FICO UK Credit Card Market Report: July 2025

Year-on-year fall in payments leads to rising active balances

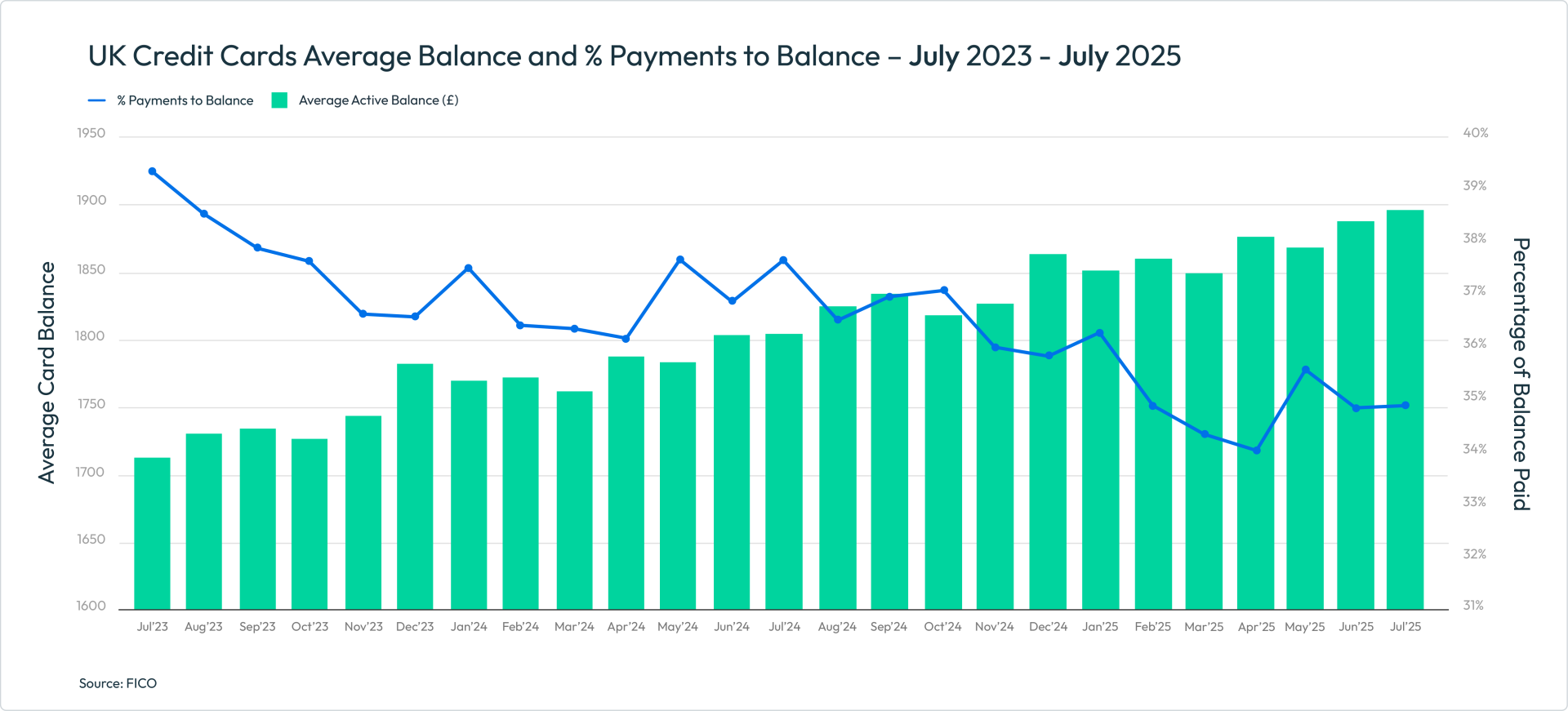

LONDON, 15 September 2025: The latest analysis from global analytics software leader FICO reveals a concerning increase in the average active balance on UK credit cards. The new data shows that despite a typical seasonal reduction in spending, balances grew to £1,895, 5.1% higher year-on-year. Also, the percentage of the balance being paid off by customers fell year-on-year by 7.7%. This is symptomatic of the ongoing affordability challenges many UK consumers face, and represents a growing latent risk for lenders. Having an appropriate level of focus on limit strategies and the identification and treatment of customers in the early stages of financial difficulties is vital to help manage this risk and support good customer outcomes.

With the average balance of customers with three missed payments increasing by 3.1% month-one-month and 8.1% year-on-year to £3,300, lenders will want to review collections prioritisation strategies to support those customers with higher outstanding balances.

Highlights

- Spending decreased to an average of £800 in July, 2.9% lower than the previous month and 1.6% lower year-on-year

- Average balances continued to move up, rising by 0.4% month-on-month and 5.1% year-on-year

- The percentage of balance paid fell by 7.7% year-on-year to 34.9%

- 10.1% more customers missed one payment compared to June 2025, with the average balance 6.4% higher than July 2024 at £2,385

- The average balance for customers with two missed payments increased 6.9% year-on-year to £2,875

- The average balance for customers missing three payments increased 3.1% month-on-month and 8.1% year-on-year to £3,300

FICO Comment:

Following the peak in June, spending on credit cards fell to an average of £800 in July. While a drop in spending is typical at this time of year, the fact that it is 1.6% lower year-on-year could reflect overall pressure on consumer finances. Lenders will be concerned, however, that even though spending was lower during the month, the average active balance continued to trend up. Early identification and support for those customers who are in the earliest stage of financial difficulties, amongst those with an increasing balance, will help to mitigate risk and support profitability.

Another area of concern for lenders is missed payments. Year-on-year there has been a drop in the number of customers missing payments. However, the average missed payment balance continues to trend upwards.

The percentage of customers missing one payment continues to be erratic. After June’s 11.3% drop, July saw a 10.1% increase to 1.39%. Year-on-year, this equates to a 10% decrease. The number of customers missing one payment has been trending down over the last 12 months.

The number of customers missing two payments has been steadier, standing at 0.3% in July, a 1% decrease month-on-month and a 5.1% decrease year-on-year. While average balances on these accounts were slightly down month-on-month by 0.4% to £2,875, this is 6.9% higher year-on-year. Average balances for customers with three missed payments rose by 3.1% month-on-month and 8.1% year-on-year to £3,300.

An important warning indicator of potential financial stress, the percentage of customers using credit cards to take out cash continued to rise. Typical of the summer months, it increased 1% month-on-month to 3.21%. It is expected that cash usage on cards will continue to increase again in August and September before dropping back down during the autumn.

When comparing delinquent balance rates to the overall balance, this ratio is gradually increasing for customers missing one payment or two, with a more apparent trend upwards for those missing three payments. Risk teams can help to mitigate this by reviewing credit card limits to ensure that those accounts more at risk of missing payments are not offered limit increases.

Key Trend Indicators UK Cards – July 2025

| Metric | Amount | Month-Month Change | Year-Year Change |

| Average UK Credit Card Spend | £800 | -2.9% | -1.6% |

| Average Card Balance | £1,895 | +0.4% | +5.1% |

| Percentage of Payments to Balance | 34.87% | +0.1% | -7.7% |

| Accounts with One Missed Payment | 1.39% | +10.1% | -10.0% |

| Accounts with Two Missed Payments | 0.31% | -1.0% | -5.1% |

| Accounts with Three Missed Payments | 0.20% | +8.0% | -5.1% |

| Average Credit Limit | £5,875 | +0.1% | +2.8% |

| Average Overlimit Spend | £90 | 0% | +1.1% |

| Cash Sales as a % of Total Sales | 0.86% | -1.5% | -4.5% |

Source: FICO

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 80 countries do everything from protecting 4 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and has been made available in over 40 other countries, improving risk management, credit access and transparency. Learn more at www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the United States and other countries.

For further press information please contact:

FICO UK PR Team

Wendy Harrison/Matthew Enderby

ficoteam@harrisonsadler.com

0208 977 9132