Code Samples - Using VDL to Create Custom Views

Start of chapter

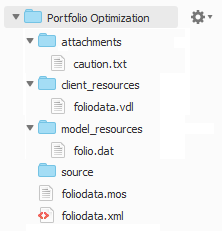

Folder Structure for this Chapter's Example

<vdl version="4.6">

<vdl-page>

<vdl-section heading-level="1" heading="Welcome to Portfolio Optimization">

<vdl-row>

<vdl-column heading="INPUT DATA" size="6">

<vdl-table page-mode="paged" page-size="5">

<vdl-table-column entity="RET" editable="true"></vdl-table-column>

</vdl-table>

</vdl-column>

<vdl-column heading="CONFIGURE THE BASIS FOR YOUR DECISION" size="6">

<vdl-form>

<vdl-field label="Max investment per share" parameter="MAXVAL" size="4">

<vdl-tooltip title="Maximum Investment per share" content="Specify the expected investment in a share category"></vdl-tooltip>

<vdl-validate pass="=value >= 0"><span vdl-text="Investment must be zero or greater."></span></vdl-validate>

</vdl-field>

<vdl-field label="Max investment in high risk shares" size="4" parameter="MAXRISK">

<vdl-tooltip title="Maximum High Risk Investment" content="Specify how much to invest in High Risk Shares"></vdl-tooltip>

<vdl-validate pass="=value <= 200"><span vdl-text="Max investment per share is limited to 200."></span></vdl-validate>

</vdl-field>

</vdl-form>

<vdl-execute-button caption="Run Optimization" mode="RUN"></vdl-execute-button>

</vdl-column>

</vdl-row>

<vdl-section>

<vdl-row>

<vdl-column heading="RESULTS" size="6">

<span vdl-text="='Calculated'+' '+'Optimal'+' '+'Return' +' '"></span>

<span vdl-text="=insight.Formatter.formatNumber(scenario.entities.Return.value, '00.##')"></span>

<vdl-table column-filter="true" show-filter="true" page-mode="paged" page-size="5">

<vdl-table-column set="SHARES"></vdl-table-column>

<vdl-table-column entity="frac"></vdl-table-column>

</vdl-table>

</vdl-column>

<vdl-column heading="SCENARIO COMPARISON" size="6">

<vdl-chart>

<vdl-chart-series entity="frac" type="pie" scenario="=i" vdl-repeat="=s,i in scenarios"></vdl-chart-series>

</vdl-chart>

</vdl-column>

</vdl-row>

</vdl-section>

</vdl-section>

</vdl-page>

</vdl>

! Data file for `folio*.mos'

RET: [("treasury") 5 ("hardware") 17 ("theater") 26 ("telecom") 12

("brewery") 8 ("highways") 9 ("cars") 7 ("bank") 6

("software") 31 ("electronics") 21 ]

DEV: [("treasury") 0.1 ("hardware") 19 ("theater") 28 ("telecom") 22

("brewery") 4 ("highways") 3.5 ("cars") 5 ("bank") 0.5

("software") 25 ("electronics") 16 ]

NAMES: ["treasury" "hardware" "theater" "telecom" "brewery" "highways" "cars"

"bank" "software" "electronics"]

COUNTRY: ["Canada" "USA" "USA" "USA" "UK" "France" "Germany" "Luxemburg" "India"

"Japan"]

RISK: ["hardware" "theater" "telecom" "software" "electronics"]

NA: ["treasury" "hardware" "theater" "telecom"]

cautionText:"** Text to be replaced **"

model "Portfolio optimization with LP"

uses "mminsight" ! For Xpress Insight

uses "mmxprs" ! Use Xpress Optimizer

parameters

DATAFILE= "folio.dat" ! File with problem data

OUTFILE= "result.dat" ! Output file

MAXRISK = 1/3 ! Max. investment into high-risk values

MAXVAL = 0.3 ! Max. investment per share

MINAM = 0.5 ! Min. investment into N.-American values

end-parameters

public declarations

!@insight.manage input

!@insight.alias Set of all shares

SHARES: set of string ! Set of shares

!@insight.manage input

!@insight.alias Set of high risk shares

RISK: set of string ! Set of high-risk values among shares

!@insight.manage input

!@insight.alias Set of all North American shares

NA: set of string ! Set of shares issued in N.-America

!@insight.manage input

!@insight.alias Estimated ROI per share

RET: array(SHARES) of real ! Estimated return in investment

!@insight.manage input

changeShare: string

end-declarations

forward procedure datainput

case insightgetmode of

INSIGHT_MODE_LOAD: do

datainput

exit(0)

end-do

INSIGHT_MODE_RUN:

insightpopulate

else

datainput

end-case

procedure datainput

initializations from DATAFILE

RISK RET NA

end-initializations

changeShare:="brewery"

end-procedure

public declarations

!@insight.manage result

!@insight.alias Outcomes

frac: array(SHARES) of mpvar ! Fraction of capital used per share

!@insight.alias Return

Return: linctr ! Objective fuction: total return

end-declarations

! Objective: total return

Return:= sum(s in SHARES) RET(s)*frac(s)

! Limit the percentage of high-risk values

sum(s in RISK) frac(s) <= MAXRISK

! Minimum amount of North-American values

sum(s in NA) frac(s) >= MINAM

! Spend all the capital

sum(s in SHARES) frac(s) = 1

! Upper bounds on the investment per share

forall(s in SHARES) frac(s) <= MAXVAL

! Solve the problem

insightmaximize(Return)

! Solution printing to a file

fopen(OUTFILE, F_OUTPUT)

writeln("Total return: ", getobjval)

forall(s in SHARES)

writeln(strfmt(s,-12), ": \t", strfmt(getsol(frac(s))*100,5,2), "%")

fclose(F_OUTPUT)

end-model

<?xml version="1.0" encoding="UTF-8"?>

<model-companion xmlns="http://www.fico.com/xpress/optimization-modeler/model-companion" version="3.0">

<client>

<view-group title="Portfolio Optimization">

<vdl-view title="Portfolio" path="foliodata.vdl"></vdl-view>

</view-group>

</client>

</model-companion>

© 2001-2019 Fair Isaac Corporation. All rights reserved. This documentation is the property of Fair Isaac Corporation (“FICO”). Receipt or possession of this documentation does not convey rights to disclose, reproduce, make derivative works, use, or allow others to use it except solely for internal evaluation purposes to determine whether to purchase a license to the software described in this documentation, or as otherwise set forth in a written software license agreement between you and FICO (or a FICO affiliate). Use of this documentation and the software described in it must conform strictly to the foregoing permitted uses, and no other use is permitted.