MIP model 1: limiting the number of different shares

To be able to count the number of different values we are investing in, we introduce a second set of variables buys in the LP model developed in Chapter 2. These variables are indicator variables or binary variables. A variable buys takes the value 1 if the share s is taken into the portfolio and 0 otherwise.

We introduce the following constraint to limit the total number of assets to a maximum of MAXNUM. It expresses the constraint that at most MAXNUM of the variables buys may take the value 1 at the same time.

We now still need to link the new binary variables buys with the variables fracs, the quantity of every share selected into the portfolio. The relation that we wish to express is `if a share is selected into the portfolio, then it is counted in the total number of values' or `if fracs > 0 then buys = 1'. The following inequality formulates this implication:

If, for some s, fracs is non-zero, then buys must be greater than 0 and hence 1. Conversely, if buys is at 0, then fracs is also 0, meaning that no fraction of share s is taken into the portfolio. Notice that these constraints do not prevent the possibility that buys is at 1 and fracs at 0. However, this does not matter in our case, since any solution in which this is the case is also valid with both variables, buys and fracs, at 0.

Implementation with Mosel

We extend the LP model developed in Chapter 3 (using the initialization of data from file introduced in Chapter 4) with the new variables and constraints. The fact that the new variables are binary variables (i.e. they only take the values 0 and 1) is expressed through the is_binary constraint.

Another common type of discrete variable is an integer variable, that is, a variable that can only take on integer values between given lower and upper bounds. This variable type is defined in Mosel with an is_integer constraint. In the following section (MIP model 2) we shall see yet another example of discrete variables, namely semi-continuous variables.

model "Portfolio optimization with MIP"

uses "mmxprs" ! Use Xpress Optimizer

parameters

MAXRISK = 1/3 ! Max. investment into high-risk values

MAXVAL = 0.3 ! Max. investment per share

MINAM = 0.5 ! Min. investment into N.-American values

MAXNUM = 4 ! Max. number of different assets

end-parameters

declarations

SHARES: set of string ! Set of shares

RISK: set of string ! Set of high-risk values among shares

NA: set of string ! Set of shares issued in N.-America

RET: array(SHARES) of real ! Estimated return in investment

end-declarations

initializations from "folio.dat"

RISK RET NA

end-initializations

declarations

frac: array(SHARES) of mpvar ! Fraction of capital used per share

buy: array(SHARES) of mpvar ! 1 if asset is in portfolio, 0 otherwise

end-declarations

! Objective: total return

Return:= sum(s in SHARES) RET(s)*frac(s)

! Limit the percentage of high-risk values

sum(s in RISK) frac(s) <= MAXRISK

! Minimum amount of North-American values

sum(s in NA) frac(s) >= MINAM

! Spend all the capital

sum(s in SHARES) frac(s) = 1

! Upper bounds on the investment per share

forall(s in SHARES) frac(s) <= MAXVAL

! Limit the total number of assets

sum(s in SHARES) buy(s) <= MAXNUM

forall(s in SHARES) do

buy(s) is_binary ! Turn variables into binaries

frac(s) <= buy(s) ! Linking the variables

end-do

! Solve the problem

maximize(Return)

! Solution printing

writeln("Total return: ", getobjval)

forall(s in SHARES)

writeln(s, ": ", getsol(frac(s))*100, "% (", getsol(buy(s)), ")")

end-model In the model foliomip1.mos above we have used the second form of the forall loop, namely forall/do, that needs to be used if the loop encompasses several statements. Equivalently we could have written

forall(s in SHARES) buy(s) is_binary forall(s in SHARES) frac(s) <= buy(s)

Analyzing the solution

As the result of our model execution we obtain the following output:

Total return: 13.1 treasury: 20% (1) hardware: 0% (0) theater: 30% (1) telecom: 0% (0) brewery: 20% (1) highways: 30% (1) cars: 0% (0) bank: 0% (0) software: 0% (0) electronics: 0% (0)

The maximum return is now lower than in the original LP problem due to the additional constraint. As required, only four different shares are selected to form the portfolio.

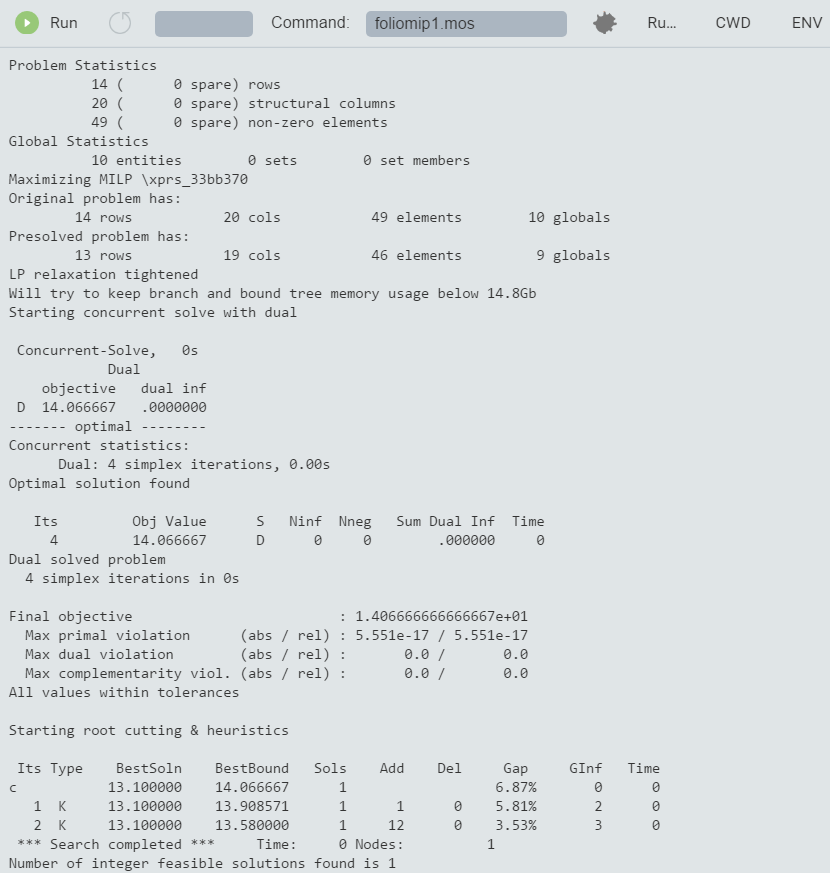

Let us now have a look at the detailed solver information:

Enable the Optimizer logging output by adding the line

setparam("XPRS_VERBOSE",true) into the model before the call to maximize and re-run the model. There are now more rows (constraints) and columns (variables) than in the LP matrix of the previous chapters.

Figure 7.1: Solver log for MIP problem

As we have seen, it is relatively easy to turn an LP model into a MIP model by adding an integrality condition on some (or all) variables. However, the same does not hold for the solution algorithms: MIP problems are solved by repeatedly solving LP problems. Initially, the problem is solved without any integrality constraints (the LP relaxation). Then, one at a time, a discrete variable is chosen that does not satisfy the integrality condition in the current solution and new upper or lower bounds are added for this variable to bring it to an integer value. If we represent every LP solution as a node and connect these nodes by the bound changes or added constraints, then we obtain a tree-like structure, the Branch-and-Bound tree.

In particular, the branching information tells us how many Branch-and-Bound nodes have been needed to solve the problem: here it is just one, the enumeration did not even start. By default, Xpress Optimizer enables certain MIP pre-treatment algorithms (see the `Optimizer Reference Manual' for further detail on algorithmic settings), among others the automated generation of cuts—i.e., additional constraints that cut off parts of the LP solution space, but no solution of the MIP. This problem is of very small size and becomes so easy through the pre-treatment that it is solved immediately.

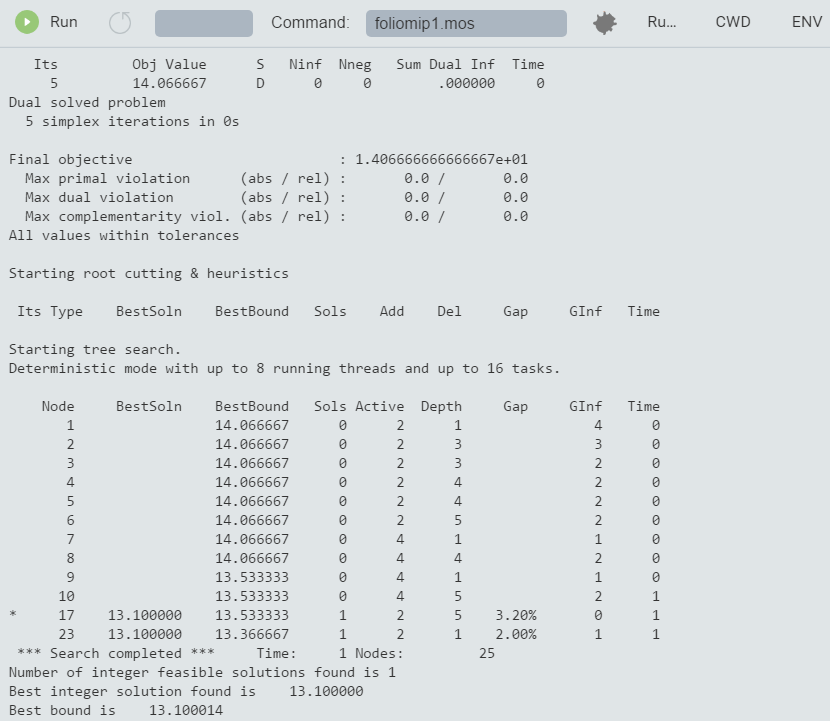

Add the lines

setparam("XPRS_CUTSTRATEGY",0)

setparam("XPRS_HEURSTRATEGY",0)

setparam("XPRS_PRESOLVE",0) to your model before the call to maximize and re-execute it. You have now switched off the MIP pre-treatment routines for automated cut generation and MIP heuristics, and also the presolve mechanism (a treatment to the matrix that tries to reduce its size and improve its numerical properties).

It now takes several nodes to solve the problem:

Figure 7.2: Solver log for MIP problem with Branch-and-Bound

© 2001-2019 Fair Isaac Corporation. All rights reserved. This documentation is the property of Fair Isaac Corporation (“FICO”). Receipt or possession of this documentation does not convey rights to disclose, reproduce, make derivative works, use, or allow others to use it except solely for internal evaluation purposes to determine whether to purchase a license to the software described in this documentation, or as otherwise set forth in a written software license agreement between you and FICO (or a FICO affiliate). Use of this documentation and the software described in it must conform strictly to the foregoing permitted uses, and no other use is permitted.