"Score a Better Future" Increases FICO Score Understanding

We answer the top 10 most asked credit scoring questions.

Your FICO® Score today doesn’t have to be your FICO® Score in the future. That is our mantra for FICO’s Score a Better Future program because we want to empower consumers to reach their financial goals. Score a Better Future is a series of free educational events FICO is holding across the US that bring together consumer advocates, credit counselors, and community leaders to help Americans learn about credit scores and provide the financial tools to help them to achieve their dreams.

Attendees are asked to complete a short questionnaire before the event starts to gauge their understanding of credit scoring fundamentals. In addition, audience credit and credit score related questions are encouraged throughout the program.

Evaluation of these questions and attendee topics of discussion surfaced strong awareness in some areas and room for improvement in others:

- The overwhelming majority of attendees correctly answered that missing payments can have a substantially negative impact on a FICO® Score and understood the difference between hard and soft inquiries – specifically that hard inquiries are considered by the score while soft inquiries are not. They also showed a strong awareness regarding when a FICO® Score can be accessed (such as when applying for an auto loan) and when it cannot not (such as setting up a Facebook profile).

- While the majority of attendees understood that having excessively high debts was not good for their credit score, there was a sizable percent of participants who incorrectly assumed that closing down inactive credit cards is a positive action that will increase their score (in reality, this action can result in a score decrease). In addition, there was widespread misunderstanding that having a revolving utilization of 30% or below resulted in optimal points within the score calculation.

- Most attendees were in-the-know that information such as gender, zip code and race are not considered in the FICO® Score calculation. Less clearly understood was the fact that income is also not factored in the score. Additionally, there was confusion regarding what happens to individuals’ credit reports and FICO® Scores when they get married. Some attendees incorrectly assumed the credit reports and scores are merged.

Chances are that other individuals who have not attended a Score a Better Future event may have similar credit score related questions and misunderstandings. As such, we have put together a list below of the top 10 credit scoring topics and/or questions that surfaced (along with answers) in the program.

Having a deeper understanding of credit, FICO® Scores, and how lending works can help consumers make better credit-related decisions and potentially save thousands of dollars in interest rates and fees.

Want to learn more about credit scores? No worries! You can test your FICO® Score knowledge by playing with our Credit Galaxy game or visit the credit education section of myFICO for more information. We encourage you to engage, share content, and help us spread the word about the importance of financial and credit education.

--------------------------------------------------------------

Top 10 FICO® Score Questions

1) Is my income considered in a FICO® Score calculation?

No. FICO® Scores focus on credit related information found in your credit reports. Verified income is not found in your credit report and does not factor into the score calculation. However, income information is an important factor that is often requested and used by a lender within their credit policies and criteria when reviewing your application for credit.

2) Will closing credit cards help improve my FICO® Scores?

No, it will not and it may have the opposite effect and cause the score to decrease.

A FICO® Score does not consider a reported closed status (closed, closed by consumer or closed by credit grantor) as a negative item. However, the FICO® Score will still consider any historical missed payments that are reported on a closed account.

The area where the action of closing a credit card account may have impact on a FICO® Score is with evaluation of revolving account utilization. This is simply a ratio that looks at how much of your available revolving credit limits are being used. The higher revolving utilization percentage the greater the risk.

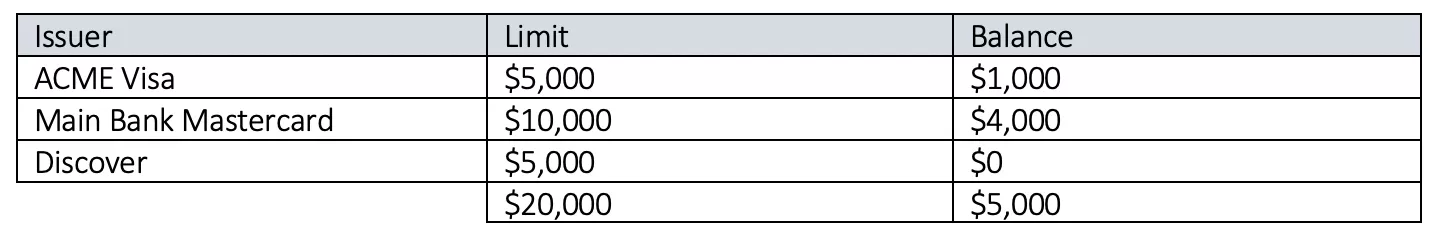

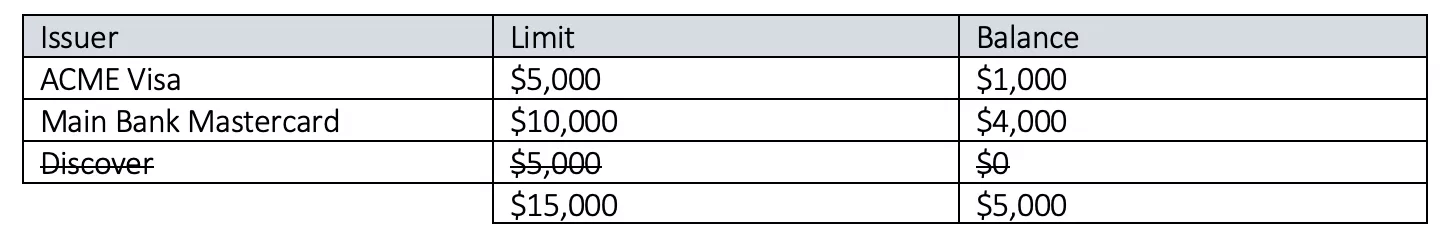

For example, assume John had the following credit card information on his credit report:

Based on this information, John is 25% utilized ($5,000/$20,000) and has two of his three cards reported with a balance.

Now, assume the Discover card is marked as closed:

Based on this new information, John is now 33% utilized ($5,000/$15,000) and has two of his two cards reported with a balance. In this case, the closed status likely impacted his FICO® Scores as his revolving utilization is higher and looks riskier.

The closing of an account may cause the score to decrease or it may have no impact at all. It depends on the information contained on the closed card as well as all the other information in your credit report.

3) What should I do to increase my FICO® Scores?

The first step is to educate yourself. Get access to your FICO® Scores so you can see where you currently stand. In addition, you should review the negative score factors delivered with the score providing insights into the main factors or reasons on why your score is not higher.

Create a plan of action based on the score factors that can help you to increase your scores overtime. For example, a focus on reducing credit card balances would make sense if “You've made heavy use of your available revolving credit” surfaced as a negative score factor. Don’t open new credit accounts if “You have a short credit history” is surfacing.

In general, actions such as paying your bills on time, using your available credit responsibly and only applying for credit when needed may help you increase your FICO® Scores overtime.

4) I have read that having 30% or lower revolving utilization results in optimal points for this credit attribute. Is this true?

The Amounts Owed category accounts for about 30% of what makes up a FICO® Score. This includes assessment of information such as the amount of balances carried on revolving and installment accounts, the number of accounts with balances and the amount of available credit being used. Generally speaking, the lower the amount of debt one has and using a lower percentage of your available credit results in more points awarded in this category.

There is nothing “optimal or significant” about 30% revolving utilization. It’s relative. Having a 30% revolving utilization is less risky and results in more points awarded compared to having a 40%, 50% or higher utilization percentage, but generates fewer points compared to having 20%, 10% or lower utilization percentage.

Note, having a low revolving balance is actually less risky compared to having no balances at all. Having a low balance indicates you are using credit in a responsible manner.

5) I have a spotty credit history, but that is all behind me now. Will my score ever increase?

The good news is that FICO® Scores are dynamic – moving up or down as the underlying information in your credit report changes. As such, a low score doesn’t have to haunt you forever. Access your FICO® Scores and learn what negative factors are impacting them the most. Focus on addressing those behaviors to help improve your FICO® Scores over time.

How quickly your scores change and by how much depends on your credit-related actions and behaviors as reported to the credit bureaus. If you have a history of missed payments, their impact on the score will gradually lessen over time as they age and your more recent credit behaviors reflect on time payment and a responsible use of your available credit.

Once you achieve that higher score, monitor and protect that credit rating you’ve worked so hard to get. A single missed payment can result in a substantial point drop.

6) I am confused as I have multiple FICO® Scores that can differ by 25 points or more in some cases. Why is that?

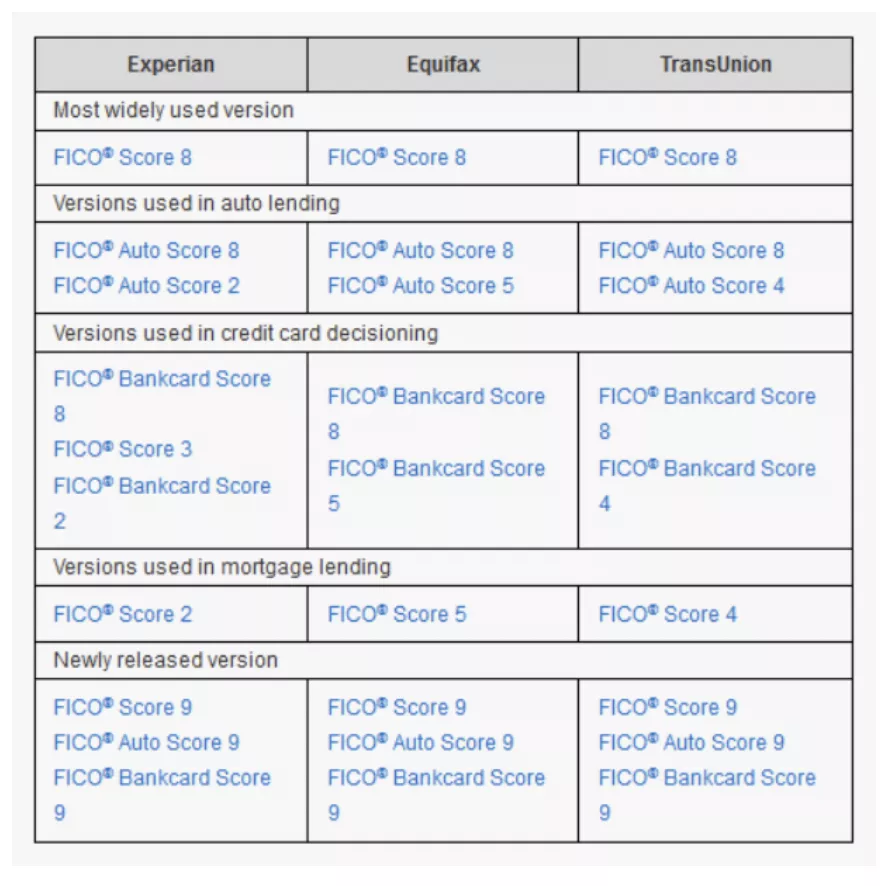

Most of us have multiple credit scores and the score values can be different. There are also educational scores offered, which are not the same as FICO® Scores. Focusing in on FICO® Scores, the below table illustrates the multiple versions that are used by lenders today.

Why are there multiple FICO® Score versions?

- There are three national credit bureaus (Equifax, Experian and TransUnion) and FICO® Scores are calculated/distributed by each of the three.

- There are “base” versions of the score as well as industry-specific versions for auto and bankcard risk assessment.

- There are several generations of the score as they are periodically updated and the newer versions are released to market.

As an analogy, think of evolution of smartphones. The various generations of the smartphone all share the same base functionality, but each version also has unique updated features to meet evolving user needs and take advantage of evolving technology. Each individual determines which smartphone version they want to use.

The same holds true with FICO® Score versions. All versions effectively predict future credit risk, but each new release has unique updates to enhance predictiveness. Each lender determines what FICO® Score version they will pull and use in their credit evaluation processes.

Walk through this checklist to help you understand potential reasons why there may be differences when you see different FICO® Score values:

- Are the scores sourced from different credit bureaus? The underlying credit report information on you likely differs across the three credit bureaus which can result in different score values.

- Were the credit reports/scores pulled at the same date/time? If not, the underlying credit report information can be different and that can drive different score values.

- Are the FICO® Score versions different (a FICO® Score 8 versus FICO® Score 5 for example)? Each version of the FICO® Score provides a unique assessment of the potential credit risk resulting in different score values.

Regardless of the version, actions such as paying your bills on time, using your available credit responsibly and only applying for credit when needed can help you increase your FICO® Scores overtime.

7) I have some extra money this month! How should I apply this to reduce my debt and increase my credit scores?

Demonstrating a history of paying down your debt on time is considered positive by FICO® Scores. However, the data shows us that the amount of revolving debt (such as credit card balances) owed tends to be weighted more heavily in the scores versus installment type debt owed – such as a car loan or personal loan . Learn more about revolving vs. installment loans.

So if you have extra money you can apply to this month’s round of bills, applying it against your credit card debt versus paying down installment debt may have a greater chance of positively affecting your FICO® Scores.

8) Will getting married result in a merged credit report and FICO® Score with my spouse?

In short, no.

Consumer credit reports are created, stored and maintained at the individual level. Credit obligations that are opened at the individual level will only be reported on that individual’s credit report. For example, you are married, but apply for a new credit card in your name only. This credit account would only be reported on your credit report. Credit obligations opened jointly (more common with mortgages and auto loans for example) will be reported on both person’s credit reports.

Negative activity on an individual account would only be reported on that individual’s credit report and impact that individual’s FICO® Scores. Negative activity on joint accounts is reported on both individual’s credit reports and impact both individual’s FICO® Scores.

9) I try to be frugal and search for the best deals. Will rate shopping for the best car financing terms hurt my FICO Score?

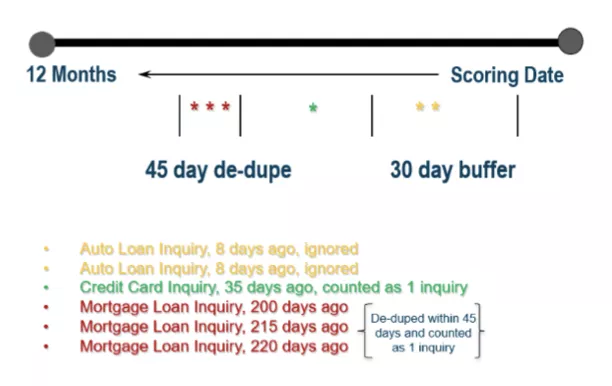

Generally, no. However, any time anyone accesses your credit report, the credit bureau captures information about that request and posts a summary on the credit report in what is referenced as an inquiry. Inquiries stay on the credit report for 24 months. FICO® Scores only consider hard inquiries posted in the last 12 months.

Inquiries factor into FICO® Scores as they are an indicator that a person is actively seeking new credit and the research shows credit seeking individuals are riskier compared to individuals who are not actively seeking new credit.

While hard inquiries are considered in FICO® Scores, their impact on a FICO® Score is relatively minor typically costing several points. In addition, FICO has created allowances to accommodate for lending scenarios where your credit report is being accessed multiple times even though you are only looking for one loan.

Auto, mortgage and student loan related inquiries that occur 30 days prior to scoring have no effect on the score. Outside this 30-day period, auto, mortgage and student loan related inquiries that occur within any 45-day period are treated as a single inquiry.

In this example, the two auto related inquiries posted in the 30 day buffer period prior to the score date are ignored in a FICO® Score calculation. The credit card inquiry counts as a single inquiry. The three mortgage related inquiries occurred within a 45 day de-dupe period and count as a single inquiry.

As a general rule, it’s ok to apply for credit when needed. Just be mindful of this information so you can start the credit seeking process with more confidence.

10) I have no credit history. How can I start to establish and build credit and have a FICO® Score?

It can seem like a “catch-22” situation. In order to get credit you need to have an existing credit history. Lenders want to be confident that you’ll pay on time as agreed if they extend you credit and seeing a history of that behavior (via a FICO® Score) helps them in that decision process.

Here are some actions you may want to consider if you don’t have a credit history:

- Apply for a secured credit card. Most lending institutions offer secured cards and most will report your performance on the secured card to the credit bureaus. FICO® Scores consider the reported secured card information like any credit card. Using the card, paying on time and keeping balances low relative to the credit limit can help you establish credit and qualify for the minimum scoring criteria.

- Be a co-applicant on a credit card or loan. Engage with a trusted family member or close friend who has good credit and would be willing to be a co-applicant with you. If approved, the lender will report the performance to the credit bureaus on both applicants, which can help you establish your credit history. Note, the primary and co-applicant are both legally responsible for the credit.

- Become an authorized user on a credit card. Again, engage with a trusted family member or close friend who has good credit and would be willing to have you as an authorized user on their credit card. The card issuer will typically report the credit card performance to the credit bureaus on both the primary cardholder and the authorized user, which can help you establish your credit history. Note, if the primary cardholder misses payments or runs up the card balance, it will likely be posted to your credit report as well and could negatively impact your credit rating.

- Periodically use your credit. Some people don’t like to use credit – and that’s fine, but it could result in you not meeting the minimum scoring criteria due to lack of recent activity. This situation can be avoided if you periodically use a credit card or other revolving credit (make a small charge and pay it off when the statement arrives in the mail) so that activity on that card is reported to the credit bureau.

While most U.S. consumers have FICO® Scores, not everyone does. In order to generate a FICO® Score, your credit report must have the following:

- At least one account opened for six months or more, and

- At least one account that has been reported to the credit bureau within the past six months, and

- No indication of deceased on the credit report

The minimum scoring criteria may be satisfied by a single account or by multiple accounts on a credit file.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.