The Future Belongs to the Intelligent Enterprise

At FICO World, we revealed how FICO Platform turns vision into action, enabling the Intelligent Enterprise of tomorrow, today

At FICO World 2025, I delivered a message that couldn’t be more timely: the businesses that will define the next decade aren’t just digitized, they’re intelligent.

In today’s rapidly evolving financial landscape, staying competitive demands more than technology alone. It requires a fundamental shift in how organizations operate, how they harness data, how they respond to customers, and how they make decisions. Institutions are continuously searching for ways to stay ahead, harnessing technology to drive innovation, efficiency, and customer satisfaction.

This is where the "Intelligent Enterprise" comes into play—a framework that empowers organizations to utilize cutting-edge technologies like artificial intelligence (AI), machine learning, and advanced analytics to unleash the full potential of their assets, whether operational, informational, or human.

An Intelligent Enterprise is more than just a buzzword. It is a model to allow you to make faster smarter decisions. It allows you to optimize every process and every interaction. And it delivers hyper-personalized experiences that meet and anticipate customer expectations.

Customer demands have changed faster than most systems and strategies can keep up. Real-time, connected, intelligent engagement is no longer a luxury. It is the cost of staying in the game.

That’s why we have continued to evolve FICO Platform. To help you not just adapt to this new reality, but define it.

What Is an Intelligent Enterprise?

An Intelligent Enterprise is not merely a technological aspiration; it is a paradigm shift in how organizations operate.

It is an enterprise that integrates AI, machine learning and advanced analytics into the core processes, companies can harness the power of their data and assets to address challenges, seize opportunities, and innovate at an unprecedented scale. It doesn’t just automate. It anticipates. It adapts in real time. It delivers the right decisions, through the right channels, at the right moment, every time.

The Intelligent Enterprise enables institutions to make best-in-class decisions, optimize your operations, drive innovation in your organizations, and allow you to deliver hyper-personalized customer experiences that you need. At its heart, an Intelligent Enterprise is:

- Data-driven: transforming raw data into real-time, context-aware decisions

- Customer-centric: Delivering true 1:1 personalization at scale

- Agile: reacting quickly, predicting, and acting ahead of the curve

- Outcome-oriented: driving growth, improving margins, and managing risk

- Connected: breaking down silos across teams, channels, and systems to deliver a unified experience at scale

Why You Need Intelligent Enterprises Today

Your customers aren’t waiting. And neither is the market.

The financial services sector is uniquely positioned to benefit from this transformative model. In an industry so heavily reliant on data, the Intelligent Enterprise allows institutions to proactively navigate challenges such as regulatory compliance, fraud, customer acquisition, and retention.

This is critical because financial services customers today demand much greater personalization, of the kind offered by the leading consumer brands.

Beyond customer-focused benefits, the operational advantages are equally compelling. Intelligent Enterprises in financial services can streamline workflows, reduce inefficiencies, and improve resource allocation, ensuring smooth operations even in the face of external disruptions.

The Intelligent Enterprise also enables organizations to take advantage of the rapid advances in AI. AI isn’t emerging; it’s embedded in everyday life, shaping interactions, recommendations, and experiences at every turn.

Today’s consumers have more power and control than ever before. They no longer need to stay loyal to one institution. Instead, they're empowered by AI-powered tools that act as their personal financial agents. These tools aren’t just making recommendations—they’re actively managing financial relationships on behalf of consumers, making decisions in real-time to optimize outcomes.

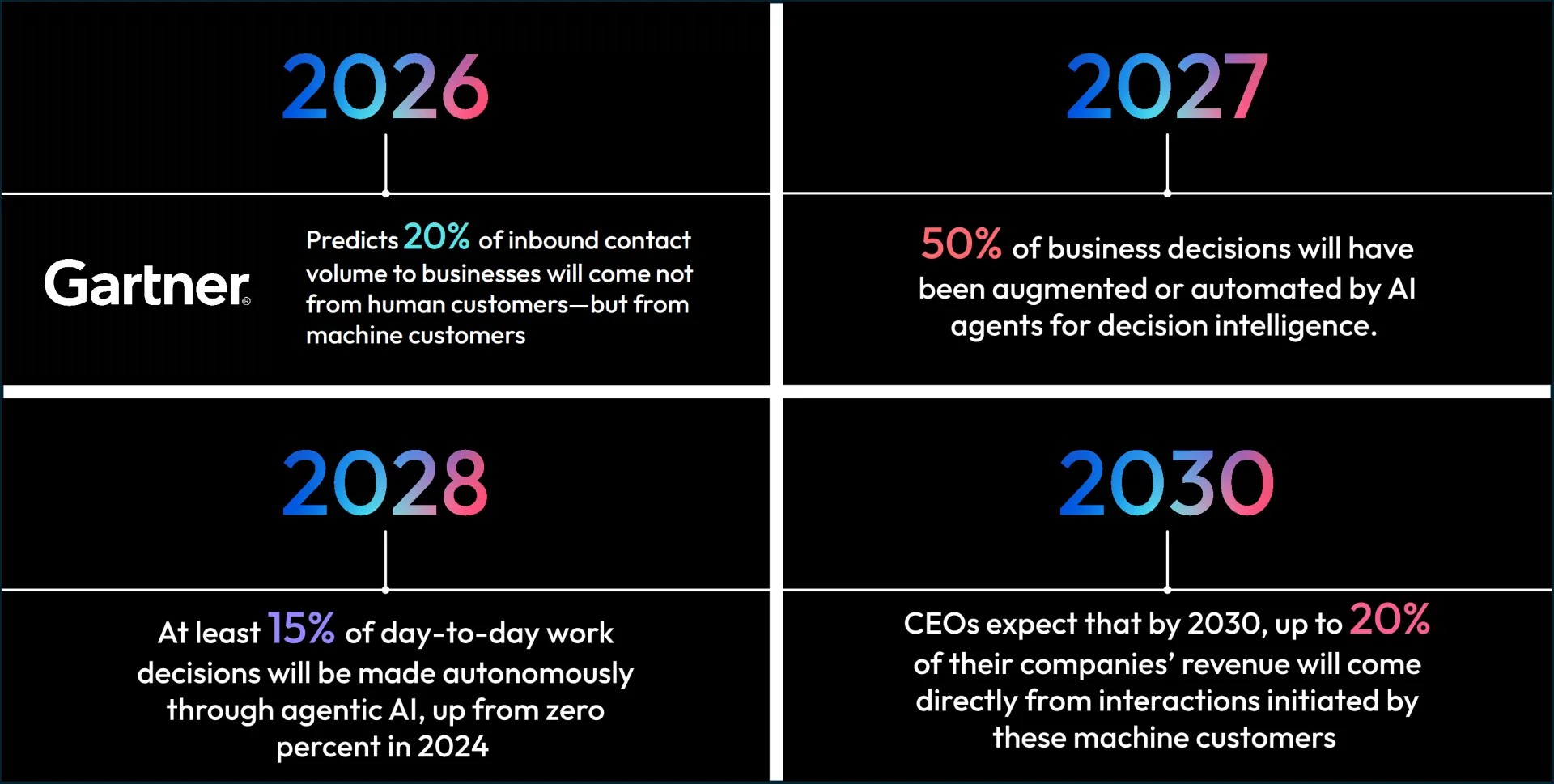

Look at these stats from Gartner:

Consumers are no longer the only customers you need to serve. AI-powered agents acting on their behalf are rapidly becoming your customers as well. If your institution isn’t ready for this shift, if it doesn’t have an agentic platform architecture one that is built to deliver the personalization, speed, interoperability, and intelligence these agents demand—they’ll move on. And they’ll take your human customer with them. In this new era, understanding and engaging both consumers and their intelligent agents isn’t optional, It is essential for growth and survival.

FICO Platform: Enabling Intelligent Enterprises

Our mission at FICO is simple: to power your Intelligent Enterprise. This is why we created FICO Platform—the only applied intelligence platform purpose-built to help you turn data into decisions, and decisions into outcomes. It brings together AI, machine learning, and advanced analytics, automation, and simulation so you can move faster, act smarter, and lead with confidence. FICO Platform serves as a cornerstone for financial institutions aiming to transition into Intelligent Enterprises.

But FICO’s offerings don’t stop at foundational capabilities. At FICO World, we announced key innovations that take this even further. Because in order to succeed in today’s market, you need a Customer Intelligence Hub—a dynamic, real-time system that continuously learns, adapts, and informs every decision across your business. It’s way more than having a 360-degree view of your consumers. It is about having a living, breathing intelligence engine that evolves with every customer interaction. Every model, rule, signal, and strategy feeds into it so that every part of your organization can act on it. It allows you to move from personalization to prediction. From disconnected systems to persistent customer engagement and from siloed decisioning to strategic agility.

To make the Intelligent Enterprise real, we’ve evolved FICO Platform with bold new capabilities designed to break silos, accelerate innovation, and unlock exponential value:

Composability

Composability is at the heart of FICO Platform. We’ve broken down our architecture even more into modular, interoperable assets that can be reused, reassembled, and redeployed across any number of use cases.

That means you don’t start from scratch every time you tackle a new initiative. Every decisioning asset you create builds a compounding advantage. Making the initiative exponentially faster to deploy, easier to manage, and more valuable from day one.

It goes beyond optimizing for today’s use case. You’re building a strategic capability that can be extended across credit, risk, fraud, marketing, collections, and beyond. It’s about a platform that scales with you.

Introducing FICO Marketplace

FICO® Marketplace is a groundbreaking new digital hub that empowers FICO Platform customers, partners, developers and an ever-expanding ecosystem of innovators to discover, share and instantly deploy decision assets. Initially decision assets will focus on third-party data, then expand to AI models, analytics tools, decision strategies, and pre-built solutions that can fast-track FICO Platform customers journey to becoming an intelligent enterprise by:

- Compressing the time to integrate a new data source down from months to hours

- Accessing a trusted place to innovate and co-create highly differentiated AI-powered experiences all without leaving FICO platform

- Breaking down organizational silos and supercharging collaboration with shareable and reusable assets for any team or department - enabling business agility and adaptability

- Unleashing innovation at scale

FICO Marketplace fundamentally re-architects the way in which FICO Platforms customers drive tangible business results in new ways and faster than ever before – simplifying the adoption of advanced technologies and ushering in a new era of the intelligent enterprise.

Check out the new Marketplace and early access providers here: https://marketplace.fico.com/

Fraud Management

Fraud remains one of the most pressing challenges facing financial services, and FICO has made significant strides in addressing this issue with its advanced fraud management solutions. FICO Falcon Fraud Manager has long set the standard for fraud prevention, protecting billions of transactions with advanced analytics and AI-powered decisioning. But fraud is no longer just a risk to mitigate. It’s a strategic opportunity to understand your customers more deeply.

By bringing Falcon’s fraud detection capabilities into FICO Platform, we’re enabling fraud signals to become enterprise signals. A suspicious transaction isn’t just a potential threat, it’s a window into real-life context.

When fraud insights are fully integrated and reusable across use cases, they help build a richer, more complete customer profile—enhancing not just protection, but personalization, trust, and relevance. Fraud now becomes a part of your customer intelligence hub, helping you spot behavior patterns, detect life events, and better anticipate customer needs in real time.

For an Intelligent Enterprise, effective fraud management is not just about preventing losses—it’s about enabling trust and reliability, ensuring customers feel secure in their financial interactions. FICO’s fraud management capabilities play an essential role in maintaining this trust, reinforcing the institution’s reputation and reliability.

Decision Agents and the Future of Agentic AI

There is a lot of hype around AI right now. But at FICO, we believe it’s not just about having AI. It’s about having AI that works for you. Two years ago we started the work to re-architect FICO Platform and make it enabled for decision agents, and we are very pleased with the progress here. Unlike traditional AI systems, agentic systems can lean and adapt autonomously, providing actionable insights without requiring constant human intervention.

Our innovation with decision agents empowers financial institutions to create systems that are not only intelligent but also proactive. From predictive models that anticipate market changes to automated decision-making processes, decision agents empower businesses to act swiftly and strategically, embodying the essence of an Intelligent Enterprise.

And while others chase headlines, at FICO we have always held one principle sacred: Whether we are building traditional AI or language models like LLMs, every model we develop must be trustworthy, ethical, and explainable.

The Future Starts Now

In a world where agility, innovation, and efficiency are paramount, the Intelligent Enterprise stands out as a transformative model for financial services. By leveraging technology to harness the power of data, organizations can optimize operations, deliver personalized customer experiences, and drive profitability.

At FICO, we believe the path to transformation doesn’t lie in chasing trends but in building the right foundation. That’s what the Intelligent Enterprise is all about: using data, AI, and decision intelligence to deliver lasting competitive advantage.

With the evolution of FICO Platform, we’re helping organizations do more than keep up. We’re helping them lead. Whether it’s embedding trust into every AI model, turning fraud detection into customer insight, or enabling real-time decisioning at scale, we’re focused on what drives impact.

The future of decisioning is connected, composable, and intelligent. It’s built on a platform that learns, adapts, and acts.

As businesses continue to embrace this model, one thing is clear: the Intelligent Enterprise is the future of financial services. And that future starts now.

How FICO Can Help You Build Your Intelligent Enterprise

- Explore FICO Platform

- Discover the new FICO Marketplace

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.