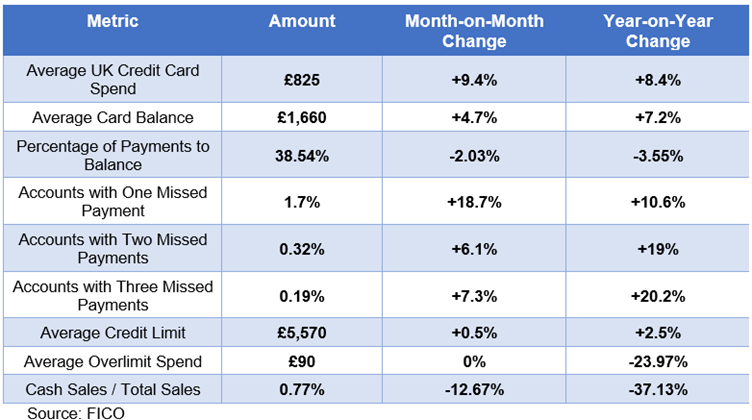

UK Card Spend Reaches Highest Level Since at Least 2006

FICO data shows that inflation and Christmas consumer spending saw a sharp rise in December, while more UK customers missed a payment

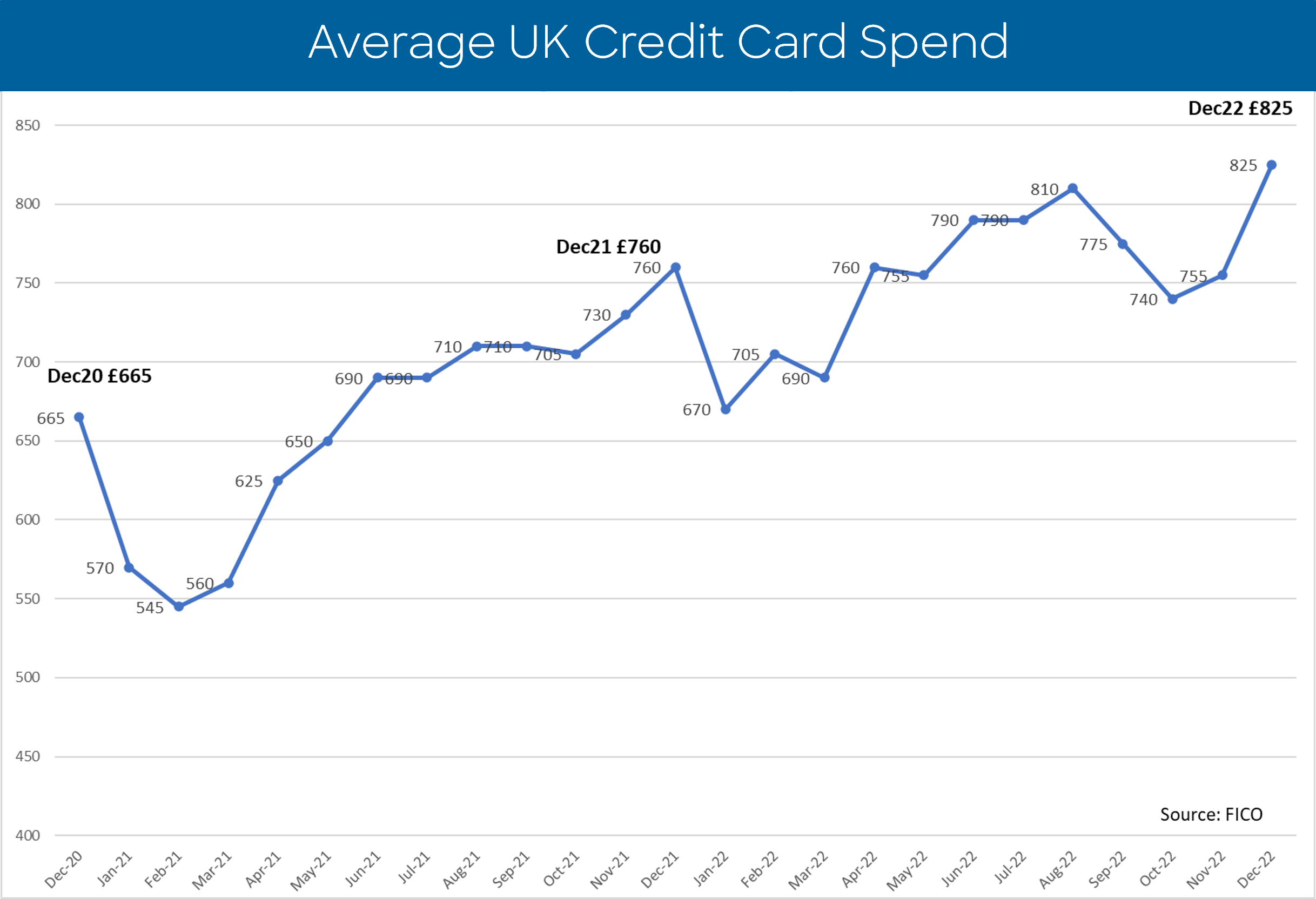

Seasonal consumer spending surged on UK credit cards in December, which is the trend you would expect in the holiday season. But this year’s rise seems to also have been driven by inflation, pushing the amount of average credit card spend in the UK to the highest level since our UK Risk Benchmarking records began in 2006. This rise occurred in a month when UK retail sales volumes were widely reported as being down relative to past years.

December also saw a significant rise in UK cardholders missing one credit card payment, which underlines the financial pressures on consumers.

Here are the highlights of our UK report for December 2022:

- Average total sales up 9% over November 2022 at £825

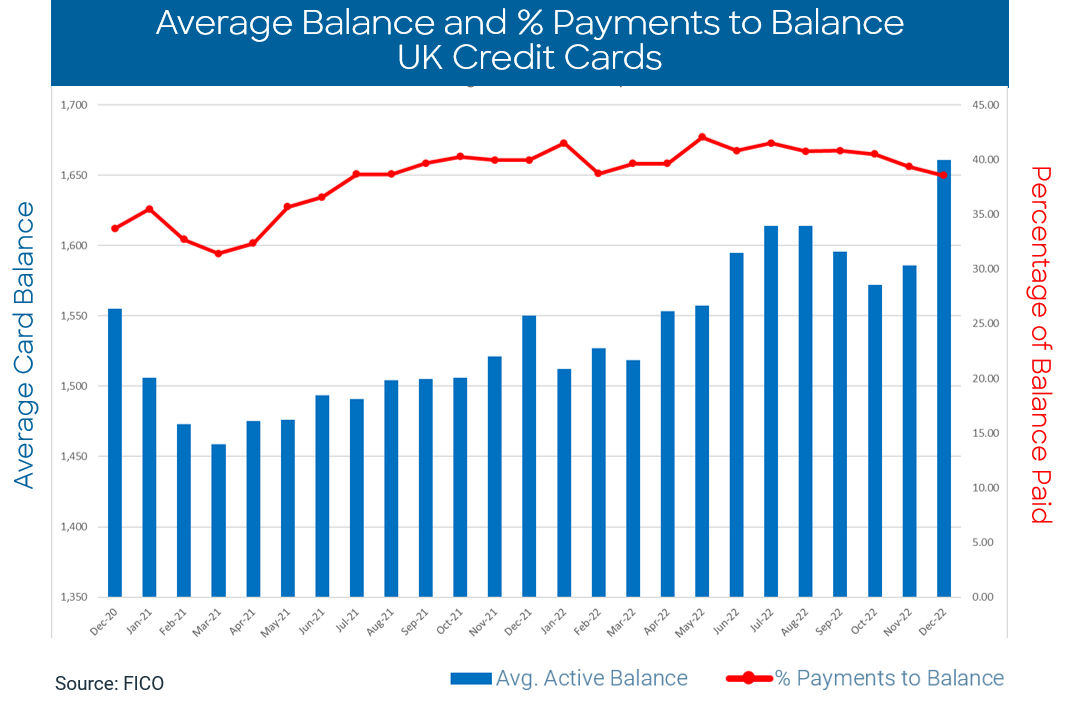

- Average credit card balances rise by 5% month-on-month to £1,660

- Accounts missing one credit card payment jumped month-on-month by 19%

- Percentage of customer accounts with two missed credit card payments was 19% higher than December 2021 and 20% higher for three missed payments

- The trend of falling payments to balance also continued in December 2022 with a 2% month-on-month drop and a 4% year-on-year decrease

The Impact of Consumer Duty

Analysis of the largest consortium of UK consumer credit cards data shows a convergence of rising prices and dwindling disposable income in December 2022. With average consumer total spend at its highest and late payments rising significantly month-on-month and year-on-year, financial institutions will be particularly concerned as the focus on Consumer Duty heightens.

The Financial Conduct Authority’s (FCA) Consumer Duty rules, which will apply to new and existing products or services that are open to sale or renewal and come into force on 31st July 2023, require financial institutions to act to deliver good outcomes for customers. Customers must be able to access products and services that meet their needs and offer fair value, as well as receive the support they need, when they need it. This includes financial institutions offering vulnerable customers other products with more suitable pricing etc.

As financial institutions face increasing numbers of late payments they will benefit from using optimised strategies to determine who and when to contact, and omnichannel communications to ensure those messages land. Those with the ability to incorporate digital-first communications will be in a much stronger position to deploy effective debt collections strategies.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client finance reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers.

For comparison with other regions, see FICO's analysis of Q4 card trends in Canada and the United States.

How FICO Can Help You Manage Credit Card Risk and Performance

- Work with our FICO Advisors team

- Explore our solutions for credit line management and collections prevention

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.