Survey: When Do Fraud Controls Ruin the Customer Experience?

Poor awareness of authorised push payment fraud scams coupled with high customer expectations of banks’ abilities to deal effectively with fraud cases present a challenge

The last few years have thrown up many challenges for banks and card providers as everything has shifted online, one of the primary challenges being fraud scams. But the online shift has also created opportunities for financial institutions to demonstrate their strong fraud controls in the digital space. The rapid rise of scams and other crimes, as well as the increasingly diverse methods used by fraudsters, has only increased the pressure for banks to protect customers from scammers and detect early signs of fraudulent behaviour.

Recent research we undertook looked at the connection between customer experience and fraud controls from a consumer perspective. We compared the UK view (1,002 respondents) against a global view (12,028 respondents).

Our survey showed a positive outlook for banks and card issuers investing and innovating significantly in the digital space. 81% of people in the UK plan to continue to do all or most of their banking online – that’s nearly 41 million active bank accounts in the UK. While this is lower than in other countries (89%), it still signifies a very clear and steady move towards 100% digital banking, encompassing digital payments and digital communication channels.

But there’s a big disconnect for UK consumers – namely, the number of individuals primarily concerned about scams and being tricked by scammers. The new digital environment presents a delicate balancing act between ensuring effective fraud prevention and potential risks associated with delivering frictionless customer experiences.

Consumers Are Less Worried About Scams than Other Forms of Fraud

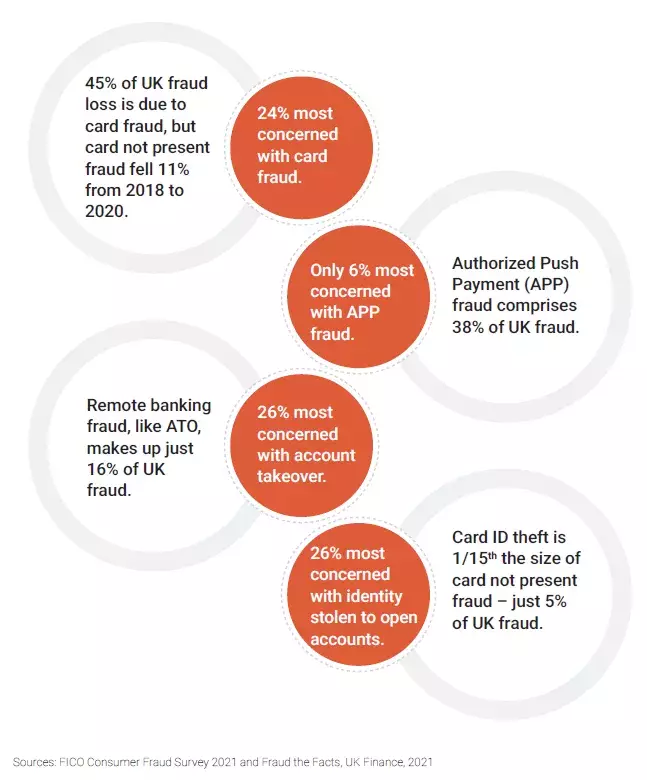

Our survey revealed that the primary fraud concerns for the UK banking population do not match the kind of fraud that is having the biggest impact in the UK.

For consumers, the biggest concerns are falling victim to account takeover (26%), and ID theft (26%). This is understandable as both these types of fraud have received significant media attention over the years. In reality, they make up only 16% and 5% of UK fraud.

A far more complex and increasing concern for risk and fraud managers, however, is authorised push payment fraud. During 2020, it accounted for £479 million in gross losses in the UK, but by mid-2021, its occurrence had risen by 71% and it now makes up 38% of all UK fraud. It received greater media attention during the COVID-19 pandemic, but it is still the least concern among consumers - only 6% of UK consumers are most concerned about being tricked into sending payment to a fraudster.

Bank and card providers have an opportunity to do more here in terms of awareness and education for their customers to prevent these scams and offer early detection. They can also include automation by implementing AI and machine learning-driven analytic models that include scams detection scores, to help bolster fraud prevention efforts.

Card fraud continues to be the biggest driver of losses in the UK (45%) and our research shows that it is a major concern for 24% of UK banking customers. Evolving tactics and techniques from criminals can make fraud prevention and detection more challenging, leaving victims more susceptible to fraudulent behaviour.

When Fraud Controls Cause Irritation

Both bank and card providers have moved quickly to implement additional security measures that address fraudulent activity, namely in the form of new authentication methods. The impact on consumers has been twofold.

On the one hand, this has resulted in a consumer perception of banks as trustworthy and as offering adequate transaction security - 73% of consumers surveyed said their banks do enough to keep their money safe. This view is also held by bank and card customers around the globe (72%). A further indication that UK consumers generally understand and accept the need for the additional fraud prevention measures is the fact that just over 60% of consumers in the UK have remained either positive or neutral about their provider when a purchase was declined (either online or in-store).

On the other hand, some of the security checks have produced irritations. The biggest irritation cited was when a legitimate purchase was declined (34%). In fact, for over a third of the UK population, it only takes two to three purchase declines (either online or in-store) before they take their transactions elsewhere (34%).

The second biggest irritation is when a fraud alert related to a purchase decline was too slow or never arrived (27%). This frustration is understandable, as many of the respondents were three times more likely to have been past victims of account takeover and two times more likely to have previously reported fraud.

Having the Right Contact Information

Part of the challenge here is that around 20% of people say that their providers have inaccurate mobile numbers for them – that potentially equates to 13 million inaccurate customer mobile phone numbers. Our research showed that the same is also true across landline, email and postal details. When you consider that 66 million credit cards were issued in the UK from January 2012 to February 2020, this is a problem and a significant risk. In order for fraud prevention notifications to work, card issuers must have accurate contact information to send texts, emails and find-me-follow-me calls, as well as replacement cards and other physical mail. Banks will need to bridge the gaps in customer data accuracy for those communications to be effective.

In fact, text messaging is a very clear preference (62%) for UK customers for verifying payments, compared to using banking apps, emails, phone calls or messaging apps. This is much higher than the global statistic, 43%. And it’s a major challenge for providers. This channel is known for its security risks, having continued to prove vulnerable to scammers and criminals. It is vital that banks take a layered approach to consumer engagement and balance individual preferences with more robust checks when they are needed.

Conclusion

While on the whole, the UK banking population accepts that banks are doing enough to prevent fraud and keep their money safe, a large proportion are still driven by their negative experience of the fraud prevention process and can quickly turn from tolerant customers to irritated ones. It is important to understand that there is a fine line between the two. 16% would quickly switch to a competitor, while 62% would complain – both results would translate directly into costs for the providers.

The stakes are high when it comes to balancing the need to fight the risk of rapidly growing levels of fraudulent activity with intense demand from customers for positive frictionless experiences. Communication will be key. They will need to be secure, and to be effective the customer data will need to be accurate. The right balance of risk mitigation and customer experience can be achieved and will be the factor that puts those that do in the lead.

How FICO Can Help You Fight Scams

- Review the FICO Consumer Fraud Survey: 2021 whitepaper for insights about global customer sentiment on fraud detection/prevention measures and customer experience.

- Download the ebook on the UK results for our survey.

- Read our blog on our new Retail Banking 3.0 model, which incorporates a Scams Detection Score.

- Explore FICO Fraud Protection and Compliance Solutions.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.