Your data. Your UltraFICO® Score.

You’re in control.

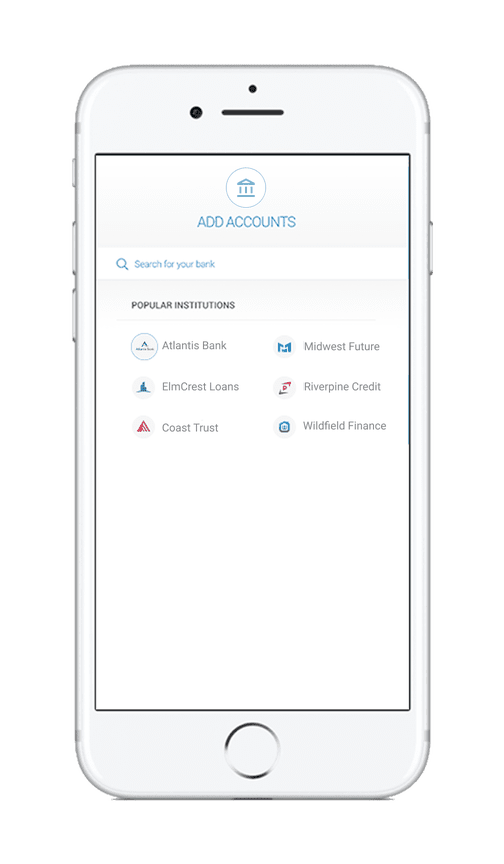

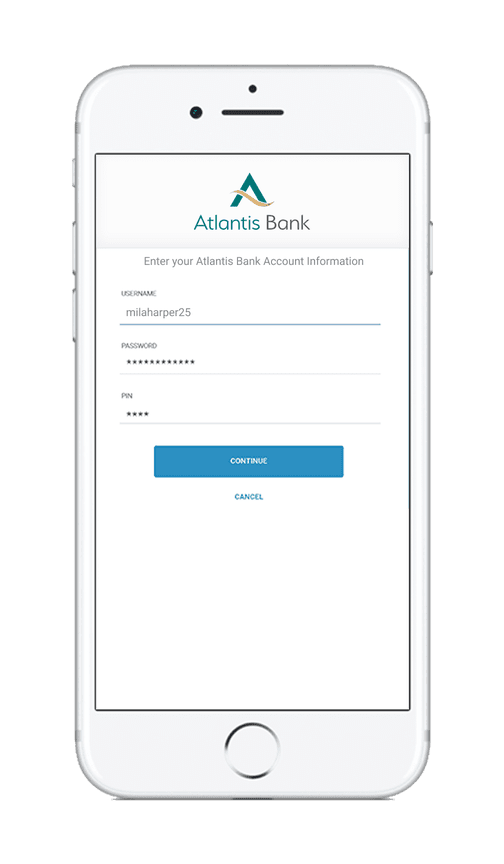

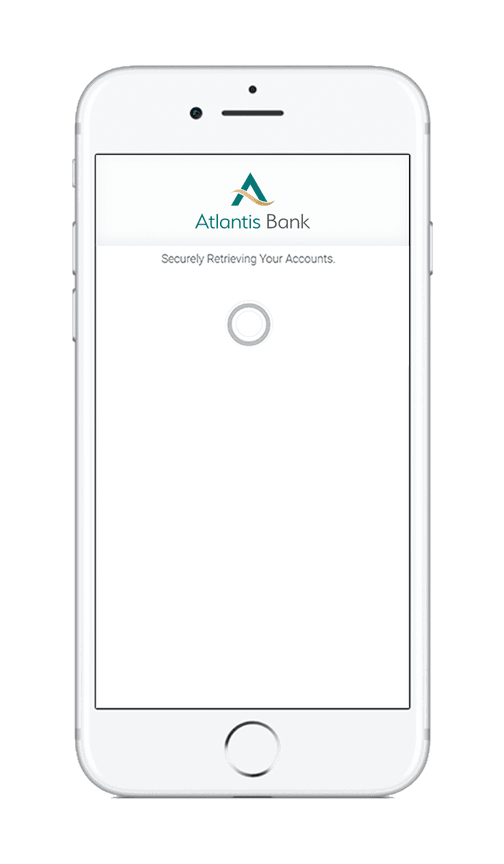

An UltraFICO® Score can unlock more credit opportunities for millions of hardworking people. You empower your UltraFICO® Score. By simply and securely linking with your checking, savings or money market accounts, your UltraFICO® Score can enhance your FICO® Score based on indicators of sound financial behavior. By opting in, you could broaden your access to more lending options and better terms.

7 out of 10

consumers

7 out of 10 people in the U.S. who have had consistent cash on hand in recent months and kept positive balances on their accounts, could see an UltraFICO® Score that is higher than their traditional FICO® Score.

Over 15 million

consumers

You may be one of 15 million people in the U.S. who can receive an UltraFICO® Score, even if you don't have enough credit history to generate a FICO® Score.

How the UltraFICO® Score Works

With the UltraFICO® Score, you are empowered to leverage your checking and savings account data to enhance your score. If you have a low FICO® Score or no score at all, you have a chance to increase your score based on data you share.

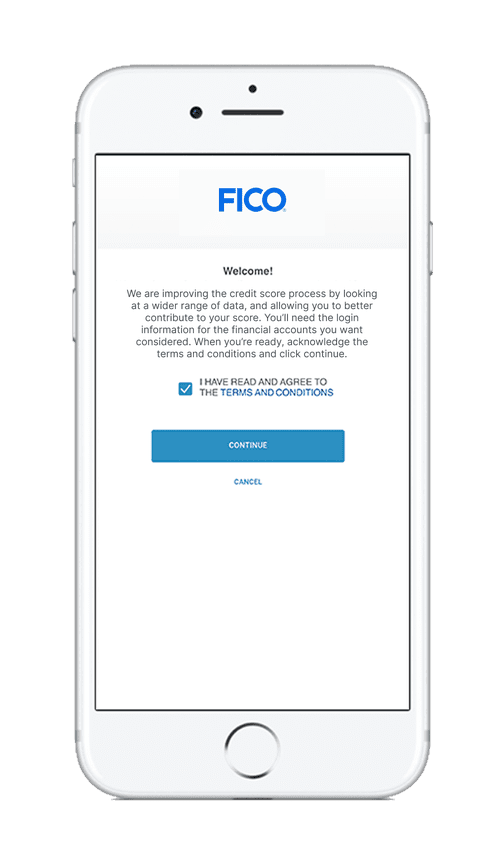

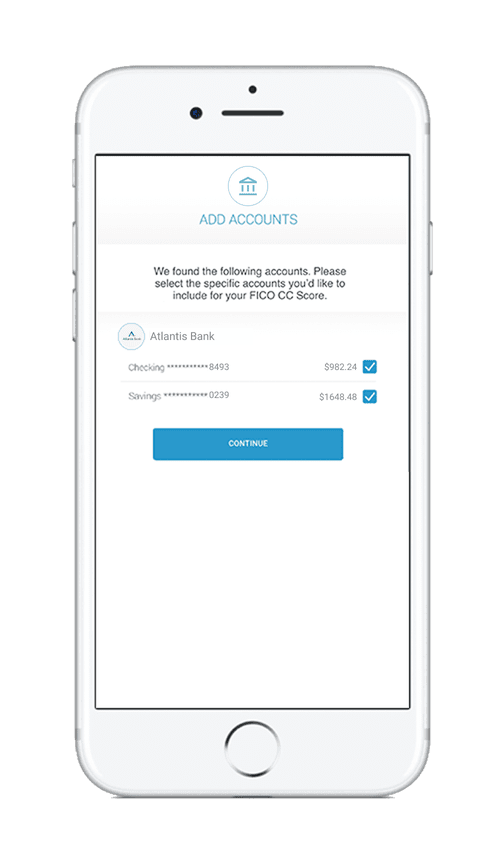

The process is easy as 1-2-3

UltraFICO® Score = New Opportunity

An UltraFICO® Score gives lenders a clearer picture of who you are as a borrower. Have you ever felt like your traditional credit score doesn’t tell the full story? Your UltraFICO® Score takes your banking activity into consideration, which provides lenders with a more comprehensive picture of your unique financial situation.

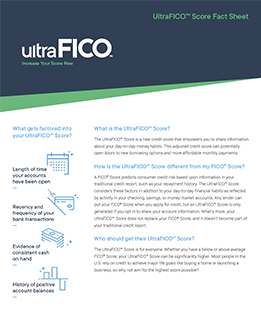

Your UltraFICO® Score lets you show lenders indicators of sound financial behavior, not visible on a traditional credit report, including:

Length of time your

accounts have been open

Recency and frequency

of your bank transactions

Evidence of consistent

cash on hand

History of positive

account balances

See where it can take you

Soon lenders will be able to provide you options to participate, opt-in to get your UltraFICO® Score and share a more comprehensive overview of your credit readiness.

Increase your score now and keep improving with the UltraFICO® Score.

As the independent, trusted leader in credit scoring, FICO pioneered the development of

scoring analytics decades ago that helped to democratize access to credit. We have led the

industry ever since, innovating new ways to responsibly expand access to affordable credit

for more and more people in the U.S. FICO Scores are used in over 90% of US lending

decisions.

Learn more at www.ficoscore.com