Top 3 Actions for Delinquency Management Alleviating Inflation Concerns

What prudent and responsible actions can we diligently deploy to face the potential fallout of inflation?

The financial institutions who were resilient during the pandemic learned from their experiences in 2008 and were better prepared for inflation.

The financial institutions who will thrive now are the ones who would have learned from their experiences over the pandemic and prepared themselves for the current challenge of looming inflation – including its impact on their customers and portfolios.

Customers couldn’t be faulted when they heavily offset the drop in purchasing power and disposable income by leveraging a higher utilization of credit products that they have at their disposal towards staying afloat in these perilous times. While the financial services industry would welcome the growth, the concern is that the share of debt transitioning into delinquency is also showing an increasing trend.

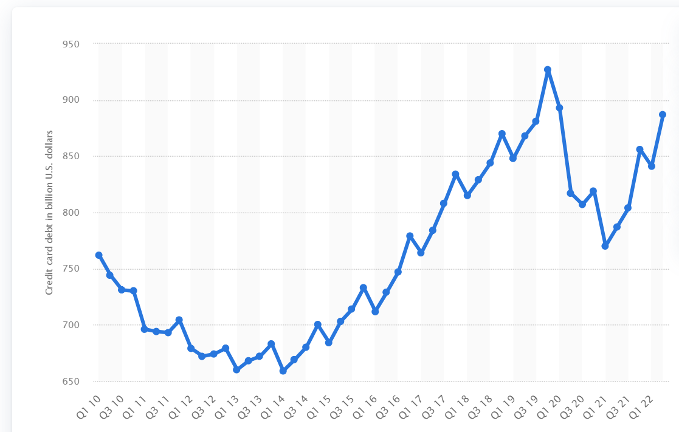

Graph 1 : Quarterly credit card debt in the United States from 1st quarter 2010 to 2nd quarter 2022 ($ Billion)

Here are 3 Learnings Driven Actions that are critical in this environment of extreme global volatility:

- Enriched data insights informing early warning, planning and strategy.

- Effective Remedial Treatment Plans optimized with consideration of affordability.

- Ease of customer engagement by fortifying digital and preferential inbound / outbound access channels.

Enriched data insights informing early warning, planning and strategy: Over the pandemic, it became clear that enriched data insights could improve the predictive power of scores. For example, occupation type became a strong indicator of which industry customers worked in and providing insight into whether they had been furloughed.

A robust data infrastructure that facilitates data enrichment and aggregation is critical. Advanced analytics and machine learning can then uncover veiled yet meaningful portfolio insights and inform strategy. This can be done through a combination of macroeconomic factors and transactional data serving as early warning indicators and delivering input into business continuity planning and credit risk strategies. These could include combinations of credit utilization, transacting vs. revolving, transaction thresholds, payment percentage patterns, spend types, overdraft usage, missing payments, standing instruction or direct debit fails, customers repeatedly attempting to contact the bank, customers suddenly changing demographic details, and customers abruptly uncontactable.

Effective Remedial Treatment Plans with diligent consideration of affordability: Most financial institutions were found lacking in their ability to conduct a viable assessment of current and foreseeable future customer affordability, appropriate customer profiling, and an awareness of customer behavior. Therefore, remedial plans were deployed at a tactical level, and we were lagging in the ability to absorb the true impact of the customer in the near, medium, and long term. These left customers struggling to pay back their debts following the remedial period. Further complicating a fair assessment was government sponsored stimulus packages, which veiled factual customer affordability. Diligent consideration of affordability widens the scope of potential risk to include senior citizens, those on reduced incomes, and those on variable rate mortgages or rentals. It might also be the case that vulnerability - marital changes, new children, expenses for elder care or childcare, medical issues, Covid-19, etc. may be emerging. The data reviewed should include communication data (website visits, calls).

Enabling the deployment of effective remedial plans would be the ability to leverage advanced predictive analytics and treatment optimization solutions strengthened by the data enrichment insights discussed above. Remedial tools would need to fit for purpose. Custom by product and market segment with an adjusted relevance to inflation and customer affordability features the reason for difficulty, foreseeable duration of adverse impact, current impaired income, expenditure, alternate cash flow resources, and indebtedness. Optimization gives you the best possible outcome, balanced across treatment options with consideration of the customer affordability, policy, relevant constraints, and “what if scenarios” that seek to balance tradeoffs between goals and constraints (such as take-up rate and charge-off losses). Thus, helping strike the right balance between loss reduction and operational limitations will help balance maximizing profitability while retaining future good customers

Ease of customer engagement by fortifying digital and preferential inbound / outbound access channels: “Contact us, call us, and we will make it right,” was the assurance played out over TV and website advertisements during the pandemic. Contact centers were then swarmed with unmanageable requests to delay payments, moratoriums, and forbearance requests, creating high call volumes and wait times. The infrastructure to service and manage the calls was lacking.

The ability to facilitate a seamless customer engagement that can scale up or down, based on peaks and troughs of volumes is critical. This mandates the fortification of a robust customer engagement infrastructure featuring the ability to self-serve 24/7, delivering personalized and digital touchpoints. This engagement with the customers would need to feature custom risk aligned communication incorporating enriched data, machine learning driven insights, and risk-based strategies through intelligent digital omnichannel communications orchestration. This data would need to be captured and fed back into the continuous learning loop where data is captured and enriched, facilitating insights informs planning, contact strategies and effective treatments are optimized.

The discipline and diligence of running these through critical and prioritized check lists will reinforce efforts towards a robust preparedness, as we face inflation and its potential global impact:

- Keep an eye on regulatory changes. It is critical to keep abreast of regulatory requirements and ensure that policies and strategies comply to any changes required by authorities. Also, it is important for care to be taken to identify and corrected for what may be misinformation on consumer interpretation and understanding. For example, the Financial Conduct Authority (FCA) rules on persistent credit card debt in the United Kingdom.

- Remind customers what they can accomplish using the banking app / website. Specifically with information regarding specialist support, URL’s can connect to your account if unable to pay an outstanding bill.

- Adapt credit strategies. Identify customers adversely affected by the crisis, and then use behavior scores and other predictive analytics to make risk-targeted modifications to credit strategies. You might raise credit lines and limits, for instance, on customers likely to pay. Customers in good standing could be granted payment deferments or loan term extensions.

- Validate behavior scorecards and models customers. Plan for a thorough review of your existing behavior models needed to be put in place now. Scorecards and algorithms can be validated, fine-tuned, or redeveloped as quickly as possible

- Pause pre-collection and collection activity for customers who self-identify. In a tightly controlled collection environment, you might elect to continue contacting customers by phone, or via the use of a two-way automated customer communication tools, as long as communications are informational and helpful.

- Make a positive connection. Use email, SMS, mobile apps, and online banking to let customers know exactly what accommodations you’re making and what to expect going forward. Try to start a reassuring, encouraging conversation that will help later when you resume collections. Importantly, encourage customers to contact you when their situation stabilizes, so you can assist them in getting back on track.

- Identify customers working in highly disrupted industry sectors. Consider different collections and customer communication protocols for customers working in the affected industries.

- Identify high-risk customers. Prioritize identifying high-risk customers to help restructure any overdue debt over a reasonable timeframe.

- Update income, which may be impaired. Aim to re-establish not only contact preferences, but also income and employment information—all critical for analyzing the borrower’s situation and correctly by offering the right tool.

- Consider transferring revolving facilities to a fixed term. To help customers, especially those in high-risk industries or professions better plan their finances during and after the crisis, offer to convert outstanding revolving credit facilities (credit cards, overdrafts, etc.) to fixed installment instruments or tiered payment plans.

- Identify affected accounts for reporting. This includes flagging accounts affected by the crisis for credit reporting agencies. Also consider whether you want to exclude these accounts or treat them differently in future model builds.

- Update contact details. On every contact with the consumer, check the contact details, such the calling the phone number with your internal data or email addresses from their messages, to help measure compliance requirements.

- Capture all changes. Make sure your portfolio and policy chronology logs are updated with all actions taken, accounts in programs, and predicted impacts. This account history will be in your books for a long time—months or years from now. Someone with no memory of the crisis must be able to understand what happened at a detailed level. These details need to include not only the impact of the crisis, but policy changes made in response to affecting portfolio performance, risk model validations, and policy analysis.

Finally, as a reminder:

- Please do continue to track inflation specific to your geography and its impact on your customers.

- Please be aware that all customers are potentially vulnerable to inflation.

- Please be aware that all credit life cycle areas need to be in tune to address vulnerability.

- Please be aware that FICO’s Global Advisory Services can help.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.