Code Samples - Using VDL to Create Custom Views

Start of chapter

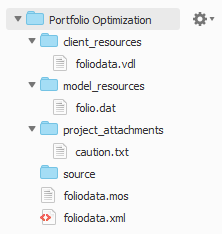

Folder Structure for this Chapter's Example

<vdl version="4.1">

<vdl-page>

<vdl-section heading="Welcome to Portfolio Optimization"

heading-level="1">

<vdl-section heading="Return per share"

heading-level="2">

<vdl-form>

<vdl-field entity="changeShare"

options-set="SHARES"

label="Choose share">

</vdl-field>

<vdl-field entity="RET"

indices="=scenario.entities.changeShare.value"

label="Estimated ROI">

<vdl-validate pass="=value >= 0">ROI must be zero or greater.

</vdl-validate>

<vdl-tooltip title="Estimated ROI"

content="Specify the expected percentage return on investment">

</vdl-field>

</vdl-form>

<vdl-execute-button caption="Run scenario"></vdl-execute-button>

</vdl-section>

<vdl-section heading="Optimal result" heading-level="2">

<span vdl-text="Calculated optimal return: "></span>

<span vdl-text="=insight.Formatter.formatNumber(scenario.entities.Return.value, '.##')">

</span>

</vdl-section>

<vdl-section heading="Recommended share allocations"

heading-level="3">

<vdl-table page-mode="paged" page-size="5"

show-filter="true"

column-filter="true">

<vdl-table-column entity="frac"></vdl-table-column>

<vdl-table-column entity="RET"></vdl-table-column>

</vdl-table>

</vdl-section>

</vdl-section>

</vdl-page>

</vdl>

! Data file for `folio*.mos'

RET: [("treasury") 5 ("hardware") 17 ("theater") 26 ("telecom") 12

("brewery") 8 ("highways") 9 ("cars") 7 ("bank") 6

("software") 31 ("electronics") 21 ]

DEV: [("treasury") 0.1 ("hardware") 19 ("theater") 28 ("telecom") 22

("brewery") 4 ("highways") 3.5 ("cars") 5 ("bank") 0.5

("software") 25 ("electronics") 16 ]

NAMES: ["treasury" "hardware" "theater" "telecom" "brewery" "highways" "cars" "bank" "software" "electronics"]

COUNTRY: ["Canada" "USA" "USA" "USA" "UK" "France" "Germany" "Luxemburg" "India" "Japan"]

RISK: ["hardware" "theater" "telecom" "software" "electronics"]

NA: ["treasury" "hardware" "theater" "telecom"]

cautionText:"** Text to be replaced **"

model "Portfolio optimization with LP"

uses "mminsight" ! For Xpress Insight

uses "mmxprs" ! Use Xpress-Optimizer

parameters

DATAFILE= "folio.dat" ! File with problem data

OUTFILE= "result.dat" ! Output file

MAXRISK = 1/3 ! Max. investment into high-risk values

MAXVAL = 0.3 ! Max. investment per share

MINAM = 0.5 ! Min. investment into N.-American values

end-parameters

declarations

!@insight.manage input

!@insight.alias Set of all shares

SHARES: set of string ! Set of shares

!@insight.manage input

!@insight.alias Set of high risk shares

RISK: set of string ! Set of high-risk values among shares

!@insight.manage input

!@insight.alias Set of all North American shares

NA: set of string ! Set of shares issued in N.-America

!@insight.manage input

!@insight.alias ROI

RET: array(SHARES) of real ! Estimated return in investment

changeShare: string

end-declarations

forward procedure datainput

case insightgetmode of

INSIGHT_MODE_LOAD: do

datainput

exit(0)

end-do

INSIGHT_MODE_RUN:

insightpopulate

else

datainput

end-case

procedure datainput

initializations from DATAFILE

RISK RET NA

end-initializations

changeShare:="brewery"

end-procedure

declarations

!@insight.manage result

!@insight.alias Outcomes

frac: array(SHARES) of mpvar ! Fraction of capital used per share

end-declarations

! Objective: total return

Return:= sum(s in SHARES) RET(s)*frac(s)

! Limit the percentage of high-risk values

sum(s in RISK) frac(s) <= MAXRISK

! Minimum amount of North-American values

sum(s in NA) frac(s) >= MINAM

! Spend all the capital

sum(s in SHARES) frac(s) = 1

! Upper bounds on the investment per share

forall(s in SHARES) frac(s) <= MAXVAL

! Solve the problem

insightmaximize(Return)

! Solution printing to a file

fopen(OUTFILE, F_OUTPUT)

writeln("Total return: ", getobjval)

forall(s in SHARES)

writeln(strfmt(s,-12), ": \t", strfmt(getsol(frac(s))*100,5,2), "%")

fclose(F_OUTPUT)

end-model

<?xml version="1.0" encoding="UTF-8"?>

<model-companion xmlns="http://www.fico.com/xpress/optimization-modeler/model-companion" version="3.0">

<client>

<view-group title="Portfolio Optimization">

<vdl-view title="Portfolio" path="foliodata.vdl"></vdl-view>

</view-group>

</client>

</model-companion>

© 2001-2019 Fair Isaac Corporation. All rights reserved. This documentation is the property of Fair Isaac Corporation (“FICO”). Receipt or possession of this documentation does not convey rights to disclose, reproduce, make derivative works, use, or allow others to use it except solely for internal evaluation purposes to determine whether to purchase a license to the software described in this documentation, or as otherwise set forth in a written software license agreement between you and FICO (or a FICO affiliate). Use of this documentation and the software described in it must conform strictly to the foregoing permitted uses, and no other use is permitted.