US Bankcard Industry Benchmarking Trends: 2022 Q2 Update

Bankcard delinquencies continue to rise as growth in the economy slows

FICO Community releases quarterly US Bankcard Industry Benchmarking trends. To catch up on the last quarter click here.

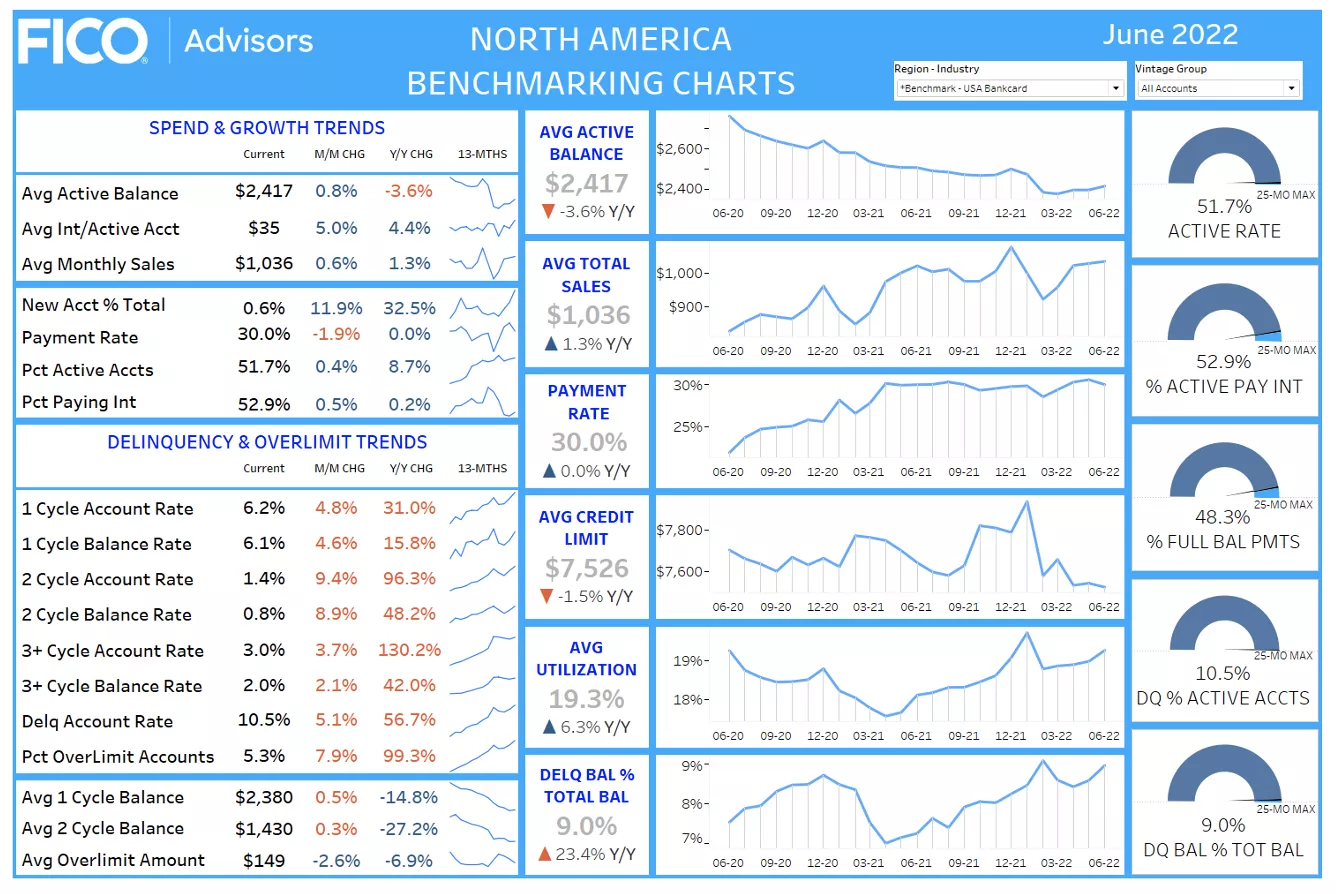

The following credit card performance figures represent a national sample of approximately 130 million accounts that comprise FICO® Advisors’ Risk Benchmarking solution. The data sample comes from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions. The solution offers a variety of account management metrics, along with month-over-month and year-over-year comparisons, as well as 25-month trends.

Stresses in the Macro Environment Are Hitting Home

Consumer sentiment in the market continues to fluctuate as the macro environment remains mixed. Interest rates and inflation are rising fast, while the unemployment rate is still at historical market lows. The key is how these macrolevel measures impact individuals’ finances – all consumers are paying higher prices at the grocery store and gas station, but not all cash strapped consumers are shopping for loans or carrying large amounts of debt.

Inflation began to rise in the Spring of 2021, but consumers had excess savings from the pandemic and pent-up demand for travel, leading to increases in consumer confidence. Then in the Spring of 2022, the Federal Reserve began increasing interest rates slowly because they believed that inflation was going to be short-lived.

Once inflation took a strong hold, consumers spent through their savings and are now beginning to turn back to credit for transactions. However, with rising interest rates, debt is also becoming more expensive – for example, the 30-year fixed rate mortgage jumped from 3.2% in January to 5.7% by June. With inflation hitting 9.1% at the end of Q2, and the US household debt surpassing $16 trillion for the first time ever, it leaves issuers wondering where the credit card market is headed. [Sources: Bureau of Labor Statistics, New York Federal Reserve]

The financial industry data from FICO® Advisors’ Risk Benchmarking solution for Q2 2022 also shows mixed results. The average active balance on credit cards has flattened since February (after trending downward for the previous twenty-four months) and payment rates remain at all-time highs. Increasing active rates are typically viewed in a positive light, but this time may be signaling that more people are pulling out their credit cards for everyday expenses. We are also observing climbing delinquency rates, which have exceeded levels seen prior to the start of the COVID pandemic (March 2020).

Credit Card Usage & Payments

Average active balance appears to be leveling out, coming in mostly flat at $2,417 for the past four months, as some consumers start to increase revolve behavior. This is only a 3.6% decrease year-over-year, but is still ~18.2% lower than it was in January 2020. Many consumers used government stimulus and excess savings to pay down their financial debts, typically tackling variable rate credit card debt first. If average balance has decreased substantially, then how did the US just hit a record high in household debt?

Turning to the active rate helps issuers understand the bigger picture. The active rate of 51.7% is 8.7% higher than one year ago and 11.7% higher than June 2020. According to a report released by American Bankers Association, there were 365 million open credit card accounts in the US at the end of 2020. Using this figure, the increase in active rate equates to ~15 million more credit cards that are being used today compared to one year ago.

Marketing departments put forth a lot of effort each year to increase the number of customers who use their credit card. However, in times like this with increasing prices, pulling out a credit card may be a last resort for everyday transactions including gas and groceries. The potential negative impacts of higher active rates may not show in the financial data for another six to twelve months.

As was discussed in the Q1 Bankcard benchmarking review, payment rates continue to hold at ~30% since April 2021. It is surprising that seasonal fluctuations have not been observed across the market as they were in years past. The percentage of consumers paying their balance in full is also near all-time industry highs at 48.3%. Despite higher than normal payment rates, delinquency rates are on the rise.

Credit Card Delinquency

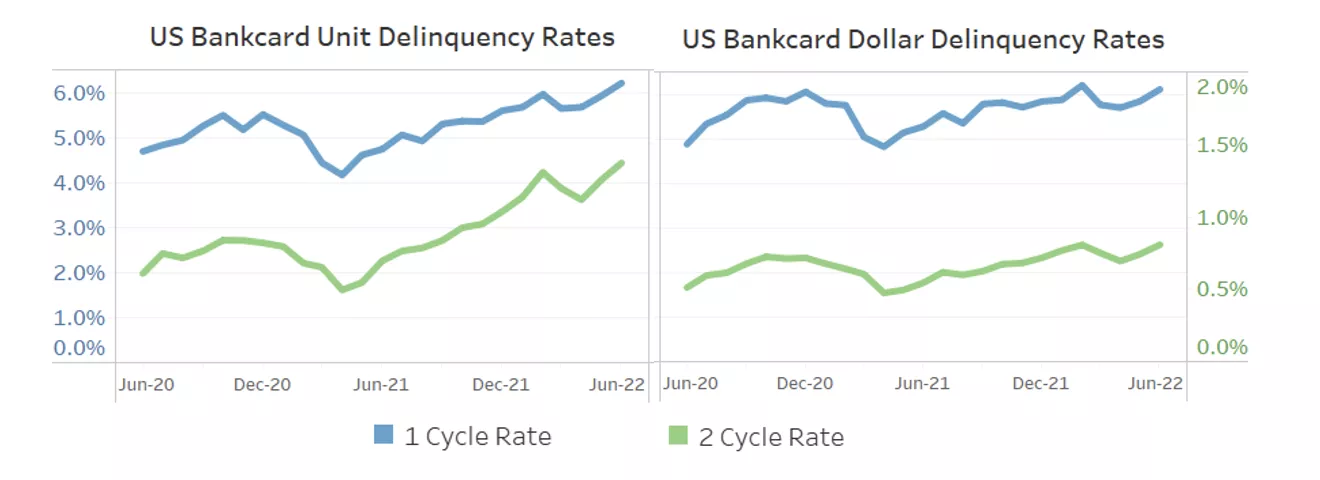

Delinquency rates have been ticking up over the past year, with unit rates increasing at a steeper rate compared to dollar delinquency rates due to lower average balances. Comparing back to when delinquency rates were fairly stable prior to the beginning of the pandemic, the one-cycle unit delinquency rate of 6.2% in June 2022 is 10.7% higher than in June 2019. The two-cycle unit rate of 1.4% is a whopping 40% higher than in June 2019.

These sharp increases in the number of customers falling past due translates to additional pressure on financial services providers and their operations staff, especially in the collections department. To relieve some of this pressure, more credit card issuers are turning to digital communications. Consumers have come to expect an email or SMS text rather than a phone call and an easy way to pay when they are ready. If you are looking for a better way to communicate with your customers, FICO’s Customer Communication Services can help. The technology brings all digital communications into one place for a seamless customer experience.

These metrics give a high-level overview of the US credit card industry. We recommend that issuers closely monitor their portfolio metrics and look for indicators that may point towards a shift in consumer behavior and market trends. As the credit industry landscape continues to change, this is a great time to revisit your customer engagement strategy and reach these customers in a timely fashion through digital channels.

If you have questions or are interested in discussing these insights in more detail please contact me, Leanne Marshall, through comments on this blog or at leannemarshall@fico.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.