UK Card Spending Hits Two-Year High (Before Christmas)

While everyone watches retail figures for the holiday season to see what kind of economic uplift they can provide, good news emerged this week regarding UK card spending. The lates…

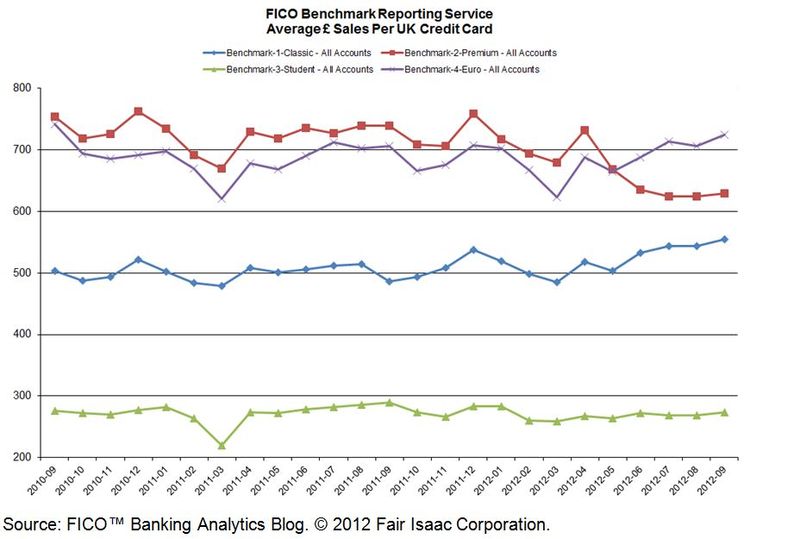

While everyone watches retail figures for the holiday season to see what kind of economic uplift they can provide, good news emerged this week regarding UK card spending. The latest data from the FICO® Benchmark Reporting Service showed that average total sales on classic cards — which exclude premium cards, student cards and Irish cards — hit £550, a 14 percent increase over September 2011.

Yes, you may say, but is this greater card debt something consumers can manage? So far, the answer appears to be yes. Our cards data also revealed strong payment performance pretty much across the board. The percentage of payments to balance was up 19 percent over September 2011, and the percentage of accounts that were one cycle (30 days) or two cycles delinquent hit two-year lows. Overlimit spending was also markedly lower.

So this seems to be good news indeed! Still, if I were managing a UK collections shop in January, I know what I’d be doing. Checking my radar. Looking at the transactions, and comparing the customer behaviour against the past. Searching for patterns. Improving credit counselling and preventive customer management. And, if the ship is in the right course, relax, open a nice champagne and cheers!

In the meantime, you can learn more about our latest report in our news release. If you are a UK card issuer and would like to get regular reports like this comparing market trends to your portfolio, contact Stacey West at staceywest@fico.com.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

It’s 2021. Do You Know What Your AI Is Doing?

New "State of Responsible AI" report from Corinium and FICO finds that most companies don’t—and are deploying artificial intelligence at significant risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.