Simulated FICO Score Impacts due to Mortgage Forbearance

Analysis identified modest impacts to FICO Scores from forbearance-related potential increases in mortgage balance.

Here at FICO, we’ve fielded numerous questions about the impact to FICO® Scores due to credit reporting during the pandemic. Most of the questions we have received center on the impact from accounts being newly reported in some form of mortgage payment accommodation (e.g., forbearance or deferment). But in recent weeks, there is increasing focus on how FICO® Scores might shift as a result of consumers exiting mortgage payment accommodation programs. In this analysis, we simulated the impact to FICO® Score 8 that could result from up to 12 months of mortgage forbearance accommodation.

As mortgage interest continues to accrue during a forbearance period, this can be reflected in increases in mortgage balances reported to the credit bureaus. FICO research demonstrates that there could be modest downward impact to FICO® Score distributions as a result. The majority of the simulated score changes were in the 1-19 point range, with the average score change being -3.7 points for a 6 month mortgage forbearance and -7.5 points for a 12 month forbearance.

Research Study Design:

- The simulation was enacted on all open mortgage accounts identified within a representative national sample of millions of U.S. consumers. As a result, all stats shared in this blog are based solely on the consumer population that has at least one open mortgage reported in their credit file.

- Two mortgage forbearance simulations were run: one assuming that monthly mortgage payments would be suspended for 6 months, and one assuming the payments would be suspended for 12 months.

- In these simulations, balances were estimated to aggregate in the amount of 80% of the total scheduled monthly payment amount per month. This was arrived at as an approximate upper bound of the portion of the payment that is interest and potentially escrow (property tax, insurance). Principal owed would not aggregate, since the principal is already covered in the current balance. The average simulated balance increase was $9,500 over 6 months, and $19,000 over 12 months.

- Post-simulation FICO® Score 8 results were calculated on the credit reports changed as described, and then compared to the pre-simulation FICO® Score 8, all else held fixed.

Impacts to FICO® Score 8 Pre & Post Forbearance

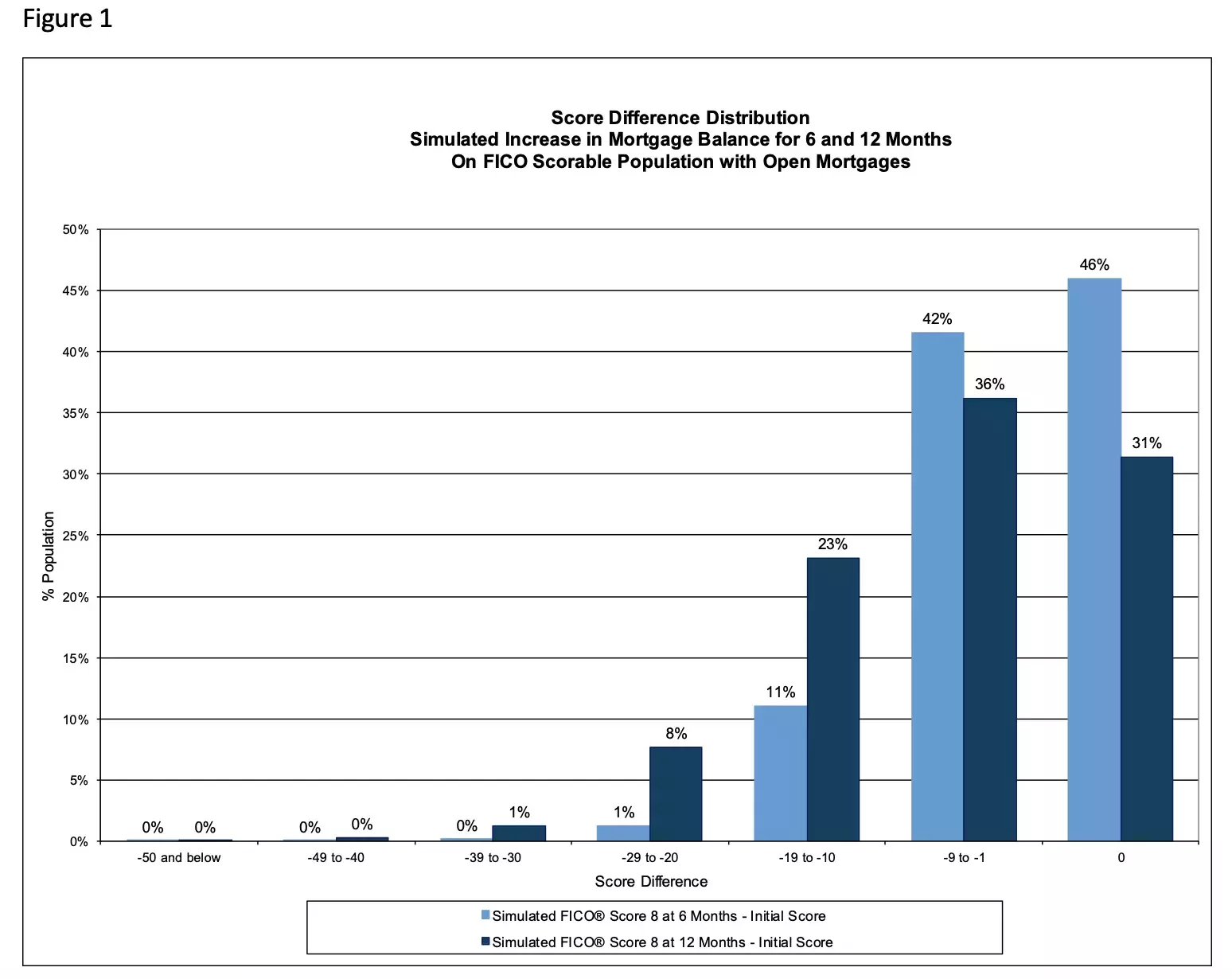

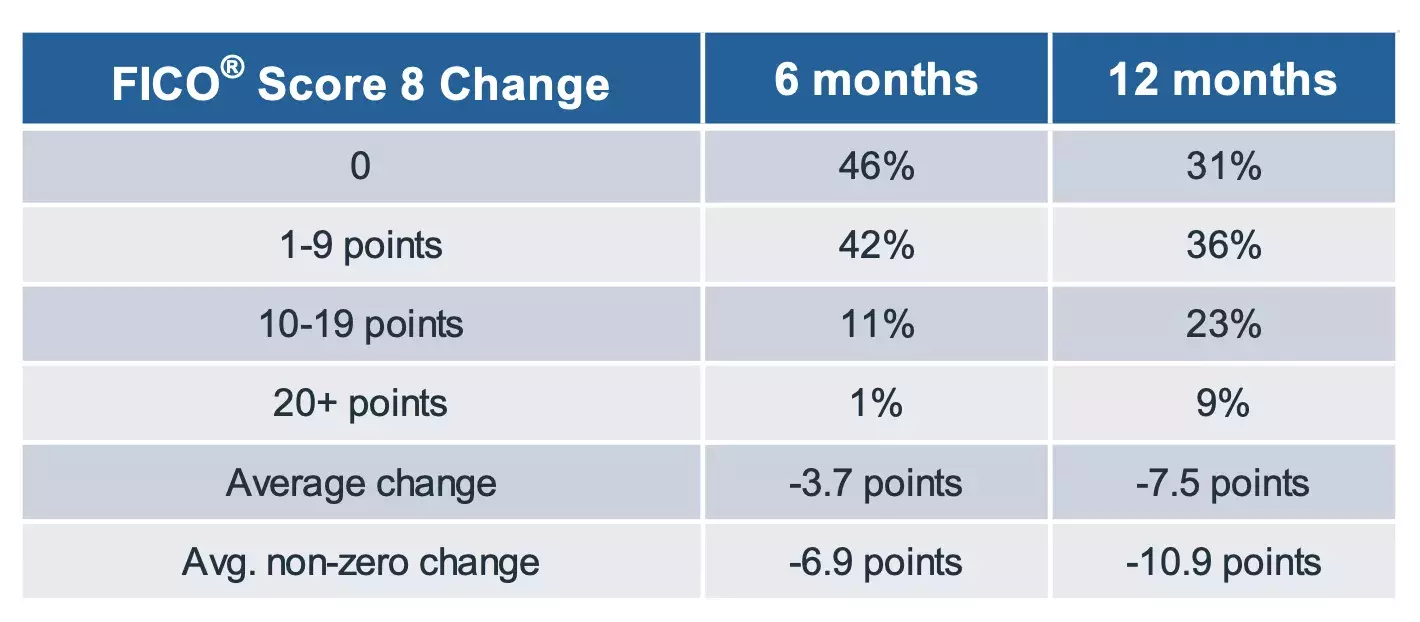

As shown in Figure 1, over 6 months of deferment, 46% of FICO® Scores didn’t change in this simulation, 42% decreased by 1-9 points, 11% by 10-19 points, and 1% decreased by 20+ points. The average score change after 6 months was -3.7 points. Among those scores that changed by any non-zero amount, the average score change was -6.9 points.

Over 12 months of deferment, 31% of FICO® Scores didn’t change in this simulation, 36% decreased by 1-9 points, 23% by 10-19 points, and 9% decreased by 20+ points. The average score change after 12 months was -7.5 points. Among those scores that changed by any non-zero amount, the average score change was -10.9 points.

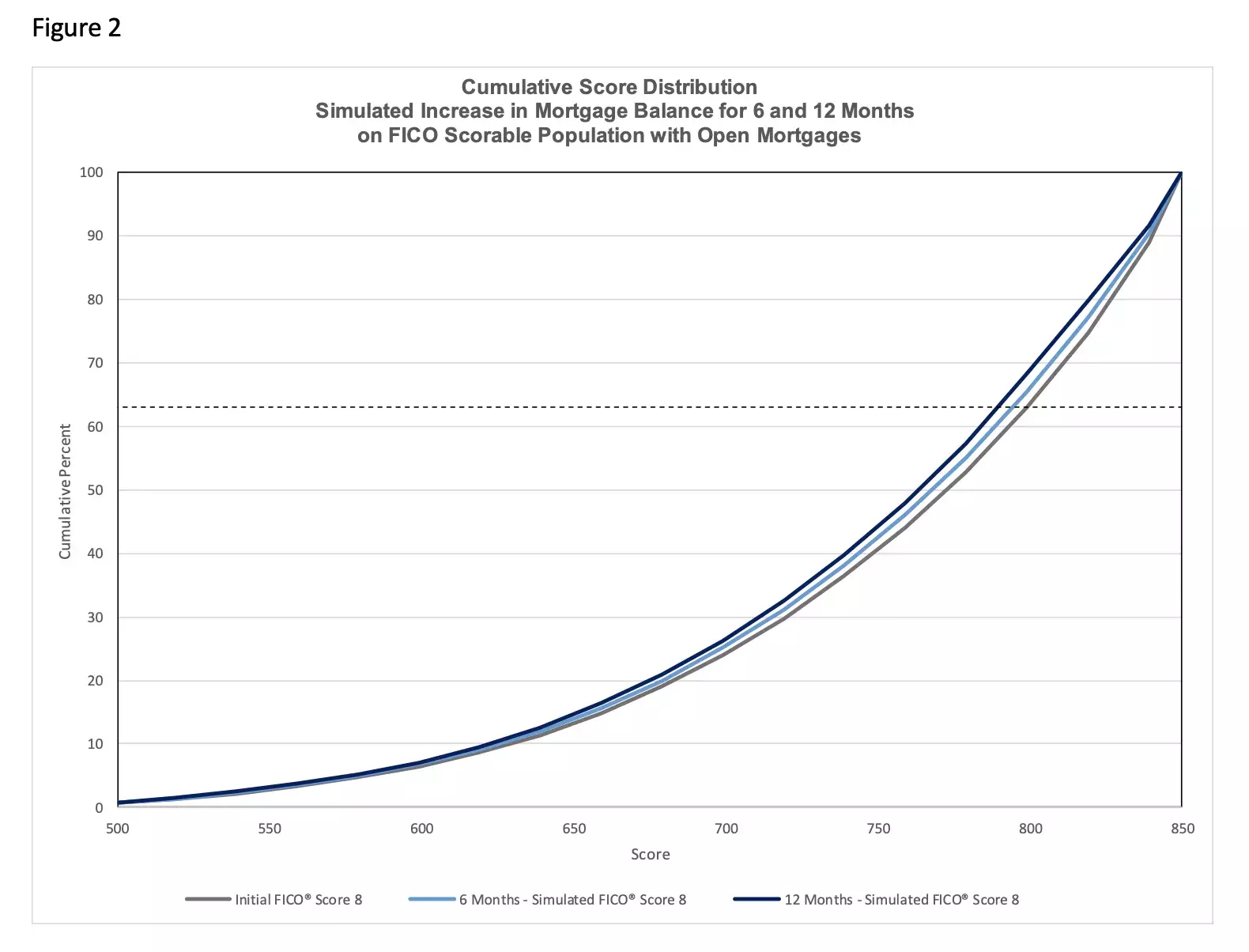

On a cumulative score distribution view (Figure 2), and focusing on the point of maximum separation between the initial and post-simulation distributions (dashed line at the 63rd percentile), you can see a downward shift of approximately 5 points after 6 months of deferment, and approximately 10 points after 12 months. Note that this point of maximum separation occurs in the higher score ranges, indicating that it is prime borrowers whose FICO® Score is more likely to be impacted, while still modestly, as a result of increasing mortgage balances due to deferment. For example, 56% of the population scored above a cut-off score of 760, whereas 54% scored 760 or higher on the 6-month simulation and 52% scored 760 or higher after simulating 12-months of mortgage forbearance. At a 620 cut-off, the percents above cut-off are 91% for the population, 91% on the 6-month simulation, and 90% on the 12-month simulation.

While this analysis shows impacts to the calculated FICO® Scores from these imputed balance increases, they are generally modest. Keep in mind that the most important factors in the FICO® Score are payment history info (delinquencies, public records, collections, satisfactory payments, none of which were modified in these simulations), and balance/utilization factors, but much more focused on revolving rather than installment. We would expect the effects of mortgage forbearance to be less impactful on FICO® Score versions prior to FICO® Score 8; and similar to what was observed in the above FICO® Score 8 analysis on FICO® Score 9, FICO® Score 10 and FICO® Score 10T.

Mortgage forbearance is a powerful tool meant to enable borrowers adversely impacted by COVID-19 the chance to remain in their house and current on their loan, while they work to get back on their feet financially. The FICO® Score study outlined above identifies impacts to consumer FICO® Scores resulting from forbearance-related potential increases in mortgage balance. These impacts are not only very modest in general, but also can be short lived provided the forbearance has the desired effect of enabling the consumer to quickly get caught back up on their mortgage payments once the forbearance period has ended.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.