Top 5 Debt Collection Posts of 2022: Crisis and Opportunity

As more people enter the collections queue due to rising costs and economic wobbles, our collections experts share their tips for early collections, digital approaches and more

The continuing effects of the pandemic, rising costs of living and skyrocketing energy costs put sharp pressure on household budgets in 2022. These factors and others led our experts in debt collection to address ways that lenders can manage the rising number of people in the collections queue. Here are the top five posts from 2022 on debt collection trends.

1. Digital Debt Collection and Early Collections

Ulrich Wiesner noted that customers under financial stress should be spoken to sooner rather than later, so that there is sufficient time to resolve the problem and prevent accounts from rolling to later stages of delinquency. Ideally, minimal operational effort is spent on customers that are likely going to pay, so that expensive debt collection resources can be focused on those customers where agent intervention makes a difference. This is a perfect opportunity for digital debt collection.

Self-service options have proven to deliver great results both in early collections and even post charge-off recovery. This frees up human collectors to spend more time with customers in forbearance situations that require empathy and consultation.

Risk-Based Segmentation and Digital Debt Collection

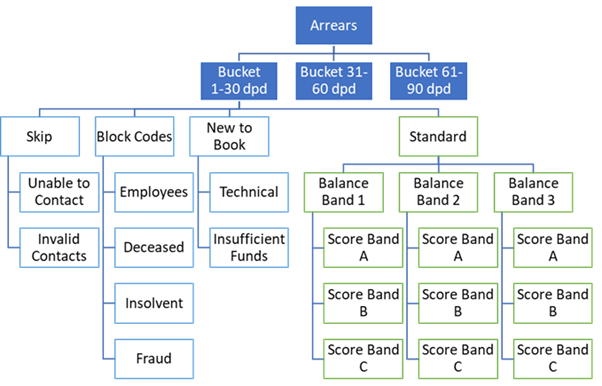

A good contact strategy for early collections typically separates out special cases which require a specific treatment, identified by one or few data attributes. Such cases might include employees, deceased customers, fraud, first-payment defaulters or customers without valid contact data. The bulk of the remaining accounts should be segmented by arrears bucket (days past due), balance and a risk indicator, ideally propensity to roll. The segmentation tree can be evaluated daily, or alternatively at cycle date, when the account balance changes, and eventually when payment agreements are made or broken.

A typical risk-based segmentation approach separates out non-standard accounts like employees, and the bulk of the standard accounts are segmented to allow for tailor treatments).

Mini Workflows Define the Customer Experience

The resulting segments can then be subject to simple mini-workflows appropriate to their risk, with a variation in communication timing, channel, and tonality, e.g., a text message on day 2 followed by a call on day 7 followed by a letter on day 15. Using champion/challenger testing, the appropriate treatment for each segment can be determined, balancing customer experience, segment performance and operational effort. In a more advanced approach, decision optimisation can be used to analytically derive the optimal treatment for each customer, minimizing a business objective like balance roll rate whilst honouring capacity constraints and alternative business targets.

Treatments paths should remain simple and not contain unnecessary conditional logic. This allows you to keep these workflows in existing case management systems, like legacy collection systems or CRM solutions.

Agility Is King in Digital Debt Collection

Effective communication strategies cannot be designed on a whiteboard and implemented in a waterfall approach — they need to be tested and gradually tailored to customer preferences and behaviour.

In consequence, the underlying decision services need to allow for flexible strategy management and configuration, and strategy performance needs to be continuously reviewed, discussed, and improved. Good decision platforms will support strategy version management, business outcome simulation, strategy staging from development to test and production, and champion/challenger testing.

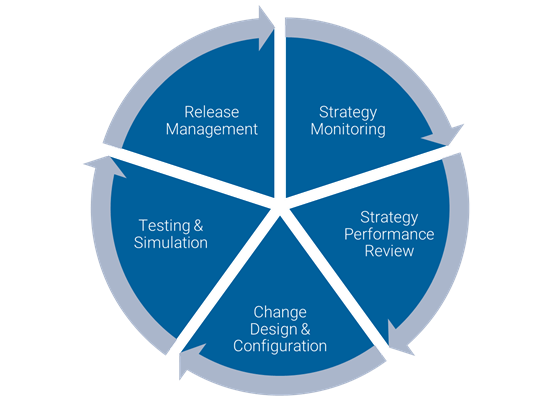

In an agile environment, the strategy lifecycle involves continuous monitoring and measurement of strategy results, typically undertaken by the strategy management team. In joint meetings with business stakeholders, strategy results are periodically reviewed, and lead to the design and configuration of strategy changes. These changes are configured by the strategy management team and typically implemented as challengers to the existing baseline (“champion”) strategy, so that the impact of the change can be quantified. Before deployment, the modified strategy undergoes appropriate quality assurance measures before release into production. With the exception of the last step, all parts of the strategy lifecycle are managed between the strategy management team and business stakeholders and should not require any involvement of IT resources.

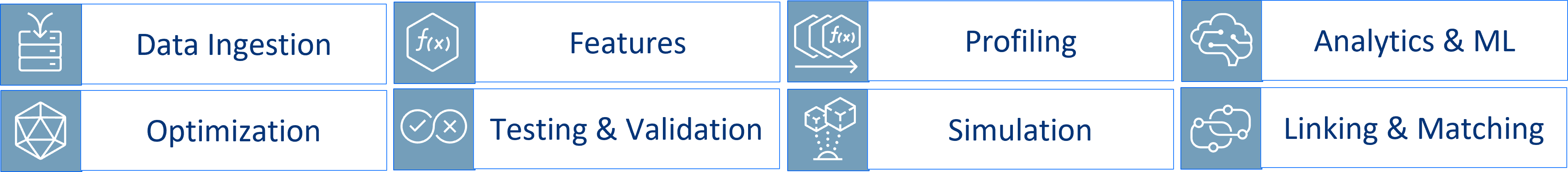

FICO Platform brings all these components together. Analytics, segmentation, strategy management, strategy execution and customer engagement are all supported by the platform, and can be integrated with existing system stacks or legacy debt collection solutions.

2. Debt Collection and Debt Resolution in 2022

Bruce Curry looked forward near the start of the year and saw a number of challenges in debt collection for lenders sifting through the pandemic’s inevitable financial fall-out.

The ability to cost-effectively deal with persistent indebtedness while offering customers breathing space is vital, particularly as income support schemes are wound down. There is also unease around BNPL as a competitive offering to traditional credit markets, its impact on consumers and the ability to successfully spot over-indebtedness.

A mass of digital solutions and fintech innovations offering real-time Open Banking data alongside transactional insight into customer affordability and vulnerability are being touted to Tier-1 lenders. The headache is knowing where to make the big bets for the best return.

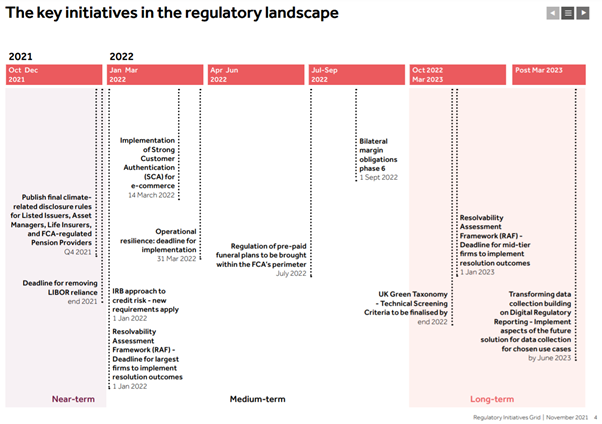

Regulation also continues to pose demands on already stretched back-offices juggling limited budgets, manpower and bandwidth challenges.

In the UK, for example, the FCA’s Regulatory Initiatives Grid details the in-flight and pending regulatory and industry-driven changes. In September 2020 there were 111 initiatives listed. In November 2021 there were 134 active initiatives listed.

https://www.fca.org.uk/publication/corporate/regulatory-intitiatives-grid-november-2021.pdf

Positive Signs for Debt Resolution

But beyond the challenges of regulatory change, it’s not all doom and gloom for lenders. Many consumers have been paying down debts; outstanding credit card debt decreased 3.7% in the year to Oct 2021 (The Money Charity, Dec 2021). there’s plenty of capital available and relatively modest collections portfolios, with most creditors reporting lower collections volumes than expected. Despite the challenges posed by the past three years, the broader economic outlook is positive. Lenders can take advantage by making a timely shift from a collections and recovery mindset to the delivery of more holistic customer support and debt resolution schemes. It’s a win-win for all parties, as I discussed in a recent webinar with McKinsey on digital-first collections.

Changing the Operating Model in Debt Collection

Technology and data sources are rapidly driving an ever-evolving back office for collections. Real-time access to ‘traditional’, new and emerging datasets continues at pace. Explainable AI, digital platforms and automation are all helping reduce overheads. But they are all critical investments that can be complex and time-consuming to set up. They also require talent and manpower to effectively deliver. Success hinges on the ability to parachute in expertise as needed when it comes to seamless installation and optimising operations.

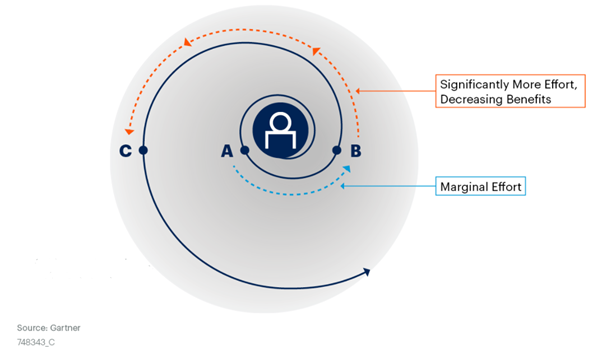

Right now, top performers are focussed on building agile, flexible and scalable capabilities. They’re less concerned about the accuracy of economic and behavioural forecasts than they are about ensuring they have the ability to handle whatever may come in a smart, expedient and appropriate manner.

3. How To Improve Collections Performance with Predictive Analytics

Bruce Curry returned to a perennial theme in debt collection: the opportunities presented by advanced analytics. These included the following.

Cutting Costs

Predictive models forecast, with a high degree of accuracy, the cases that are most likely to pay - and the assigned cases likely to return the highest yield. The magic happens when models accurately predict the likely lower-yield cases. These can be categorised, put in the hands of a collection agency, or sent for alternative, lower cost treatments.

Enhancing Customer Service

Predictive models can also help enhance customer service by offering lower-risk customers the opportunity to self-cure. If the model predicts a customer will respond and pay via a light-touch, high-return strategy, then it makes sense to give them more time to pay. Irrespective of the favoured channel, tone of voice is everything. Phone calls, letters, SMS texts can be less insistent and less intrusive, often resulting in fewer complaints and less embarrassed customers.

Improving Strategy Performance Over Time

Analytics can help continually improve operations by measuring and informing the impact of individual changes to collections approaches. So-called adaptive control or champion / challenger testing, for example, has highlighted how up to 80% of delinquent accounts are often willing to adapt to existing collection strategies, while 10% may favour an alternate strategy and the other 10% prefer another technique.

Analytics can accurately measure the impact of changes from each strategy, because all the other factors will be kept in sync. It’s a particularly effective approach for successfully comparing differing contact timings, differing channels, messaging, call campaigns and payment agreements. Virtually any strategy change can be accurately compared and analysed. Test and learn allows continual improvement to operations, or the implementation of hybrid approaches, when debtors receive differing treatments depending on the likely success of their respective customer segment.

Optimizing Collections Strategies with Prescriptive Analytics

It’s also often referred to as optimization. Crucially, it takes predictive analytics even further by looking across an entire business process to find the single strategy, or group of strategies, that are likely to result in the highest level of success. Goals can be simple such as maximising sums collected or maximising potential returns within a set timeframe. Optimization algorithms can also account for staff, budget, legal costs and other constraints.

Prescriptive analytics also allows organisations to balance staff against their respective workloads. They can highlight the opportunity cost of moving staff between specific workloads, or specific activities on cases. Crucially, they can show when to stop working a case and stop chasing a lost cause in face of budgetary and resource limits.

Prescriptive analytics can also use a learning loop to continually ensure results are fed back into collections models, allowing automated fine-tuning of strategies. If customer behaviour, or economic circumstances abruptly change, models can be re-calibrated to stay consistent over time.

4. 9 Steps to Improve Contact Data Quality in Debt Collection

Ulrich Wiesner presented this advice on how to improve contact data quality.

1. Get Contact Data Before You Need It

It is much easier to get valid contact data from your customers than from a third party. And updating contact data when you need to contact a customer as part of a collections process is typically much harder than in originations or account management. Hence managing contact data should be an enterprise task.

Data capture at customer acquisition should not be limited to data that is required to complete the originations process. Specifically, mobile phone number and email addresses should be captured in addition to the physical address whenever possible, as they facilitate digital engagement and hand-off to self-service processes.

2. Test Your Data Quality

Whenever contact data is acquired, it should be checked for syntactical plausibility – two-digit phone numbers and email addresses without an @ or without a valid top level domain will not be of much use later. And ideally, contact data should be tested. At originations, such tests can be branded as a customer satisfaction survey, which is a sensible thing to do anyway. Switch channels if you can — for example, if emails are used to update your customer on progress during the originations process, use phone or text for a follow-up survey.

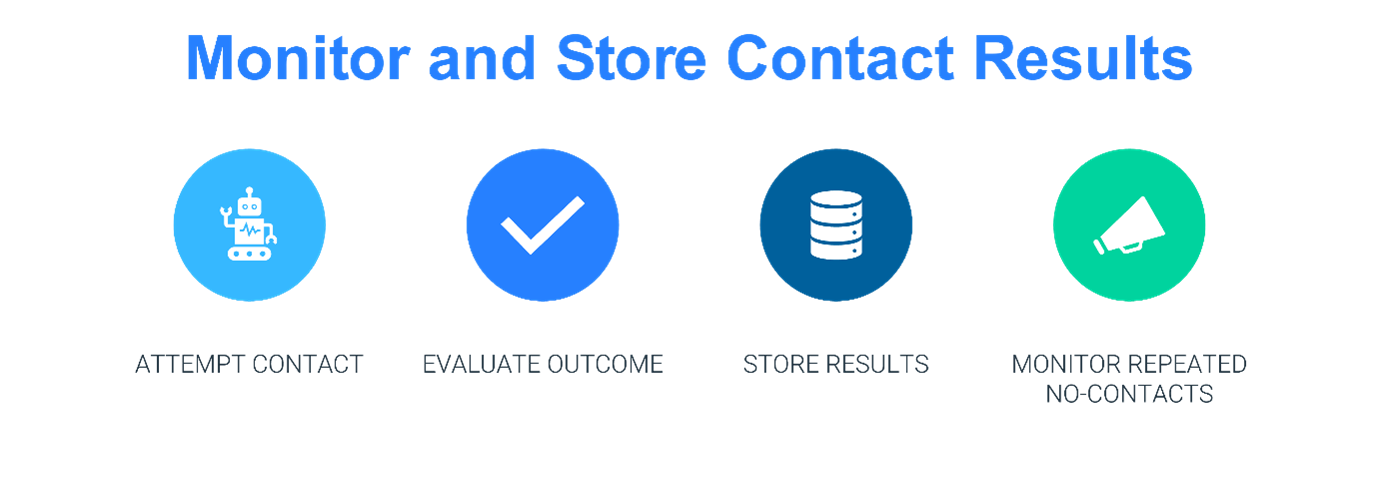

3. Evaluate Your Communication Results

For every outbound customer contact, the physical outcome should be evaluated; failures should be logged and should trigger a respective rectification process. Negative outcomes include undeliverable emails and text messages, invalid phone numbers and returned physical mail. Addressing the problem when it first occurs increases the likelihood that customers can still be reached on another channel.

4. Periodically Confirm Contact Data

Over time, customers will change their contact details, and specifically for low-interaction, long-term products like mortgages or credit cards, it is important to periodically validate contact data with the customer. This can be achieved through pop-ups on the customer portal or mobile app or as part of the call script during customer service contacts. For a reasonable customer experience, the date of the last validation should be stored, and the next confirmation should be triggered based on that date.

5. Process Contact Changes

While it might be appropriate to insist on a written confirmation for changes to the primary legal address, contact changes provided by the customer should never be disregarded just because they don’t meet certain formal requirements. Instead, such contact data should be captured and flagged as unconfirmed. Where required, confirmation can be gained via pop-ups in customer portals or via pre-filled forms that are sent to the customer.

6. Define a No-Contact Strategy in Debt Collection

In highly automated collection environments, it is even more important to keep track of customers you have not been able to contact. Such customers need to be removed from standard processing and assigned to a dedicated no-contact strategy, where the reason for the failed attempts gets evaluated and addressed.

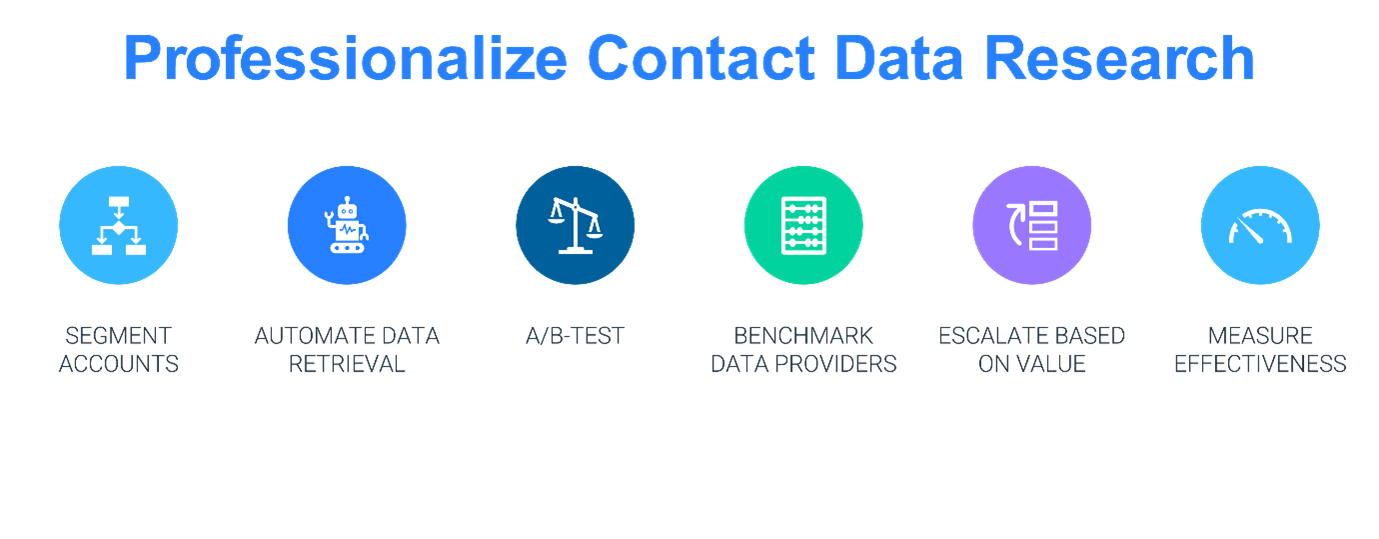

7. Professionalize Data Research

Even if you follow the above recommendations, you might end up without valid contact data. Then it is time for data research.

Leaving contact data research to the individual collector is probably the most expensive approach. Research should be a specialist task, executed by dedicated resources. This is the only way to get a grip on which methods work best, and to gain an understanding of costs and benefits of alternative approaches. In smaller organizations that don’t have a dedicated team, contact data research should still be handled by specialized resources, even if this is not their sole responsibility.

8. Automate and Escalate

Even if accounts missing contact data should be the exception, they typically lead to high-volume processes. For this reason, automation of data retrieval is key.

Wherever possible, initial data retrieval attempts should be undertaken in bulk, e.g., by contacting the customer on an alternative channel and asking for updated contact details. In many geographies, address research services provide updated contact information and charge on a success basis only. Where multiple providers exist, you might pit providers against each other in champion/challenger tests, or rotate failed attempts from one provider to the next. Implementing processes in your decision engine can provide the structure and agility to dramatically accelerate the test and learn.

For customers without any valid contact data, larger institutions have internal mini trace teams and outsource the qualified Gone Away for Trace and Collect to specialist agencies. Smaller organisations might go straight to Trace and Collect. What is important is that Gone Away accounts are not immediately assumed to be a much higher risk if they are easily traced and contacted. A Gone Away tag or label should not dismiss the need to validate the financial vulnerability of the customer.

9. Measure What You Do to Improve Your Data Quality

Whatever your approach to contact data retrieval is, activities should follow a structured process, should be logged, and should be monitored for efficiency and effectiveness. This is the only way to improve your processes and data quality over time, to understand what works for which type of customer, and to get the most out of your research efforts.

5. Meeting Debt Collection Challenges Amid a Squeeze on Income

Bruce Curry reviewed some lessons learned during the financial crisis of 2008, and how they could be applied now. He asked, “Do you have the right tools and capabilities to do these six things well?” He also shared the components of the integrated FICO Platform that can close the gap between where collectors are today and there they should be.

1. Understand the differing profile of collections customers given abnormal economic situation - Leverage diverse data sources, using customer analytics to drive deep insights, tailoring treatment strategies and engagement approaches to debtors based on emerging insights.

2. Have confidence in profile refinement - Dynamically update profiles as new information is received, including streaming customer interaction and transactional data, enriching with external sources -including credit bureaux and Open Banking data - to provide rich 360-degree view.

3. Pre-determine outcomes ahead of executing the treatments – Understand how to develop, deploy and monitor action effect models, driving from predictive to prescriptive analytics and mathematical optimization.

4. Encourage round-the-clock customer collaboration – Enabling two-way customer dialogue at any time via the channels of their choice.

5. Secure confident assurance of a right outcome – Through auditable, transparent and ethical AI at each and every point of decision and execution.

6. Constantly monitor triggers and indicators of changing circumstances – Instigating appropriate customer treatment and action weighted towards something that has happened instead of by something that hasn’t happened, or simply the passage of time.

How FICO Can Improve Your Collections Performance

- Learn more about the FICO Platform.

- Watch the webinar with Bruce Curry and Matt Higginson of McKinsey on digital-first collections.

- Explore our solutions for collections and recovery.

- See our solution for customer communications with borrowers.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.