QP

To adapt the model developed in Chapter 2 to the new way of looking at the problem, we need to make the following changes:

- New objective function: mean variance instead of total return.

- The risk-related constraint disappears.

- Addition of a new constraint: target yield.

The new objective function is the mean variance of the portfolio, namely:

where VARst is the variance/covariance matrix of all shares. This is a quadratic objective function (an objective function becomes quadratic either when a variable is squared, e.g., frac12, or when two variables are multiplied together, e.g., frac1 · frac2).

The target yield constraint can be written as follows:

The limit on the North-American shares as well as the requirement to spend all the money, and the upper bounds on the fraction invested into every share are retained. We therefore obtain the following complete mathematical model formulation:

∑s ∈ NA fracs ≥ MINAM

∑s ∈ SHARES fracs = 1

∑s ∈ SHARES RETs·fracs ≥ TARGET

∀ s ∈ SHARES: 0 ≤ fracs ≤ MAXVAL

Implementation with Mosel

In addition to the Xpress Optimizer module mmxprs we now also need to load the module mmnl that adds to the Mosel language the facilities required for the definition of quadratic expressions (mmnl is documented in the `Mosel Language Reference Manual'). We can then use the optimization function maximize (or alternatively minimize) for quadratic objective functions to start the solution process.

This model uses a different data file (folioqp.dat) than the previous models:

! trs haw thr tel brw hgw car bnk sof elc

RET: [ (1) 5 17 26 12 8 9 7 6 31 21]

VAR: [ (1 1) 0.1 0 0 0 0 0 0 0 0 0 ! treasury

(2 1) 0 19 -2 4 1 1 1 0.5 10 5 ! hardware

(3 1) 0 -2 28 1 2 1 1 0 -2 -1 ! theater

(4 1) 0 4 1 22 0 1 2 0 3 4 ! telecom

(5 1) 0 1 2 0 4 -1.5 -2 -1 1 1 ! brewery

(6 1) 0 1 1 1 -1.5 3.5 2 0.5 1 1.5 ! highways

(7 1) 0 1 1 2 -2 2 5 0.5 1 2.5 ! cars

(8 1) 0 0.5 0 0 -1 0.5 0.5 1 0.5 0.5 ! bank

(9 1) 0 10 -2 3 1 1 1 0.5 25 8 ! software

(10 1) 0 5 -1 4 1 1.5 2.5 0.5 8 16 ! electronics

]

RISK: [2 3 4 9 10]

NA: [1 2 3 4] Note that we have chosen to use numerical instead of string indices. Since the set SHARES is defined in the model, we do not have to list the index-tuple for every data entry in the file—those tuples given are for clarity's sake only.

model "Portfolio optimization with QP/MIQP"

uses "mmxprs", "mmnl" ! Use Xpress Optimizer with QP solver

parameters

MAXVAL = 0.3 ! Max. investment per share

MINAM = 0.5 ! Min. investment into N.-American values

MAXNUM = 4 ! Max. number of different assets

TARGET = 9.0 ! Minimum target yield

end-parameters

declarations

SHARES = 1..10 ! Set of shares

RISK: set of integer ! Set of high-risk values among shares

NA: set of integer ! Set of shares issued in N.-America

RET: array(SHARES) of real ! Estimated return in investment

VAR: array(SHARES,SHARES) of real ! Variance/covariance matrix of

! estimated returns

end-declarations

initializations from "folioqp.dat"

RISK RET NA VAR

end-initializations

declarations

frac: array(SHARES) of mpvar ! Fraction of capital used per share

end-declarations

! Objective: mean variance

Variance:= sum(s,t in SHARES) VAR(s,t)*frac(s)*frac(t)

! Minimum amount of North-American values

sum(s in NA) frac(s) >= MINAM

! Spend all the capital

sum(s in SHARES) frac(s) = 1

! Target yield

sum(s in SHARES) RET(s)*frac(s) >= TARGET

! Upper bounds on the investment per share

forall(s in SHARES) frac(s) <= MAXVAL

! Solve the problem

minimize(Variance)

! Solution printing

writeln("With a target of ", TARGET, " minimum variance is ", getobjval)

forall(s in SHARES) writeln(s, ": ", getsol(frac(s))*100, "%")

end-model This model (file folioqp.mos) produces the following solution output (tab Output/input of the solution information window):

With a target of 9 minimum variance is 0.5573934236 1: 29.99999999% 2: 7.153923216% 3: 7.382487455% 4: 5.463589348% 5: 12.6553572% 6: 5.911771509% 7: 0.3330412872% 8: 29.99996789% 9: 1.099855797% 10: 6.303833229e-06%

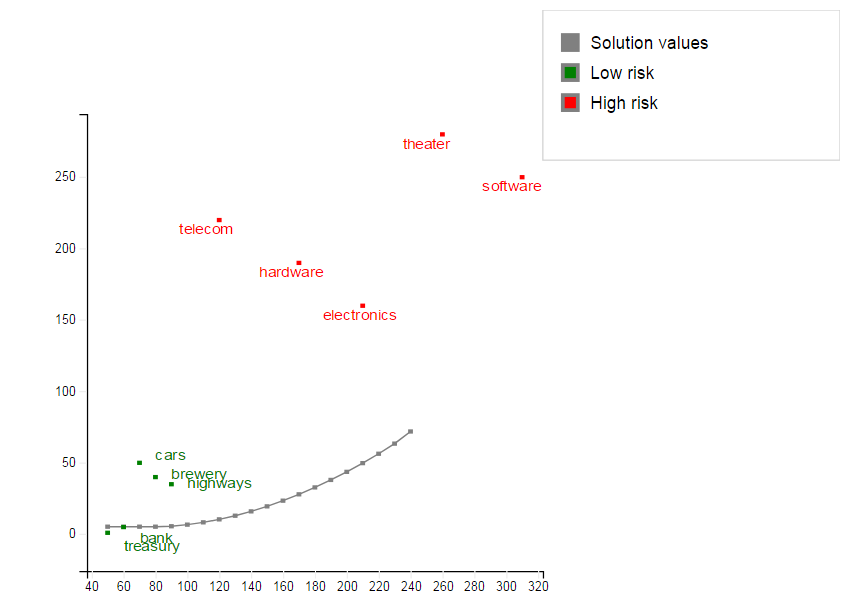

Similarly to the algorithm shown in Chapter 5, we may re-solve this problem with different values of TARGET and plot the results in a target return/standard deviation graph, know as the `efficient frontier' (model file folioqp_graph.mos):

Figure 8.1: Graph of the efficient frontier

© 2001-2025 Fair Isaac Corporation. All rights reserved. This documentation is the property of Fair Isaac Corporation (“FICO”). Receipt or possession of this documentation does not convey rights to disclose, reproduce, make derivative works, use, or allow others to use it except solely for internal evaluation purposes to determine whether to purchase a license to the software described in this documentation, or as otherwise set forth in a written software license agreement between you and FICO (or a FICO affiliate). Use of this documentation and the software described in it must conform strictly to the foregoing permitted uses, and no other use is permitted.