The Maslow's Hierarchy of Digital Transformation: 5 Levels

Just as very few people achieve “self-actualization” in life, not many companies achieve full digital transformation; here are the stages to help map your journey to the top

Business leaders frequently ask, “How much does it cost to achieve digital transformation?” It’s a fair question. Unfortunately, the answer is – just like you can’t buy love, health, or happiness – companies can’t “buy” digital transformation: it’s the result of a methodical, multi-tiered process of continuous improvement. In other words, it’s a journey, and that means there are some guideposts to navigate.

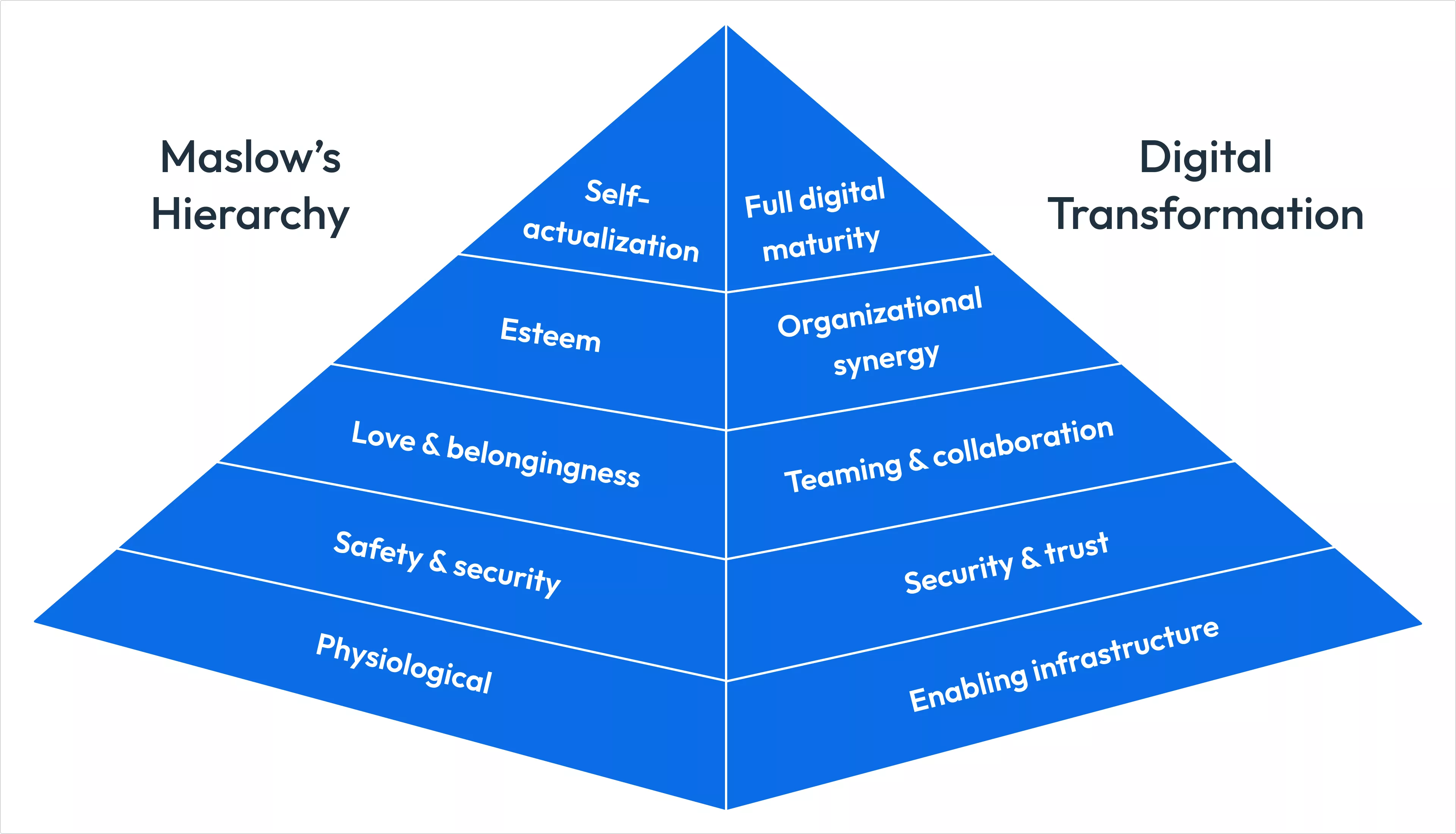

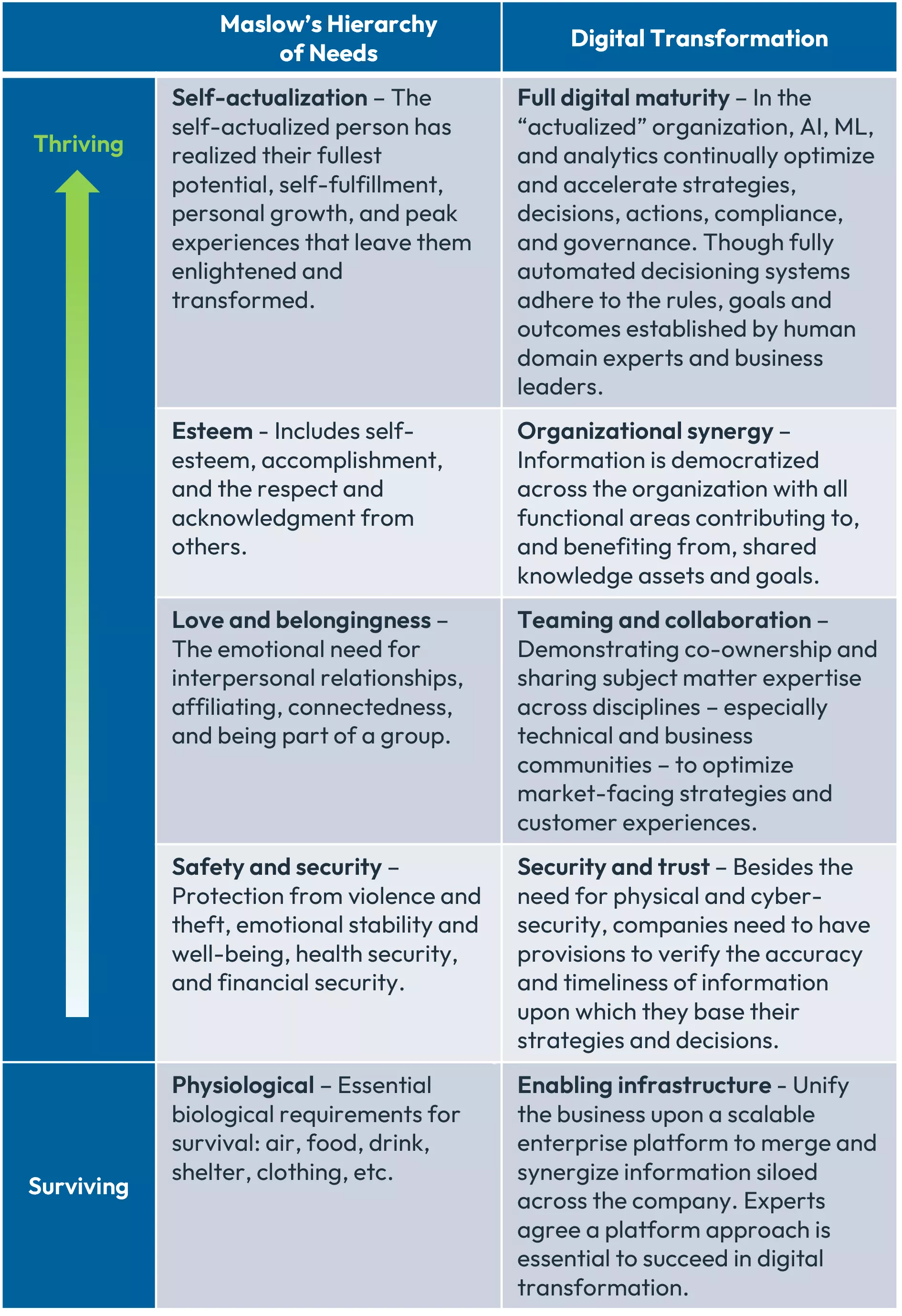

It’s not unlike Maslow’s Hierarchy of Needs. Anyone who’s ever taken a psychology course is familiar with Abraham Maslow and his famous five-level pyramid: the peak of performance is “self-actualization,” which represents your fullest potential – a rare and difficult state to unlock.

Maslow’s Hierarchy is a fitting metaphor for attaining your digital transformation: 91% of companies –virtually all financial institutions and most insurers, telcos, retailers, and leaders in other industries -- have a digital transformation strategy in place. But very few claim to have actualized their digital transformation potential: they get stuck somewhere along the way to the top due to the complexity of digital banking and insurance. Think about it this way:

In either case, failure to reach the top of the pyramid is the result of not mastering lower-level stages along the way. Just as you can’t achieve self-actualization if you lack safety and security, financial institutions and insurers can’t achieve digital transformation if employees can’t collaborate, build synergy, and make customer experiences their shared top priority for compelling digital banking and insurance strategies. This stumbling block is why fintech and insurtech upstarts are thriving.

From “Digital Transformation” to “Digital Actualization”

In the case of digital transformation, financial services and insurance companies must start at the bottom level and solidify their capabilities before they can graduate to the next level. And they can’t buy their way there: IDC projected that companies would invest $10 trillion in digital transformation through 2025, but the composite estimate from McKinsey, Boston Consulting Group , KPMG and Bain & Company found that just 18% would achieve their digital transformation goals.

The end goals of digital transformation in the banking industry are to increase revenue and improve efficiency ratio in banking (and increase revenue and improve combined ratio in insurance.) This occurs when they succeed in creating a customer-centric culture that aligns people, processes, and technology from across the enterprise, and focuses them on the common goal: creating compelling, hyper-personalized customer experiences that draw upon the organization’s full portfolio.

When achieved, this shared applied knowledge is often called an “enterprise intelligence network,” the business equivalent of self-actualization. If you are new to the concept of an enterprise intelligence network in the context of digital transformation, here’s what each of those terms mean:

- Enterprise: All information across your organization and beyond is synergized and mobilized for customer-centric action in real-time, wherever, whenever, and however it is needed.

- Intelligence: Artificial Intelligence, machine learning, analytics, and business knowledge contextualize, optimize, and memorialize every shred of data, resulting in iteratively smarter, personalized customer decisions.

- Network: At every node of interaction between everyone from internal employees to all of your customer touchpoint across all channels, ensuring pre-validated next-best-actions are standing by to ensure delightful user experiences, increased satisfaction, better retention, and a higher share-of-wallet.

Thus, an enterprise intelligence network empowers financial services and insurance firms to make ever-smarter, ever-faster, and ever more-profitable business decisions, wherever and whenever data can be leveraged to gain sustained competitive advantage… the ultimate goal of digital transformation.

It empowers those in financial services and insurance firms to predict, analyze, and optimize customer interactions; giving them the ability to make better customer decisions in real-time, leveraging data from across the enterprise using advanced analytics, decision modeling, and AI… all working synergistically in an open and extensible platform to simultaneously transform the customer experience and advance the company’s goal of accelerating time-to-value in digital banking and insurance in a manner that fintech and insuretech competitors cannot.

Done in proper sequence, the steps described above provide a good course heading for those responsible for planning their company’s digital transformation strategy in the banking industry or insurance. Each company’s starting point, journey, and finish line is as unique as a fingerprint… but with planning and persistence, every company has a path to the apex.

And getting there will do wonders for your self-actualization.

Learn How FICO Platform Can Power Your Digital Transformation

- Explore innovation with FICO Platform

- Watch the video “FICO® Platform: Applied Intelligence, when and where it matters”

- Read the whitepaper “FICO® Enterprise Intelligence Network: Redefining the next generation of applied intelligence”

- See customers discuss their use of FICO Platform

- Read the article from The Journal of Digital Banking, “How Financial Services Leaders Are Using Enterprise Intelligence to Optimize Efficiency Ratios”

- Watch FICO Platform in action with the story of your everyday consumer, Digital Jane

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10 T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10 T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.