US Bankcards Industry Benchmarking Trends: 2022 Q4 Update

Bankcard delinquencies continue to rise, higher losses are coming in 2023

FICO releases quarterly US Bankcard Industry Benchmarking trends, to catch up on the last quarter click here.

Another full year is in the books

As 2022 came to a close, the economic environment in the United States is teetering on the edge of a recession. Inflation is easing as funding rates have risen to 15-year highs, but the technology sector is beginning to lay off employees in masses – through 2022 low levels of unemployment kept the U.S. out of recession even when growth was negative. Despite lower energy prices, the cost of housing, food and services continues to increase to all-time highs causing consumers to tighten their belts even more than before.

The numbers: Annual GDP for 2022 released by the U.S. Bureau of Economic Analysis showed the economy grew at a pace of 2.1%. The first two quarters of 2022 were slightly negative (Q1: -1.6%; Q2: -0.6%) but then the economy returned to growth in Q3 and Q4. Expectations from Visa are that the GDP will turn negative once again in Q1 and Q2 of 2023 leading The National Bureau of Economic Research to declare a recession. The two main differences this year vs. 2022 are that the housing market has slowed down dramatically (sales are down 35.4% from November 2021 to November 2022) and the unemployment rate is expected to rise to 4.6% according to the Federal Reserve forecasts. The year-over-year calculation for the Consumer Price Index, also known as inflation, slowed to 6.5% in December; however, prices remain at all-time highs with the Consumer Price Index flattening between October to December.

What does a recession mean for consumers trying to keep up with their payments?

Although the overall macro economy may not directly impact individuals, the environment that develops into a recession affects households in various ways.

Increasing of the fed funding rates leads to higher interest rates when seeking new credit or carrying balances on credit cards. For example, the average interest rate on credit cards accruing interest in Q4 2022 was 20.40% compared to 16.44% in Q4 2021 (Source: Federal Reserve G.19 report on Consumer Credit). The difference in interest rate amounts to ~$30 more in interest paid each month per $10,000 of revolving debt – making or breaking some budgets, especially with elevated prices of goods.

An increase in the unemployment rate from 3.5% to 4.6% also means that ~1.8 million more people will be out of work over the next 12 months. With savings rates down and limited government assistance available, more consumers depend on their income to pay for daily expenses and pay down debts.

The following card performance metrics help us understand the impact of the macro environment on the credit card industry at an aggregate level. These figures represent a national sample of approximately 130 million accounts that comprise FICO® Advisors’ Risk Benchmarking solution. The data sample comes from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Usage & Payments

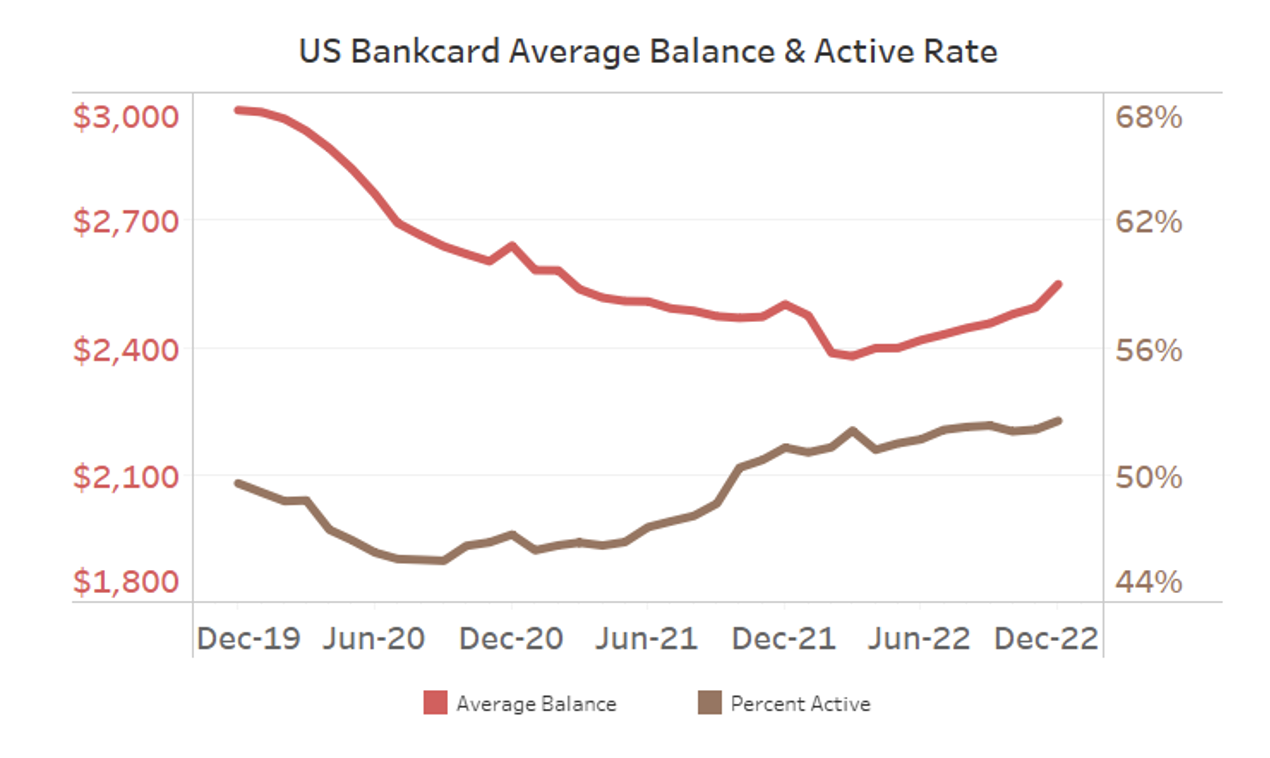

More consumers turned to credit in 2022 to help cover their everyday purchases and are revolving a higher percentage of that spend. The average balance of $2,549 has increased 7.1% since March 2022 and is up 1.9% compared to December 2021 with average monthly spend staying flat. Not only are balances increasing, the percentage of credit cards that are being used each month is substantially higher than prior to COVID when the active rate was very stable around 49% (December 2022: 52.5% vs. December 2019: 49.6%).

Throughout 2022 we have been discussing how average balances trending towards pre-COVID levels is positive news. This, combined with higher active rates, is exactly what Marketing departments strive for. However, now more than ever, Risk departments and Collections Operations are feeling the pressure that the balances being added may eventually turn into higher losses for the issuer.

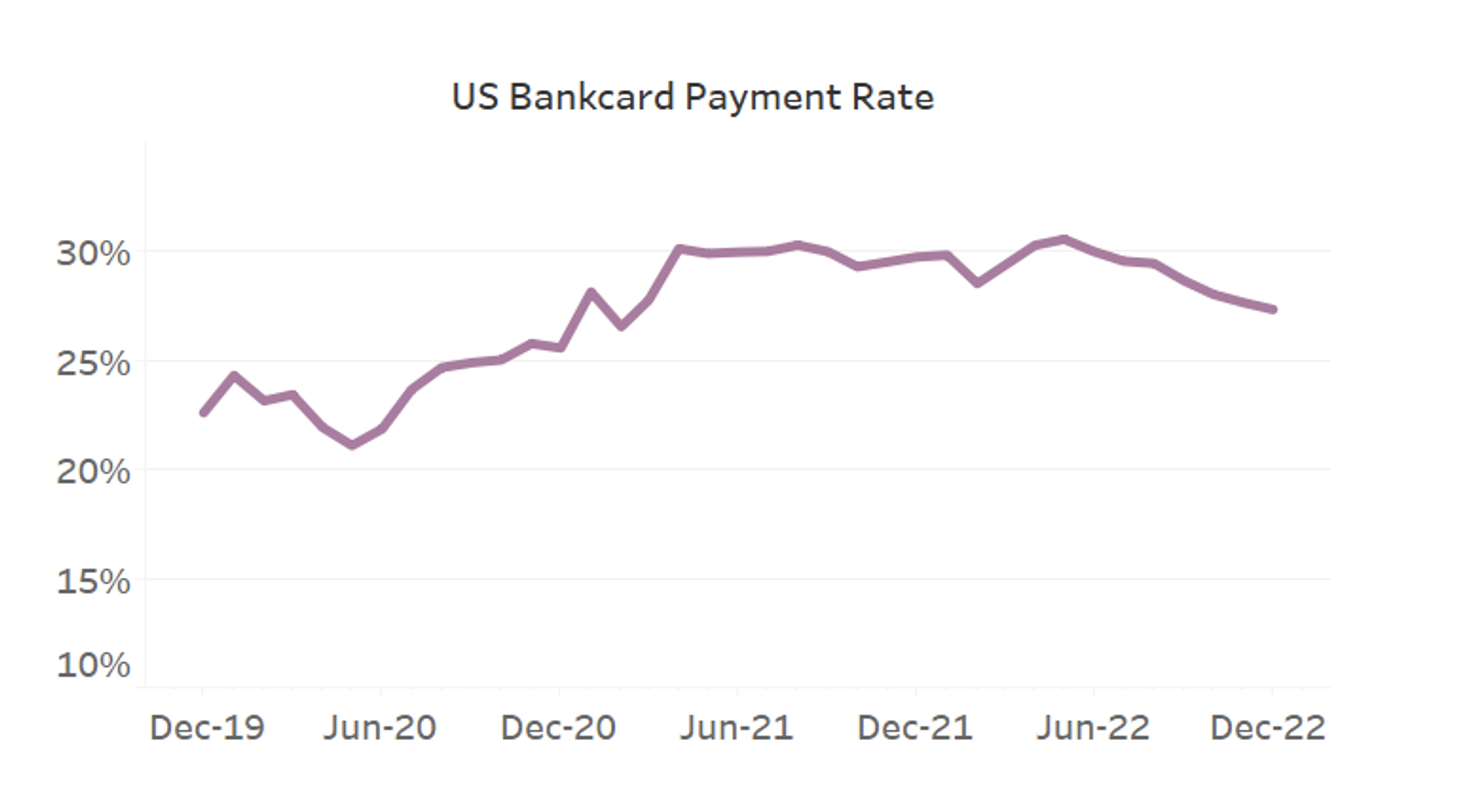

Showing more signs of consumer stress is the payment rate. This metric is calculated as the percentage of overall balance that is paid back each month. Consumers remained confident through the end of 2021 and into 2022 leading to record high payment rates. Unfortunately, the past seven months have returned decreasing rates landing at 27.3% in December, an 8.1% drop year-over-year.

Delinquency

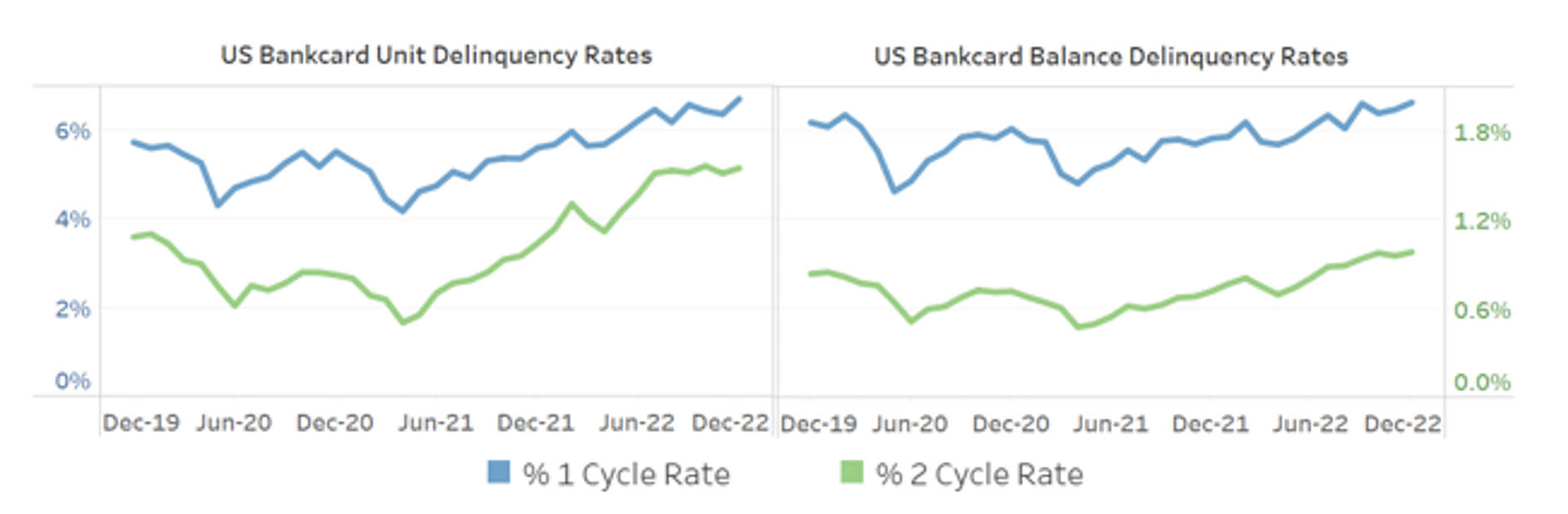

Higher balances and lower payment rates lead to turmoil in trying to keep customers on track. The percentage of accounts missing one or two payments have been trending upward for the past 20 months with no signs of slowing down (up 19.7% and 49.3% year-over-year, respectively). The percentage of balances that are past due have exceeded pre-COVID levels as well, which means that issuers will be taking on higher losses in 2023 than over the past three years.

If consumers are having trouble making their payments, the best course of action is to call the credit card companies and explain the situation as soon as possible. Most companies offer short-term or long-term payment plans depending on the expected length of the hardship. Tools at myFICO.com are also available to help consumers track their credit usage and FICO Score. There is a myriad of articles and community posts to help consumers understand the impact of taking on new debt, increasing revolving debt load or missing payments.

Based on the trends we have reviewed and predictions for 2023, it may be a difficult year for many consumers and institutions. Risk Managers should be reviewing lending strategies to ensure customers are receiving the right treatments across the lifecycle and getting the help that is needed if debts cannot be fulfilled. Reach out to your Solution Success Manager or Client Partner for a discussion and currect state assessment if you need any help completing this evaluation.

If you have questions or are interested in discussing these insights in more detail please contact me, Leanne Marshall, through comments on this blog or at leannemarshall@fico.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.