Vantiv, Now Worldpay: A Decision Management Maturity Rockstar!

“It’s a long way to the top, if you wanna rock and roll.” Luckily, Decision Management (DM) technology has been invented and has come a long way since AC/DC released this epic anth…

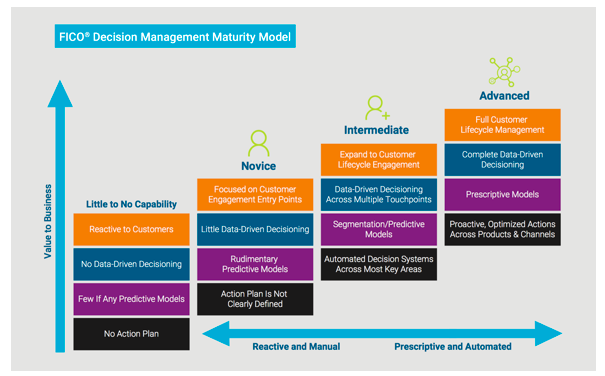

“It’s a long way to the top, if you wanna rock and roll.” Luckily, Decision Management (DM) technology has been invented and has come a long way since AC/DC released this epic anthem in 1975. With solutions like the FICO Decision Management Platform (DMP), the journey from novice to rockstar can be faster than a speed metal riff. In this blog, the last in my series about the FICO Decision Management Maturity Model and Map, I’ll provide a FICO customer example, using merchant onboarding, that illustrates how quickly companies can gain the benefits of becoming DM “rockstars.”

Vantiv, now Worldpay, accelerates its Decision Management maturity

Vantiv, which recently joined forces with Worldpay, is one of those rockstars. Vantiv is the number-one acquirer in the US, UK and worldwide, annually processing 40 billion transactions valued at $1.5 trillion. I recently caught an excellent session at FICO World 2018 featuring Worldpay’s rapid DM transformation.

In just a few short years, Worldpay has quickly advanced from an intermediate position on the FICO Decision Management Maturity Map (DM3), to a position that is significant and leveraging DM technology to gain a competitive advantage.

Merchant Onboarding: The need for speed

With its first foray into decision management, Worldpay wanted to accelerate merchant onboarding. With new software and fintech disruptors setting new expectations around the pace of onboarding in the acquirer space, merchant onboarding timelines had been drastically reduced. With “instant onboarding” its new mantra, Worldpay quickly recognized that onboarding speed would be a strategic differentiator since merchants had come to expect an instant response.

Specifically, Worldpay wanted to reduce manual merchant onboarding process timelines from up to nine days to just minutes by:

- Making faster onboarding decisions

- Mitigating risk by onboarding the best vendors

- Configuring policies quickly

- Making more intelligent risk-based pricing choices.

FICO solutions accelerate deployment of Merchant Onboarding

To overhaul its onboarding process, Worldpay chose the FICO Decision Management Platform to deploy its merchant onboarding solution, using modules including:

FICO Application Studio for UI and service orchestration

The reduction of onboarding timelines from days to minutes is only the start of the benefits, those additional benefits including:

- Increased accuracy in detecting merchant fraud and default

- Reduced portfolio risk and lower costs

- Improved the customer experience, resulting in accelerated business growth

- Streamlined rule and strategy development, to help Worldpay quickly adapt to market and regulatory changes.

Accelerating progress on top of an ambitious roadmap

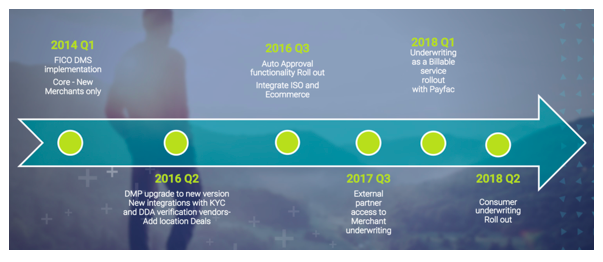

Since then, Worldpay has built an ambitious roadmap for its globally scalable decision management resources. The acquirer has incorporated a broad array of new automated functions, for example, additional compliance features such as know your customer (KYC) and bank account (DDA) verification and wrapping into a highly innovative business model of underwriting as a service (UaaS).

With help from FICO Decision Management Suite, Worldpay has achieved impressive improvements in automated merchant approval rates, rising from 32% in Q3 2016 to 51% in Q1 2018—a relative increase of almost 60%!

To start the decision management journey and assess your organization’s own decision management maturity, download the white paper, “FICO Decision Management Maturity Model and Map.” Follow me on Twitter @ScottZoldi.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.