US Bank Priorities for 2013: Big Data, Customer Experience

I've been blogging about results from our latest quarterly survey of US bank risk professionals. This quarter, we took the survey in a new direction by also asking about bu…

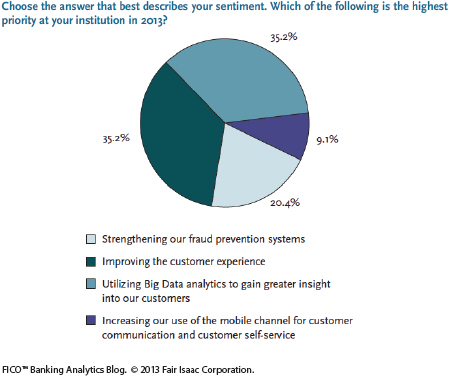

I've been blogging about results from our latest quarterly survey of US bank risk professionals. This quarter, we took the survey in a new direction by also asking about business priorities in 2013. Two related responses tied for the top spot, each with 35% of respondents: utilizing Big Data analytics to gain greater insight into customers and improving the customer experience—both key themes at last week's FICO World 2013 conference.

These responses align closely with the anecdotal evidence I’ve gathered while talking with FICO banking clients, both within and outside the US. Almost without fail, they tell me that enhancing the customer experience is a strategic goal this year, and they increasingly recognize the value of Big Data analytics in executing against these initiatives. We’re helping clients worldwide apply Big Data analytics to everything from marketing and originations to account management and collections. In fact, I share best practices on this very subject in my new Insights white paper: "When Is Big Data the Way to Customer Centricity?" (#67, registration required), which I invite you to download.

You’ll note that strengthening fraud prevention was cited as the top priority by 20% of respondents, and 9% said it was increasing utilization of mobile technology. For those of you with like-minded priorities, stay tuned to this blog where my colleagues and I will continue to share innovations and best practices in both these areas.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.