What Is Decision Optimization?

This short video explains how decision optimization works in financial services, applying advanced analytics to determine decision strategies

Decision optimization is becoming a core technology in financial services, because of its ability to deliver substantial increases in profit for specific strategies, driving the business forward in a systematic fashion. In this short video, Marc Drobe of FICO explains how decision optimization works.

As Mark explains, decision optimization can be described as a mathematical optimization process to develop better decision strategies. What we mean by better is that those strategies are more profitable, more manageable, and most importantly meet business goals and constraints.

At the core of the optimization approach is decision impact modelling, which combines:

- Profit modelling, including cost and revenue functions

- Predictive & action effect modelling that is required include probabilities of customer behaviour as well as sensitivities and

- Business expertise

- Define scenarios using objectives and constraints

- Solve for the optimal strategy within those given constraints -

- Analyse expected effects on KPIs and drill into trade-offs, including portfolio profit

- Choose the scenario you want to operate your portfolio at and convert into decision strategies putting you new strategy ‘life’

- What is the impact on my portfolio if I change my strategy?

- What are the possible points I can run my portfolio at, or expressed differently

- What is the impact on my KPIs if I move away from business as usual and

- Maximise net interest income?

- Maximise origination volume?

- What are the possible impacts if I want to increase both NPI and volume?

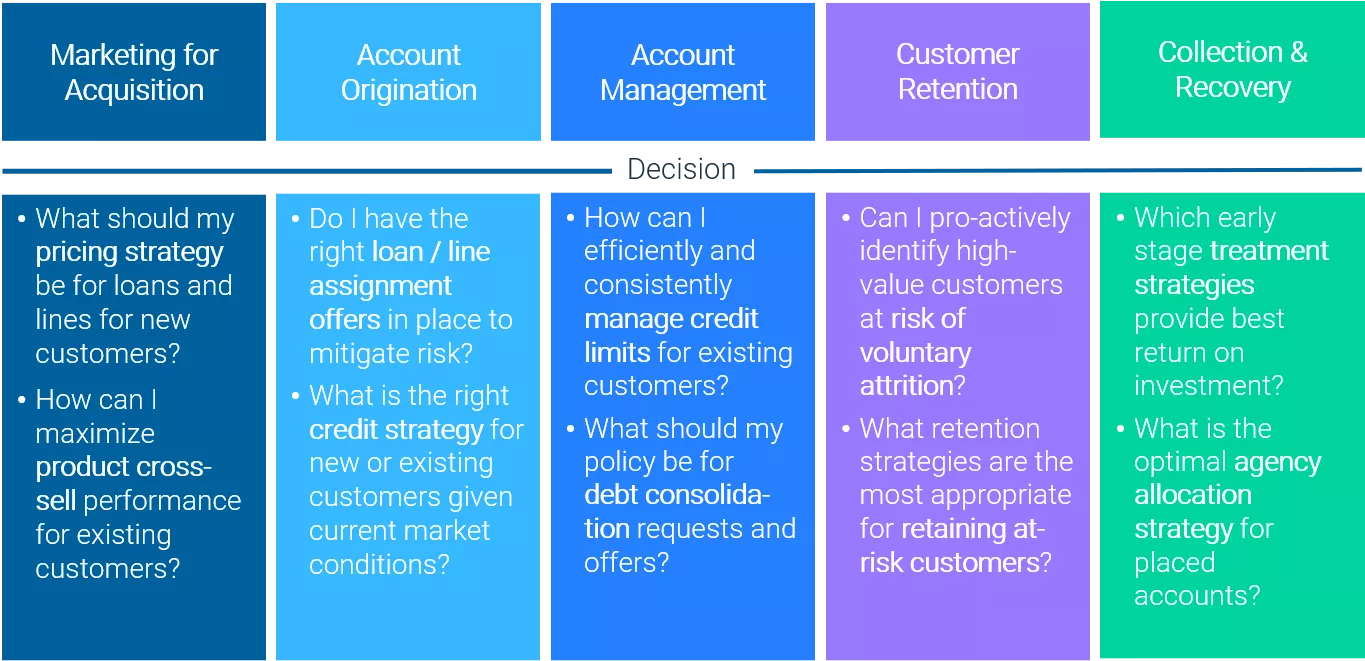

Decision optimization can be used to answer these questions and improve strategies across the customer lifecycle.

A good example of decision optimization is action is Home Credit International’s loan pricing optimization project. Watch these videos to hear first-hand how that project was managed and the results it achieved.

Check out FICO’s solutions for optimization in financial services and other industries.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.