Who are your strategic defaulters?

Accurately predicting strategic default risk remains a big challenge for mortgage servicers. Because strategic defaulters behave differently from traditional mortgage defaulters, i…

Accurately predicting strategic default risk remains a big challenge for mortgage servicers. Because strategic defaulters behave differently from traditional mortgage defaulters, it's quite difficult for servicers to identify consumers with the greatest potential to strategically default. And after all, you can't predict what you can't measure.

FICO recently conducted research to address this very issue. We found that, compared to those who go delinquent across the board, strategic defaulters are characterized by:

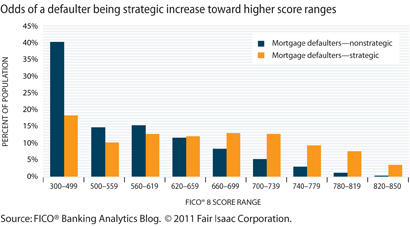

- Higher FICO® Scores—in other words, good previous credit history. The chart below shows 90+ days delinquencies for 2008-2009 mortgages. The odds of a defaulter being strategic increase toward the higher FICO® 8 Score ranges—in fact, the majority of defaulters scored above 620.

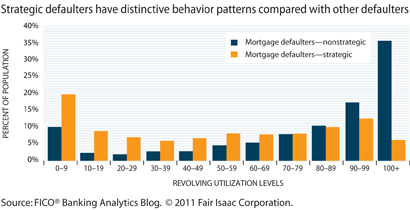

- Lower utilization, as shown in the chart below. We also saw less overlimits on credit cards, reflecting better credit management behavior.

- Less retail balance—chances are that they spend money carefully.

- Shorter length of residence in the property—and thus, likely less attachment to that property.

- More open credit in the past six months—perhaps in anticipation of damaging their credit?

Where the key driver for the behavior of traditional defaulters is affordability, the key driver for strategic defaulters is incentive. Strategic defaulters can afford to continue making mortgage payments, but they believe that it is not in their financial best interest; generally because they are "underwater," owing more on their mortgage than their house is currently worth.

FICO has just published a new study with full details about our research into predicting strategic defaults. I encourage you to check it out and post your questions/comments here on the blog.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.