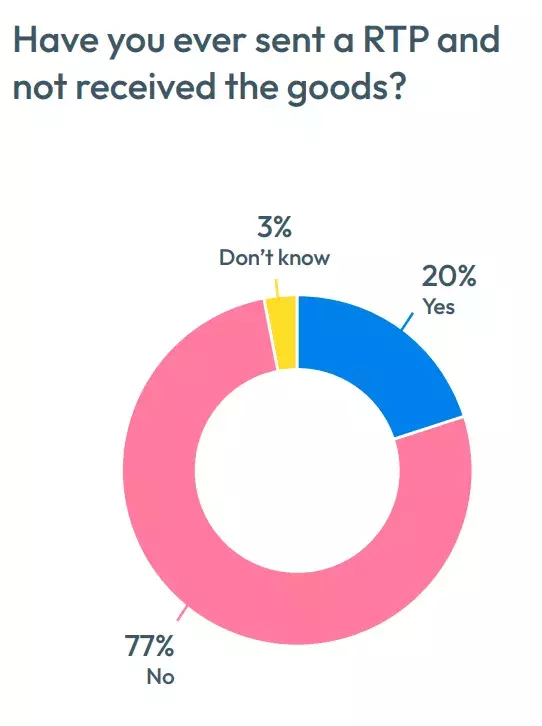

Our survey shows that 68% of consumers have received an unsolicited text, email or phone call that they thought was part of a scam, and 20% have sent an RTP for goods or services they never received. In India, which is experiencing its own wave of impersonation and APP fraud scams, 45% of consumers have sent RTPs for goods they have not received.

Opportunities for Education

One contributing factor to the impact of scams is likely a widespread misunderstanding about the risks consumers face when using RTP channels. Unlike credit cards, which include explicit liability protections for fraudulent charges, many RTP channels do not offer liability protection for payments sent to a criminal by the authorized user. Using RTP is akin to using cash — once you hand it over, you can’t readily get it back.

Despite these important differences, more than half (56%) of consumers believe RTP are more secure than credit card transactions and three-quarters feel RTP processes include sufficient security checks. These attitudes persist, despite 68% of consumers saying they’ve received a likely scam text, email, or phone call and more than half (51%) believing their friends or families have been victims of scams.

For banks, there is a significant opportunity to provide more education about the differences between RTP channels and credit card payments, as well as consumer impacts of sending authorized payments to scammers. This approach could help offset some negative consumer sentiment, as nearly a third of consumers (31%) say banks aren’t providing enough education on real-time payment scams while 65% would like to see more warnings about emerging scams during the payment process.

Authorized User Fraud Requires a New Approach to Detection and Prevention

Bank customers would be grateful for any intervention on their behalf. Our survey finds that 70% of consumers worldwide would feel positive about their bank if a scam payment were stopped in progress and before a loss occurred.

While security and user authorization are priorities for RTP providers, scams typically involve authorized users being manipulated into sending payments to criminals. Scams and APP fraud can deceive traditional fraud management models as a result, because they see an authorized payment rather than an authorized payment coerced by a scammer.

Banks can help protect customers by using technology to identify and segment transactions that have characteristics of authorized user/APP fraud. Rather than relying on models and approaches that have been historically geared to unauthorized user or third-party fraud, a bigger analytical picture can include scam detection technology and other data points like:

- Time of day

- How long the recipient has been connected to the sender

- The sender’s RTP history

- Whether the customer moved funds into an RTP accessible account in the same online session

- Other contextual factors

By looking at these behavioral data points, banks and other financial institutions can start to answer the critical questions of both who is conducting a transaction, as well as why they are making this particular one. Armed with the right data, and the ability to apply it in real-time, banks can give their customers powerful defenses against scams.

How FICO Can Help Protect Against Scams

- Download the 2023 Global Scams Impact Report

- Explore FICO’s award-winning retail banking and scam detection model to identify and stop potentially fraudulent transactions.

- Learn how real-time, two way omnichannel communications can connect you with customers and confirm transactions in real-time.

- Join us at FICO World 2023 for insightful and engaging sessions about the global impact of RTP and scams. Register now!

Follow me on LinkedIn for more insights about FICO’s innovative fraud fighting efforts.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.