Which Consumer Segments Have Driven the Average FICO Score Higher Over the Past Decade?

A closer look at how much the national average FICO Score has been impacted by notable changes in the FICO scorable population

A few weeks ago, we announced that the average U.S. FICO® Score as of April 2019 is now 706, some 20 points higher than the national average score back in April 2009.

Key drivers of this trend are the steady economic growth experienced over this period, as well as improved financial behavior driven by consumer awareness of their FICO® Scores. An interesting and important question to ask is how much the national average FICO Score has been impacted by two notable changes in the FICO scorable population over the past decade:

- There are consumers who have stopped using traditional credit over the past decade who as a result are no longer FICO® scorable

- There are consumers who weren’t using credit back in 2009 but who have since established a sufficient credit history to meet the FICO minimum scoring criteria. The FICO minimum scoring criteria exists to ensure that there is sufficient – and sufficiently recent – information in the consumer’s credit file to support the generation of a reliable and accurate score.

When evaluated over the past decade, how large are these populations? Could one or both of these groups be key to understanding the increase in national average FICO® Score? We explore these questions below.

A Tale of Three Segments

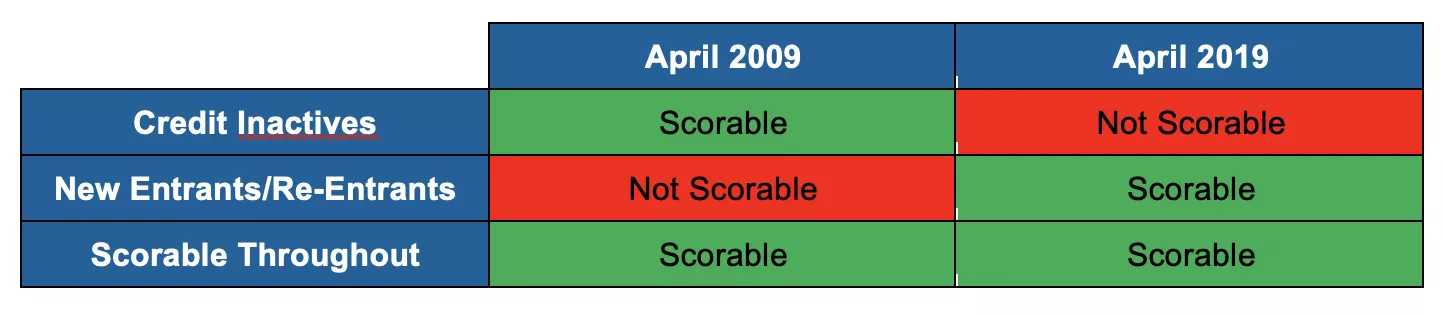

There are three subsegments of the population that factor into the calculation of the national average U.S. FICO® Score as of April 2009 and/or April 2019:

Using a nationally representative sample of millions of U.S. consumers, we set about sizing and profiling each of these populations.

Credit Inactives

The first population is those who were FICO scorable as of April 2009, but are no longer FICO scorable as of April 2019. Generally speaking, this population was credit active as of April 2009, but over the subsequent 10 years became inactive, either through choice (‘credit retired’) or through lack of continued access to credit (‘credit impaired’). As of April 2019, many of these credit inactive consumers have not had an update to their credit file in years.

The FICO minimum scoring criteria requires that a credit file have at least one account update reported in the past 6 months. The purpose of the FICO minimum scoring criteria is to ensure that a score is only returned when there is sufficient information---and sufficient recent information---to support a reliable assessment of a consumer’s creditworthiness. Scoring credit inactives based on their substantially stale credit file information alone is a recipe for drawing inaccurate conclusions about the true level of credit risk posed by these consumers.

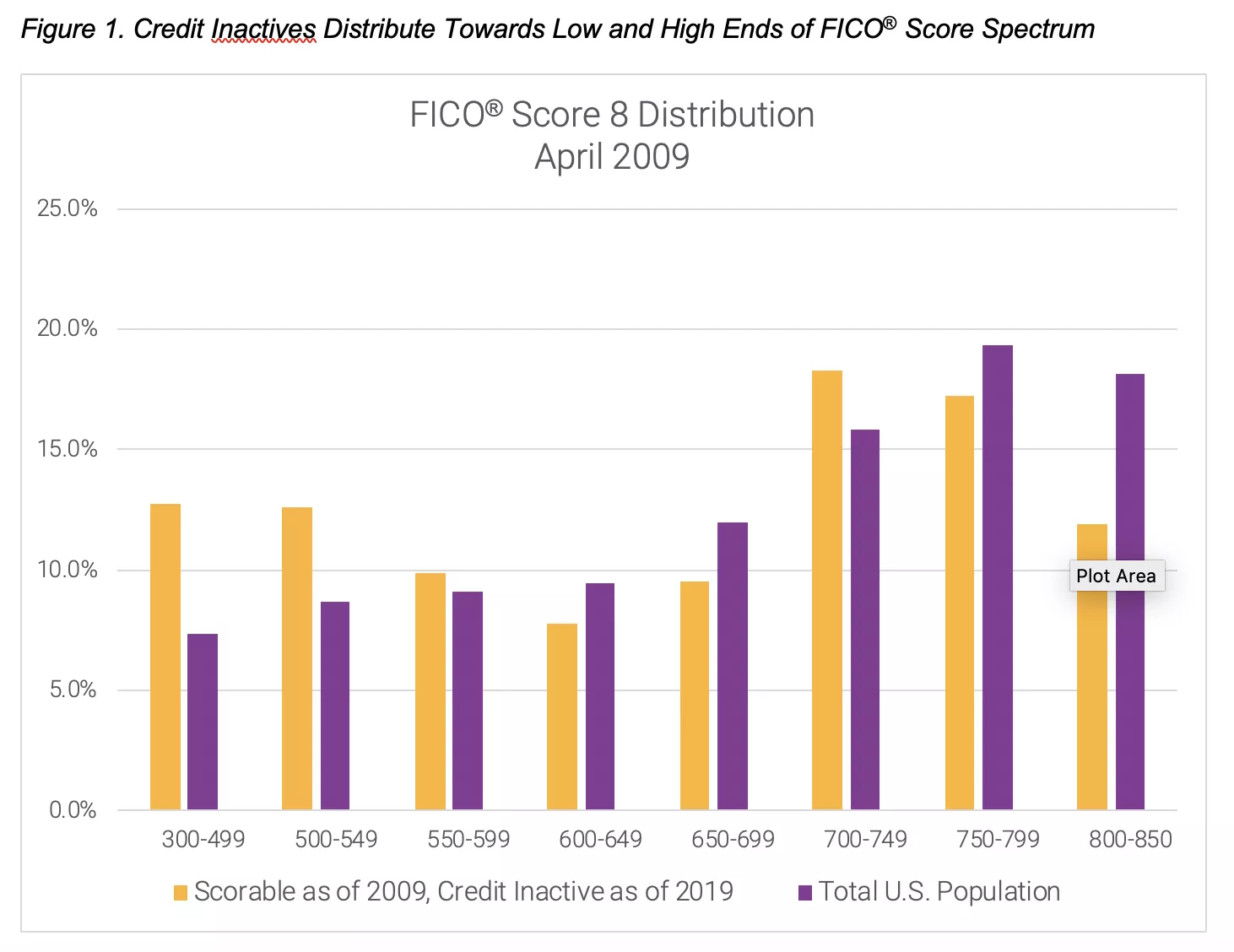

The duality of this credit inactive population can be observed in the FICO® Score distribution shown in Figure 2, which compares the distribution as of April 2009 for the credit inactives to the total population.

Note that there is high concentration of the credit inactive population in both the low (<550) and high (750+) score bins. This speaks to the different reasons that consumers might have been dropping out of the credit active population between 2009 and 2019. On the lower scoring end are the credit impaired, who likely faced significant financial struggles during the Great Recession, and as a result may have defaulted on most of their credit obligations and lost access to credit. Many on the higher scoring end are the now ‘credit retired’, who have an average age above 70 and between 2009 and 2019 voluntarily walked away from the use of credit.

We’ve sized this credit inactive population at over 40 million consumers, with an average score as of April 2009 of 660. Given the relatively low average score in comparison to the national figure, the fact that this population dropped from the scorable universe would have indeed helped to drive the overall average score higher.

New Entrants/Re-entrants

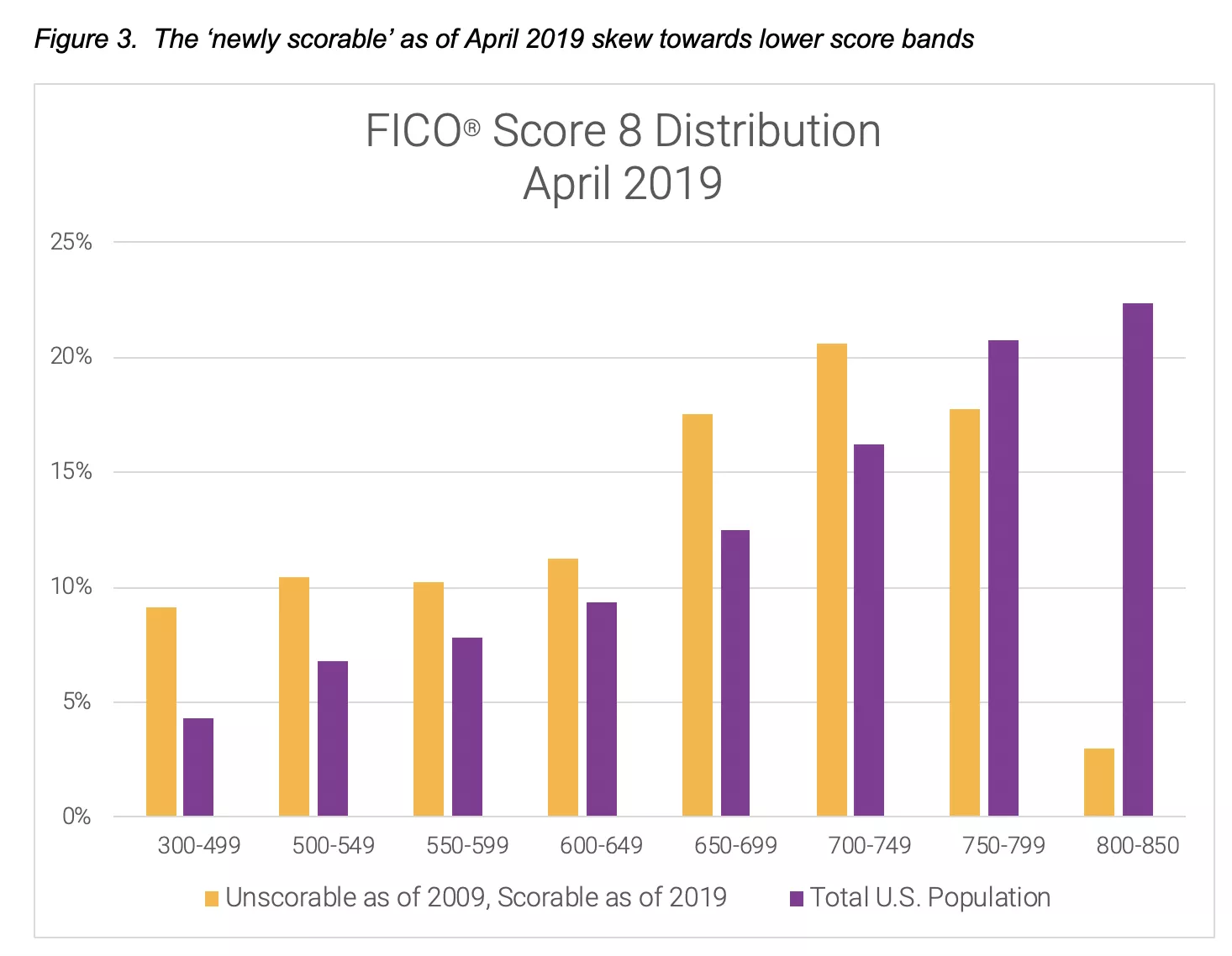

There were also consumers who entered the average FICO® Score calculation by becoming scorable over this period. Almost 90% of these consumers had credit files that were first established in the past 10 years; unsurprisingly, this population skews young, with a median age of 27. As has been covered previously here, younger consumers tend to have lower scores than other segments of the population. Not surprisingly then, the FICO® Score distribution of consumers who are “newly scorable” as of April 2019 skews lower than the total population (see figure 3).

We’ve sized this ‘newly scorable’ population at over 45 million consumers, with an average score as of April 2019 of 657. Given the relatively low average score in comparison to the national figure, the fact that this population entered the scorable universe is, if anything, driving the overall national average score lower.

In terms of impact on the shift in national average FICO® Score over the past decade, it seems that the credit inactives (who factored into the 2009 avg FICO calculation) and the newly scorable population (who factor into the 2019 avg FICO calculation) are more or less cancelling each other out. As covered above, both populations are of similar size, and have similar average scores. So that points to the third and final population as the real driver of the improvement in national average FICO® Score over the past decade.

‘Scorable Throughout’

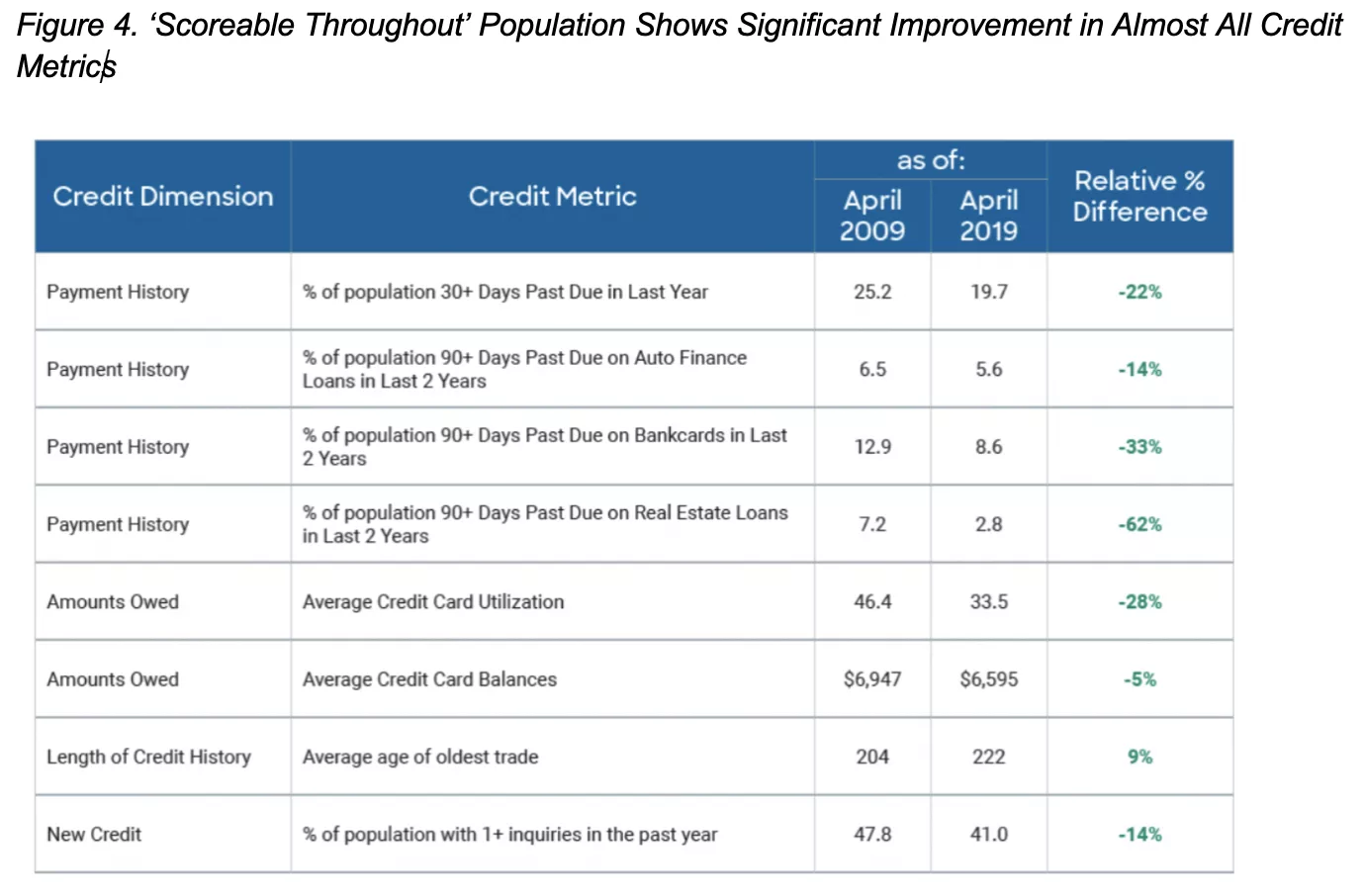

In fact, the national average FICO® Score on those who were scorable as of 2009 and still scorable as of 2019 has increased from 694 to 723 over the past decade. This 29-point improvement outpaces the 20-point improvement that has been observed on the national level.

An analysis comparing key drivers of the FICO® Score (not to mention important consumer financial metrics) for this population reveals just how substantial the improvement over that decade has been.

Account-level delinquencies down double-digit percentages, substantially lower credit card utilization, lengthier credit histories, and less credit seeking activity — it is no surprise that this population has experienced a major improvement in their FICO® Score.

Coupled with the sheer size of this ‘scorable throughout’ population---roughly 160M consumers---it is clear that improvement in the credit profile of this population has been at the epicenter of the shift upwards in national average FICO® Score over the past decade.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.