Tracking Credit Risk in a Challenging Economy - South Africa

Using FICO Scores for account management can help lenders identify which borrowers have increased risk

Credit scoring is widely used in South Africa to determine the risk of credit applicants — using this kind of objective, precise measure of risk lets banks, retailers and other organizations lend with more confidence, which in turn means more people get approved for credit. However, some lenders can miss opportunities by not continuing to monitor those same consumers’ risk profiles once the credit has been granted to them.

In this post, I will share an analysis that shows why using the Empirica Score (the FICO® Score in South Africa) — the leading credit score in South Africa, available from TransUnion — is equally important in maximising a lenders’ return on investment for both opening new accounts and managing them. I will share a recent analysis completed on South African data for both new lending and existing consumers.

About the Empirica Score

The Empirica Score was developed by predictive analytics software company FICO with the aim of equipping organisations that offer credit to their customers with solid risk assessment when determining an applicant’s eligibility for a credit. Through the Empirica Score, creditors are also able to draw information that can help them improve on the profitability of any lending transaction they have booked with each of their respective customers. FICO has been delivering the Empirica score to the South African market for over 20 years, with Empirica 5 being the latest version of the score available and the score this analysis has been based on. FICO is a world leader in credit scoring, with credit scores in some 30 countries.

The Empirica Score features the following two components:

- An Account Origination score, which rates the risk of a credit applicant at account origination.

- An Account Management score, which rates the risk of an existing customer, and supports portfolio management strategies throughout the customer management lifecycle, including credit line management.

FICO analysts periodically review these scores to ensure that the models are providing a high-degree of accuracy in risk assessment that is expected of FICO products.

Account Origination Analysis Shows Downward Shift in Risk

The distribution of the Empirica Score for Account Origination on newly booked accounts is largely driven by the risk appetite and acceptance criteria of individual lenders. The table below shows an analysis of a group of consumers who applied for credit in 2017 and were scored with the Account Origination score. The same consumers are scored 12 months later, again with the same Account Origination score, to see how their risk profile had changed.

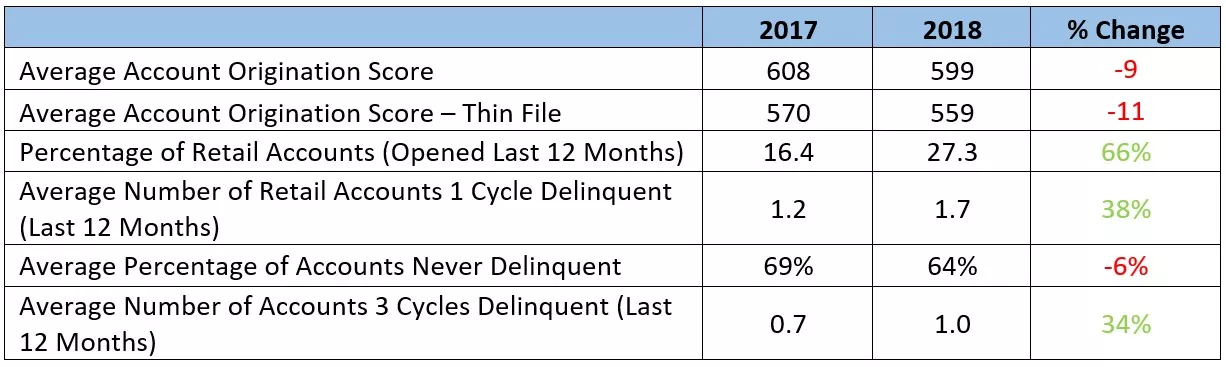

Figure 1: Account Origination Score Migration and Drivers

In 12 months, the average score for this group of consumers dropped by 9 points overall and by 11 points for the Thin File[1] population. Looking at some key characteristics that factor into the score calculation, we can start to understand why:

- The delinquency levels have significantly increased for this population, with fewer never-delinquent consumers and a 34% increase in 3-cycle (90 days) delinquency.

- A considerably higher proportion of Retail accounts opened by these consumers went delinquent within the 12-month analysis period.

This shift towards a more risky profile among borrowers who were recently granted credit highlights the importance of careful risk monitoring of this population. Regular review of monitoring reports helps lenders identify if a tranche of business is shifting risk and merits proactive risk management.

Risk shifts such as this show why it’s even more important for lenders to leverage robust account management tools to ensure they maintain a healthy portfolio.

Account Management Score Shows Increased Risk

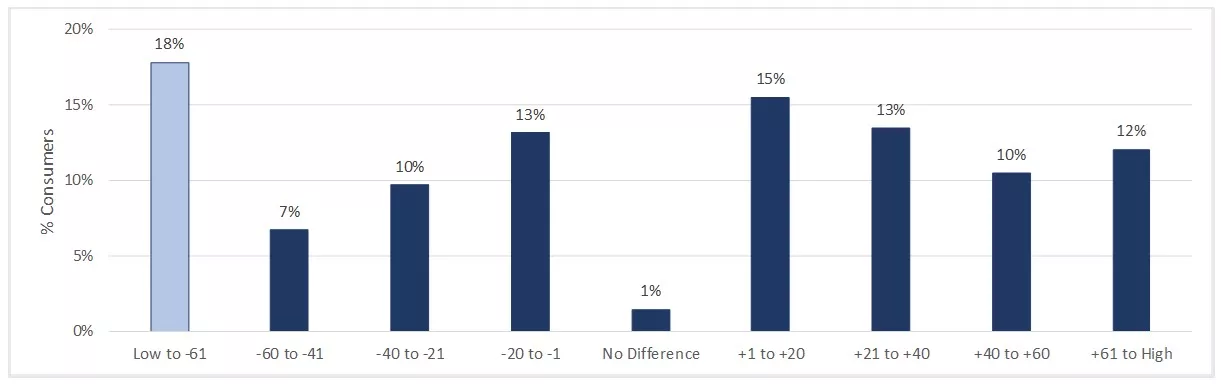

We performed a similar analysis using the Account Management score, comparing a robust dataset of 15 million South African consumers’ scores as of March, June, September, December 2017 and again as at March, June, September, December 2018. Over the 12-month period in question, the majority (70%) of consumers experienced a significant change in their Account Management score of 20 or more points (Figure 2):

- 35% of consumers experienced a material score increase (21 points or higher).

- 35% of consumers experienced a score decrease (21 points or lower).

However, the single largest shift was seen in the group with a score difference of minus 60 points. These are people who have experienced substantial deterioration in their risk profile, either due to new missed payments or a ramp up in their outstanding debt. Without the use of a refreshed Account Management score, these important shifts in the credit risk posed by a customer are unlikely to be spotted in time for the lender to take action and reduce their own exposure.

Figure 2: Account Management Score Migration, 2016 to 2017

What’s Behind the Change?

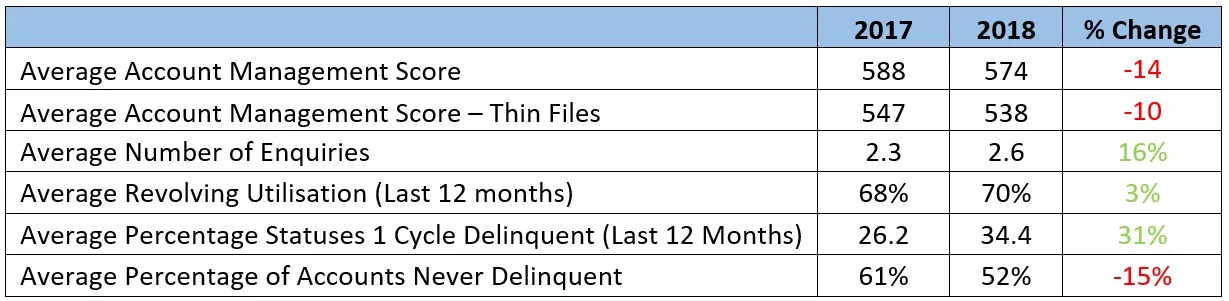

Examining how key credit characteristics shifted between 2017 and 2018 highlights some of the drivers in the 14-point decrease in the average Account Management score. The increase in the delinquency, utilisation and enquires are all factors that have contributed to the decrease in the average Account Management score.

Figure 3: Account Management Score Migration and Drivers

The deterioration in the overall portfolio quality means fewer consumers may qualify for positive actions, such as credit limit increases. For example, if a lender has a strategy of line increases with a score cut-off of 610 (FICO® Score for Account Management), 3% fewer consumers would have qualified for that line increase in 2018 compared to 2017.

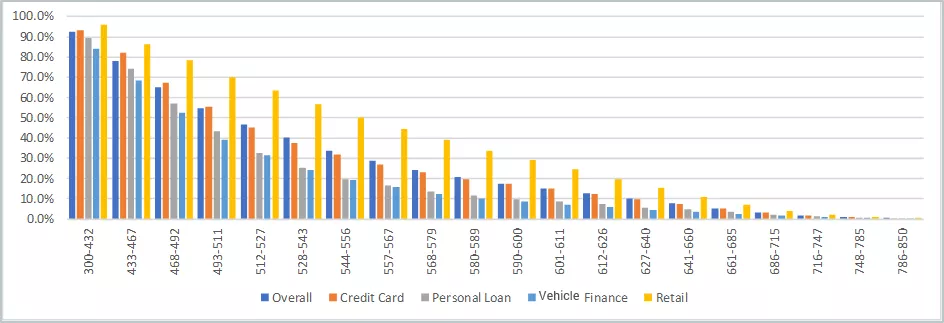

Strong Risk Segmentation

When evaluating risk, the FICO® Score for Account Management offers excellent segmentation. For example, the overall 90+ bad rate in 2018 for consumers scored in 2017 is 19.9%, whilst the lowest-scoring 5% of consumers have a bad rate of 92.4% and the highest-scoring 5% of consumers have a bad rate of 0.4%. This near 250-fold difference in default likelihood between the top and bottom 5% of consumers based on their FICO® Score again demonstrates the high degree of rank-ordering offered by Empirica Score (Figure 4), both overall and for specific industries.

Lenders can leverage this predictive strength to significantly improve profitability, by using the Empirica Score in conjunction with internally developed behaviour scores (scores based on a customer’s activity with that lender alone) to enhance their account management strategies at both the lower and upper score ranges.

Figure 4: Account Management Bad Rate by Score Distribution

Final Thoughts for South African Lenders

The above analysis shows the importance of using the Empirica Scores for both Account Origination and Account Management for an economy that is contracting. As South Africa’s economy faces economic challenges with a high unemployment rate and negative growth, consumers may find it hard to repay existing credit obligations and therefore it will be important for lenders to use all tools available to them in order to make the most robust and profitable lending decisions to cater for the deterioration in risk on their existing portfolios. Using the Empirica Score from TransUnion will enable lenders to significantly improve profitability based on a more complete view of the creditworthiness of both new and existing customers.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.