Using Benchmarking Data Strategically for Card Management

Benchmarking data can help you evaluate strategies, identify focus areas for your portfolio, and provide information to auditors and regulators

When assessing the success of a strategy, whether it is related to limit management, collections or another decision, issuers will use a variety of data both internal and external. Based on the original objectives, various metrics will be reviewed over time to determine if the strategy met, exceeded, or did not meet the expected results. If the strategy is a challenger, it will be judged in comparison to the champion strategy.

However, what can be missing is the impact the strategy will have on the portfolio’s market position. That’s where benchmark data can be extremely valuable.

In this post I am discussing credit cards, but this principle is the same for all products. Data for the industry averages has been taken from the FICO Credit Card Benchmarking Service. FICO uses this data on a regular basis to help provide our FICO® TRIAD® Customer Manager clients with insights into their portfolios and advise on areas where further investigation or focus is needed to help guide the next generation of strategy design. This data proved invaluable during the 2008 financial crisis and recovery to understand the market impact. This data will now play a fundamental part in helping us gauge and understand the impact of COVID-19 now and over the coming months on the cards market.

Why Use Benchmarking Data?

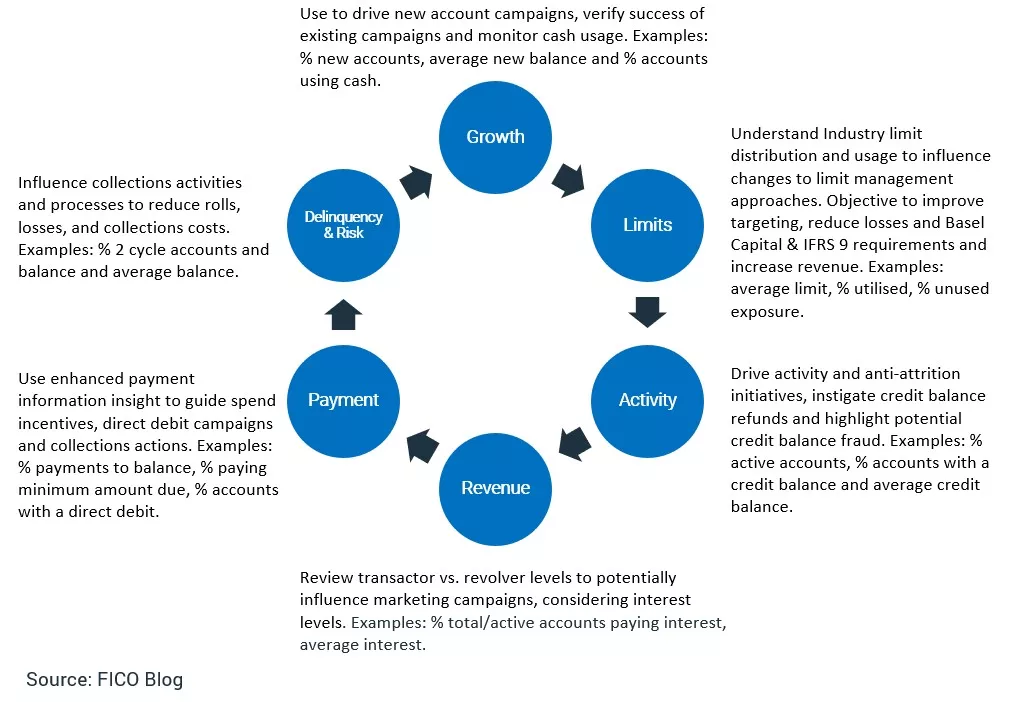

There are ways that benchmarking data can help you decide your strategic approach, design new strategies and judge the success or failure of new strategies:

- Taking a wider view and being able to prioritise changes accordingly.

- Monitoring the market and being able to act quickly to close performance gaps or change your industry position.

- Validating portfolio perceptions and tailor objectives and monitoring accordingly.

- Supporting responses to internal compliance, auditors and financial regulators.

- Challenging an instruction to change a strategic approach, e.g., reduce apparent high limits if the market position can be demonstrated to be positive and highlight other subpopulations where focus is required.

- Gauging the impact on your portfolios compared to your peers, when new regulations are introduced, which can influence how issuers shape their strategic approaches. Persistent debt is an example.

- Proving to regulators that positive performance because of requested changes is due to your actions rather than a general industry trend.

- Providing executive management with details of underlying market conditions in relation to your strategy changes and so improving management information reporting.

- Having a deeper understanding of total exposure, activity levels and delinquency compared to peers, which can guide your IFRS9 approach.

- Assessing the impact of a financial crisis on your market position.

Having a variety of benchmarked metrics covering different aspects of the lifecycle allows for a comprehensive understanding of your book and the industry.

Benchmarking Your Performance Against the Industry

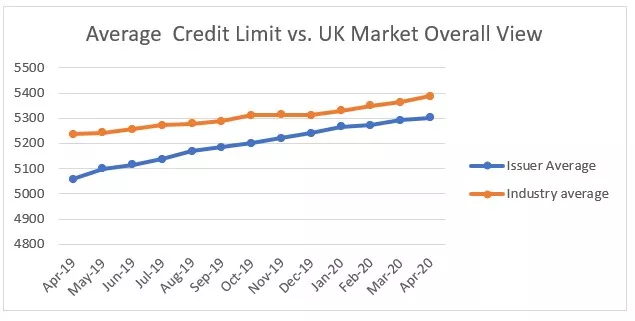

Monitoring at the total level provides insight into your performance against the market. In this example, the issuer’s objective is to be in line with the market for average card limits. Results show they are drawing closer to the average and remain below it, so the objective has been met.

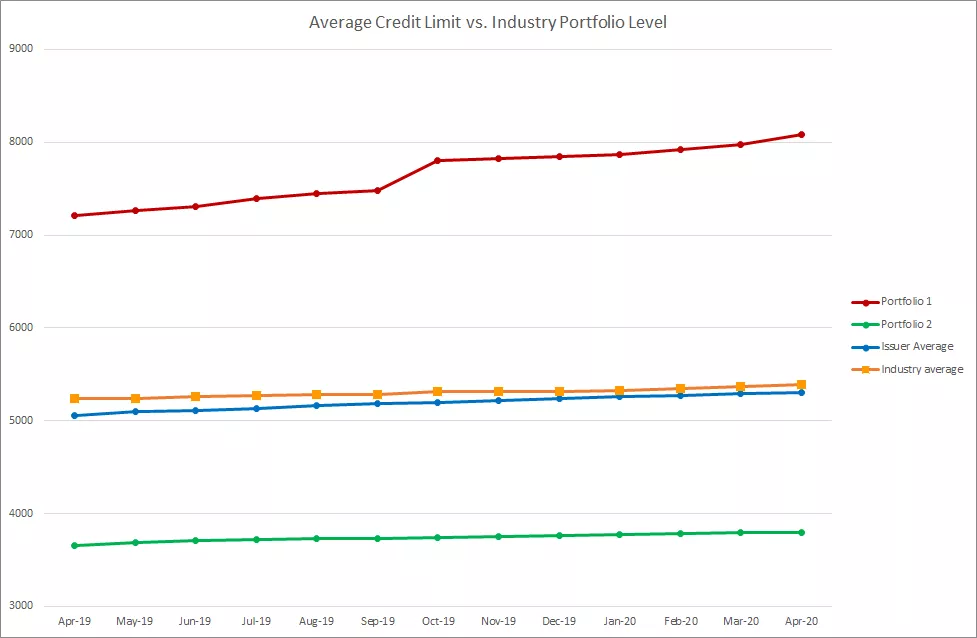

Looking at the individual portfolio level, however, shows that Portfolio 1 is noticeably above the average card limit and growing at a faster rate, with Portfolio 2 stable and below average (see chart below). This view will help to highlight if indivdual portfolios are performing as expected compared to your peers. In this example, if Portfolio 1’s growth rate and higher limits are not where the issuer wants to be placed, lower increases could be applied, cutoffs could be tightened or longer periods between increases applied. The saved exposure on this portfolio could be offered to Portfolio 2 to boost limits.

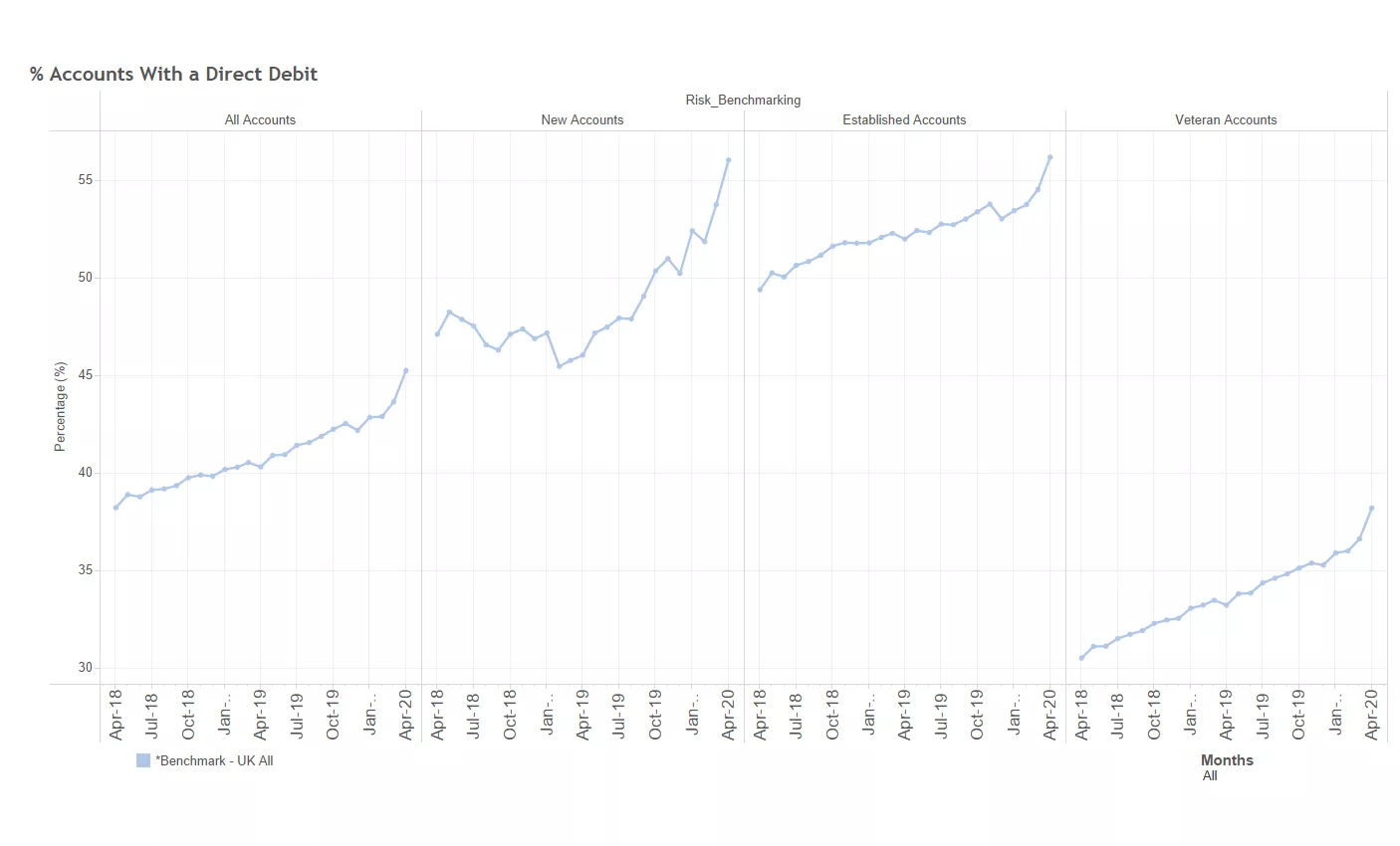

Added understanding and benefits can be gained by observing levels below portfolio — for example, based on how long the account has been open. If you were reviewing the overall percentage of accounts with a direct debit and wanted to outperform the market, you might set your objective to be 50% penetration, instigating campaigns from originations through to collections based on the overall average.

However, when you segment further based on time on books, you can see that in the industry the “veteran” accounts with >5 years on book lower the average. Looking at your distribution by time on books will determine which segment you focus on, depending on your industry position. You can determine whether your campaign should be focussed on originations, due to a low percentage for new accounts (up to one year on book), or on a targeted campaign for your more mature accounts, as per the market indicators.

This data can also be beneficial when monitoring the performance of new strategies, whether there is one champion in place or challenger strategies as well.

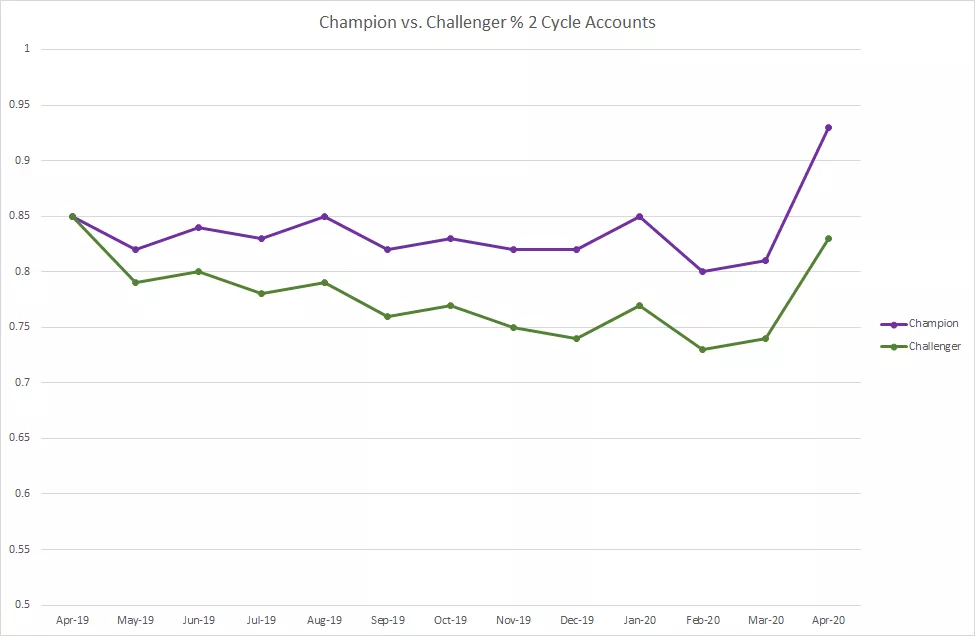

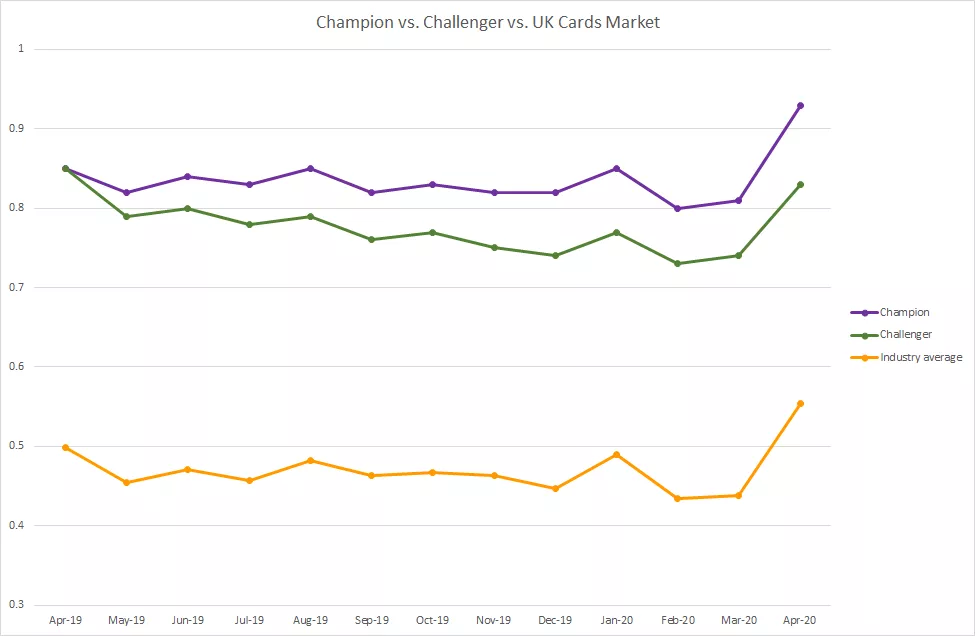

Without this data, strategies can be deemed to be a success; however, the situation could be that the metrics linked to that strategy are being outperformed by the market. In the example below, the challenger objective was to reduce the 2 cycle accounts by 10%. The data shows this has been achieved and the strategy is a success and rolled out and focus shifts to another area for the next challenger.

However, by overlaying the benchmarking data you may find that the Industry is still outperforming you and more work is required in this area, so the focus stays on a 2-cycle challenger.

Alternatively, benchmarking data can reveal that you are focused on areas where you are positively outperforming the market, which may mean you are missing opportunities to concentrate efforts where your market position is not as anticipated. For example, you might find your 2 cycle rates are in line or below the average, whilst your 1 cycle rates are significantly above, so what you need to focus on is pre-delinquency tactics. You could find your delinquency rates are in line, but you have the highest and/or fastest growing card limits, and this is not where you want to be placed in the cards market.

Another worthwhile use of benchmarking data is to identify areas where your portfolio is not following the market. This can be a positive result — your delinquency rates are falling, whilst the industry is seeing higher rates, indicating that you have strong collections performance and potentially tighter originations’ policies, so better quality accounts are being approved. Alternatively, the opposite could be happening, and further investigation is needed to determine where the difference is occurring — a particular portfolio, vintage, or cycle — so the appropriate action can be taken.

Using Benchmark Data When Dealing with Audits and Regulators

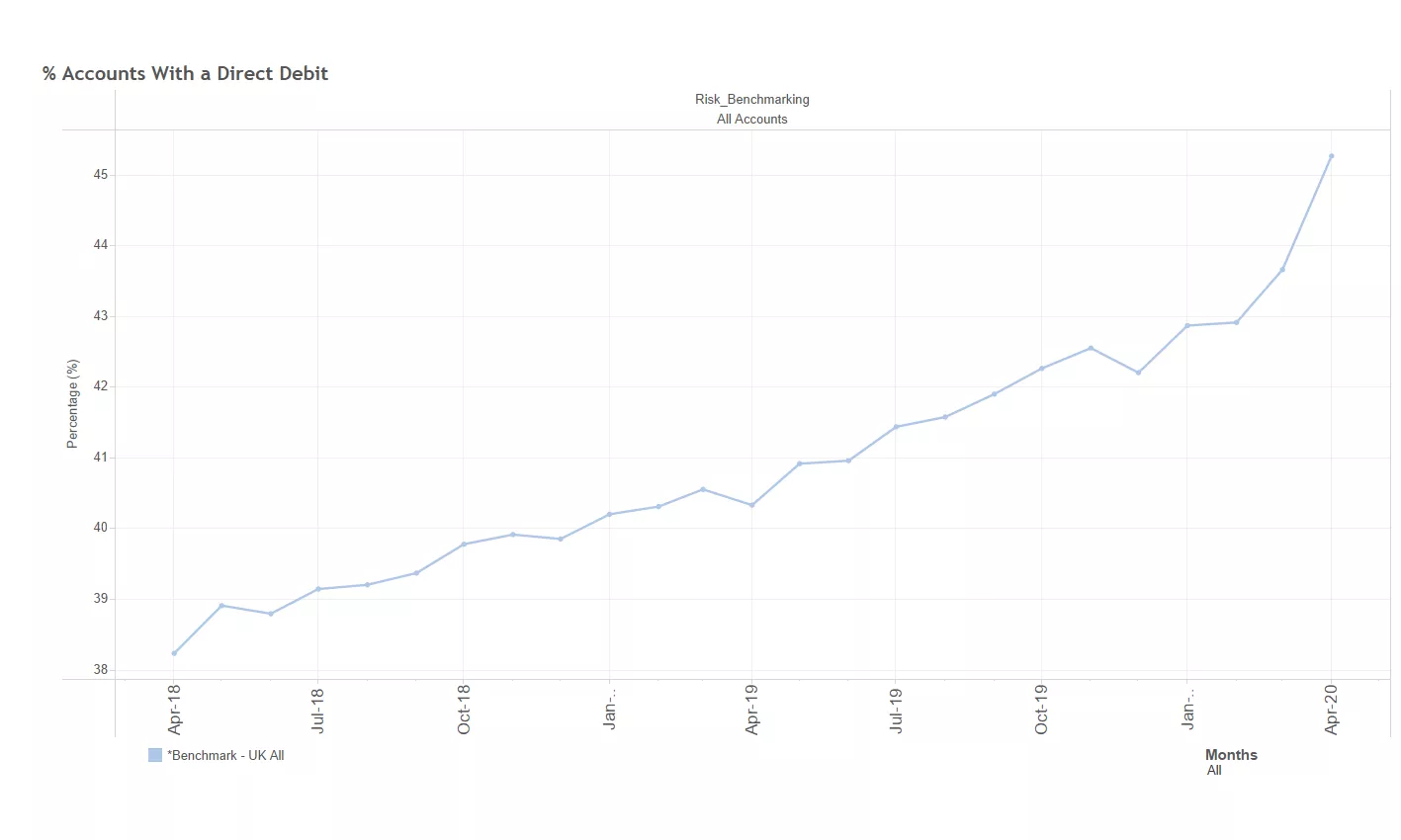

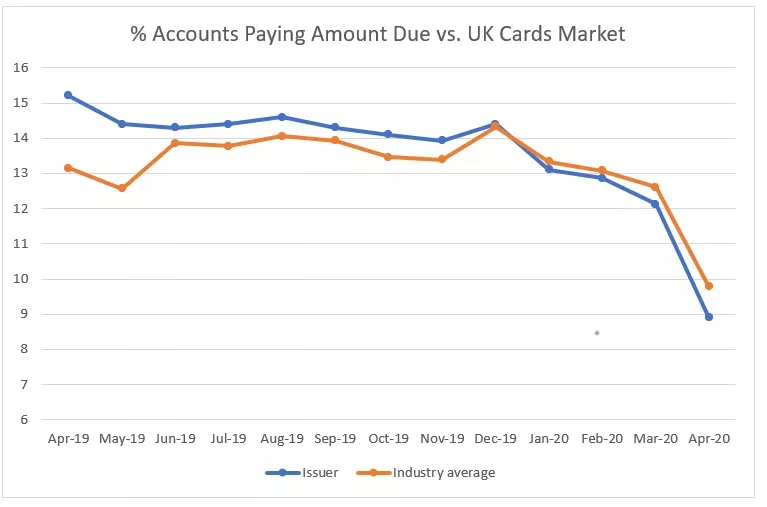

As previously mentioned, benchmarking data is useful when interacting with internal compliance/audit teams and regulators. For example, the risk team could be instructed to concentrate on reducing the number of accounts paying the amount due, linked to the persistent debt regulations. However, benchmarking data can be used to challenge the assumption.

The graph below shows that historically the issuer had a higher percentage of accounts paying the amount due than the industry. However, since the new regulations came into effect in September 2019, their actions have resulted in a decrease in the volume, which has resulted in the issuer positively falling below the average. Showing the growth in accounts paying more than the amount due or the full balance would help to support the challenge. So, whilst more potentially could be done, there may be other areas where greater benefits can be gained from strategic changes.

As shown, there are numerous benefits for incorporating benchmarking data into your strategic design and monitoring processes.

If you are interested, I would be happy to discuss this issue with you. You can contact me at staceywest@fico.com.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.