New Technology Can Detect & Prevent Scams in Real Time

Protect your customers and prevent fraud losses from various types of scams using intelligent intervention

Battling Sophisticated Scam Threats in a Digital World

Fraudsters are continually using advanced digital tactics to deceive and manipulate customers. With the rise of Authorized Push Payment (APP) fraud worldwide contributing to more than $1 trillion in losses in 2024, customers expect strong security measures and protections from their financial institutions. This includes effective engagement strategies to mitigate losses and protect against scams. Implementing proactive, real-time fraud detection and personalized communications is essential to protecting customers from financial crime and maintaining trust.

Globally, 65% of consumers believe banks should be required to reimburse scam victims for their losses always (34%) or most of the time (31%). In response, regulations requiring banks to reimburse consumers who have fallen victim to an APP scam are gaining traction. In the United Kingdom, the sending and receiving financial institutions already share the cost — up to £85,000 — of reimbursing the victim of APP fraud.

To stay ahead, vigilance is essential. This involves the ability to rapidly interpret consumer actions in real-time, analyze behavior in context with historical patterns, and incorporate insights from new data sources, providing additional intelligence to make better decisions. Scam prevention may require strong actions like blocking payments and transactions and / or manual interventions in addition to contacting the customer.

Proactive Scam Detection & Real-Time Intervention

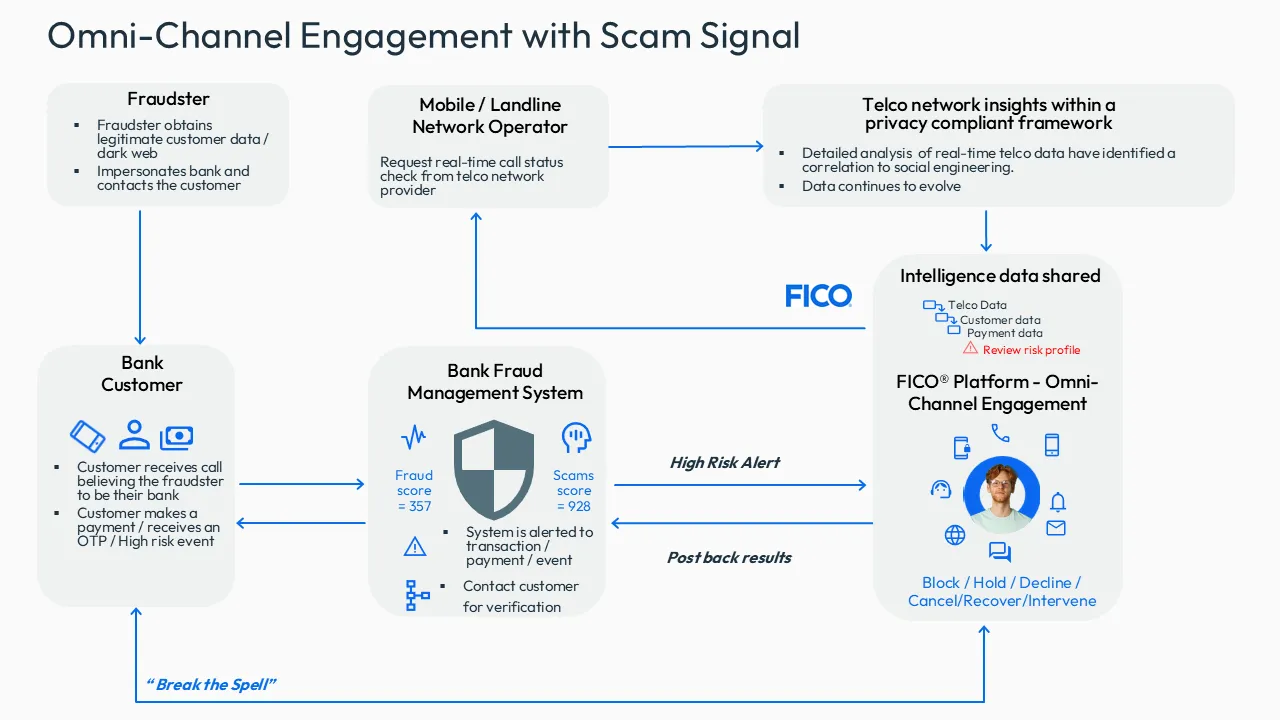

Proactive scam detection requires real-time intervention that enhances fraud prevention and protects sensitive information. Using advanced analysis of real-time telco network data, customer and payment information and /or high-risk customer processes during live transactions, proactive and real-time solutions can intelligently detect scenarios where a customer may be being coached through security or manipulated into making a payment during a phone conversation. Effective real-time intervention could include blocking a payment, disabling the online service, or contacting the customer for more information.

Obtaining additional intelligence indicative of a scam brings future-proofed investment for enterprise omni-channel engagement across the entire customer lifecycle. That means:

- Customer protection and fraud loss prevention: Perform real-time APP scam detection and prevention to stop scammers.

- Smart messaging strategies: Automate intervention strategies based on your risk tolerance and fraud policies, from blocking the payment to securing the account to to contacting the customer.

- Scaling your best agents: Simultaneously conduct any number of individualized dialogues with the efficiency, courtesy, and compliance of your best agents.

- Any channel, any time: Let consumers interact 24x7 through their chosen channel.

Scam Signal: Protection Features & Evaluation Checklist

When evaluating solutions, organizations should zero in on features that provide future-proofed value:

| FEATURE | QUESTIONS TO ASK |

| Real-time behavioral analysis |

|

| Customer and payment data integration |

|

| Omni-channel engagement integration |

|

| Intelligent intervention |

|

| Multiproduct coverage |

|

| Regulatory compliance |

|

| Audit capabilities |

|

Datos Insights Awards: Scam Protection Winners & Losers

In the fight against the growing problem of scams, FICO and Jersey Telecom (JT) have produced a powerful innovation, which has won another award from Datos Insights, a global advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to the financial services industry.

In August 2025, Datos Insights again recognized FICO and JT as the repeat winners of the Silver Medal for the 2025 Impact Awards in Fraud for Best Scam and APP (Authorized Push Payment) Fraud Prevention Innovation solution for credit and debit transactions. FICO and JT also won silver for the same award in 2024 for Scam Signal, specifically related to real-time payments.

Datos Insights uses these criteria to evaluate fraud scam solutions:

- Level of innovation

- Competitive advantage assessment

- Impact on customer experience

- Impact on operational efficiency

- Market needs assessment

- Financial crime risk mitigation

- Integration and scalability

- Future roadmap

For the full report, visit: https://datos-insights.com/reports/the-2025-impact-awards-in-fraud/

Key UK Results for Scam Signal

The report details how bank customers have expressed gratitude for the increased protection, with front-line colleagues reporting success in preventing cryptocurrency scams and providing education around investment fraud. Early implementations of Scam Signal have delivered substantial improvements in fraud detection and prevention:

- Rapid deployment success: A UK high street bank, the first to implement the solution globally, cut its proof-of-value engagement from the typical six to 18 weeks to just two weeks due to favorable results, going fully live in December 2024. The bank identified nine social engineering victims on the first day after full implementation, demonstrating the solution’s immediate effectiveness.

- Operational improvements: A bank that recently implemented FICO’s Omni-Channel Engagement capability saw an 8% increase in resolution rates, 50% reduction in inbound call activity, 15% reduction in net loss per case, 24% reduction in customer time to respond, and 600% fewer complaints compared to previous methods.

- Fraud loss reduction: At the implementing bank, the solution is forecast to reduce total debit card and credit card fraud losses between 6% to 10% per year while providing positive customer impact through increased protection.

- Detection accuracy: The highly predictive nature of Scam Signal when used with customer and payment data improves detection rates while avoiding false positives, reducing friction in legitimate payment processes.

- Industry recognition: Scam Signal has been recognized and awarded internationally, and was recently featured in a “Breaking New Ground” webinar by the GSMA in March 2025.

The solution’s success has led to expansion plans across multiple channels within several implementing banks throughout 2025, with geographic expansion planned across 15 additional priority countries.

Scams are a global issue. FICO, JT and GSMA plan to expand this service to additional countries to provide enhanced protection through intelligent decisioning for clients and their customers.

Scam Signal: How It Works

Scam Signal operates through a complex integration of telephony intelligence, customer data analysis, and real-time intervention capabilities. Scam Signal’s effectiveness stems from its ability to analyze telephony data in real time while customers are engaged in potentially fraudulent transactions and /or high-risk customer processes which have been alerted to FICO’s Omni-Channel Engagement capability. By identifying behavioral patterns indicative of social engineering — such as when customers are being coached through security processes — the system can trigger immediate intervention through personalized messaging designed to alert customers to potential fraud attempts.

Scam Signal uses advanced analysis of real-time network data together with customer and payment data, during live transactions, to effectively detect and mitigate social engineering attempts aimed at deceiving and defrauding account holders. The Scam Signal can incorporate this data from across 2G, 3G, 4G, 5G, VoLTE and Wi-Fi calling for multiple mobile network operators and is currently being extended to support UK landlines.

In the rapidly evolving landscape, we’re seeing new and emerging use cases. Although Scam Signal was originally developed to combat APP scams for digital payments, all forms of social engineering (also known as “impersonation”) facilitated over the phone can benefit from this service. Our clients have gained superior outcomes through real-time detection and intervention.

Initial results from a bank include:

- Up to 41% reduction in people being scammed on real-time digital payments

- Up to 44% decrease in gross scam fraud losses on real-time digital payments

- 15% reduction in loss per case on debit cards

- 30% detection rate on social engineered losses on cards

- Overall, 55% fewer false positives

How FICO and Scam Signal Can Help You Stop Scam Losses

- Learn more about Scam Signal

- Explore FICO's fraud solutions

- Read How Scam Prevention and Scam Detection Help Banks and Customers

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.