UK Auto Buyers Shift to Online Auto Financing - Slowly

In a new FICO survey, 21% of UK buyers got online auto financing, vs. 15 percent last year, an increase of almost 33 percent.

Online auto financing grabbed a bigger piece of the pie last year in the UK, according to a new survey from FICO. Our survey of 2,000 recent car buyers in nine countries showed that:

- 21% of UK buyers got online auto financing, vs. 15 percent last year, an increase of almost 33 percent.

- Of the nine countries in Europe and the Americas surveyed, only Chile saw more respondents getting loans online (24%).

- 37% of UK car buyers said they would prefer to apply online the next time they buy a car.

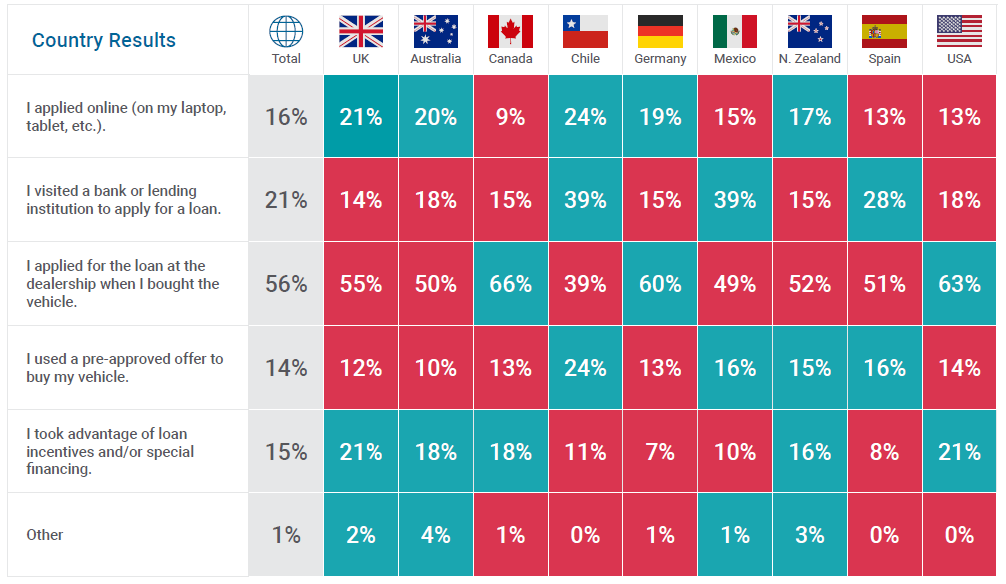

How did you acquire your most recent automotive loan or lease?

"Consumers are taking greater control of the auto financing process,” said Steve Hadaway, general manager for Europe, the Middle East and Africa at FICO. “They are moving online in their search for a better deal. Those lenders that can instantly offer a superior financial package based on analysis of the applicant’s data stand to gain."

Our survey also showed that:

- UK car buyers got their financing faster than any other country but Germany, which tied with the UK. 55% of respondents got their financing in less than 30 minutes, but this was less than last year, when 63% of buyers waited less than 30 minutes. Nonetheless, UK car buyers found the process easier than people in other countries. In the UK, 82% or car buyers surveyed said the process was easy, just above Germany (81%) and Mexico (80%), and well above the USA (68%).

- Just 47% of UK car buyers evaluated financing offers from more than one lender.

- 41% of UK car buyers said they would accept an instant loan offer for financing a vehicle if that meant they could avoid dealing with a bank or doing extra paperwork.

For more information on trends in online auto financing and other areas, check out our ebook on Global Consumer Survey: Vehicle Finance Perceptions.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.