What are MVD’s and Why Do They Matter?

Most Valuable Disciplines (MVD) are driving excellence in Debt Collection and Recovery, particularly over periods of ambiguity.

COVID-19 has steered a unique shift in the way people consume, interact, engage, and conduct business. As of September 2021, unprecedented uncertainties continue, making it challenging for anyone to predict with a high level of confidence when, or how quickly, the economy will fully recover. Consumers, however, have been prudent with spending and with their use of stimulus checks. Surveys have shown that customers used at least a portion of their relief payments to pay down debts or get caught up on their loans, notably surveys have also found that households plan to use more than one-third of their stimulus payment to pay down debt (HERE).

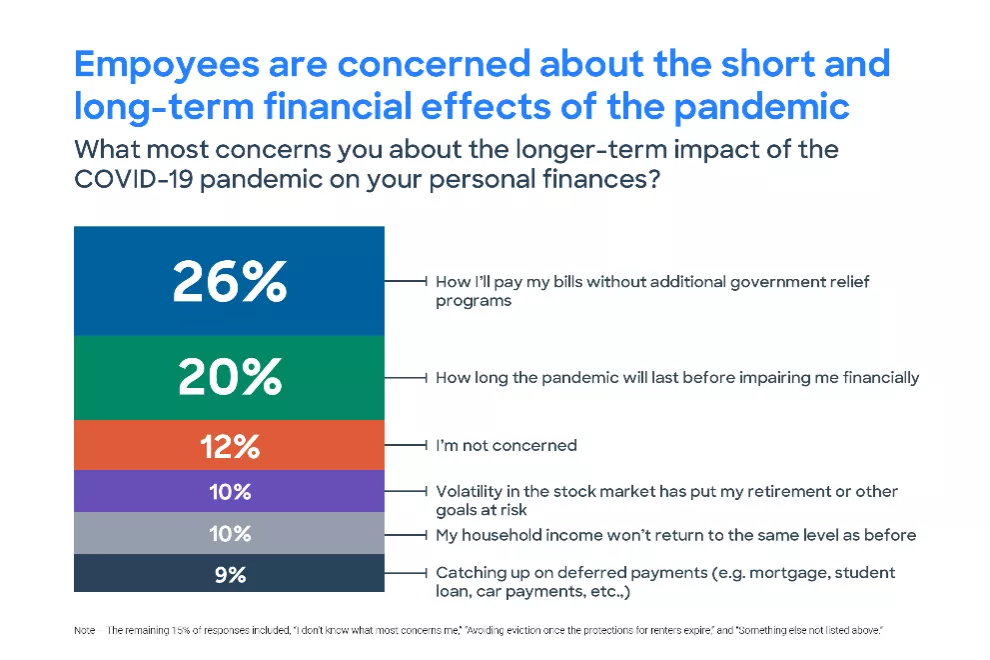

While we look ahead with positive anticipation of an economic recovery, we still must be mindful of the potential lagged and lingering impact of the last 18 months on the economy and consumer behavior. As per PWC, employees whose financial stress have increased due to the pandemic are four times as likely to

- have experienced a decrease in overall household income

- find it difficult to meet household expenses on time each month

It would be prudent to validate if the risk distribution of customers has shifted towards the high risk especially following the survey findings of the 2021 PwC Employee Financial Wellness Survey.

Collections and Recovery is in a unique situation at this pivotal period. The post pandemic customer landscape is potentially shifting across risk distributions within the delinquent portfolio. Further complexities owing to changing customer engagement preferences, make it critical that collections ascertain which customers will self-cure so that collections treatments can focus on the customers who require collections intervention to resolve their payment issues.

Organizational risk appetite may be shifting as well, especially where economic recovery is slower or less certain. In such an environment of ambiguity, managing a successful Collections and Recovery organization balancing twin goals of improving and sustaining collections portfolio effectiveness and maintaining or reducing operating costs within budget, necessitates the strategic infusion of certain most valuable disciplines or MVD’s as I refer to them.

The 7 Essential Debt Collections and Recovery Most Valuable Disciplines (MVD)

- A Customer Level View: Define and design a complete and single view of the customer across the multiple product lines, which facilitates the ability to have a strategy in place that ensures collections efforts are directed at a customer level. Collection strategies and apportioning of related costs are therefore concentrated on the appropriate customer level cases. The overall customer experience with the collections department is also better aligned to facilitating growth and profitability through the appropriate retention of future good customers through effective rehabilitation. Feedback from Chief Risk Officers to FICO indicates that a customer view enables 14% lower loss rates than having a fragmented view.

- Data & Analytics: Define a broad range of input sources available for collections specific decisioning including collections activity data, account performance from initial entry to a past due state, collections transactional data, and relevant alternative data sources. For a full-service bank, data sources can also include deposit account data – especially considering any changes in direct deposit payroll activity.

- Scores, Segmentation & Models: Define and leverage collection models to increase the ability to collect debts over the COVID-19 / post COVID-19 period while focusing on minimizing the cost of collections by efficient and effective allocation and management of resources and deploying the appropriate treatments on the customers based on their risk levels to protect an adverse impact to impairment with the most cost-effective treatment.

- Optimization: Define and design a competitive collections strategy leveraging optimization. Experiment with trade-offs between decision factors and business constraints, simulate various scenarios and compare their impact on collections key performance indicators and contributions to the bottom-line. This improves the ability to adopt and deploy the optimal strategy right at outset.

- Digital Communications Solutions: Define and design analytically driven contact strategies aligned to the risk of the account, IFRS9/CECL implications and compliant with regulatory requirements, and customer contact preferences to achieve improved collections effectiveness via a coordinated multichannel orchestration approach utilizing preferred and efficient contact practices. Efficient omni-channel communication utilizes data and analytics, determines precisely how to make contact, and provides seamless continuity across the interaction with connected decisioning.

- Collections Strategy Framework: Define and design 3 versions of the Collections Strategy: (a) Collections Strategy for when the tailwinds have propelled growth and the results continue to hold post pandemic; (b) A Collections Strategy for when the headwinds have stifled growth and potentially pummeled delinquency rates; (c) A Collections Strategy for successfully maneuvering the headwinds and tailwinds and positioning the financial institution for continuous improvement through leveraging champion challenger strategies

- Operating Model: Define and design the Target Operating Model that provides a framework for effective strategy design and seamless execution. Ensure all stakeholders are aligned to business objectives. Assign the appropriate roles and responsibilities to all Collections staff. Create metrics and MIS to ensure that all resources are correctly aligned and effectively deployed, as well as delivering against business goals and expectations. The operating model must also ensure and facilitate a robust, resilient, and scalable Collections and Recoveries department that leverages all the Most Valuable Disciplines (MVD’s) efficiently and effectively.

Has this been your experience?

- Tailwinds

- Consumers are performing well one year into the pandemic with delinquency rates low across most consumer product lines

- Surge in account originations activity continued its uptrend and return to ‘normal’ levels

- Banks release reserves in anticipation of lower Covid losses

- Headwinds

- Possibility that delinquencies are low since stimulus payments were saved or applied to debt and stimulus payments will shortly cease

- Expiration of protections that prevented aging and reporting delinquency in favor of extended forbearance preventing issuers from differentiating those taking advantage of these moratoria and those truly unable to pay

- Post stimulus payments altering consumer risk distribution moving towards high risk

- IFRS9 requirements and potential CFPB new rule implications compounded by changing customer contact preferences

At FICO, we support our strategic clients through a combination of FICO® Advisory and Analytics Services to successfully leverage the current environment’s tailwinds that are propelling the momentum towards revenue and growth and maneuver the headwinds that could blow against the potential positive trajectory.

FICO Advisors support our clients in defining and designing a collections and recoveries operating ecosystem that enables agile, efficient, and seamless decisioning across analytics, strategy, operations, and communication. This is achieved through supporting and facilitating the cohesive implementation of these essential Most Valuable Disciplines (MVD) critical to success, notwithstanding a lagged delinquency impact that could make itself felt in 2021-22, a sharp increase in delinquencies or an improving and stable portfolio post the pandemic.

To find out more, about how FICO can help your business, click here.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.