European Risk Managers Say Increased Lending Will Take Precedence Over Regulatory Efforts in 2014

Regulatory compliance and raising capital have been at the top of risk managers’ To Do lists for years. Our latest survey of European risk managers shows that is starting to change…

Regulatory compliance and raising capital have been at the top of risk managers’ To Do lists for years. Our latest survey of European risk managers shows that is starting to change — bankers now say increasing lending will be a greater priority this year.

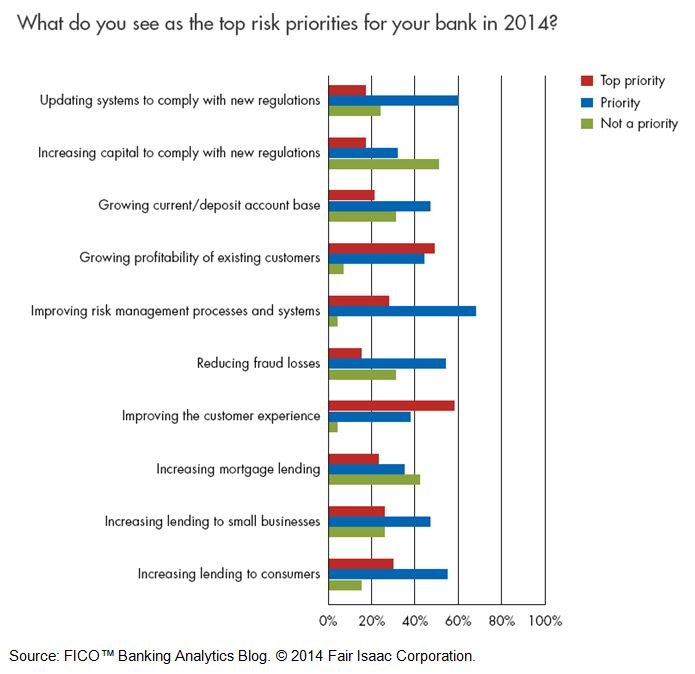

New lending to consumers is a 2014 priority for 85% of our respondents and new lending to SMEs is a priority for 73%. At the very top of the list of risk management priorities were improving risk management processes and systems, improving the customer experience and growing the profitability of existing customers. These were also the top priorities for risk managers in the U.S. and Canada, according to a similar survey by FICO and PRMIA released today.

Mobile technologies will play a significant role in not only attracting high-quality customers, but also in creating engaged customers who demand a multichannel environment. A recent Gallup survey of 3.000 bank customers revealed that customers were using more than 750 unique combinations of contact channels to meet their banking needs. Yes, mobile communications is here to stay, but it forms just part of the answer to engaging with customers more productively.

For the full results of our survey, including breakdowns of the UK, Germany and Central and Eastern Europe, download the report.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.