Russians' credit health is strengthening

Much of the focus on the Russian election this week has put a spotlight on how far the country has come since perestroika and the end of the Cold War. Yesterday FICO released our o…

Much of the focus on the Russian election this week has put a spotlight on how far the country has come since perestroika and the end of the Cold War. Yesterday FICO released our own analysis on an interesting part of the country’s picture: the credit health of Russian consumers.

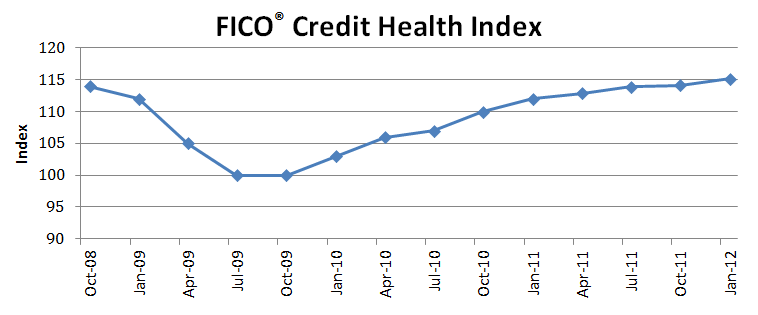

In conjunction with the National Bureau of Credit Histories (NBKI), Russia’s leading credit bureau, we released data showing that Russians are managing their credit better than at any time in the last three years. The January 2012 FICO® Credit Health Index for Russia shows the highest mark since the index was established in October 2008, revealing a sharp and sustained decrease in credit risk since 2009.

The FICO Credit Health Index measures the overall credit health of the country, based on the percentage of consumer loans and credit cards reported to NBKI that are delinquent by more than 60 days. Since October 2009, when this “bad rate” was 11.28 percent, the index has been steadily improving, and in January 2012 just 7.05 percent of Russian credit accounts were delinquent — a reduction of 37.5 percent.

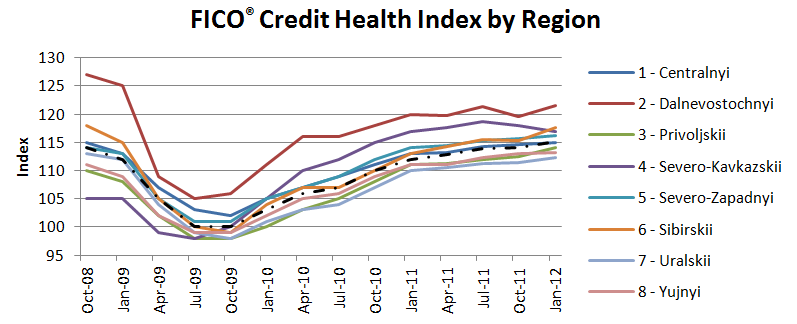

FICO and NBKI also studied the performance of eight regions in Russia separately. Each region shows a pattern similar to the overall trend, but some regions clearly outperform others. The Dalnevostochnyi region had the best overall credit health, while the Severo-Kavkazskii has improved the most since 2008.

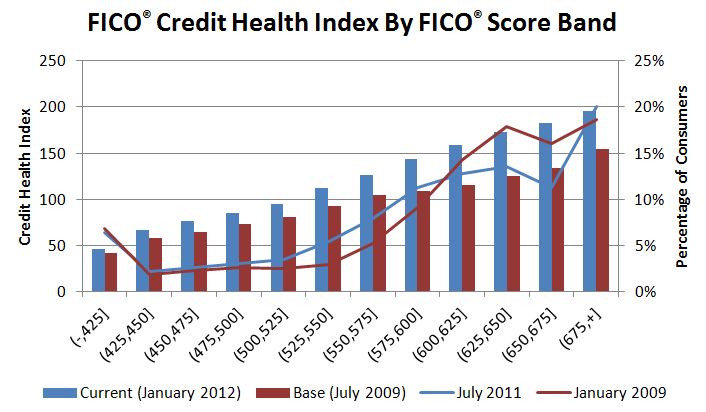

Finally, FICO’s latest report also demonstrates the relationship between the FICO Credit Health Index and the FICO® Score. The red and blue bars in the chart show that the FICO Credit Health Index increases for consumers with higher FICO Scores. Between July 2009 and January 2012, the credit risk level has improved for consumers in every score range.

The red and blue lines indicate the percentage of consumers that fall into each FICO® Score band. The shift in the distribution shows that more consumers scored higher in July 2011 than in January 2009.

Overall, this picture provides a contrast with many markets in Europe, where delinquencies are increasing and credit health is deteriorating. For that data, watch this space later this month when I blog about our latest European Credit Risk survey.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.