Top 5 Customer Development Posts of 2022: Digital Banking and Pricing Opti

The most popular posts in our Customer Development category dealt with digital banking, optimizing credit line increases, loan pricing and machine learning for credit risk models.

Digital transformation and mathematical optimization were hot topics in 2022 as lenders continued to mobilize their offerings online, fend off increased competition and look for ways to improve the banking experience and the way backend risk management decisions are made. Product teams, business models and customer development strategy were all challenged in the last year as adaptation became the name of the game.

The most popular posts in our Customer Development category dealt with digital banking, optimizing credit line increases, loan pricing and machine learning for credit risk models.

Here are extracts from those customer development posts.

1. Digital Banking: Humanizing the Customer Experience

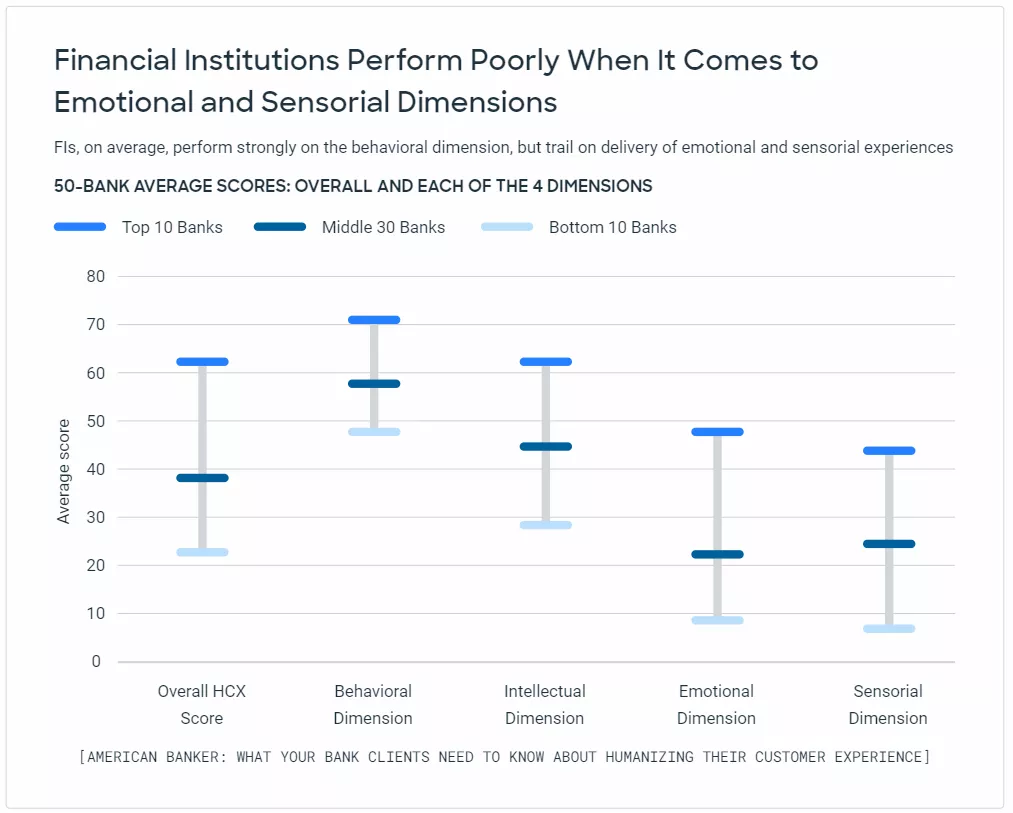

Darryl Knopp outlined the importance of delivering a banking experience that connects with the customer. His insights on humanizing interactions come from his larger piece on digital banking called The 11 Commandments of Digital Banking eBook. When we look at customer experience, many of the leaders are startups and digital banks who rely making this a differentiator as part of their business model. Traditional players need to examine their customer development strategy if they are going to get buy in from them and focus on how they deliver customer centric experiences.

This is what Darryl had to say on personalization:

The COVID pandemic has undoubtedly accelerated plans for digital transformation. Many enterprises have succumbed to the inclination to digitize everything, which by default leads to cold, clinical experiences. It’s difficult, but embracing new technology means that we have the opportunity – nay, the imperative – to focus on humanizing the customer experience. Banks must find ways to humanize their business models, by being personable in these seemingly impersonal channels. It’s about utilizing the data you have to create differentiated experiences based on your knowledge of the customer.

Be Personable in This Impersonal Channel

The digital banking journey needs to be intuitive, friendly, and transparent. Despite assumptions, banking doesn’t have to be boring! Be enthusiastic and make customers feel like they made a great choice opening your app or website.

As a financial institution, you already have enough customer data to make subtle adjustments to your customer model that can create a better experience. Leverage that data so you can make intelligent and meaningful offers, but remember that personalization and customer development isn’t about selling products – it’s about making customers feel comfortable and valued from onboarding and customer creation to every interaction they have with you.

Analytics-powered digital solutions enable intelligent personalization based on context (i.e., what’s happening in the moment). Use location data to say “Good Morning!” or “Good Afternoon!” depending on the time zone where the customer is located. Find ways to be proactive and show them that you care about their financial wellbeing. Celebrate with your customers (e.g., birthdays, anniversaries, financial accomplishments) – think of it as digital confetti. Simple personalization that’s prominently displayed is the digital equivalent to a teller giving you a big waive and smile as you walk into the bank branch. Even naming your banking app can make it sound more personable, which is why both legacy companies and startups have given their AI programs people names (such as Alexa, Siri, and Erica).

Allow for customer discovery by giving them option to move seamlessly between channels, don’t prescribe the journey for them – everyone is different. Leverage technology to handle simple interactions, but make it easy for customers to speak to a human being whenever they want. Remember that every time you engage with a customer, there’s a learning opportunity for both.

Engage Them, Teach Them, Feed Their TikTok Obsession

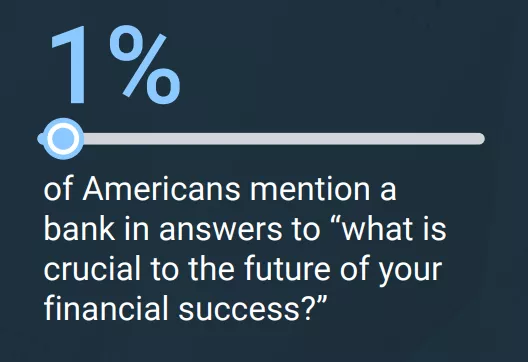

While many consumers are digitally savvy, they’re not necessarily financially savvy. This is something that banks should be involved with – but when Americans consumers were asked, “What is crucial to the future of your financial success?” only 1% of them mentioned banks.

People want to master their financial lives and they want engaging content that teaches them how. That said, customers have increasingly high standards and you only have a short amount of time to impress them (especially Millennials).

What can financial institutions learn from TikTok? It has a tight set of constraints that forces you to create content that’s quick, compelling, and easily understood. Making enjoyable financial services content isn’t easy, but the medium matters a lot.

Videos need to have lots of movement and good visual examples to keep your audience’s attention – and don’t be afraid to add some music! Make sure your content is easy to like, comment, and share. You want customers to engage, and shorter videos give them a reason to come back and watch more. Create content not just to educate existing customers, but also to use as a broader opportunity for organic growth.

Remember these key rules:

- You have 7 seconds to make your first impression.

- Customers want mastery, but they don’t like to learn or hear a lecture. Frame your financial literacy content accordingly.

- ‘How To’ videos are extremely effective, especially for coaching customers through new banking tasks.

Always be respectful of the time customers give you. Engage people and teach them – but don’t lecture or talk down to them. Make sure your content is easy to like, comment, and share. There’s nothing wrong with making it fun!

Read the full customer development post

2. How Credit Line Increase Optimization Drives Top-Performing Portfolios

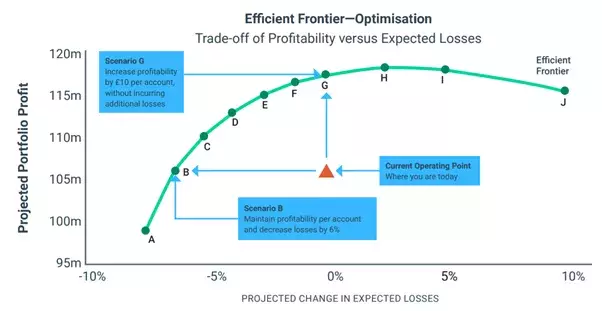

Barry Honeycombe started the year with an insightful blog on the power of optimization when it comes to credit lines. The business model here needs to focus on a strategy that balances lending growth while keeping risk in check. It's a strategy that requires accurate customer validation and data analysis, with an emphasis on action-effect modelling rather than hypothesis.

Here is an excerpt of his top ranking post:

Credit limit management is regarded as a key driver to profitable portfolios. But despite this, many issuers fail to apply advanced prescriptive analytics to a crucially important process, or if they have, it may often be without a framework or infrastructure to maximise the effectiveness of the insights it can bring. Credit limit increase optimization (CLI) is a powerful tool to achieve portfolio goals.

Among the underlying elements to optimizing credit limits is a need to have a detailed understanding of the impacts of any actions the issuer takes on their customers. Understanding the action-effect relationship is crucial to creating a solution that enables you to assess the likely impact of multiple alternative scenarios on key performance metrics.

It enables decision-makers to define the best strategy easily and quickly for their CLI campaign, while supporting critical business objectives. It’s achieved by configuring a decision impact model, which includes and can leverage action-effect modelling.

Action-effect models are analytics that accurately predict how a customer will react to any offer brings great flexibility, but also drive vital insight into potential difficulties in managing the many dimensions of customer behaviour.

Among the crucial elements to understanding the art of the possible and potential value of CLI is the so-called ‘Efficient Frontier’, which enables issuers to compare differing scenarios and opt for the one that meets their growth objectives and market conditions at the time, while maximising profitability.

Managing Profitability and Exposure

Credit line management optimization helps you manage more than just profit. Overall exposure can also be managed by balancing income and exposure, with risk level typically used as a constraint. The critical value is knowing how, where, and when accepting a slightly higher level of losses will drive an overall increase in the average profit per account—and crucially by how much.

At the same time, CLI campaigns need to ensure they are compliant and don’t offer customers unrealistic or unacceptable limit increases. Constraints can be applied to ensure that strategies are compliant and that they are treating customers fairly.

Read the full customer development post

3. Competitive Loan Pricing: How To Outprice (not Underprice) Rivals

Matt Stanley outlined a compelling argument in his blog about the importance of pricing speed and agility in identifying the sweet spot, where price and all key elements of the offer meet the needs and objectives of both the customer and the business. The assumption here when it comes to customer development is that lenders need to understand how to create a more open ended pricing strategy that considers numerous relationship factors.

This is what Matt had to say about revising the existing business model when it comes to pricing:

Competitive loan pricing is a term that’s often overused to imply lower pricing than close competitors. But it's not always strictly true. Financial institutions that can make offers at higher prices, while continuing to win business, are even more competitive.

The leading lenders achieve this by mastering customer-centric loan pricing optimization, which encompasses much more than just price. It’s an approach where financial services firms make astute decisions about the entire loan offer – based on detailed predictions of customer value, sensitivities, and behavior analysis, as well as customer attitudes and choices, revealed at the point of sale.

Competitive Loan Pricing Is a Race – But Not to the Bottom

In many financial services markets, the downward pressure on prices is being caused by thin margins, new sources of competition, and the ease with which consumers can assess a mass of competing products and offers. The perceived need to continually underprice competitors can exert a vortex-like pull, drawing financial services firms into a race to the bottom. But competitive loan pricing doesn't need to be a downward spiral.

Instead, it should be a race to the so-called “sweet spot” – an offer that fully meets the needs and objectives of both the customer and the business. Companies that quickly identify the sweet spot have an edge over competitors even when their loan prices are often not the lowest.

Today, we can use AI and machine learning to drive better loan pricing decisions. Customer-centric pricing optimization combines analytic, collaborative, and interactive processes into smart, flexible, and efficient workflows.

5 Key Steps to Outpricing Competitors

Increasingly, companies are winning with a focus on customer-centric loan pricing optimization. Unlike traditional methods rooted in price sheets, loan prices now emerge from very granular Big Data-driven analytic segmentation of customer populations. With this approach, loan pricing is not an isolated exercise. Instead, loan prices are optimized within the context of the entire customer offer.

The five key steps to outpricing your competitors when it comes to loan pricing are as follows:

- Simplify complex loan pricing challenges.

- Make analytics transparent, understandable, and easy to use.

- Enable stakeholders to collaboratively drive your optimization processes.

- Integrate backroom policymaking with real-time customer interactions.

- Ensure agility for your business so you can adapt to the speed of the market – or faster.

Simplify Complex Loan Pricing Problems

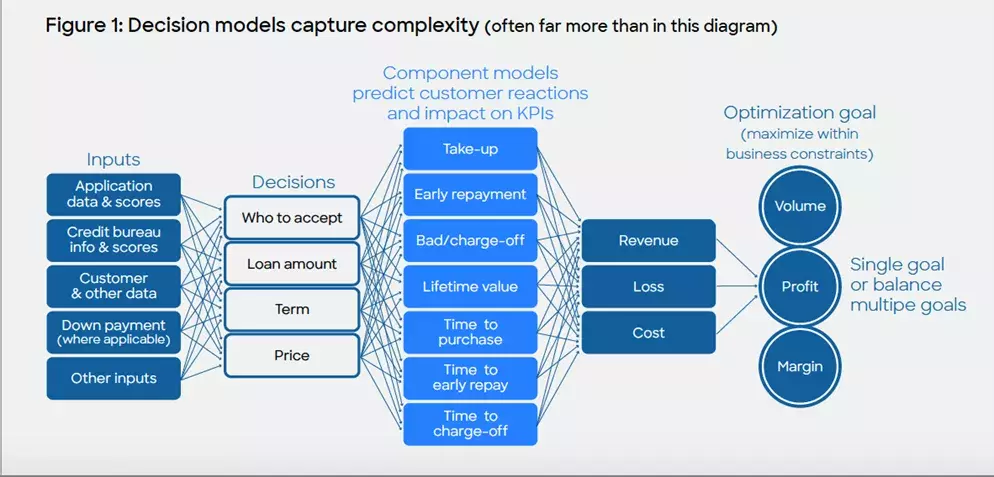

Outpricing the competition means directly tackling the complexity of the loan pricing problems financial services face in today’s crowded, dynamic, and highly regulated markets.

To deliver the fine-grained analysis and accurately target offers to key customer segments, financial services firms need to consider a wide range of data and customer behavioral predictions. Analytic techniques are used to capture such complex loan pricing problems and model each decision. Modelers work backward from the business goal to identify the important decision factors and codify relationships between them in mathematical equations (represented by the blue arrows in Figure 1).

At the heart of the decision model is a network of action-effect models, predicting likely customer reactions to the company’s possible actions – including loan pricing and other offer aspects – and the resulting impact on KPIs.

Leading lenders continue to move from a price-sheet approach to one where optimal pricing emerges from very granular analytics-based segmentation of customer populations and state-of-the-art optimization supports segments as small as one individual.

Read the full customer development post

4. 11 Commandments of Digital Banking: The Customer Journey

Darryl Knopp kicked off the year with the first in a series of posts on digital banking called The 11 Commandments of Digital Banking eBook. He makes the point that customer acquisition and retention in the digital age requires startup thinking and flawless execution when it comes to the customer development, risk and product team's approach.

This is what he had to say in his first post:

Last year we published a highly successful The 11 Commandments of Digital Banking eBook that introduced the 11 commandments:

- Digital lift-and-shift is not a strategy!

- Friction – not inherently good or evil

- Be personable in this impersonal channel

- Respect the data

- Engage me, teach me – feed by TikTok obsession

- Use your branch wisely!

- Respect my time and match my effort

- Pester me … but only when I want it

- Be fascinated by your customers, not your technology

- Make me feel safe

- Come together like a symphony orchestra

With increased competition from challengers and Fintechs, financial institutions need to approach digital transformation as an opportunity to build something fundamentally new. You have the chance to start with a clean slate – and banks should use this opportunity to completely reimagine their products and services.

Digital Lift-and-Shift Is Not a Digital Banking Strategy

Many companies are realizing that simply carrying over analogue assumptions and digitizing in-person processes aren’t producing the desired results. Future-proofing your organization now involves studying behavioral science and how people engage with technology.

Think about the digital journey you’re trying to take people on. Consider how your interactions with customers must adapt to different digital channels versus a bank branch. You need digital greetings that are akin to a customer walking into your branch and being greeted with a smile.

In the past, we designed our banking applications and engagements for face-to-face interactions. But today we need to think about the benefits and strengths of different digital avenues (e.g., mobile, tablet, desktop) and how we leverage them to create an intuitive experience for the customer. This means utilizing modern platforms and software to make your banking experience better across all channels. And to be truly successful, bankers and designers need to create a religion around conversion rates and understand what drives them.

The Most Important Conversion Rates (online loan example):

|

Remember these 3 rules:

- Start with first principles and rebuild how you think about financial services.

- Don’t get bogged down by technology stacks and risk committees.

- Clearly define how you differentiate yourself and focus on “How we win.”

For instance, consider the digital account opening process. Why does it require a form? Could it be an interactive chat with a virtual assistant instead? You can collect relevant information during the flow of conversation while also making it enjoyable and personable by responding in context.

You need to establish a learning culture where you can rethink the way your organization operates. Run A/B tests so when you start to see things that impact your rates, you’re able to make the changes quickly. You can’t have to risk your job to make a change – fear tends to drive small changes instead of dramatic changes.

Friction Is Not Inherently Good or Evil

Unintentional or unnecessary friction in the customers’ experience is always bad – however, friction itself is not inherently evil. In fact, thoughtfully designed points of friction can be extremely valuable for managing risk and making customers feel safe. Make sure you understand where you are putting in friction and ensure that it’s deliberate.

Small UX improvements (like real-time address lookup) can have a big impact on customer experience. An incorrect customer address poses little actual risk of fraud, but verifying it or making customers retype their address adds unnecessary friction to the process. Instead of having customers enter each piece of information manually, streamline the data entry experience by making real-time suggestions, which also reduces the odds errors.

Remember these 3 rules:

- As a default, assume that customers are impatient and will move on if you make them wait – save them time by importing data and using pre-fill options whenever possible.

- Prospective customers are different than existing customers – existing customers expect and deserve VIP treatment.

- Compare yourself to your peers and best-in-class digital experiences (such as Amazon, Apple, Uber, etc.).

Banks should focus on applying the appropriate amount of friction based on the situation and perceived risk level. When you ask a customer for information, help them understand why you’re asking (e.g., “we need this data to help protect your identity” or “the federal government requires us to ask this”). Only ask for information that you truly need and that hasn’t been supplied in the past, and look for external data sources that can help you verify.

Read the full customer development post

5. Improving IRB and RWA Calculations with Machine Learning

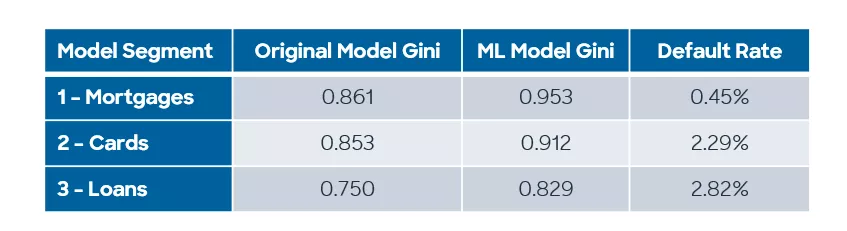

Peter Ould explained in his blog that ML delivers a significant reduction in RWA from an improvement in discrimination, powered by more advanced models that are able to produce more power from the large data sets that are typical of IRB model builds.

Here is an excerpt of his post:

Traditional scorecards have been the backbone of IRB expected capital loss calculations for years, but could advances in machine learning provide better models and reductions in IRB and RWA calculations?

In November 2021, the European Banking Authority (EBA), the prudential arm of the European Union, issued a discussion paper on the use of machine learning in IRB models. This was predicated on advances in explainability of machine learning models (e.g., for tree ensembles) helping to address some of the challenges that such complex models create. As the introduction to the discussion paper puts it:

“Whereas standard regression models may not be able to keep track with the emergence of the so called ‘Big Data’, in fact, data is the fuel that powers ML models by providing the information necessary for training the model and detecting patterns and dependencies. This does not come without costs; indeed, ML models are more complex than traditional techniques such as regression analysis or simple decision trees, and often less ‘transparent’.”

Here at FICO we’ve been exploring for almost a decade the use of explainability in machine learning through our xAI technology (check out Scott Zoldi’s post on Using Machine Learning in Credit Risk Models) which is now embedded in FICO Platform. Through our explainable machine learning models, behavioural and PD models for the retail banking sector can be created that provide higher levels of predictiveness coupled with explainable outcomes and reason codes.

Do Machine Learning Models Bring Predictive Improvements?

To test whether using machine learning for PD models would have a significant impact on expected capital loss for banks, we used some research data from a previous IRB model build for a Eurozone bank. The original model structure had three PD model segments predicting default at the exposure level. We built explainable Gradient Boosted PD models for each of these three segments, with exactly the same input variables and generated characteristics as the previous scorecards.

As might be expected for a behavioural model with already high Gini values, there were minor improvements in predictability across the four segments, but nothing overly dramatic. We have, however, demonstrated the power of Gradient Boosted models and managed to produce an improved Gini with just one model over the entire data rather than four segments. Straight away there are definite future cost savings in model development and monitoring to be had by this approach.

Read the full customer development post

How FICO Can Improve Your Customer Development

- Learn more about the FICO Platform and how it can deliver for customer development.

- Watch FICO's Darryl Knopp and Alex Johnson, Director of Fintech Research at Cornerstone Advisors, discuss digital transformation in fintech and banking based on their ebook "11 Commandments of Digital Banking."

- Read the essential customer development ebook "11 Commandments of Digital Banking."

- Explore some of our solutions for customer development.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.