Strategic Planning: How Bank A Avoided the Profit Cliff

In my last post, I blogged about our work with banks to improve strategic planning performance. Using a new analytics-driven approach, these banks are cutting through massive data…

In my last post, I blogged about our work with banks to improve strategic planning performance. Using a new analytics-driven approach, these banks are cutting through massive data and across organizational silos to identify and prioritize actions that move the needle on lending portfolio profitability.

Case in point: A large Asian bank—who I’ll call Bank A—was experiencing significant growth in its credit card portfolio, including a 50% increase in balances over the previous year. Balance-level delinquency rates and losses were low, making the portfolio quite profitable. All apparent signs indicated it would continue to be so. But more granular, comprehensive analysis indicated signs of trouble emerging within the next 12 months.

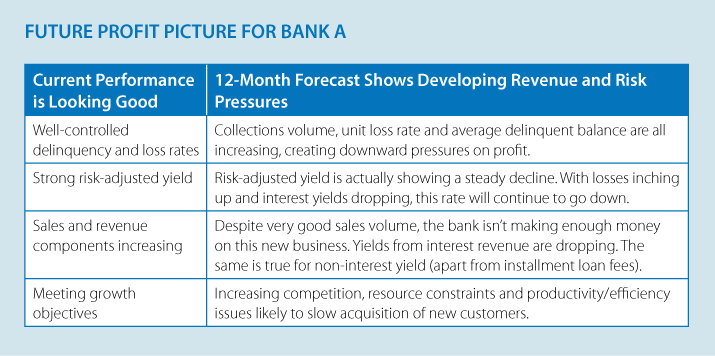

FICO consultants showed that the bank wasn’t making enough revenue. While interest revenue, non-interest revenue and risk-adjusted revenue were all increasing, yields (% revenue to balances) were dropping. This downward trend was likely to worsen, given signs that market competition was increasing and the economy slowing. We deconstructed forecasts to identify the drivers, summarized in this table:

One reason Bank A’s risk-adjusted yield was trending downward is that marketing programs were generating growth at the expense of revenue. This is a common problem in growth markets. Promotional pricing drives the numbers of accounts and average balances upward, but cuts into interest revenue.

For Bank A, this drop was offset partly by rising non-interest revenue, largely from fees on installment loans offered to cardholders. But this trend would likely be unsustainable, as increasing competition from other lenders could force fees down.

The other key factor affecting risk-adjusted yield was that while the bank’s loss rate had declined since the previous year, it had not dropped fast enough to keep up with the drop in interest revenue. And with aggressive credit line management programs driving average balances up, risk would likely increase in the future. The loss rate trend was therefore likely to slow further or even to start rising. In fact, average delinquent balance had already risen sharply.

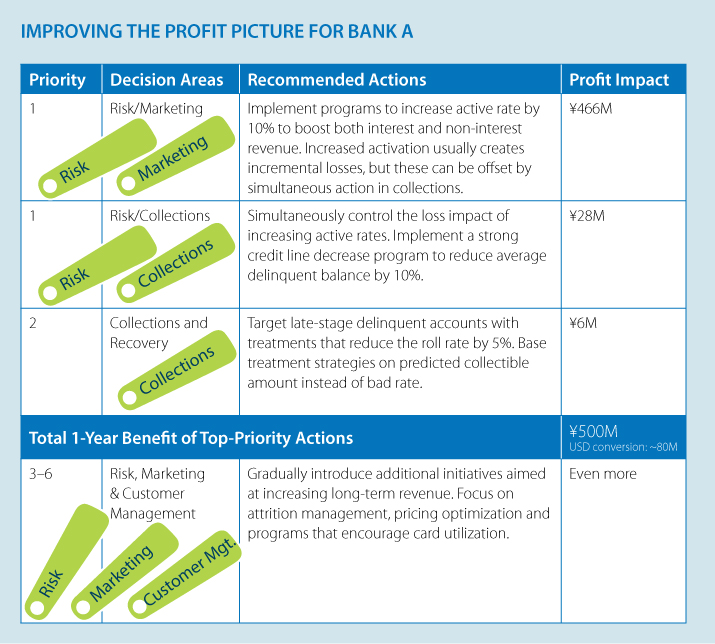

Fortunately, these threats to Bank A’s future profitability could be countered. Our cross-lifecycle analysis resulted in a detailed set of recommendations. Among them were the high-priority interrelated actions summarized in this table:

Bank A now has a roadmap for correcting the future profitability issues in its credit card portfolio. The institution can continue to pursue growth, while avoiding pitfalls. Ongoing cross-lifecycle analysis of profit drivers will enable Bank A to continue steering a course to sustained profitability.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.