US Bankcards Industry Benchmarking Trends: 2024 Yearly Report

Credit card delinquency rates picked up in the back half of the year as spending slows

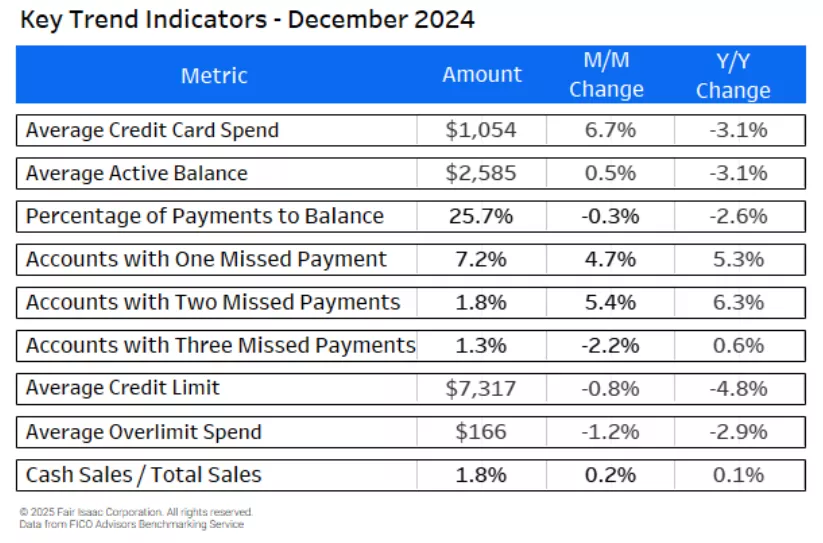

As the latest credit card data from FICO shows, 2024 ended with lower average credit card spending and lower average balances year-over-year, while delinquencies continued to climb – reaching multi-year highs once again. The rate at which customers are paying back their balances continues to trend downward and is back to what was seen in 2020 after four years of unusually high payment rates. Here are the US Credit Card and Consumer Spending Highlights:

The uncertainty in the overall US economy has led to lower consumer confidence and frustration with high prices and high interest rates. Credit card issuers end the year with caution while closely monitoring higher delinquency and loss rates. The data trends shared below from the FICO® Risk Benchmarking solution give us a more in-depth picture – this data represents a national sample of approximately 130 million US accounts gathered from FICO client reports generated by FICO® TRIAD® Customer Manager and Adaptive Control System solutions.

Credit Card Usage and Payments

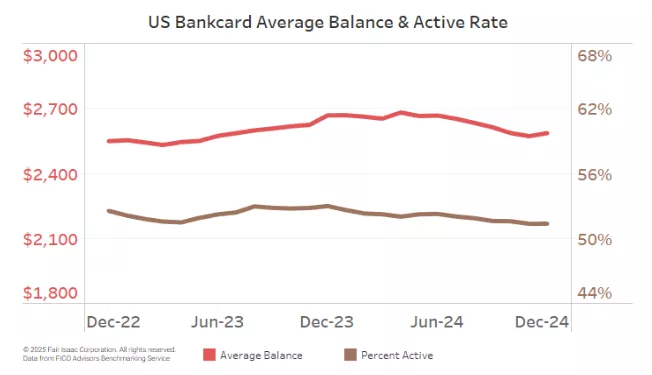

The average balance on US Bankcards began trending downward in April 2024 after rising consistently for the preceding 24 months. In December, the ending average balance of $2,585 is down 3.1% year-over-year. The percentage of accounts with a balance, also referred to as active rate, and average monthly spend are both down 3.1% year-over-year as well. The active rate of 51.4% remains 500 basis points higher than the pre-Covid average. December’s average monthly spend of $1,054 represents another data point in the slowing trend in credit card spend.

Many tactics are available to encourage customers who have the ability to repay their balance to continue to responsibly use their credit cards. Risk Managers should be working to identify those who could benefit from the additional access to credit and offer more competitive interest rates or credit limit increase programs.

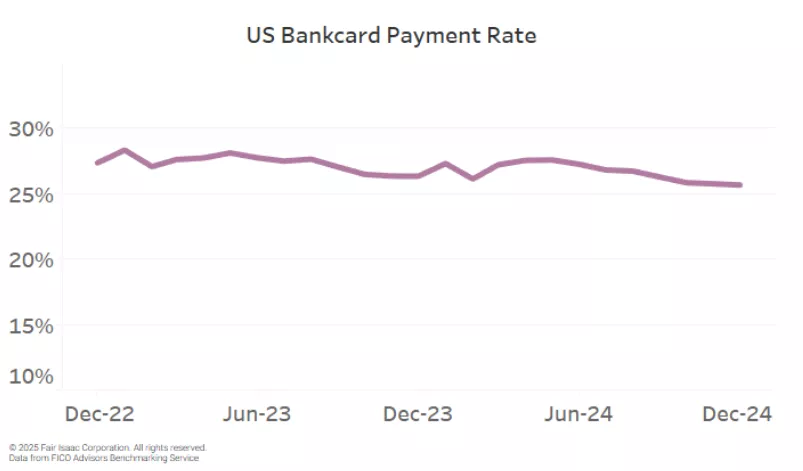

Credit Card portfolio managers in both Risk and Finance departments should also be keeping a close eye on payment rates (the percentage of balance that was paid back). Fluctuations in payment rate can be an early warning indicator of potential pockets of risk in the portfolio and can impact interest income and profitability. As of December, the payment rate of 25.7% is 2.6% lower year-over-year and is the lowest payment rate observed since December 2020. One other extremely important metric to monitor associated with payments is the percentage of customers making only the minimum payment. There has been an alarming 18% increase, from 8.0% to 9.5%, in this metric year-over-year indicating that many customers are on the brink of delinquency.

Credit Card Delinquency Rates

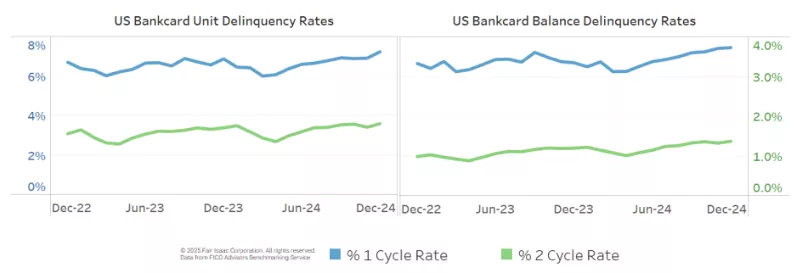

In the mid-year update, delinquency rates appeared to be stabilizing. Unfortunately, the trend has turned back upward. The percentage of active accounts that have missed one payment has increased by 5.3% since December 2023 and balances on those accounts have grown 11.5% year-over-year to 7.4%.

The percentage of active accounts that have missed two payments has also turned upward having increased to 1.8% in December, a 6.3% increase year-over-year. The percentage of total balance that is currently two payments past due has risen 14.5% year-over-year to 1.4%.

To summarize the credit card performance in 2024, we are not out of the woods yet. Consumers are more strapped for cash than over the past few years as savings have run out and the cost of carrying debt remains high. Risk Managers should be monitoring the metrics shown as well as many other key performance indicators.

If you are a consumer who is struggling, there are tools available at myFICO.com to help keep track of credit card usage and your FICO Score.

Please leave a comment on this post if you have any further questions.

How FICO Can Help You Manage Credit Card Risk and Performance:

Explore our solutions for customer management.

See my previous posts on US card performance.

Consumers who are struggling can find tools at myFICO.com to help keep track of their credit usage and FICO Score.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.