Top 5 Scores Posts of 2022: Steady FICO Score, BNPL and Alternative Data

2022 marked the first year in over a decade the average FICO Score did not increase, while the industry’s attention remained on topics such as alternative data and BNPL.

As the independent standard in credit scoring, FICO® Scores are the leading credit scores used extensively across the lending ecosystem. 2022 marked the first year in over a decade the average FICO Score did not increase, while the industry’s attention remained on topics such as alternative data and

BNPL. Here are the five most-viewed posts from 2022 on the FICO Blog related to FICO Scores.

1. FICO Fact: How Alternative Data Enhances the Accuracy of Consumer Credit Profiles

Joanne Gaskin discussed that when we talk about alternative data, we focus on how it can help bring millions more people into the mainstream credit ecosystem. An important benefit of finding new broad-based data sources and incorporating them into widely-used credit scoring models is the ability to provide greater visibility into the overall profile of an applicant population.

FICO® Score XD 2 allows for exactly that. Developed by FICO in partnership with LexisNexis Risk Solutions and Equifax, this innovative credit score utilizes alternative data—data not included in the traditional credit bureau file. The inclusion of this alternative data leads to a more reliable estimate of consumer credit risk and helps score more than 26.5 million previously “unscorable” consumer files.

In addition to bringing new consumers into the system, alternative data also provides more clarity on credit files for consumers who are “credit retired,” meaning they have not used credit in at least six months, and consumers who only have negative information in their file. There are many reasons why a consumer may be inactive and gaining this insight can be challenging. FICO® Score XD 2 solves this problem by incorporating public records and property data from LexisNexis Risk Solutions, supplementing credit file data with this public registry information.

2. BNPL in Credit Reports: How Could This Data Impact FICO Scores?

Ethan Dornhelm dove into a hot topic of Buy Now, Pay Later (BNPL) plans, which allow shoppers to make purchases and pay for them in installments over a defined period. According to the research from Cornerstone Advisors, these point-of-sale short-term installment loans with low credit amounts have been increasing in popularity during recent years for retail purchases like clothing, household goods, electronics, and more. BNPL loans are cited as a potential driver of greater financial inclusion, both in terms of consumer access to the BNPL loan themselves, as well as access to credit products that could enable unbanked and underbanked consumers to establish (or re-establish) their credit histories with one or more of the Consumer Reporting Agencies (CRAs).

As BNPL loans become a more commonplace form of credit used by consumers, these loans could also become an important factor in consumer credit reports, and by extension, in the FICO® Scores based on those credit reports. While the BNPL product offers consumers some attractive features, it is essential that both lenders and consumers alike understand the potential impact these BNPL loans could have on consumers’ credit scores. All FICO Score versions can consider BNPL data, provided that the information is reported and made available to be incorporated into the algorithm.

But what might be the impact of BNPL accounts being included in the credit report and the FICO® Score calculation? There are several key factors to consider:

- BNPL reporting approach: How a BNPL lender reports these accounts to a credit bureau can materially influence the impact these loans ultimately have on the FICO® Score. BNPL loans reported to the CRAs as a revolving debt are likely to have a more substantial effect (in either direction) than BNPL loans reported as installment loans, mainly because the credit utilization ratio on revolving accounts is an important factor for FICO Scores.

- Overall credit profile: Where a consumer is along their credit journey is another important consideration as far as how the inclusion of BNPL data might impact their FICO® Score. Consumers with a credit history including missed payments in their credit report may benefit from the inclusion of BNPL loans that offer new evidence of on-time payments being made. Credit builders with thin or new-to-credit profiles might also be impacted more significantly by the inclusion of new data coming from a recently opened BNPL loan.

- Payment history and behavior on BNPL accounts: Consistent with all types of lending products reflected in the consumer credit file, the inclusion of BNPL loans that demonstrate on-time payment data and/or low utilization will be more likely to support a higher FICO® Score.

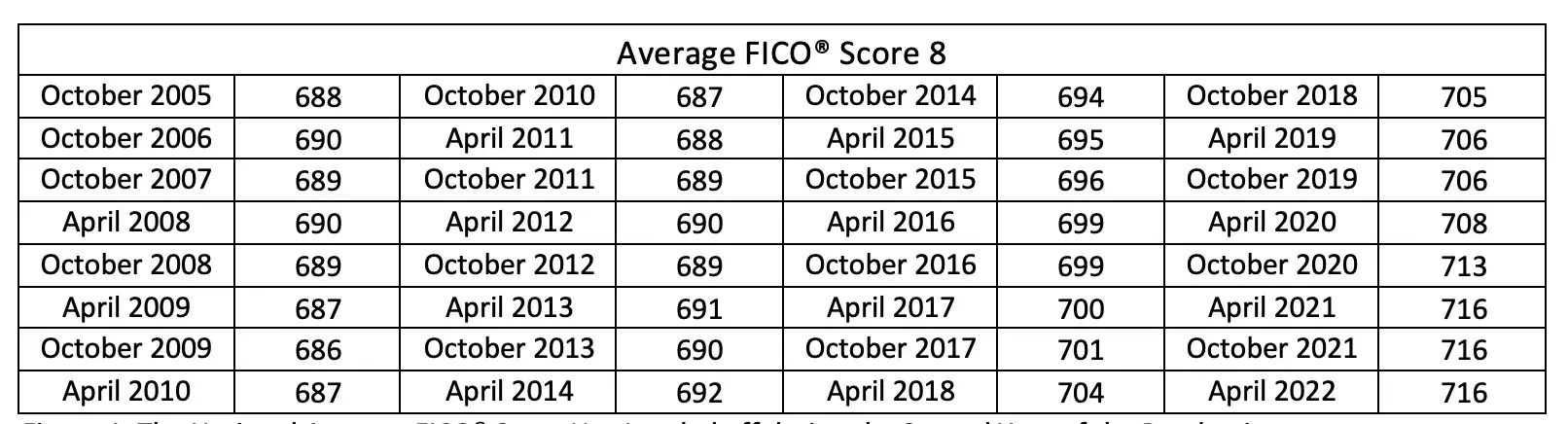

3. Average U.S. FICO® Score Stays Steady at 716

Can Arkali explained that each year, we provide insight into the national average FICO® Score to help ensure consumers have a baseline measure of credit health standing. We saw a substantial increase in the first year of the pandemic when the average FICO® Score rose five points from 708 to 713, due to the rapid recovery of the economy, government stimulus programs and historic levels of household saving, along with payment accommodation programs offered by lenders to help consumers manage their debts in the face of COVID-related income loss. Now, the average FICO® Score has leveled off during the second year of the pandemic. The national average FICO® Score currently sits at 716, the same as when we last reported on it a year ago.

Looking back to 2020, the average FICO® Score increased most notably for consumers with FICO® Scores between 550 and 699. For example, consumers with FICO® Scores between 550 and 599 saw a score increase of up to 20 points from April 2020 to April 2021. In contrast, the uptick in the average FICO® Score by the same FICO® Score bands were much more muted during the second year of the pandemic. Those consumers with FICO® Scores between 550 and 599 as of April 2021 saw an increase of 7 points to their average score within the year span -- on par with the increase observed during the pre-pandemic period of April 2019 to April 2020.

The leveling-off of the average FICO® Score this year has been driven by modest degradation in key metrics considered by the score: a small uptick in missed payments, slightly elevated consumer debt levels, and an increase in consumers obtaining new credit. Let’s dive into each of these trends in a bit more depth:

- Missed payments are on the rise: Missed payments reported in the credit file are up slightly.

- Consumer debt levels are increasing: While still below pre-pandemic levels, consumer debt levels have been increasing slightly over the last year.

- New credit activity is back at pre-pandemic levels: More consumers are obtaining new credit at near pre-pandemic levels.

4. Medical Collection Removals Have Little Impact on FICO Scores

Tommy Lee reports that more than 100 million people in America have health care debt, according to Kaiser Health News. This medical debt often arises from unforeseen events leading to unpaid medical bills, and can be exacerbated by complicated, and at times confusing collection agency and billing practices in the healthcare industry. In July 2022, the three credit bureaus are scheduled to change the handling of certain medical debt collections in the credit report:

- Paid medical debt collections will no longer be reported.

- The waiting period for unpaid medical debt collections to appear on credit reports will increase from six months to one year.

Based on our analysis, these two changes would impact ~5 million FICO scorable consumers. Conversely, ~200M scorable consumers do not have a relevant medical collection that would be impacted by these changes.

Additionally, the credit bureaus announced that in the first half of 2023, medical debt collections less than $500 (and possibly higher collection debt amounts - the exact threshold is still being determined) will no longer be reported.

It is anticipated that existing medical debt collections that meet this criteria will be removed from credit bureau data when the changes go into effect. Additionally, medical debt collections meeting any of these criteria will not be added to the credit report going forward. Credit scores that utilize credit bureau data will be impacted, including, but not limited to, FICO® Scores.

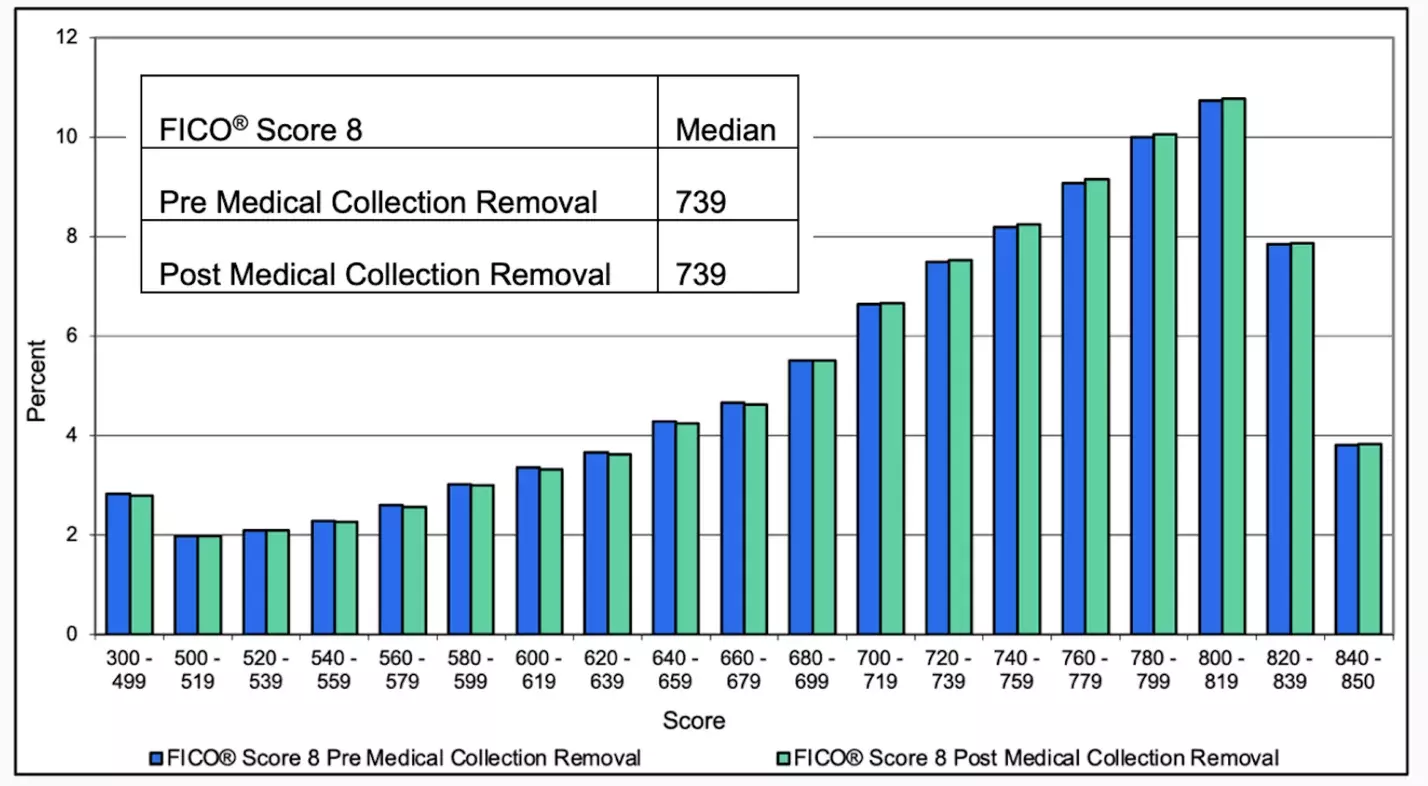

FICO recently conducted research on most widely used FICO® Score versions to assess the impact of the July 2022 changes to the FICO® Score. The results shared below include the impact of removing paid medical debt collections and increasing the waiting period to 1 year, but exclude the impact of removing medical debt collections less than $500.

Our results show that the July 2022 changes would have no material impact on the aggregate population to the FICO® Score’s predictive performance, odds-to-score relationship, or credit score distributions.

For example, the figure below compares the FICO® Score 8 distribution on the total US population before vs. after the July 2022 medical collection removals; the two credit score distributions are nearly identical.

Based on FICO’s analysis, only 3% of FICO scorable consumers would be impacted, and these files are very likely to have additional derogatory information on their credit report. Therefore, impacted files tend to score relatively low, even after these medical debt collections are removed from the credit report. Less than 1% of the total U.S. scorable population will experience a FICO® Score 8 change of more than 20 credit score points as a result of the July 2022 changes.

5. FICO Fact: No Credit Score Versus Low Credit Score

Joanne Gaskin explains that a low FICO score for a consumer can have the perverse effect of preventing them from having access to a second chance through manual underwriting.

We all know that having a higher credit score helps a consumer gain access to credit and get better terms from a lender. And financial institutions use FICO® Scores to underwrite lending to millions of people so that they can achieve their financial goals like buying a first home or starting a business.

At the same time, many consumer advocates have raised an important question: Is it better to have a low score just to have a credit score? Axios recently spoke on the demand to issue out more credit scores. The National Consumer Law Center suggests that “a bad score could shut out a renter out of apartments in a decent school district or even permanent housing.” And experts like Vanessa Perry of George Washington University warn that the mortgage lending industry’s adoption of scoring models that reduces minimum scoring criteria “would simply increase the pool of consumers with poor credit scores who either could not qualify for a mortgage or would enter the subprime market.”

We agree with consumer advocates that this is a legitimate concern. To avoid situations like this, it is critically important that credit scoring models are proven over time and based on sufficient data to reliably assess a consumer’s credit risk in a way that doesn’t generate a low score.

It’s for that reason that FICO is deeply committed to strong minimum scoring criteria. To receive a FICO® Score, we have found that at least 6 months of credit history, as well as at least one piece of credit data reported within the past 6 months, is required to best ensure a reliable look at a consumer’s current financial position. Our research has consistently found that models that rely solely on sparse and/or outdated credit information are not only less reliable at forecasting future performance, but they can lock people into low scores that put credit even further out of reach.

While reducing underwriting standards might sound like it removes barriers to credit, in fact it can have significant downside: consumers can get trapped with low credit scores, perpetuating their inability to build a credit history, and the reduced reliability of credit risk assessment across the entire consumer lending system increases costs for consumers, lenders and investors alike. And any claimed benefits of lowering minimum score criteria results simply isn’t borne out by the data: nearly all of the consumers who can receive a credit score through these reduced standards either have stopped seeking credit or would receive a score too low to receive affordable credit.

Learn more about the FICO Scores

Review our blog posts on FICO Scores

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.