Empowering Lenders in India: Advanced Analytics for Debt Collection

Discover how FICO's advanced data analytics is empowering lenders in India to enhance debt collections strategies.

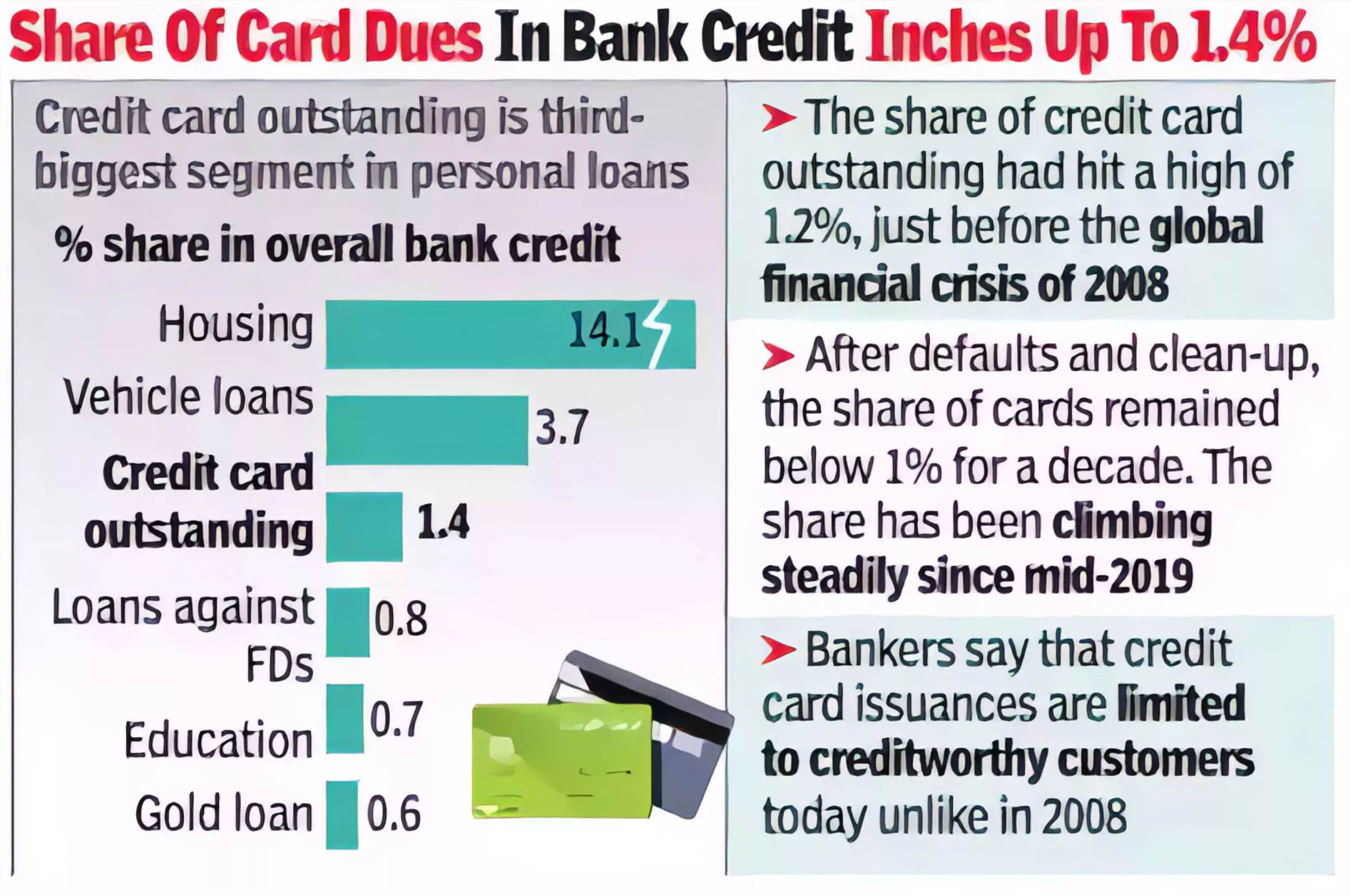

With credit card dues in India surging by 29.7 percent compared to the last financial year and the outstanding amount crossing 2 lakh crores (24.3B USD), the Reserve Bank of India (RBI) has raised concerns about unsecured loans, including credit cards. It is now imperative for banks to assess their collections landscape and bolster their capabilities to mitigate potential risks. In light of this, we explore three critical capabilities that empower businesses to confidently and effectively manage collections, along with showcasing how the FICO Platform, renowned for its advanced analytics solutions, enables financial service providers to enhance their collections strategies.

|

The RBI's recent response to a Right to Information (RTI) query by The Sunday Express, highlighted that bad or non-performing assets (NPA) in the banking industry’s credit card segment jumped by Rs 765 crore, or 24.5 per cent, to Rs 3,887 crore between April to December in 2022.

The credit card NPA figure is considerably smaller when compared to the total outstanding debt for banks; however, the rising NPA trend is becoming a growing concern for the RBI. (Credit card NPAs accounted for just 2.16 percent of the total credit card debt outstanding or loan exposure as of December 2022, a marginal increase from 2.11 percent on March 31, 2022). The central bank has cautioned banks about unsecured loans, including personal loans and credit cards.

Debt collections face a unique situation in this pivotal post-pandemic period, while inflationary and cost of living concerns persist. Given the complexities arising from changing customer engagement preferences, it is crucial for collections to identify customers who will self-cure, enabling a focused approach on those who require collections intervention to resolve their payment issues.

Amidst the economic uncertainty, effectively managing a successful Collections unit requires striking a balance between improving and sustaining collections portfolio effectiveness and maintaining or reducing operating costs within budget. This necessitates the strategic infusion of key capabilities.

In the fiercely competitive financial services market in India, where lenders vie for wallet-share, collections play a vital customer assist function that underpins success. Lenders must explore viable opportunities to enhance customer interaction and engagement efficiently and effectively.

Traditional mass dialler campaigns and blasting collections messaging by risk segment are no longer effective. With cost-consciousness remaining a top priority, it is crucial to allocate budgets wisely and optimize customer-centric approaches for reaching customers with relevant and contextualized modes and means of contact, engagement, and resolution.

Gain a Deeper Understanding of Customers through Daily Transaction Scoring

Comprehensive customer understanding is essential for prioritizing accounts and determining appropriate actions. Daily transaction scoring, combined with collections behavior scores, enhances risk assessment by identifying risky patterns earlier than traditional cycle-based scores. The collaboration between FICO and ANZ on a transaction scoring project showcases how this approach can mitigate potential risks in the payment card segment. Utilizing transaction-level data, financial service providers can proactively identify risky patterns and implement customer-centric collections treatments to prevent bad or non-performing assets (NPA).

Apply Customer Activity Insights to Optimize Collections Engagements

Engaging customers effectively during collections becomes a battleground for banks in the highly competitive financial services market like India. By integrating traditional customer data with transaction-level data, banks can predict customer collections behavior and proactively engage with them based on their profiles and potential vulnerability. Hyper-personalization plays a vital role in tailoring collections treatments to specific customers, enabling contextualized communications through data, analytics, AI, and automation. This approach empowers banks and financial service providers to optimize their marketing strategies, target customers with relevant and contextualized contact modes, and deepen customer engagement.

Empower Collections Risk and Operations Stakeholders with Simulation Capabilities

As financial service providers strive for growth, managing risk becomes crucial. The ability to simulate and compare collections strategies empowers stakeholders to make informed decisions and respond effectively to external challenges. Stress-testing predictive and prescriptive models, decision flows, and strategies enables businesses to identify key parameters and simulate multiple scenarios aligned with their risk appetite. The FICO Platform provides a robust framework for running "what-if" analysis, empowering collections risk portfolio managers to assess the impact of strategy adjustments and make data-driven choices that drive game-changing innovations.

In conclusion, the surging credit card dues in India demand a reassessment of collections strategies. We've explored three critical capabilities empowering businesses and showcased how the FICO Platform enables enhanced collections amidst rising bad assets. Strategic infusion of these capabilities is crucial for success in the competitive financial services market.

Learn More About How FICO Helps You Improve Your Collections

- Read about the collaboration between FICO and ANZ on a transaction scoring project showcasing how daily transaction scoring on FICO platform helps them to improve customer management and collections.

- Read about how Czech Republic’s, Česká spořitelna used FICO Prescriptive Analytics to improve effectiveness of its collections by 25% during the pandemic.

- Discover more about FICO's collections solutions.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.