Digital Jane

Meet Jane. She’s a modern consumer (with high expectations) and she needs a bank that can keep up with her busy life. Watch this series to learn how leading financial institutions are successfully achieving digital transformation and delivering next-generation, customer-centric interactions via applied intelligence – all powered by the FICO Platform.

01. Loyalty

Jane is a valued customer. How can her bank make sure she knows she’s appreciated? Using Applied Intelligence, the bank determines that Jane would love a free coffee. Watch this video to see how her bank uses the FICO Platform to make this digital loyalty experience possible.

02. Insurance Quotes

Jane set up a Car Savings Account, which means her bank knows that she is looking to purchase a new car. Watch this video to see how the FICO Platform enables the bank to provide an exceptional customer experience by proactively sending Jane auto insurance quotes.

03. BNPL Purchase

Jane’s mom has a birthday coming up, so Jane decides to purchase her a new laptop as a birthday gift. Watch this video to learn how Jane’s bank can offer “Buy Now, Pay Later” at the point of checkout and how the FICO Platform made it happen.

04. Fraud Check

Jane’s friend is visiting from out-of-state and they get together for lunch. Her friend picks up the bill and her bank checks in to make sure there’s no fraudulent activity. Watch this video to see how the FICO Platform gives banks the power to keep customers safe and communicate alerts intelligently.

05. P2P

Jane decides to pay her friend for her share of the lunch bill. Jane uses her banking app, which sends money to her friend in a matter of seconds. Watch this video to see how the FICO Platform makes it easy for Jane to transfer money quickly and securely.

06. Originations

Today, Jane is purchasing a new car. The dealership finds an auto lender with an alternative deal structure that works for her budget, and Jane’s bank helps her insure her new ride. Watch this video to learn how the lender and the bank both use the FICO Platform to create outstanding customer experiences.

07. Mortgage Origination

Jane and Luis have been dating for a year and are looking to purchase a condo together. Jane gets a pre-approved mortgage offer, but they fall in love with a condo that costs more than the pre-approved amount. Watch the seamless experience provided by Atlantis bank as they file a joint application, get approved, and purchase their dream home.

Also see how Atlantis Bank facilitates Jane and Luis’ condo purchase. Using FICO Platform, the Fraud, Analytics, Risk, Underwriting, and Mortgage Pricing teams collaborate to provide a seamless home buying experience for Jane and Luis.

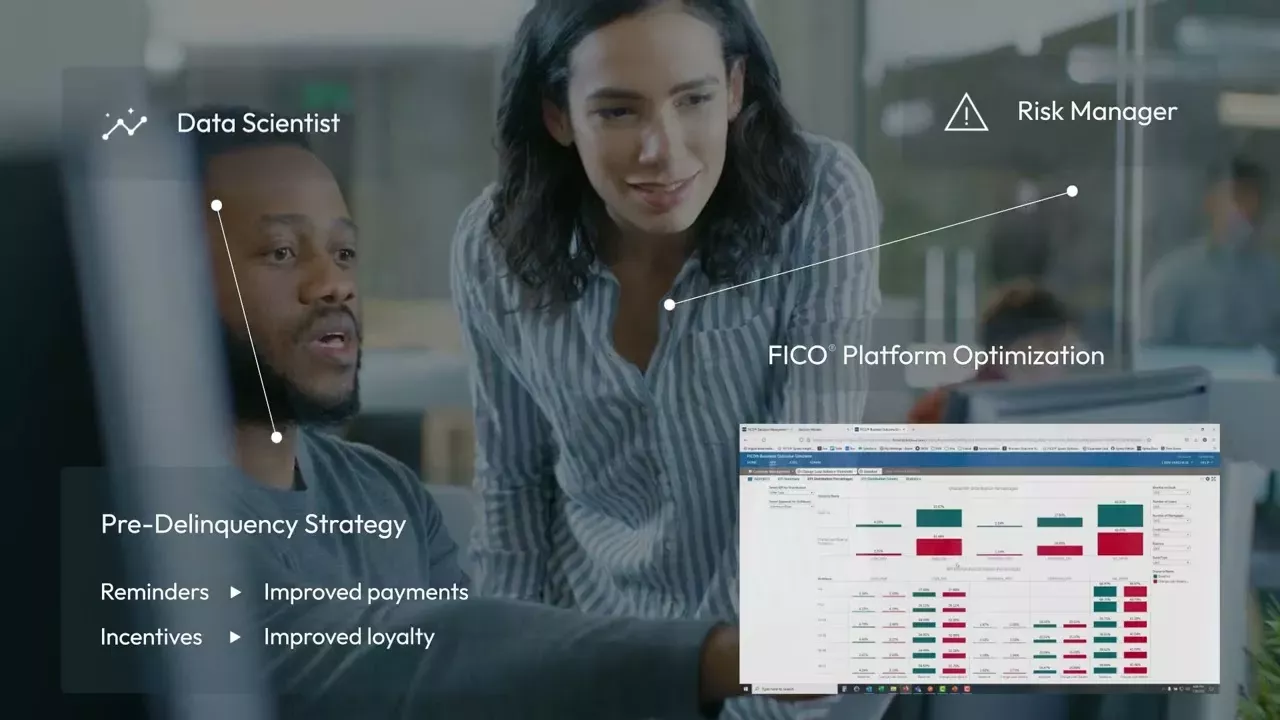

08. Account Management - Predelinquency

Jane’s friend Sam is working on rebuilding her credit score after her wild college days. Watch how Atlantis bank helps her stay on track with her finances and rebuild her FICO Score.

Also see how the Data Science, Risk, and Credit Card teams at Atlantis bank come together to develop a predelinquency strategy using FICO Platform to help customers like Sam rebuild their financial health.

09. Transaction Fraud

Jane’s brother James gets a message with an investment opportunity that turns out to be a scam. See how Atlantis bank saves him from making a big mistake.

Also see how Atlantis Bank reacts to the growing trend of customers falling prey to scams by leveraging FICO Platform to create a strategy to keep customers like James safe.

10. Application Fraud

Now that they have purchased a home together, Jane and Luis set-up a joint account with a line of credit to take care of household expenses. See how Atlantis Bank makes it easy and seamless for them.

Also see how the Deposits and Line-of-Credit teams at Atlantis Bank come together to address fraud challenges in the account opening process using FICO Platform.

11. Early-Stage Collections

Steve, Luis’ oldest friend loses his job and misses a car payment. See how Atlantis bank is able quickly assess Steve’s situation and offer him options to tide him over until he lands a new job.

Also see how the teams at Atlantis come together to address rising loan delinquency to best serve their customers while keeping their loss rates under control with FICO Platform.

12. Hyper-Personalization at Hyper-Scale

Watch as Atlantis bank uses its deep knowledge of their customers and FICO Platform to send hyper-personalized messages and offers to people at Jane and Luis’ engagement party.

13. Next Best Action

Carrie, Atlantis Bank’s new Head of Retail lending uses FICO Platform to bring in data from various sources, increases the frequency of data refreshes, and uses machine learning and AI to gain insights to drive timely and relevant next best actions in near real time. This results in growing revenue, improving customer retention, maintaining primary bank status, and controlling risk.

14. Telecom Empathetic Collections

Abbie, Zing Telecom’s VP of Global Services needs to improve collection dollars as delinquency rates are on the rise. Abbie and her team use FICO Platform to automate Zing’s collection process. See how Abbie increases payments collected while increasing customer loyalty.

15. PIX Instant Payments

Ricardo, Head of Risk Management in Brazil needs to spot and prevent fraud in real time. He uses FICO Platform to process data instantly from different sources, make a real-time decision on whether a payment is potentially a scam, and then warn the customer immediately.

16. Wealth Management

How can you bring efficiency to your wealth management division at the bank? This video in FICO’s Digital Jane series gives you an example of how the wealth management team can leverage the FICO Platform capabilities already being used by the Retail Banking side of the business to improve and speed up their processes.

See how the wealth management team at Atlantis Bank leverages the retail banking account opening process to automate their account opening process without having to start from scratch. They are also able to reuse capabilities being used by retail banking to shorten their decisioning processes from hours to minutes enabling their financial advisors to have the data they need to better serve their clients.

17. Augmented Decisioning

Get a sneak peek into what you will be able to do with FICO Platform in the not-too-distant future.