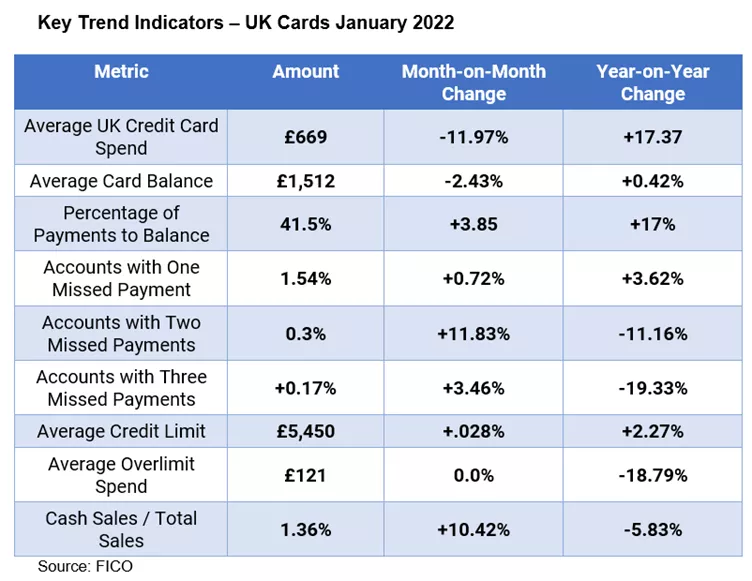

UK Cards Trends: Good Performance Despite Rising Living Costs

The FICO UK Credit Card Market Report for January 2022 shows strong financial management by consumers, but concerns remain over UK cards trends as fuel and other costs rise

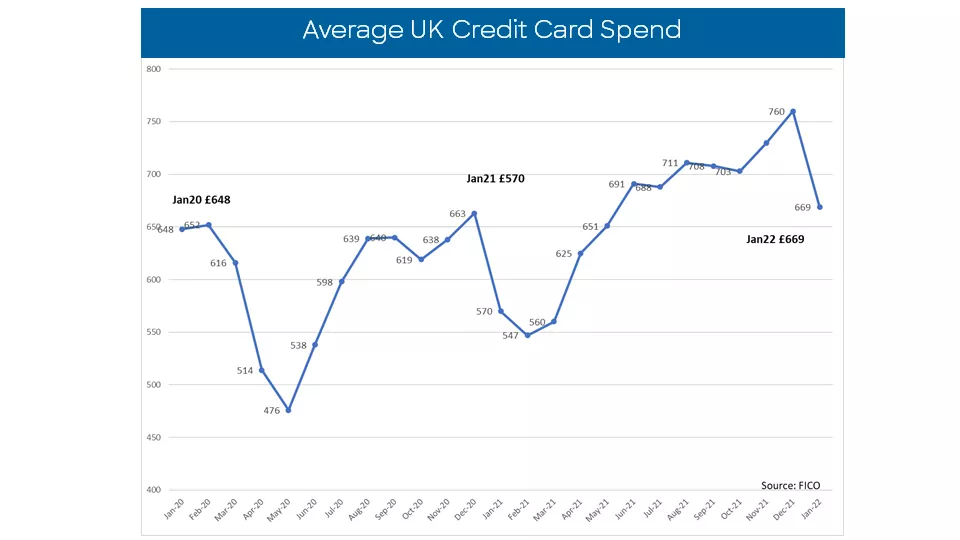

How are UK cardholders managing their payments? Our analysis of UK card trends for January 2022 suggests that they're managing card spend relatively well, despite well-documented increases in the cost of living.

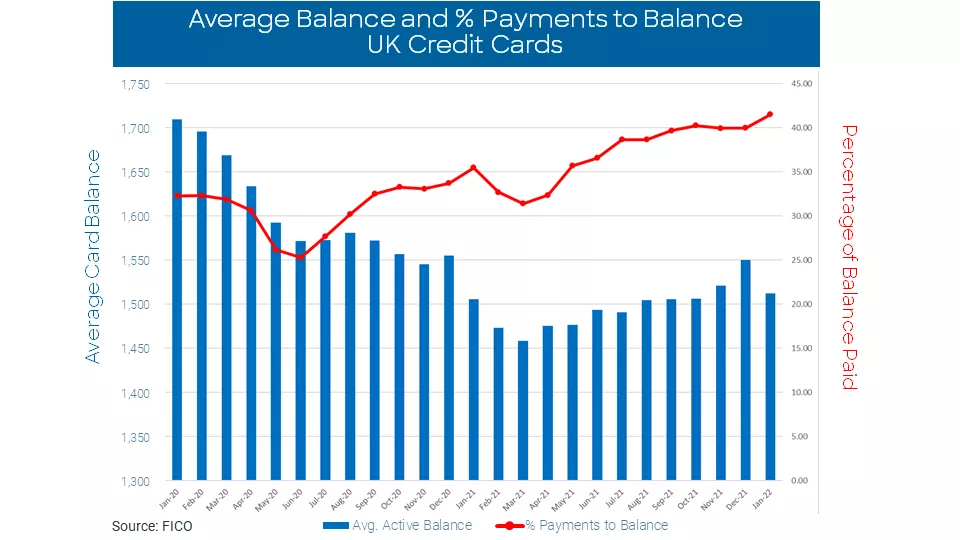

The new data for January 2022 illustrates the continued mixed picture of consumer financial management. Having seen the percentage of accounts paying their full balance start to drop in December, it was anticipated this pattern – and other signs of financial stress - would be evident in January, particularly in response to rapidly rising inflation. However, the FICO data actually suggests continued strong financial management. Month-on-month and year-on-year there were increases in the proportion consumers paid of their credit card balances, suggesting continued use of pandemic savings. This also suggests that consumers want to continue to have credit available for future spending.

Of some concern to lenders – although usually expected after Christmas – is the month-on-month increase in card holders missing payments, in particular those falling two months behind. Whilst the percentage of accounts with two missed payments is lower than January 2021, the impact of pandemic savings this time last year as well as supressed spending due to the lockdown may have been influential.

The FICO data suggests that credit cardholders with lockdown savings are continuing to use these to pay off credit card balances. The question is whether this resilience can be sustained as the cost of living generally and utility and petrol prices in particular continue to escalate. Lenders will need to be vigilant to any further increases in missed payments in the coming months and ensure that they are offering support to customers where it’s needed.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service produced by FICO® Advisors, the business consulting arm of FICO®. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.