Credit and Risk Trends in Brazil Highlight Need for Tailored Treatment

July data shows Brazil's credit portfolio is in good shape - combined with a decline in delinquency, this makes a fertile ground for credit granting

This month, FICO Risk Trends has received updates released by the Central Bank of Brazil regarding the closing of June 2024. To facilitate understanding, we have condensed our main observations into the following sections:

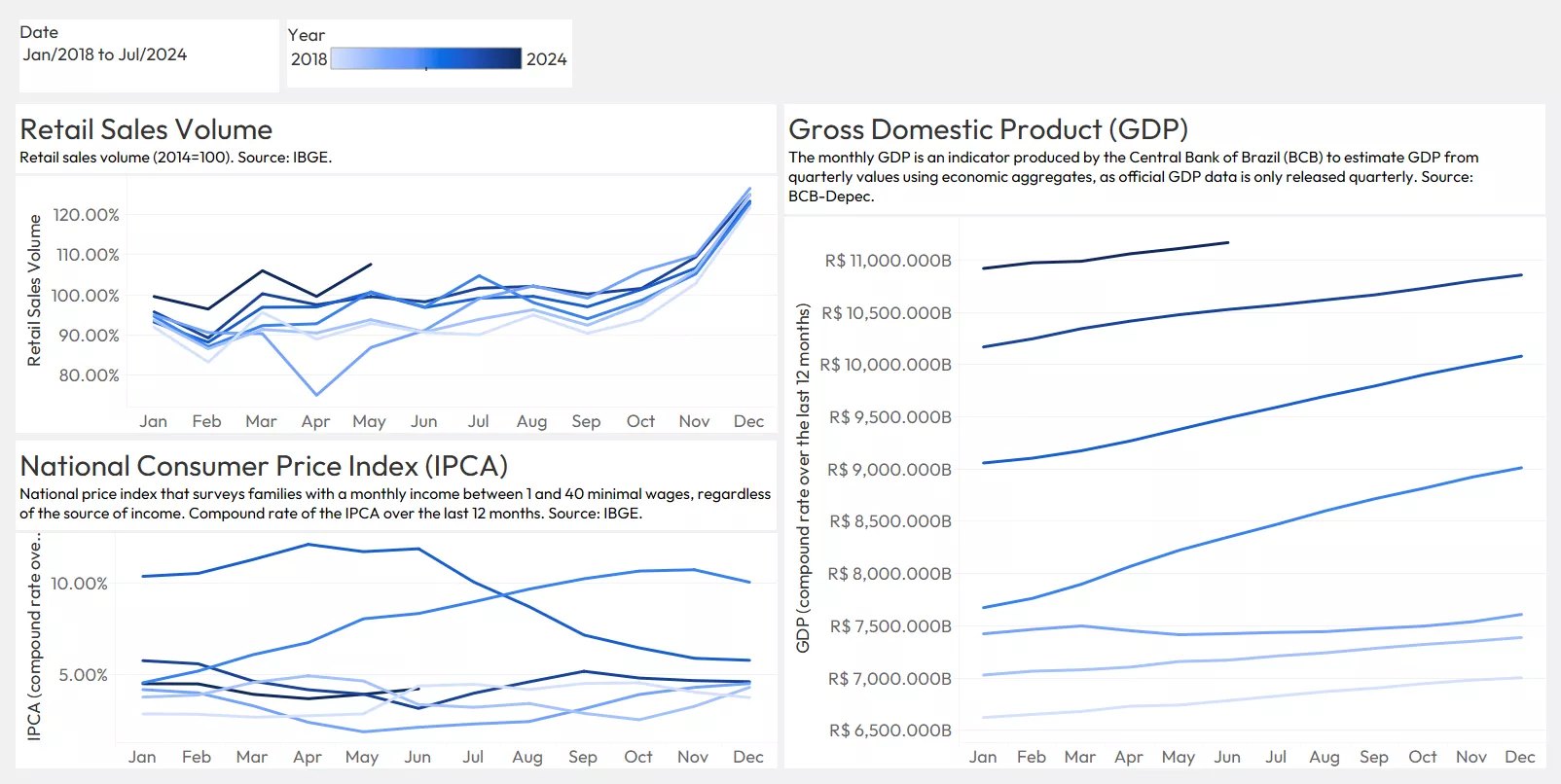

Macroeconomic Analysis

This month, the main highlight in the Brazilian macroeconomy is the ongoing trend of increasing IPCA (National Consumer Price Index), which has been rising since April and reached 4.23% in June. This represents an increase of 1.07 percentage points compared to June last year.

Additionally, we have included the GDP (Gross Domestic Product) in Risk Trends, showing stable growth that reached R$ 11.17 trillion in June. This is a 6.1% increase compared to the same period last year (R$ 10.52 trillion).

Including this indicator allows us to better understand the Credit-to-GDP ratio (53.90% in June), as fluctuations in this ratio are sometimes more related to GDP variations than to changes in the credit portfolio. For example, last month, GDP grew by 0.5%, while the portfolio grew by 1.0%, indicating that the 0.38 pp growth corresponds to a real net increase in the portfolio of 0.7% relative to GDP.

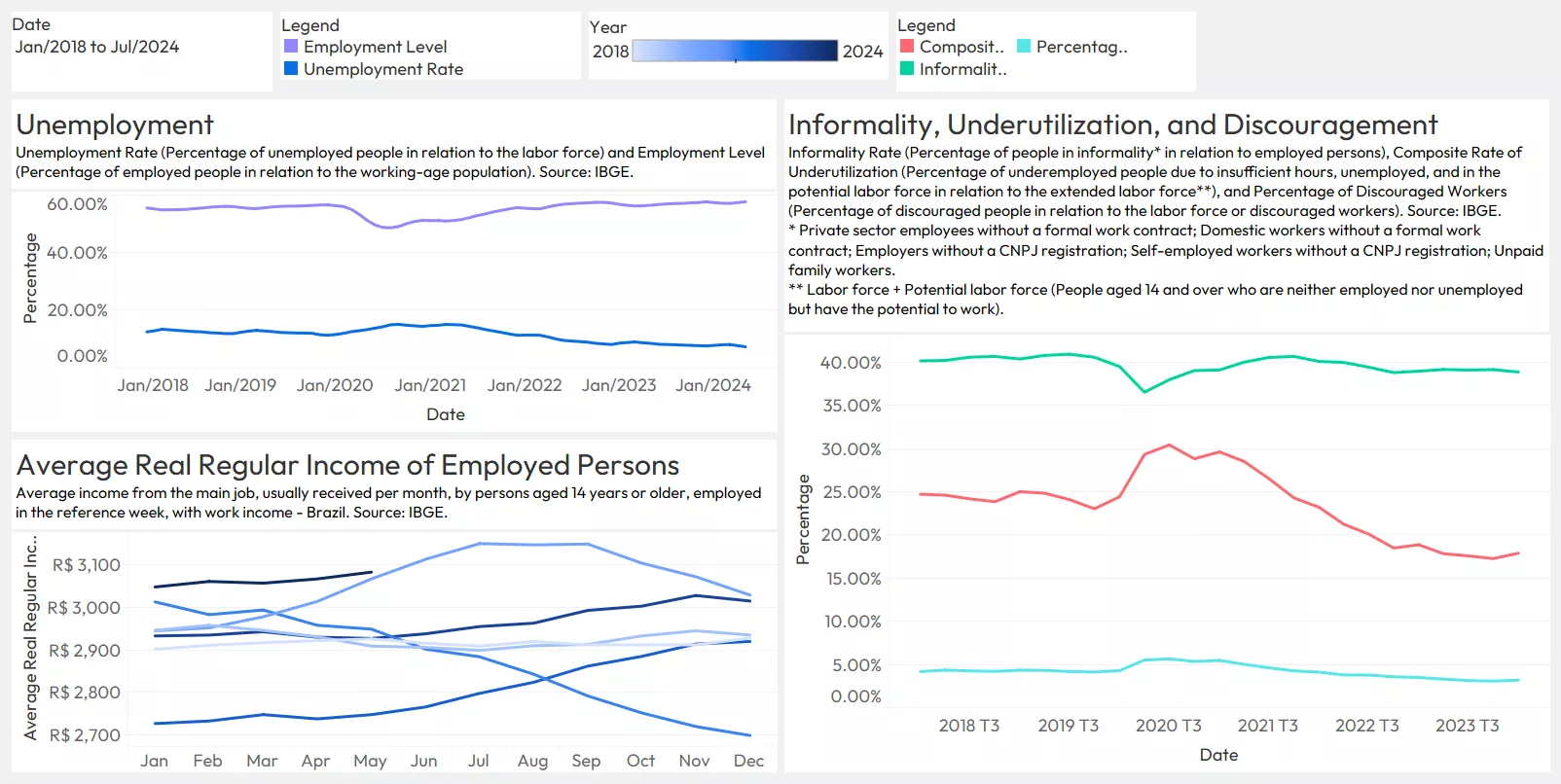

Labor

We have added a new Labor section, detailing the employment situation in Brazil. We highlight the decline in the Unemployment Rate and the growth in the Employment Rate, which have not seen such positive values since early 2015 – reaching 7.1% and 57.59% in May, respectively.

Additionally, the Informality Rate decreased between the end of 2021 and the end of 2022, stabilizing since then at 38.86% for the first quarter of this year. The Composite Underutilization Rate and the Percentage of Discouraged Workers (workers who have given up looking for a job) have been trending downward since early 2021 but showed a slight increase in the first quarter of this year, marking 17.89% and 3.20%, respectively.

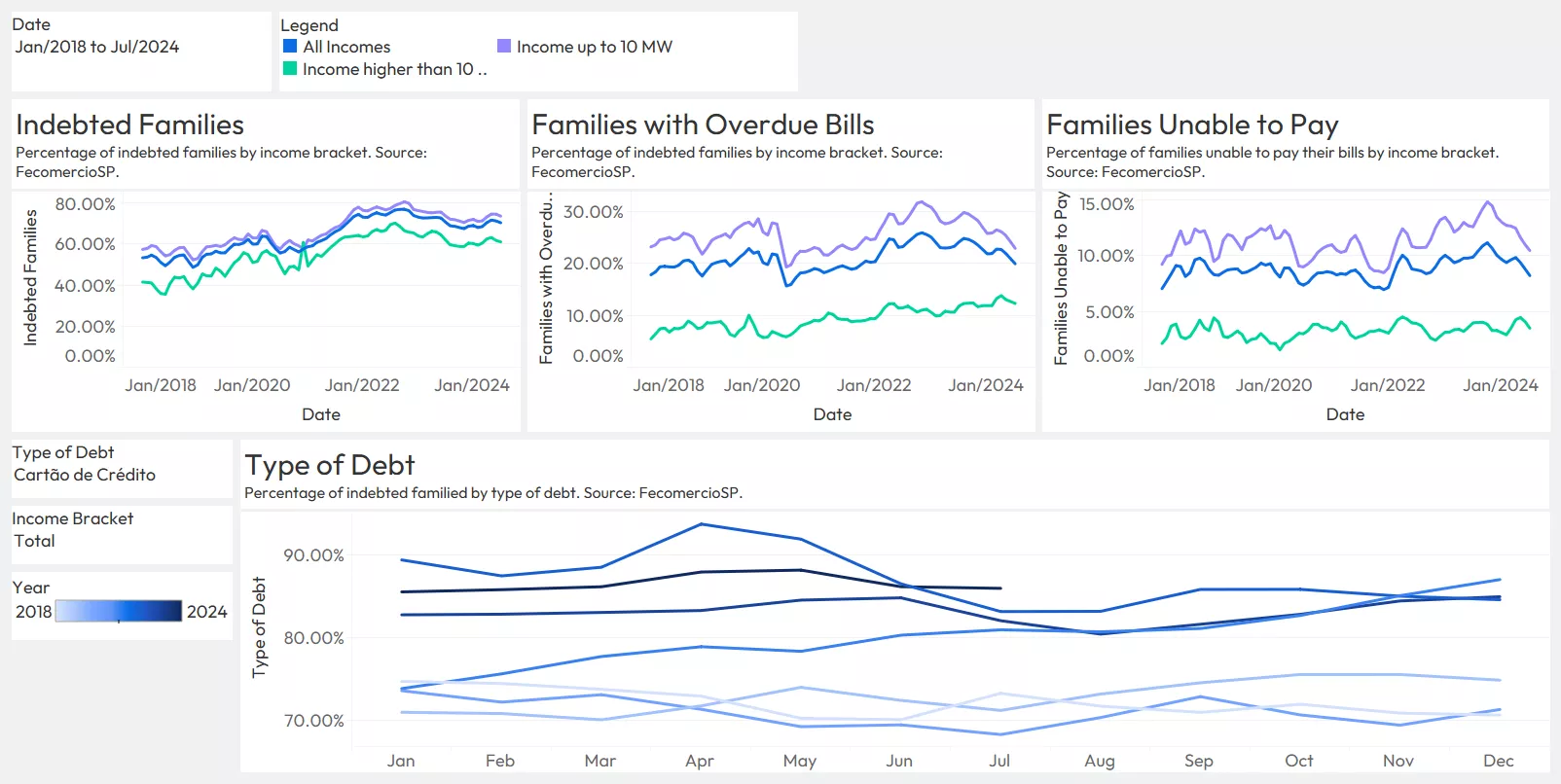

Indebtedness

Regarding indebtedness, there has been a decline in all three categories: indebted families, families with overdue bills, and families unable to pay, especially in the last two categories.

Credit card debt remains the type with the highest percentage of indebtedness, stabilizing around 85% (85.93% in July). Additionally, Unsecured Personal Loans saw a 1.53 pp increase last month, reaching 15.43% in July.

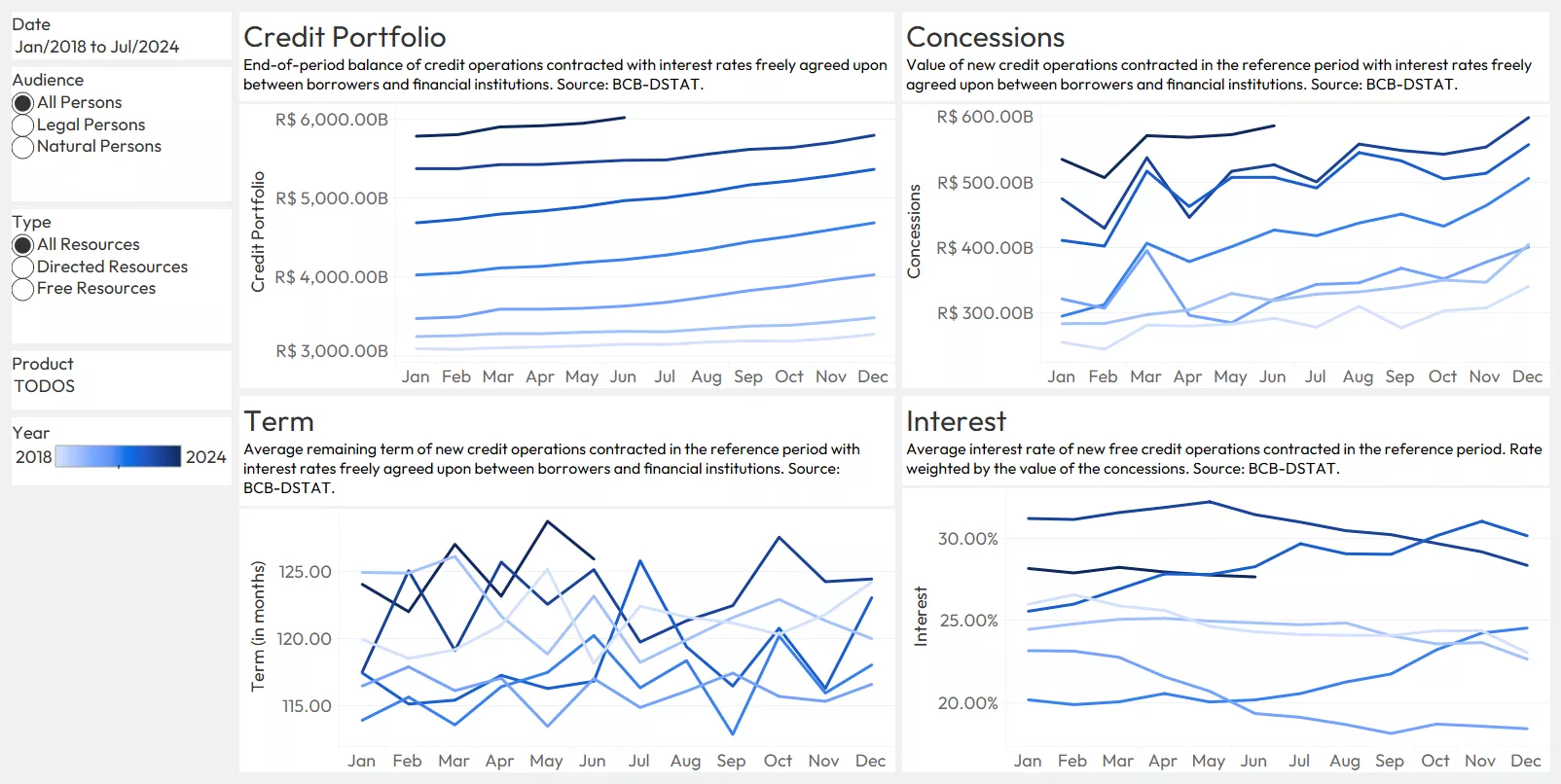

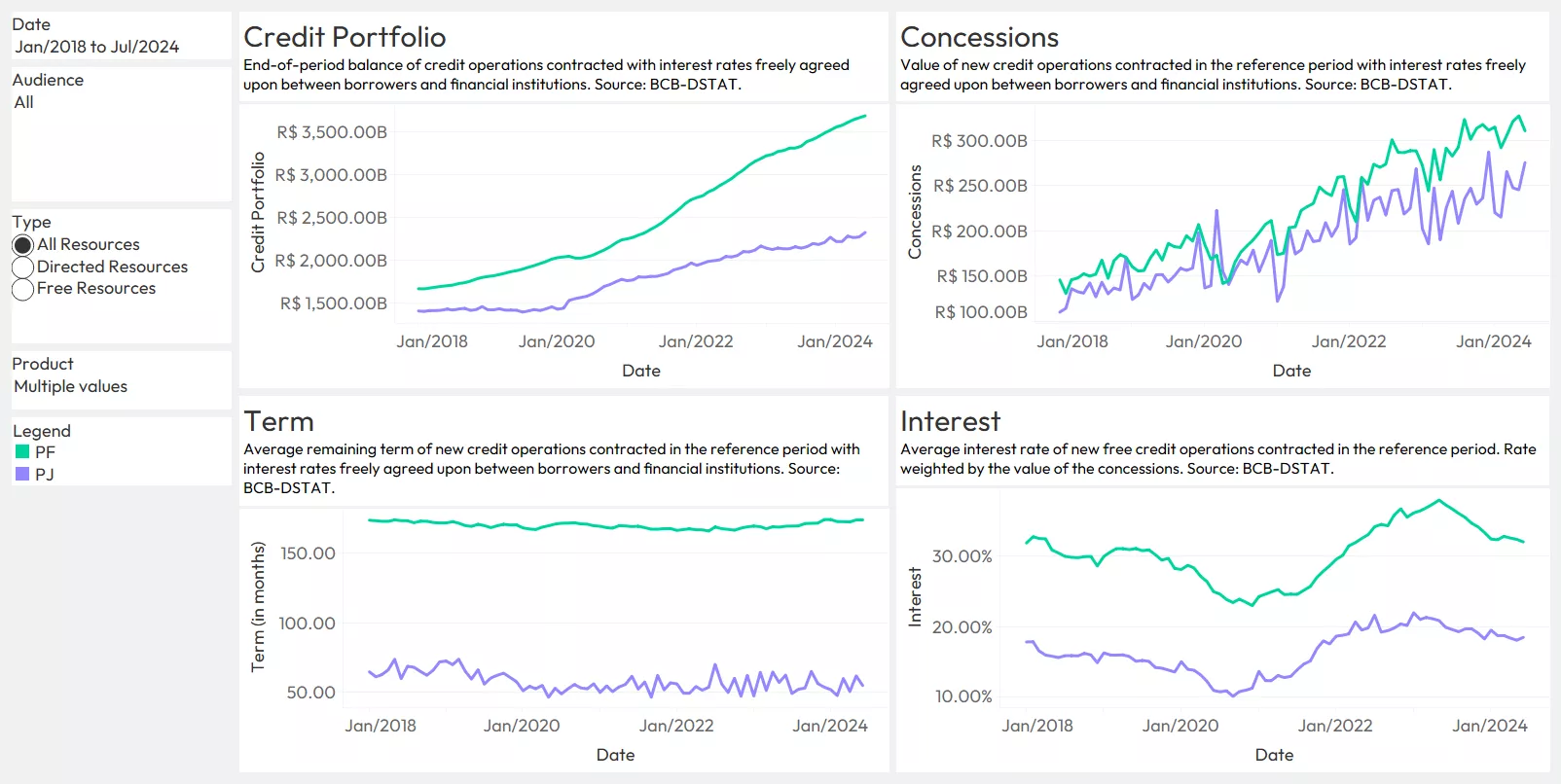

Credit Portfolio

The credit portfolio continues to grow steadily. It reached R$ 6.02 trillion in June, representing a 9.90% increase over the last year. Loan granting totaled R$ 585.92 billion – an 11.3% increase over the same period.

Meanwhile, the credit portfolio for Natural Persons saw a 11.4% increase (R$ 3.69 trillion in June) and granting grew by 9.9% (R$ 310.60 billion in June). For Legal Persons, the portfolio grew by 7.7% (R$ 2.33 trillion in June) and granting increased by 12.9% (R$ 275.32 billion in July).

We highlight the following credit products:

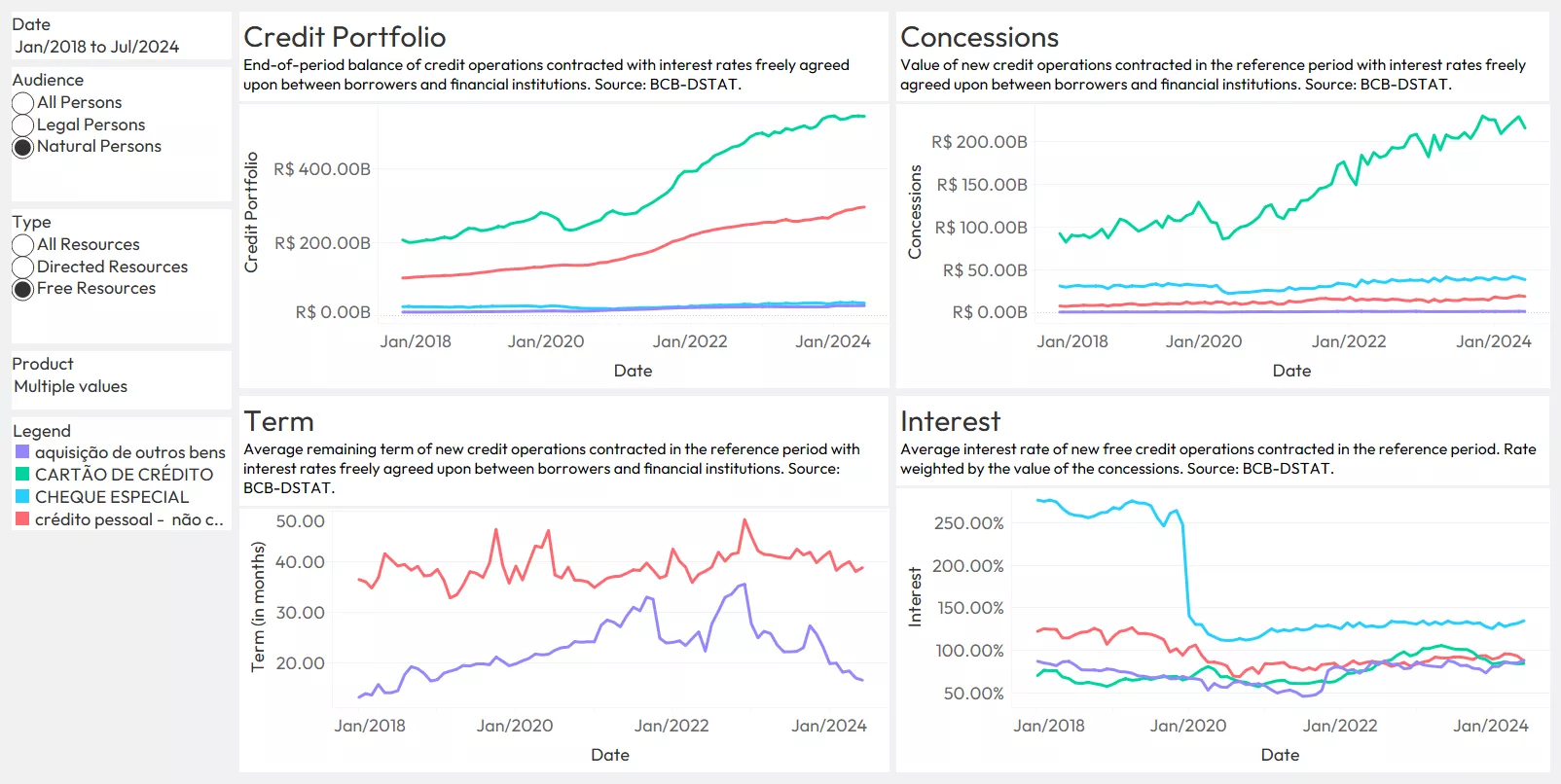

- Credit Cards: Granting decreased (R$ 215.69 billion in June) by 5.8% compared to last month but increased by 5.7% compared to the previous year. Additionally, there was a significant decline in the average interest rate (84.96% in June) compared to the same period last year, down by 18.3%, possibly due to new regulations that limited it. The portfolio (R$ 542.90 billion in June) grew by 7.5% over the past year, reaching a historic high.

- Overdraft: The portfolio (R$ 34.05 billion in June) and granting (R$ 38.34 billion in June) decreased compared to last month – by 3.2% and 5.5%, respectively. Compared to the previous year, the portfolio increased by 4.0%, while granting decreased by 1.6%.

- Acquisition of Other Goods (mostly Installment Loans): Granting (R$ 1.21 billion in June) fell by 4.0% last month but increased by 27.4% over the past year. Additionally, the average term (16.64 months in June) fell by 2.5% last month and by 25.1% compared to the same period last year. The average interest rate (88.79% in June) increased by 3.6% last month. The portfolio remained stable from the beginning of the year, at R$ 27.11 billion in June.

Unsecured Personal Loans: Granting (R$ 18.74 billion in June) decreased by 3.9% last month, with a significant annual increase of 34.2%. The portfolio grew by 15.0% over the past year, reaching R$ 295.73 billion in June.

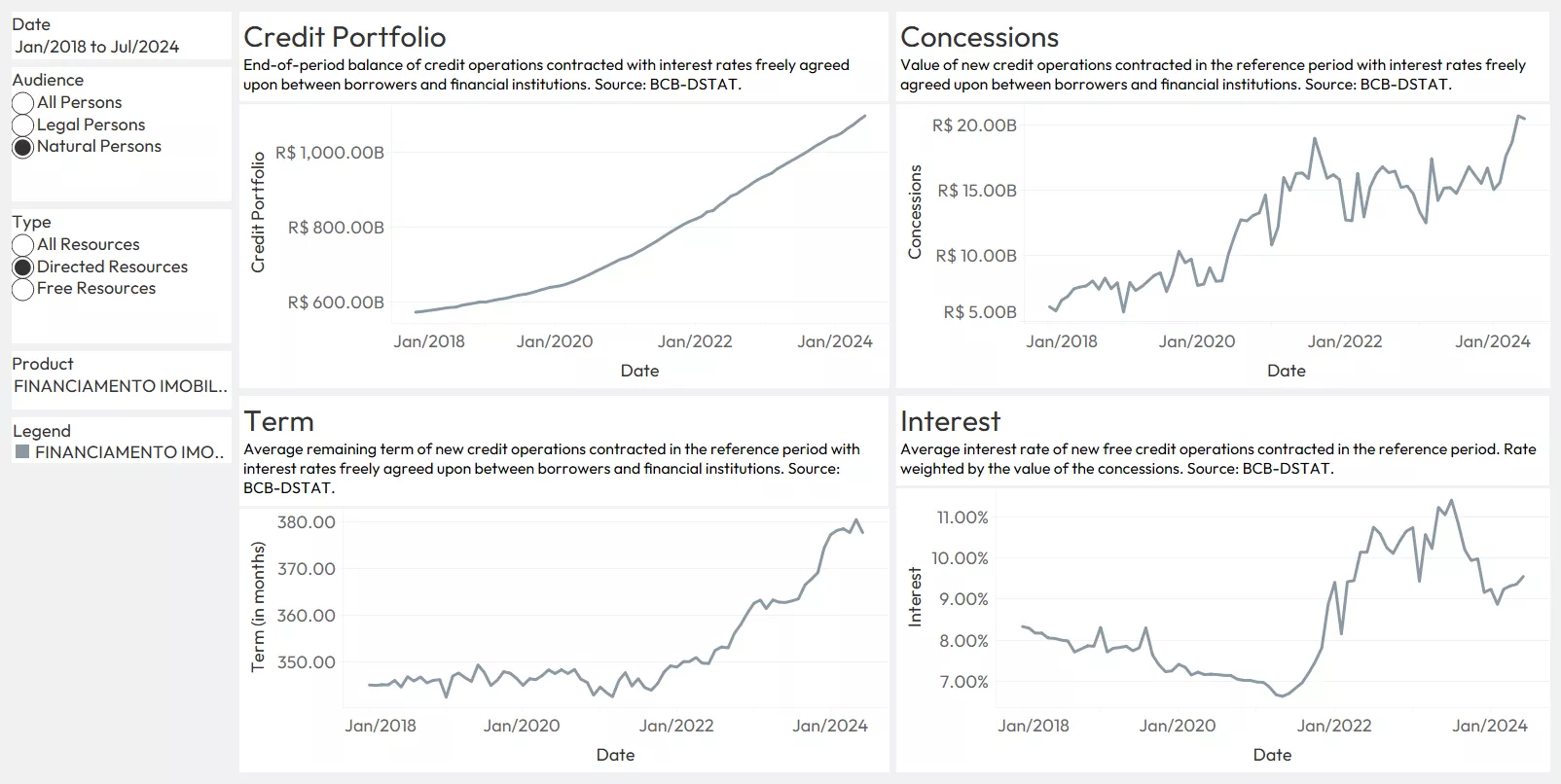

- Real Estate Credit: Granting (R$ 20.47 billion in June) fell by 1.1% compared to last month but increased by 34.7% compared to the same period last year. The portfolio (R$ 1.10 trillion in June) grew by 11.7% over the past year, reaching a historic high. This growth indicates a high level of confidence in the economy, as increases in this product occur when people plan for their future.

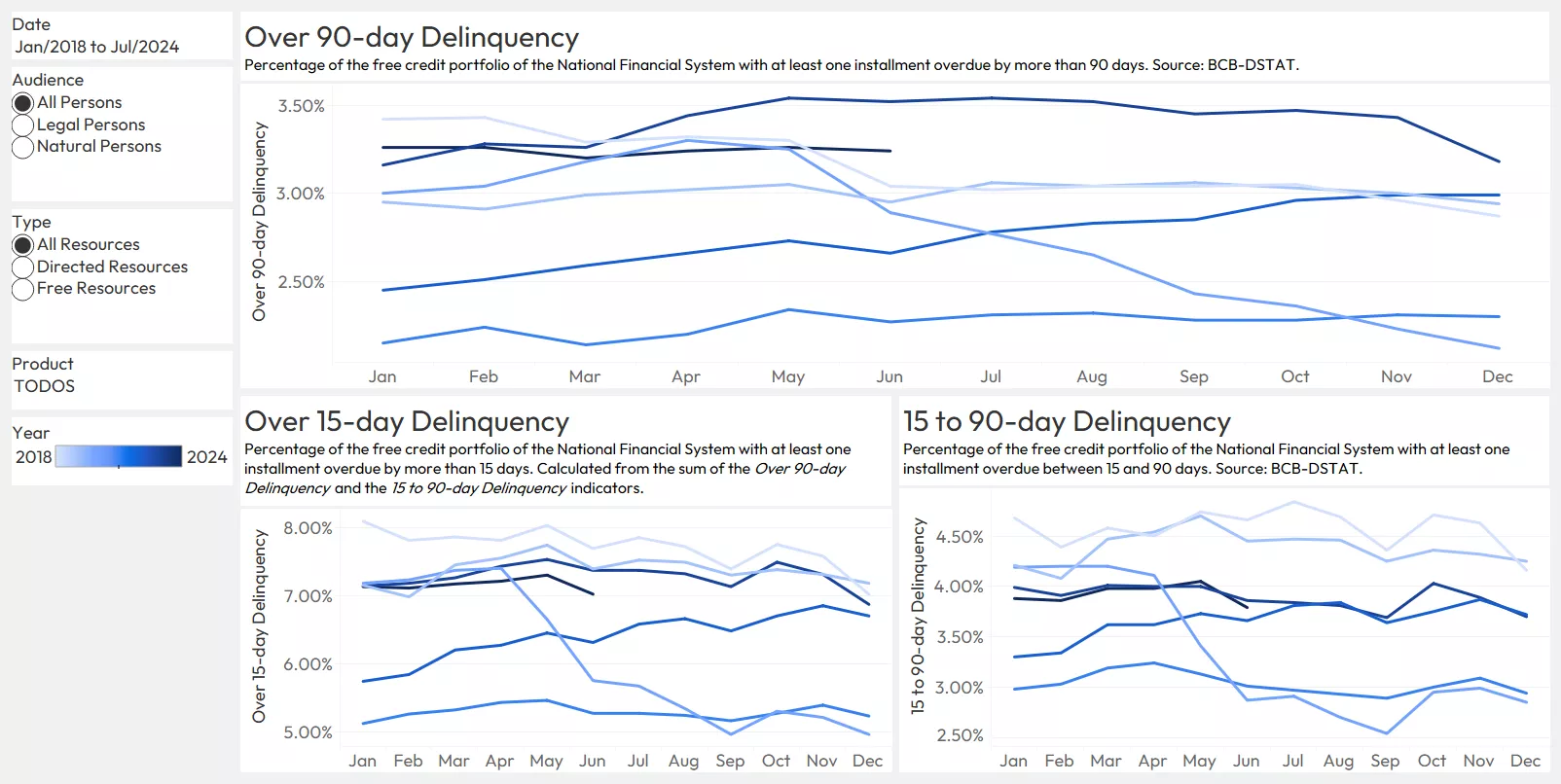

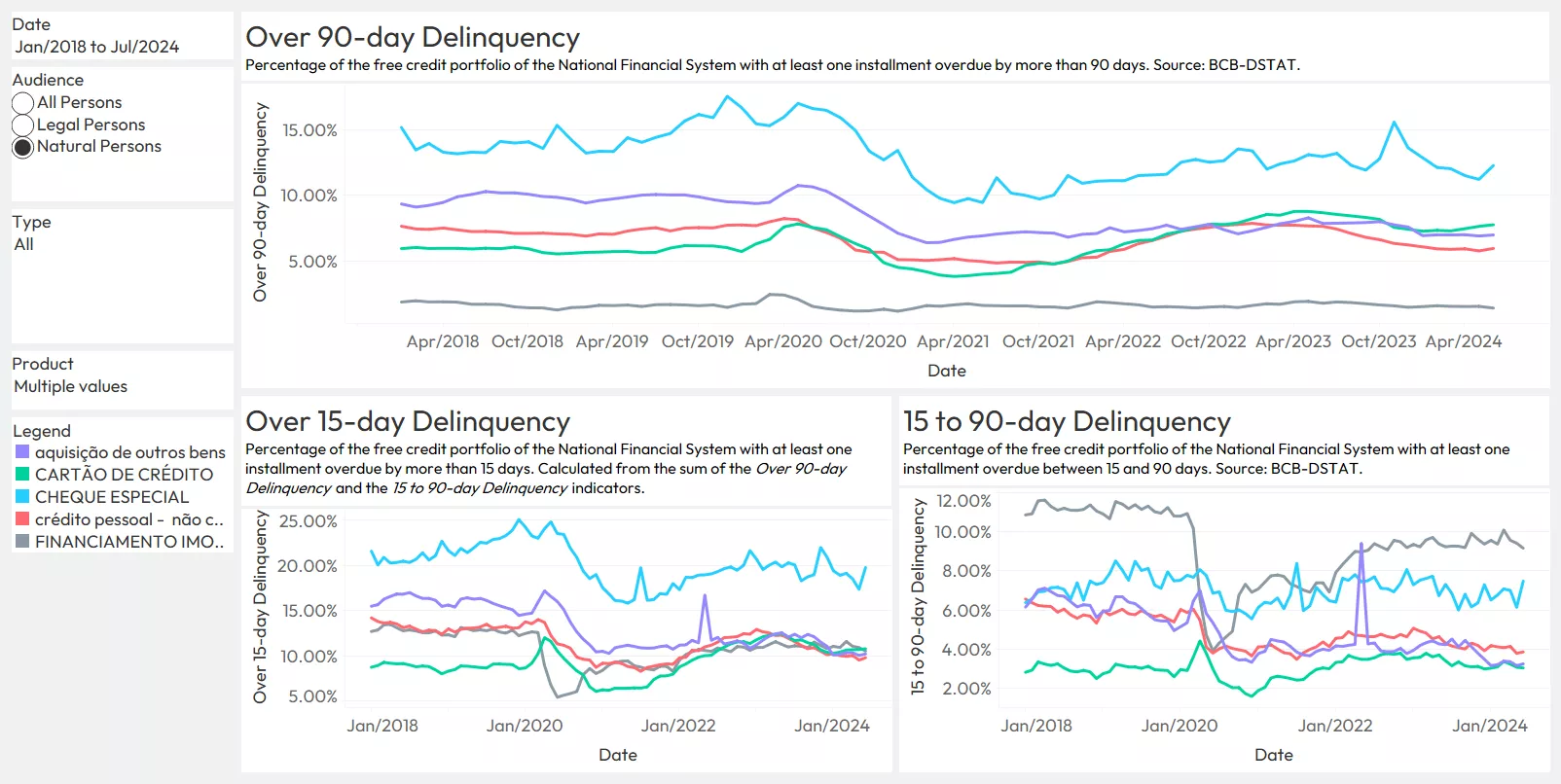

Delinquency

Regarding delinquency, a seasonal increase was observed in May, followed by a decline in June. This decline is mainly seen in Over 15-day Delinquency and 15 to 90-day Delinquency, which reached 7.03% and 3.79%, respectively – decreases of approximately 0.27 pp.

Additionally, significant decreases were observed compared to the same month last year in Over 90-day Delinquency, which reached 3.24% in June, and in Over 15-day Delinquency, by 0.28 pp and 0.35 pp, respectively.

We highlight the following credit products:

- Credit Cards: Annual decreases of about 0.9 pp were observed across all indicators, but monthly increases were seen in Over 90 and Over 15-day Delinquency by an average of 0.1 pp. Over 90-day Delinquency reached 7.75% in June.

- Overdraft: Significant monthly increases in all three indicators (an average of 1.6 pp) were observed. Nonetheless, annual decreases in Over 90 and Over 15-day Delinquency by an average of 0.6 pp were noted. Over 90-day Delinquency registered 12.28% in June.

- Acquisition of Other Goods (mostly Installment Loans): Annual decreases in all three indicators by an average of 1.2 pp were observed. However, compared to the previous month, the opposite trend was seen, with a rise of 0.1 pp. Over 90-day Delinquency reached 6.97%.

- Unsecured Personal Loan: Significant annual decreases in all three indicators by an average of 1.4 pp were noted. However, all three indicators registered a monthly increase of an average of 0.2 pp. Over 90-day Delinquency was 5.94% in June.

- Real Estate Credit: Decreases in all indicators by an average of 0.3 pp were observed annually and monthly. Over 90-day Delinquency was 1.38% in June, reaching its lowest historical value.

Advice

The current labor scenario in Brazil, particularly due to the high Informality Rate, indicates a need for new operational plans and more customized debt negotiations, structured around weekly or bi-weekly payments, centered on the periods of the month when clients are paid. Open Banking can also assist financial institutions in identifying these income periods, allowing consumer profiles to be created based on data from multiple sources.

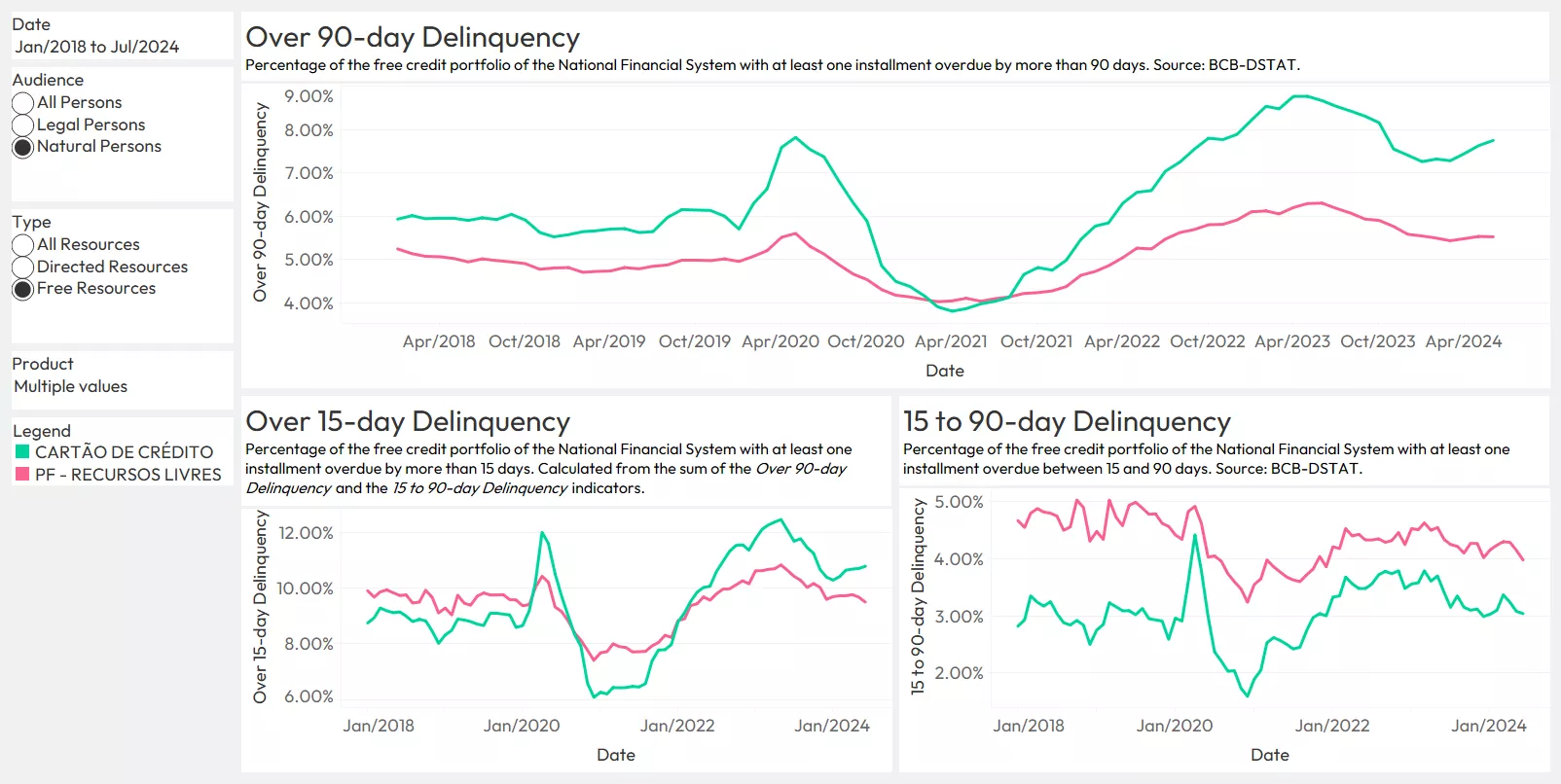

Credit Cards: the new regulation governing the transfer of credit card debt balances is likely to change the market landscape. With this change, institutions should focus on offering more attractive terms to consumers, with lower interest rates, to ensure that this new competitive environment does not result in portfolio losses. Additionally, this change should help reduce credit card delinquency, which is currently rising, approaching its historical peak (see graphs above, comparing credit card rates with Free Resources for Individuals).

Overdrafts: this product has very high delinquency rates and a decline in both the portfolio and granting. Therefore, financial institutions with other similar products, such as credit cards, may choose to offer these products instead of Overdrafts.

Unsecured Personal Loans and Installment Loans: these products are on the rise, representing good investment opportunities. Generally, they showed an increase in granting and average interest rates over the past year, along with a decline in delinquency and average terms, indicating an ideal scenario for healthy growth.

Credit Portfolio for Legal Persons: this also presents a good investment opportunity, combined with proper risk management. This is due to the increase in bankruptcy filings for Legal Persons, especially Micro, Small, and Medium Enterprises (MSMEs) – according to Serasa Experian Brazil, this increase was 71.0% in the first half of the year. Despite this, this segment shows a historic high in both the credit portfolio and granting, with a notable growth rate, particularly for Invoice Advances.

Disclaimer

These recommendations are based on data analysis and the experience of our consulting team. They represent a specific view of the team and do not necessarily reflect FICO's views, nor do they assume responsibility for any results from applying these suggestions.

Summary

Based on official data, we observe a predominantly positive scenario for credit and risk in Brazil, along with their evolution trends. Despite the rising inflation trend, an increase in GDP and its relationship with the credit portfolio was observed, along with a reduction in indebtedness. Employment remains stable, given the continued decline in the Unemployment Rate. However, the country’s high Informality Rate requires attention and special actions.

The credit portfolio and granting also registered increases over the past year, which, combined with a decline in delinquency, ensures a fertile ground for credit development opportunities, particularly for Credit Cards, Installment Loans, Unsecured Personal Loans, and credit portfolios for Legal Persons. Another significant product is Real Estate Credit, which also showed growth, representing society's confidence in building their future.

The new regulation governing the transfer of credit card debt balances is also expected to change the market landscape, directing financial institutions to offer more attractive offerings with lower interest rates, ensuring that this competitive environment does not result in credit portfolio losses.

Furthermore, the high Informality Rate requires a customized negotiation context, with credit plans structured around weekly or bi-weekly payments, centered on periods of the month when consumers earn their income. Open Banking can be effectively combined with this approach, helping to identify income periods and profile customer behavior, based not only on their data but also on those from other institutions.

In summary, the country presents a favorable scenario for credit development. However, actions must be client-centered and consider each economic, credit, and delinquency context to mitigate potential risks.

How FICO Can Help You Manage Credit Risk

- Explore our solutions for customer management

- Check out more details and other indicators in FICO Risk Trends, and follow the next releases to follow the evolution of the national credit and risk landscape

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.