Slow EMV Conversion Invites Fraudsters to Self-Serve at Gas Stations

By leveraging machine learning, the FICO Falcon can help to capture the latest scams and frauds.

With an October 1, 2020 deadline to have EMV chip card readers installed on the nation’s 1 million fuel dispensing pumps, the number that remain to be converted could be as high as 75%, industry experts say. The prevalence of magnetic-stripe readers, coupled with road-tripping Americans’ out-of-pattern spending behaviors, creates a perfect storm for fraudsters to use purloined cardholder details to commit fraudulent purchases at unattended terminals. The good news is that FICO is on it—by leveraging machine learning, the FICO® Falcon Fraud Platform is able to capture the latest fraud trends and transform raw data into actionable insights.

Gas stations are a hotbed for fraud

Since the mid-1980s, gas stations across the country have been transitioning to unattended, pay-at-the-pump systems to reduce costs and facilitate the consumer’s ability to fuel their vehicle. While convenient for customers, unattended pumps make it easier for use fraudsters use compromised cardholder information (available in plentiful supply on the Dark Web) to make fraudulent purchases.

Since legitimate cardholders visit 10% new merchants every month, fraudsters work to mix their transactions among these new legitimate transactions. Fraudsters’ transactions join the myriad legitimate unattended gas transactions occurring each day, adding to the ever-increasing complexity in identifying these transactions as fraudulent.

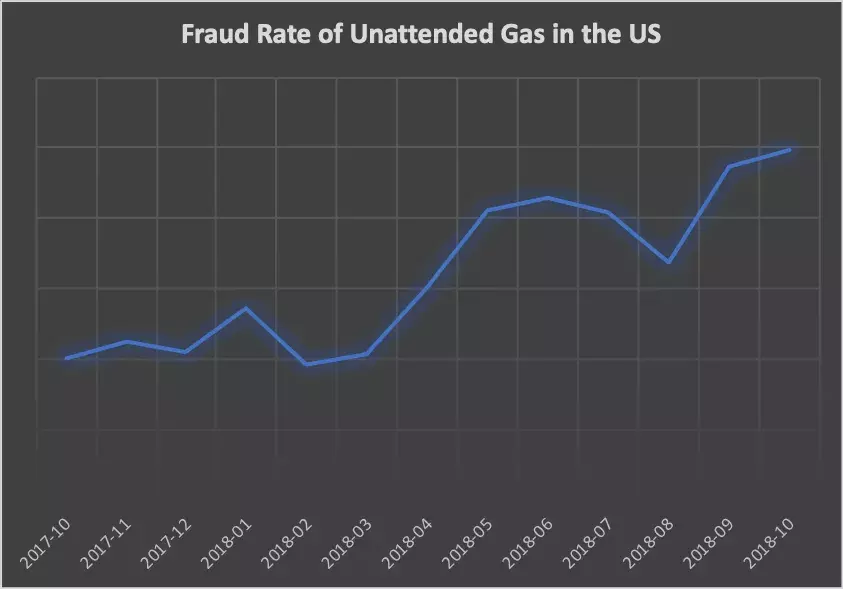

Data from the FICO® Falcon® Intelligence Network verifies that fraudsters are taking advantage of the opportunity unattended gas stations present; the national rate of fraudulent transactions originating at US-based unattended gas stations rose about 30% from October 2017 through October 2018.

How FICO pinpoints fraudulent fuel transactions

Machine learning technology enhances the FICO® Falcon Fraud Platform, allowing it to assess the breadth of consumer and geographic behaviors and dynamically update the signals that denote fraudulent cardholder activity. As a result, Falcon can proactively increase fraud detection while simultaneously decreasing the false-positive rate.

For example, let’s say there’s a flurry of cardholder activity in a new state. As one-off events, sporadic interstate transactions may be indicative of a compromised account used by a fraudster driving around the country. They may also be indicative of something far more benign, such as a cardholder visiting potential out-of-state universities with their family member. In isolation one may reasonably pin these transactions as fraudulent, but if the cardholder has been legitimately transacting in other new geographies, a pattern may emerge that suggests this new set of transactions as legitimate behavior. Falcon is able to tap into eclectic sets of historical cardholder behaviors to detect subtle, and not so subtle, changes in how consumers choose to transact.

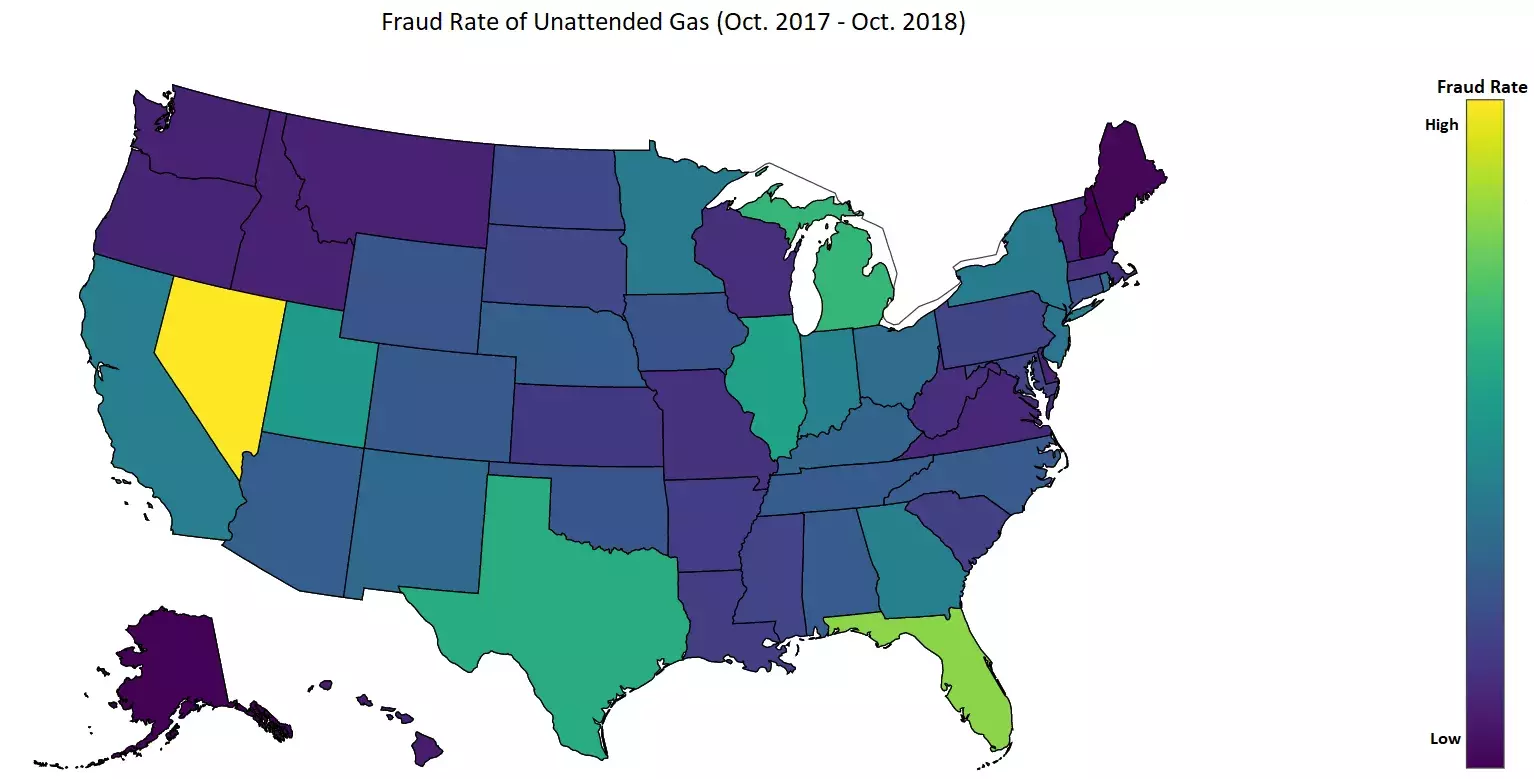

Data from the FICO® Falcon® Intelligence Network illustrates the variability in unattended gas fraud across the US. Nevada, Florida and Michigan have the highest unattended gas fraud rates, while the lowest are in New Hampshire, Alaska and Maine.

Highest 3 fraud rate states: Nevada, Florida, Michigan

Lowest 3 fraud rate states: New Hampshire, Alaska, Maine

FICO offers comprehensive protection

Card skimmers also present an inherent risk of transacting at pay-at-the-pump terminals. These illegal card readers are installed by fraudsters with the intent to steal cardholder information, to then be sold or used for their own nefarious means. With thousands of skimmers found at gas stations across the US over the past few years, it is impossible for consumers to completely protect themselves. Fortunately, FICO® Card Compromise Manager, a powerful companion to the FICO® Falcon Fraud Platform, will mitigate the number of cards that may be affected by a compromised terminal.

Leveraging the Falcon Intelligence Network, Card Compromise Manager detects a point-of-compromise, alerting the respective fraud prevention teams that cards who have transacted at the terminal may themselves be compromised. This allows fraud prevention teams to proactively assist affected cardholders by blocking and reissuing their cards, placing them on watchlists, or using additional monitoring strategies to prevent further fraud.

As gas station owners race to meet the October 1, 2020 deadline to install EMV chip readers, one thing is certain: fraudsters will find new ways to commit their crimes—and FICO will be committed to detecting them.

For more of my thoughts on fraud, machine learning, artificial intelligence, follow me on Twitter @ScottZoldi.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.