Will Europe's Small Business "Credit Gap" Shrink?

FICO research has uncovered a hint that the “credit gap” for small businesses may indeed be shrinking. In our latest survey of European credit risk professionals conduced with Efma…

FICO research has uncovered a hint that the “credit gap” for small businesses may indeed be shrinking. In our latest survey of European credit risk professionals conduced with Efma, the difference between the percentage of respondents who forecast an increase in credit requested and the percentage who forecast an increase in credit granted fell dramatically.

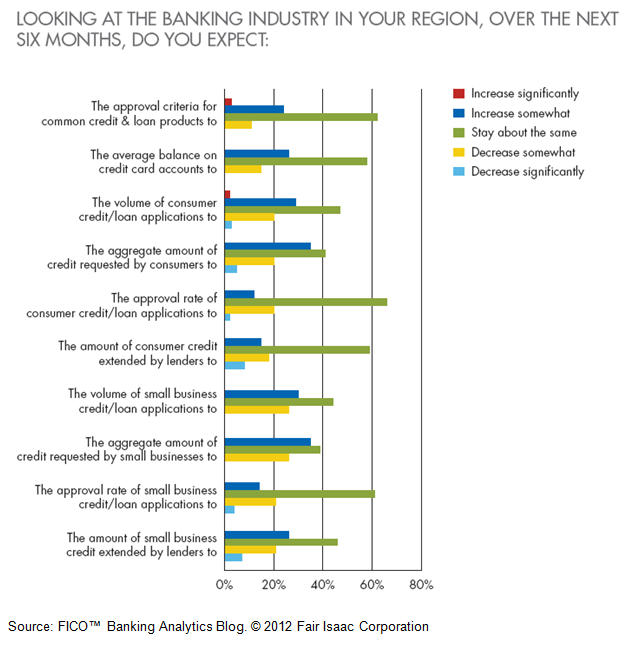

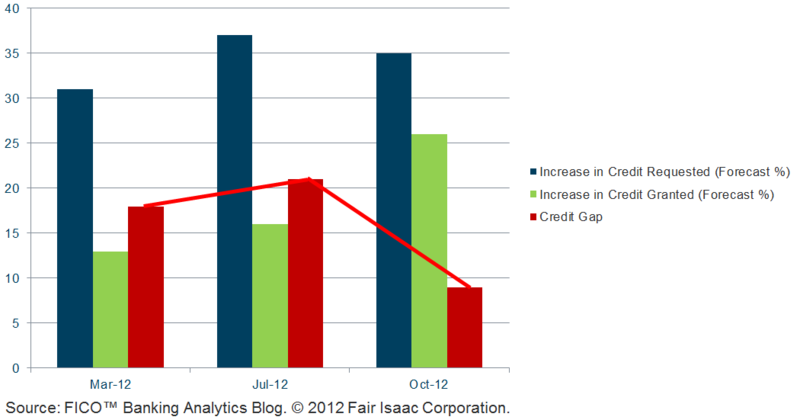

Here are the results from our survey of more than 70 bank risk officers, conducted in September and October. 35% of respondents say the volume of credit requested by small businesses will rise, and 26% say the volume granted will rise. That’s a 9% “gap,” but still well below recent forecasts.

At the 7th Annual SME Banking Conference in Vienna in mid-November, I put these results in context by looking at the forecasts from our other 2012 surveys of European risk managers. The credit gap for small businesses reached its highest point in 2 years in July 2012, and has been cut in half in the latest survey.

One survey does not make a trend. Still, there is reason for European small business owners to be cautiously optimistic.

Now the bad news: The credit gap appears to be growing for consumers. 35% of respondents see the amount of credit requested to rise, compared with just 15% who see the amount granted to rise. If consumers do intend to increase borrowing, will the supply be there to greet them?

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.