UK Credit Market Report June 2021: Spending Tops 2019 Level

Credit card spend 3.5% higher than June 2019, suggesting some households are benefitting from pandemic savings, but not everyone is confident in financial position

Our latest FICO UK Credit Market Report looking at UK card trends for June 2021 shows that average card spend continued to increase compared to 2020. As the UK was only just coming out of lockdown in June 2020, this rise in spend is unsurprising, but the fact that average spending was 3.5% (£23) above 2019 levels suggests that, for those who have been able to save through the pandemic, there is confidence in their future financial stability.

However, the percentage of accounts missing payments reflected the fact that not everyone has been able to accrue savings during the last 18 months. With the end of lockdown across the UK and summer holidays prompting spending in the next months, and government support for furlough payments reducing from 1st July, lenders will need to be vigilant for those already facing financial pressure who could struggle further to stay on top of debts.

Spend on UK cards continued to increase, along with the percentage of payments

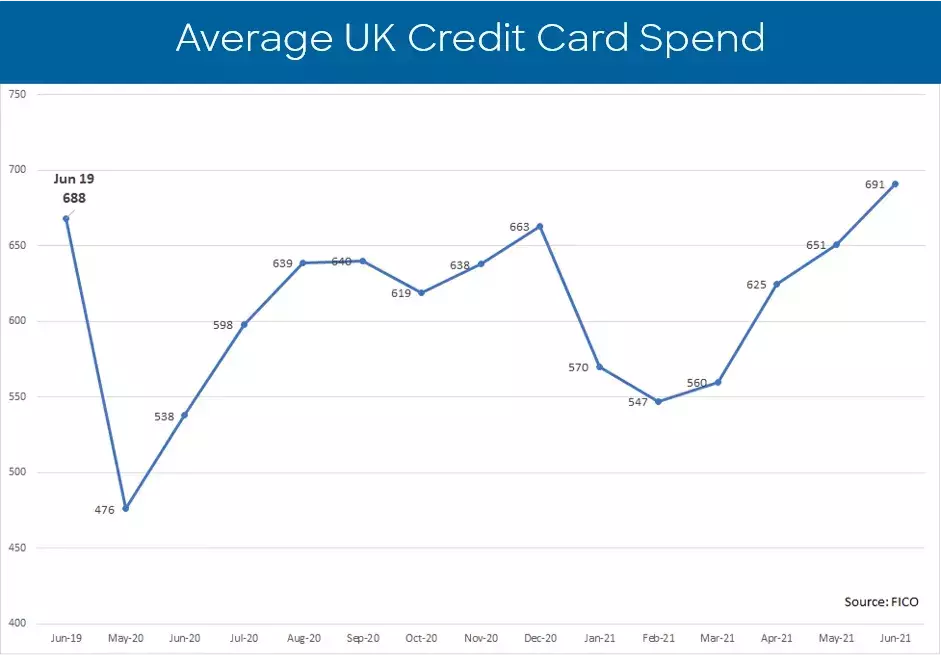

The average spend on UK credit cards increased year-on-year for the fourth consecutive month, by £40 to £691, a larger increase than seen in May. It also exceeds the June 2019 spend by £23 with the sunny weather and the Euro 2020 competition likely to have contributed to this uptick.

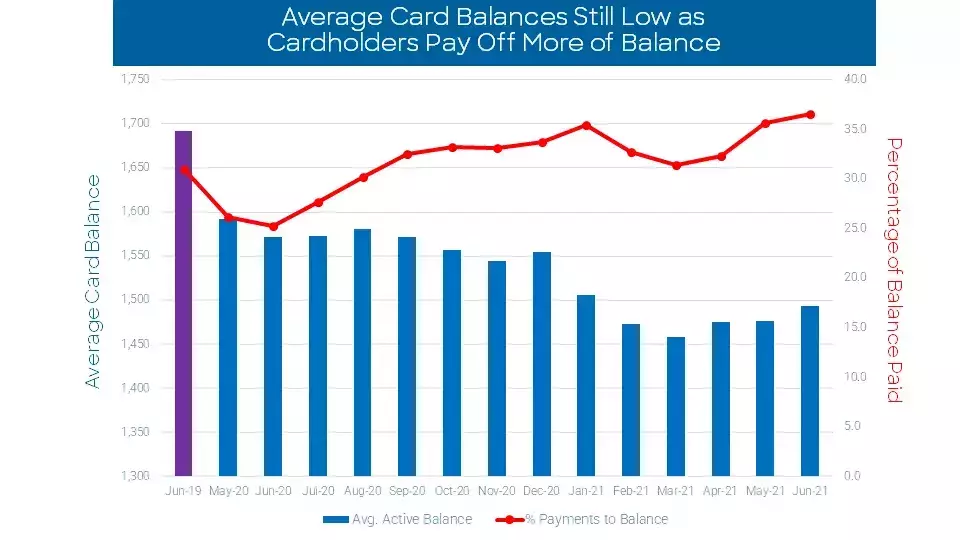

Average card balances marginally increased month on month. They are 4% lower than a year ago and 12% below June 2019 levels, suggesting that households are trying to manage their spend in the face of a still-uncertain future.

Mixed picture on payments

Whilst average spend increased year-on-year, the FICO data reveals mixed fortunes when it comes to payments.

The growth in the payments-to-balance ratio started to slow in June 2021, increasing by just 2.5% month on month. Year-on-year it is 45% higher, although that is unsurprising as some businesses were still arranging furlough and loan support in June 2020. However, it is 18% above June 2019 levels, suggesting the use of savings as well as continued government support.

The number of accounts paying the full balance stabilised in June and was 16% higher than June 2020. Despite the percentage of accounts paying the minimum payment increasing by 3% in June, the proportion is still 11% below that seen in June 2019.

Missed payment rates remain low

The percentage of accounts missing one payment increased in May. A proportion of these were unable to make a payment in June, which resulted in a 15% increase in the percentage of accounts missing two payments and a 9% increase in their balance compared to total balance.

All average balances on accounts missing payments decreased month-on-month again in June. However, all balances are higher than a year ago, and 2, 3 and 4+ missed-payment accounts are higher than June 2019, prior to the pandemic with 3 and 4+ balances over 18% higher.

Cash usage continues to slowly grow but remains below pre-pandemic levels

Cash as a percentage of total spend fell month on month and is 8% lower than a year ago and 37% lower than June 2019, highlighting the change in attitudes towards cash.

Whilst the percentage of consumers using cash on their credit cards increased for the third consecutive month, it is 16% lower than June 2020 and 62% lower than June 2019.

Looking ahead

FICO July data will reflect the initial impact of the last stage of the re-opening of high-risk retail and entertainment sectors, as well as the start of the school holidays. It is expected that spend will continue to increase, although levels may not be as high as anticipated because of the ongoing confusion around foreign travel rules. Higher levels of savings may also continue to blur the picture of those negatively impacted by the winding down of the furlough scheme and further business closures.

Lenders will be keeping a watch on the impact all these factors have on their customers and any changes in payment trends as early indications of financial stress. Those that act quickly, offering the most appropriate options, will be viewed most positively by their customers and the regulators.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. Issuers wishing to subscribe to this service can contact me at staceywest@fico.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.