Challenges in Countering Trade-Based Money Laundering

Financial institutions should consider the introduction of machine learning and artificial intelligence (AI) to go beyond simple red-flag indicators of TBML.

In part 1 of the series on trade-based money laundering (TBML), we established a definition of the term, explored some recent studies and highlighted some typical techniques employed by the criminals. In this second part, we will explore the challenges of countering TBML and explore some recent industry trends.

Challenges in identifying and countering TBML exist at both the public and private sector levels, with a lack of understanding, awareness, and collaboration both domestically and internationally. The GAO Study cited in part 1 states that “retrospective review of data on imports and exports, suspicious financial activity, and legal investigations is essential to identifying patterns and anomalies in trade transactions.”

Efforts should also be made to raise financial institutions’ knowledge of TBML and related risks. Financial Intelligence Units (FIUs) can play a critical role in producing sophisticated analysis on TBML schemes – including reporting entities (SAR/STR data).

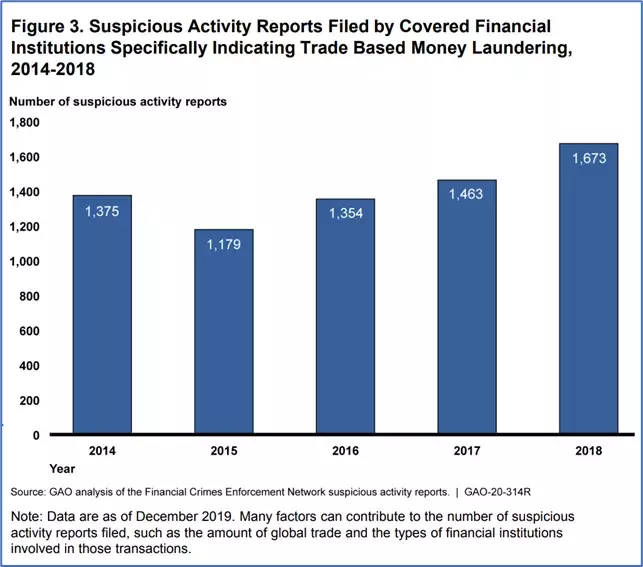

Financial institutions in the U.S. must report potentially suspicious activity (including trade-related transactions) to FinCEN. The graph below shows the trend of TBML-related SARs filed with FinCEN between 2014 and 2018. During this period, financial institutions filed 7,044 SARs specifically designated as suspected TBML/BMPE (Black Market Peso Exchange) activity, versus the more than 9.6 million SARs filed overall during the same period.

Trade finance has traditionally been a resource-intensive manual process because global trade still depends on paper documents, making it susceptible to documentary fraud. However, financial institutions should also consider the introduction of machine learning and artificial intelligence (AI) as well as other new technologies, to go beyond simple red-flag indicators to appropriately detect the complex behavior associated with trade transactions.

Transformational Change and Industry Trends

A recent study conducted by BNY Mellon “Global Payments 2020: Transformation and Convergence” notes a number of evolving trends and challenges. These include:

- Post-pandemic shift to a new world order with associated changes to the relative importance of different currencies.

- Trade flows being reshaped by the increasing engagement of developing markets.

- A shift away from established documentary trade payment and financing mechanisms toward less complex and less expensive open-account terms.

- New payment and financing solutions (such as the Bank Payment Obligation or BPO) aimed at supporting global supply chains, along with the expectation of near real-time settlement of financial transactions.

- New tools and technologies that could address challenges related to TBML—such as the use of fraudulent documentation and the general lack of visibility in trade transactions.

- Evolution of traditional trade finance models from paper and process-intensive models to a data-driven, automated decisioning mode.

Other Risk Considerations

Apart from identifying money laundering and terrorist financing risks in trade transactions, organizations must also think about potential anti-bribery and corruption concerns, as being pressured to pay bribes can lead to FCPA (Foreign Corrupt Practices Act) violations and hefty fines.

Here are some quick tips to keep you focused on your priorities:

- Review Risk Assessments and adjust internal controls as needed

- Maintain a strong Tone at the Top (“Culture of Compliance”)

- Set clear and realistic priorities

- Exercise caution in dealings with third parties

- Plan for upticks in particular areas of AML compliance activity

- Leverage newer technology and consider technological innovation

- Coordinate effectively with local resources, where possible

- Document, document, document! (In particular, the rationale behind not filing a SAR)

Additionally, as per the DOJ’s 2020 updated guidance on evaluating corporate compliance programs, the key elements of a compliance program include the following:

- Written policies, procedures, and standards of conduct.

- Designation of qualified compliance officer along with a compliance oversight committee (or governance committee).

- Developing effective and open lines of communication.

- Designing and delivering effective and ongoing training and education.

- Conducting internal monitoring and auditing.

- Responding promptly to detected offenses or misconduct and undertaking appropriate and timely corrective measures (action), including a root cause analysis to help determine if one-off issue or if systematic issue persists.

To learn more about how FICO helps organizations fight financial crime visit our website and connect with me on LinkedIn. Also, check out related blogs written by my colleagues Erik Stretz on “Illegal Wildlife Trade: What Banks Must Do” and by Frank Moser on “TBML: A Practical Guide for Protecting your Business.”

Follow this Fraud and Financial Crime blog and stay tuned for additional posts on Bank Secrecy Act / AML and related matters.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.